Utilizing such a form empowers borrowers to avoid potentially unfavorable loan terms and protects them from predatory lending practices. Clear disclosure of loan costs promotes financial awareness and responsible borrowing. For lenders, adherence to these disclosure requirements ensures legal compliance and fosters trust with consumers.

This foundational understanding of standardized loan disclosures allows for a deeper exploration of related topics, including consumer rights, responsible lending practices, and the regulatory framework governing lending institutions. The following sections will delve further into these crucial areas.

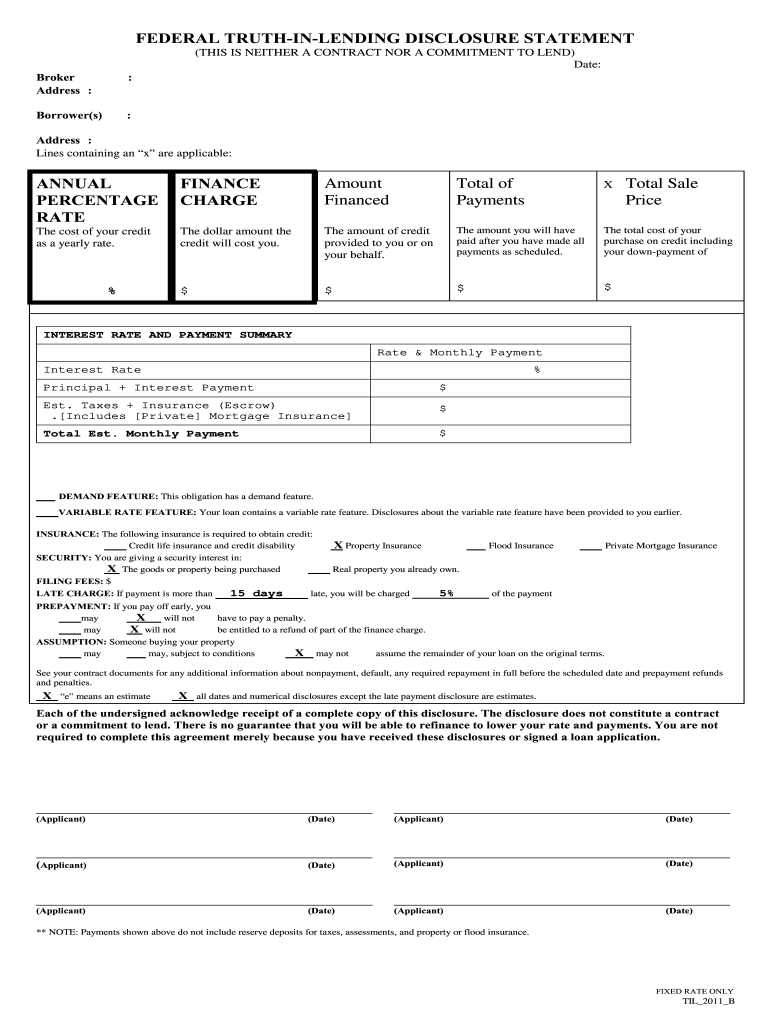

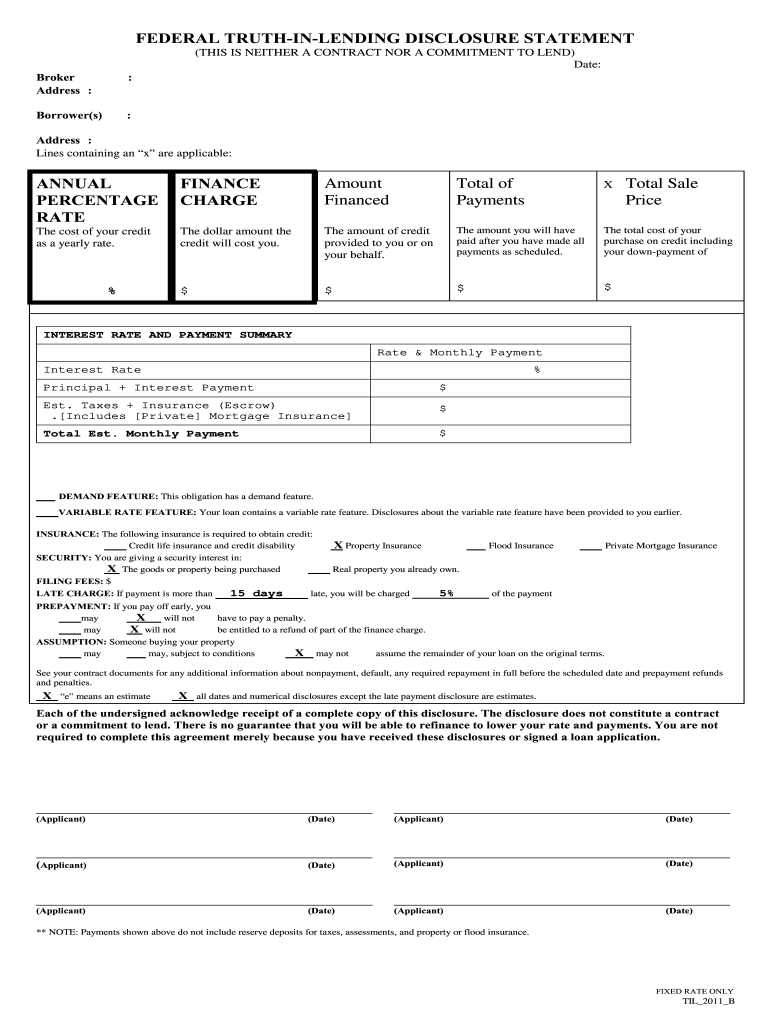

1. Standardized Format

Standardization is a cornerstone of the federal truth in lending disclosure statement. This consistent structure ensures that all lenders present the same essential information in a uniform manner. This uniformity facilitates direct comparison of loan offers from different lenders, irrespective of their individual branding or marketing strategies. Imagine attempting to compare loan offers with varying terminology, differing presentation of fees, and inconsistent disclosure of key terms. The standardized format eliminates this complexity, empowering borrowers to focus on the actual cost of credit.

A practical example illustrates the importance of this standardization. Consider a borrower comparing a mortgage offer from a large national bank with one from a local credit union. The standardized format ensures both institutions disclose the APR, loan term, finance charges, and total repayment amount in the same clear, concise manner. This allows the borrower to directly compare these critical figures, even though the institutions marketing materials and overall lending approaches may differ significantly. Without this standardization, comparing loan offers would be a considerably more complex and potentially confusing process, increasing the risk of overlooking critical cost differences.

The standardized format of loan disclosures ultimately simplifies the borrowing process and promotes transparency in lending practices. This structure serves as a critical tool for consumer protection, enabling informed decision-making and fostering a more equitable lending environment. Understanding the role of standardization within these disclosures reinforces the importance of consumer financial literacy and highlights the practical benefits of regulatory oversight in the financial sector.

