Life can be unpredictable, and while we often plan for the big moments, it’s just as vital to prepare for the unexpected. Thinking ahead about your financial future is not just about saving or investing; it’s also about ensuring that your financial affairs can be managed smoothly, even if you’re unable to do so yourself. This is where a financial durable power of attorney comes into play, offering a critical layer of protection and peace of mind for you and your loved ones.

Imagine a situation where sudden illness or an accident leaves you temporarily or permanently unable to make decisions. Without a designated person to handle your finances, everything from paying bills to managing investments could grind to a halt. This could lead to significant stress, missed payments, and potential legal complications for your family. A durable power of attorney proactively addresses these concerns, empowering someone you trust to act on your behalf, ensuring your financial well-being remains secure.

Understanding What a Financial Durable Power of Attorney Entails

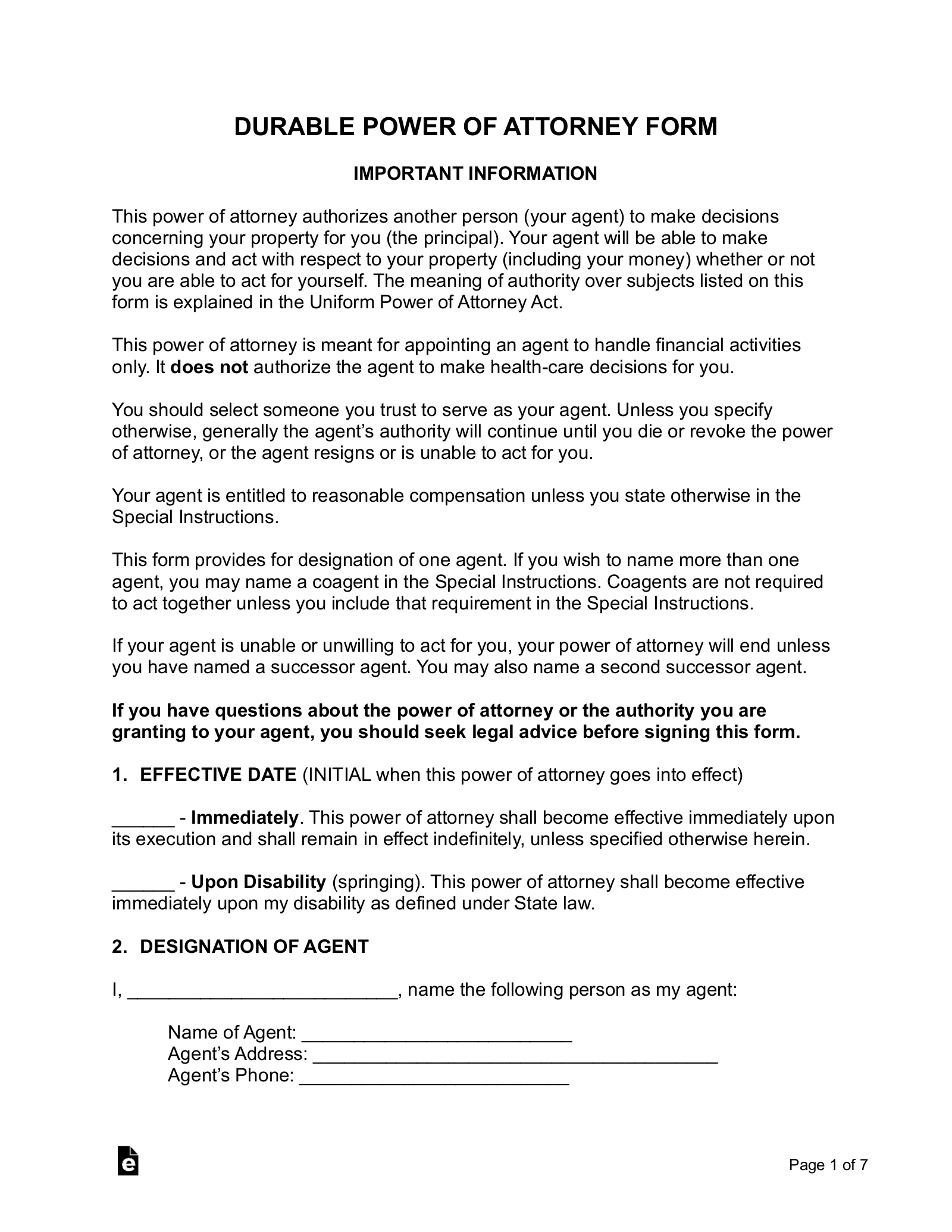

At its heart, a financial durable power of attorney is a legal document that gives one person (known as the agent or attorney-in-fact) the authority to make financial decisions and manage assets on behalf of another person (the principal). The key word here is “durable,” which means the document remains effective even if the principal becomes incapacitated. This is a crucial distinction, as a non-durable power of attorney would automatically become invalid upon the principal’s incapacitation, precisely when it might be needed most.

The appointment of an agent is a significant decision. This individual will have access to your bank accounts, investments, real estate, and potentially other valuable assets. Therefore, it’s paramount to choose someone you trust implicitly, someone with integrity, reliability, and preferably, a basic understanding of financial matters. They are legally obligated to act in your best interest, upholding a fiduciary duty.

Specific Powers You Can Grant

When you create a financial durable power of attorney, you can grant a wide range of powers to your chosen agent. These powers should be clearly defined within the document to avoid any ambiguity. While a comprehensive financial durable power of attorney form template can guide you, it’s essential to customize it to your specific needs and wishes. Some common powers often included are:

- Managing bank accounts and conducting transactions

- Buying, selling, or leasing real estate

- Handling investments and securities

- Paying bills, taxes, and other financial obligations

- Applying for government benefits, such as Social Security or Medicare