2. Mandatory Disclosures

Mandatory disclosures are the bedrock of the federal truth in lending disclosure statement template. These legally required revelations ensure borrowers receive crucial information about loan terms, enabling informed decision-making and protecting against predatory lending practices. Understanding these key disclosures is essential for navigating the complexities of borrowing.

- Annual Percentage Rate (APR)The APR represents the total cost of borrowing, including interest and other fees, expressed as a yearly rate. This figure provides a standardized metric for comparing loan offers, even if they have different fee structures or repayment terms. For example, a loan with a lower advertised interest rate might have higher fees, resulting in a higher APR. The mandatory disclosure of the APR ensures borrowers understand the true cost of the loan.

- Finance ChargesFinance charges encompass all costs associated with borrowing, including interest, origination fees, application fees, and other charges. Clearly disclosing these charges allows borrowers to understand the total amount they will pay beyond the principal loan amount. For instance, a mortgage might include origination fees, appraisal fees, and points, all of which are included in the finance charges. This transparency helps borrowers budget accurately and avoid unexpected costs.

- Total Repayment AmountThis figure represents the total amount the borrower will repay over the loan term, including principal, interest, and all finance charges. This disclosure provides a clear picture of the long-term cost of the loan. Comparing the total repayment amount across different loan offers helps borrowers assess the overall financial implications of each option.

- Payment ScheduleThe payment schedule outlines the amount and frequency of loan payments. This disclosure details when payments are due, the amount of each payment, and the breakdown between principal and interest. Understanding the payment schedule allows borrowers to plan their finances effectively and ensure timely repayments.

These mandatory disclosures collectively provide a comprehensive overview of the loan’s terms and costs. By ensuring transparency and standardization, these disclosures empower borrowers to make informed decisions, compare loan offers effectively, and avoid potentially unfavorable lending arrangements. This framework of mandatory disclosures strengthens consumer protection within the lending market.