- Dealing with insurance matters and claims

- Accessing safe deposit boxes and managing other personal property

The “durability” aspect of this document truly underscores its importance. It’s not just for convenience; it’s a contingency plan for your long-term financial stability. Without it, your family might have to go through a potentially lengthy and expensive court process, such as guardianship or conservatorship proceedings, to gain the authority to manage your affairs. This can add immense emotional and financial strain during an already difficult time.

Key Considerations When Preparing Your Financial Durable Power of Attorney

When you embark on preparing a financial durable power of attorney, starting with a reliable financial durable power of attorney form template can be incredibly helpful. However, merely filling in the blanks isn’t always enough. You’ll want to carefully consider the scope of authority you’re granting and when that authority becomes effective. Some people prefer an “immediate” power of attorney, meaning it’s active the moment it’s signed, while others opt for a “springing” power of attorney, which only becomes effective upon a specific event, such as your incapacitation, usually determined by a doctor’s certification.

Choosing your agent is perhaps the most critical step. This person will be entrusted with significant responsibilities, so they should be someone who is financially responsible, organized, and capable of making sound judgments. It’s also wise to name one or more successor agents in your document. This ensures that if your primary agent is unable or unwilling to serve, another trusted individual can step in without requiring you to create a new document.

While a financial durable power of attorney form template provides a strong framework, remember that legal requirements for these documents can vary by state. What’s valid in one state might not be in another, particularly concerning witnessing and notarization. Always ensure your document complies with your state’s laws to guarantee its enforceability. A poorly executed document could be challenged or deemed invalid, defeating its entire purpose.

Finally, once the document is prepared and properly executed, communicate its existence and location to your agent and other relevant family members. Keep the original in a safe, accessible place, and provide copies to your agent and perhaps your attorney or other advisors. Review your document periodically, especially after major life events like marriage, divorce, or the birth of children, to ensure it still reflects your wishes and current circumstances. Proactive planning today can prevent significant future difficulties.