3. Loan Cost Transparency

Loan cost transparency, a cornerstone of responsible lending, finds its practical application through the federal truth in lending disclosure statement template. This legally mandated document serves as the primary vehicle for achieving transparency, requiring lenders to disclose all costs associated with a loan in a clear, standardized format. This disclosure empowers borrowers to understand the true cost of borrowing, fostering informed decision-making and promoting fair lending practices. Without such mandated transparency, borrowers could face hidden fees, misleading interest rates, and ultimately, unfavorable loan terms.

Consider a scenario where an individual seeks a personal loan. Multiple lenders offer seemingly attractive interest rates. However, without a standardized disclosure form, comparing these offers becomes complex. One lender might advertise a low interest rate but impose hefty origination fees, while another might have a slightly higher rate but fewer fees. The standardized disclosure, mandated by the Truth in Lending Act, compels all lenders to disclose the APR, finance charges, and total repayment amount in a uniform format. This transparency allows the borrower to accurately compare the total cost of each loan, regardless of varying fee structures or promotional tactics. The practical significance of this transparency becomes evident when the borrower can confidently choose the loan that truly offers the lowest overall cost, avoiding potentially costly misunderstandings or misleading marketing.

Loan cost transparency, facilitated by the federal truth in lending disclosure statement template, represents more than just a regulatory requirement; it is a critical component of consumer protection in the lending market. It empowers borrowers, promotes responsible lending practices, and fosters a more equitable financial landscape. Understanding the integral relationship between loan cost transparency and the standardized disclosure form equips individuals with the knowledge necessary to navigate the complexities of borrowing and make sound financial decisions. The challenges of ensuring consistent compliance and educating consumers about the importance of these disclosures remain ongoing, highlighting the continuing need for regulatory oversight and consumer advocacy in the financial sector.

4. Consumer Protection

Consumer protection forms the very foundation of the federal truth in lending disclosure statement template. The template serves as a critical instrument in safeguarding borrowers from deceptive or predatory lending practices. By mandating clear and consistent disclosure of loan terms, the template empowers consumers to make informed decisions, compare loan offers effectively, and avoid potentially exploitative financial arrangements. This protection manifests in several tangible ways. Prior to the widespread adoption of standardized disclosures, borrowers often faced opaque loan terms, hidden fees, and inconsistent information, making it difficult to assess the true cost of borrowing. This lack of transparency created an environment ripe for exploitation, where lenders could obscure unfavorable terms and lure borrowers into costly agreements. The standardized template directly addresses these vulnerabilities.

A practical illustration highlights the significance of this consumer protection. Imagine a prospective homeowner seeking a mortgage. Without a standardized disclosure, comparing offers from different lenders becomes a labyrinthine task. One lender might offer a low headline interest rate but bury significant fees in the fine print, while another might have a slightly higher rate but significantly lower fees. The standardized disclosure mandates the prominent disclosure of the annual percentage rate (APR), which encompasses all costs associated with the loan, enabling a direct comparison of the true cost across different offers. This transparency empowers the consumer to choose the most advantageous loan, avoiding potentially thousands of dollars in hidden fees over the life of the loan.

The federal truth in lending disclosure statement template represents a substantial advancement in consumer protection within the financial lending landscape. It provides a crucial shield against predatory practices, promotes transparency, and fosters a more equitable lending environment. However, challenges remain. Ensuring consistent compliance among lenders and promoting financial literacy among consumers remain ongoing efforts. These efforts are vital to ensuring that the protections afforded by the template translate into tangible benefits for all borrowers. Ultimately, the template’s effectiveness hinges on the continued vigilance of regulators, the advocacy of consumer protection organizations, and the informed engagement of borrowers themselves.

5. Informed Decisions

Informed decision-making in financial matters, particularly borrowing, hinges on access to clear, comprehensive, and comparable information. The federal truth in lending disclosure statement template plays a pivotal role in facilitating such decisions by providing borrowers with standardized, readily digestible information about loan costs and terms. This framework empowers consumers to navigate the complexities of the lending market, compare offers effectively, and choose financial products that align with their individual needs and circumstances.

- Comparative AnalysisThe standardized format of the disclosure enables borrowers to compare loan offers from different lenders on an apples-to-apples basis. Key metrics like the annual percentage rate (APR), finance charges, and total repayment amount are presented uniformly, allowing for direct comparison. For example, a borrower considering two mortgages with differing interest rates and fee structures can use the standardized disclosure to determine which loan offers the lower overall cost. This comparative analysis empowers borrowers to select the most advantageous loan product, maximizing their financial well-being.

- Understanding Loan CostsThe template mandates the clear disclosure of all costs associated with a loan, eliminating hidden fees and promoting transparency. Borrowers gain a comprehensive understanding of the total cost of borrowing, including interest, origination fees, closing costs, and other charges. For instance, when considering a personal loan, the disclosure clearly outlines all applicable fees, enabling the borrower to accurately assess the total financial obligation and plan accordingly. This transparency minimizes the risk of unexpected costs and promotes responsible borrowing.

- Evaluating Loan TermsBeyond cost, the disclosure provides crucial information about loan terms, including the loan amount, repayment period, and payment schedule. Understanding these terms allows borrowers to evaluate the long-term implications of the loan and assess its suitability for their individual circumstances. For example, a borrower considering an auto loan can evaluate the length of the loan term and its impact on monthly payments and total interest paid. This evaluation facilitates selection of a loan term that aligns with the borrower’s budget and financial goals.

- Mitigating RiskBy promoting transparency and facilitating informed decision-making, the disclosure template serves as a critical tool for mitigating financial risk. Borrowers armed with comprehensive information about loan costs and terms are less susceptible to predatory lending practices and more likely to make sound financial decisions. This informed approach reduces the likelihood of default, promotes financial stability, and fosters a more equitable lending environment.

The federal truth in lending disclosure statement template ultimately empowers consumers through information. By providing standardized, comprehensive, and comparable data, the template facilitates informed decision-making in the complex landscape of financial lending. This informed approach to borrowing promotes financial well-being, protects consumers from exploitative practices, and contributes to a more stable and transparent lending market. The template’s effectiveness hinges on both the consistent compliance of lenders and the active engagement of borrowers in utilizing the disclosed information to make sound financial choices.

6. Regulatory Compliance

Regulatory compliance forms the backbone of the federal truth in lending disclosure statement template. Adherence to these regulations, primarily stemming from the Truth in Lending Act (TILA), ensures lenders provide borrowers with standardized, comprehensive information about loan costs and terms. This compliance fosters transparency, protects consumers from predatory lending practices, and promotes stability within the financial lending market. Failure to comply can result in significant legal and financial penalties for lenders, underscoring the importance of meticulous adherence to these regulatory requirements.

- Truth in Lending Act (TILA) AdherenceThe core of regulatory compliance lies in adherence to TILA. This act mandates specific disclosures, such as the annual percentage rate (APR), finance charges, and total repayment amount, ensuring borrowers receive a clear picture of the loan’s true cost. For example, a lender offering a mortgage must disclose the APR, which reflects the total cost of the loan, including interest and fees, expressed as a yearly rate. Accurate calculation and prominent display of the APR are crucial aspects of TILA compliance.

- Consistent Application and EnforcementRegulatory compliance requires consistent application and enforcement of TILA provisions across all lending institutions. This ensures a level playing field for lenders and protects borrowers from inconsistent or misleading practices. Regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), oversee compliance and investigate potential violations. Consistent enforcement deters non-compliance and fosters a fair and transparent lending environment. For instance, if a lender consistently understates the APR on its loan disclosures, the CFPB can investigate and impose penalties, ensuring that borrowers receive accurate information.

- Accurate Disclosures and CalculationsAccurate disclosures and calculations are essential components of regulatory compliance. Lenders must ensure that all disclosed figures, such as the APR and finance charges, are calculated correctly and reflect the true cost of the loan. Errors in these calculations, even unintentional ones, can constitute violations of TILA. For example, if a lender miscalculates the finance charges on a personal loan, the borrower might unknowingly pay more than legally required. Accurate calculations are crucial for protecting borrowers from such discrepancies.

- Maintaining Records and DocumentationMaintaining comprehensive records and documentation related to loan disclosures is a critical aspect of regulatory compliance. Lenders must retain records of all disclosed information, including loan applications, disclosure forms, and supporting calculations. These records serve as evidence of compliance and can be crucial in resolving disputes or responding to regulatory inquiries. For instance, if a borrower disputes the accuracy of a disclosed fee, the lender can refer to the retained records to demonstrate compliance with TILA disclosure requirements.

These facets of regulatory compliance, all anchored in the framework of the federal truth in lending disclosure statement template, work in concert to protect consumers, promote transparency, and ensure the integrity of the lending market. Consistent adherence to these regulations fosters a more equitable and stable financial environment for both borrowers and lenders. Ongoing monitoring and enforcement of these regulations remain crucial for safeguarding consumer rights and maintaining the efficacy of the truth in lending framework.

Key Components of a Federal Truth in Lending Disclosure Statement

Understanding the core components of a standardized loan disclosure form is crucial for both borrowers and lenders. The following elements represent key aspects of such a template.

1. Annual Percentage Rate (APR): The APR represents the total cost of borrowing, including interest, fees, and other charges, expressed as a yearly rate. This standardized metric allows borrowers to compare loans with varying terms and fee structures, providing a comprehensive view of the true cost of credit.

2. Finance Charges: This component details all costs associated with the loan beyond the principal amount, including origination fees, application fees, points, and other charges. Transparency regarding finance charges enables accurate budgeting and informed borrowing decisions.

3. Total Repayment Amount: This figure represents the total amount the borrower will repay over the life of the loan, encompassing principal, interest, and all finance charges. Understanding the total repayment amount provides a clear perspective on the long-term financial implications of the loan.

4. Loan Term: The loan term specifies the duration of the loan agreement, typically expressed in months or years. The length of the term significantly impacts the amount of interest paid and the size of the monthly payments.

5. Payment Schedule: The payment schedule outlines the frequency and amount of each loan payment, detailing the allocation between principal and interest. This information allows borrowers to plan their finances effectively and ensure timely repayments.

6. Amount Financed: This represents the actual amount of credit provided to the borrower, excluding any fees or prepaid finance charges. Understanding the amount financed ensures borrowers receive the expected funds and can accurately assess the loan’s cost.

7. Prepayment Penalty: If applicable, the disclosure must clearly state whether a prepayment penalty exists. This penalty, charged if the borrower pays off the loan early, can significantly impact the overall cost of borrowing.

8. Late Payment Fees: The disclosure must detail any fees associated with late payments. This transparency helps borrowers understand the potential consequences of missed payments and encourages timely repayment.

These standardized elements ensure borrowers receive consistent and comparable information, enabling informed decisions and fostering a transparent lending environment. This framework strengthens consumer protections and promotes responsible lending practices within the financial market.

How to Create a Federal Truth in Lending Disclosure Statement

Creating a compliant federal Truth in Lending Disclosure Statement requires careful attention to detail and adherence to specific regulatory requirements. The following steps outline the process of generating a compliant disclosure.

1. Gather Required Information: Compile all necessary loan details, including the annual percentage rate (APR), finance charges, total loan amount, loan term, payment schedule, amount financed, and any applicable prepayment penalties or late fees. Accuracy is paramount; errors can lead to non-compliance.

2. Utilize a Template or Software: Employing a readily available template, specifically designed for TILA compliance, simplifies the creation process and reduces the risk of errors. Several software solutions also offer automated disclosure generation, streamlining the process further.

3. Input Loan Data Accurately: Carefully input the gathered loan information into the chosen template or software. Double-check all entries to ensure accuracy and prevent discrepancies. Even minor errors can lead to non-compliance.

4. Clearly Disclose All Costs: Ensure all costs associated with the loan, including interest, fees, and other charges, are clearly and conspicuously disclosed. Transparency is crucial for compliance and builds trust with borrowers.

5. Review and Verify: Before finalizing the disclosure, thoroughly review all disclosed information for accuracy and completeness. Compare the disclosed figures with the loan terms to ensure consistency and prevent discrepancies.

6. Provide to Borrower: Deliver the completed disclosure statement to the borrower in a timely manner, as required by TILA regulations. Providing ample time for review empowers borrowers to make informed decisions.

7. Maintain Records: Retain copies of all disclosure statements and supporting documentation for a period consistent with regulatory requirements. Maintaining accurate records is crucial for demonstrating compliance and resolving potential disputes.

Accurate and timely disclosure of loan information empowers consumers, facilitates informed decision-making, and fosters a fair and transparent lending environment. Meticulous adherence to these steps ensures compliance with TILA regulations, protects borrowers from potentially unfavorable terms, and mitigates legal risks for lenders.

Standardized loan disclosure forms mandated by the Truth in Lending Act serve as a critical instrument for consumer protection and transparency within the lending market. These forms provide borrowers with essential information regarding loan costs, including the annual percentage rate, finance charges, and total repayment amount, enabling informed comparisons and responsible borrowing decisions. Accuracy, clarity, and timely delivery of these disclosures are paramount for compliance and contribute significantly to a more equitable lending environment. Furthermore, adherence to these regulatory requirements protects lenders from potential legal repercussions and fosters trust with consumers.

The ongoing evolution of lending practices and regulatory oversight underscores the continued importance of these standardized disclosures in promoting financial literacy and protecting consumer rights. Understanding and utilizing these disclosures empowers borrowers to navigate the complexities of the lending market confidently and make sound financial decisions, ultimately contributing to a more stable and transparent financial landscape. Continued vigilance and advocacy are crucial for ensuring these disclosures remain effective tools for consumer protection in the evolving financial marketplace.