Keeping track of a company’s assets is crucial for financial accuracy and operational efficiency. Every time a new piece of equipment, furniture, vehicle, or technology is brought into the business, it represents a significant change to your balance sheet. Without a proper system, these additions can easily become overlooked, leading to inaccuracies in financial statements, tax reporting, and even asset depreciation calculations.

Imagine the chaos if a rapidly growing company tried to manage its expanding pool of assets purely from memory or scattered notes. That’s why having a structured approach, like utilizing a dedicated fixed asset addition form template, is not just helpful but essential for any business serious about its financial health and long-term planning. It provides a standardized way to capture all the necessary information from the moment an asset is acquired, ensuring nothing falls through the cracks.

Why a Fixed Asset Addition Form Template is Indispensable for Your Business

When you consider the lifecycle of an asset, its initial recording is perhaps the most critical step. This foundational data impacts everything from your financial reporting to insurance policies and future disposal plans. A well-designed fixed asset addition form template acts as the central hub for collecting this vital information consistently, regardless of who is completing the form or where the asset is acquired. It brings order to what could otherwise be a fragmented and error-prone process.

Think about the implications of inaccurate asset records. Overstating assets could lead to higher insurance premiums or incorrect valuations for loans, while understating them might result in missed depreciation deductions, leading to higher taxable income than necessary. Furthermore, an organized record-keeping system allows for better internal controls, reducing the risk of asset misplacement or even theft. It ensures that every new acquisition is properly documented, assigned to a responsible party, and integrated into the company’s asset register.

Beyond the immediate financial benefits, having a clear and consistent process for asset additions contributes significantly to strategic decision-making. When you have accurate, up-to-date information on all your assets, you can better analyze your capital expenditure, assess the return on investment for various acquisitions, and plan for future purchases or upgrades. This level of insight is invaluable for scaling operations and maintaining a competitive edge.

Key Benefits of Using a Standardized Template

- Enhanced Accuracy: Standardized fields minimize data entry errors and omissions.

- Streamlined Workflow: Provides a clear step-by-step process for recording new assets.

- Improved Compliance: Helps meet regulatory and auditing requirements by providing verifiable records.

- Better Financial Management: Ensures accurate depreciation calculations and balance sheet reporting.

- Greater Transparency: Makes it easy for various departments to access and understand asset information.

- Efficient Asset Tracking: Facilitates the creation of a comprehensive asset register from day one.

Ultimately, investing the time to implement a robust fixed asset addition form template saves countless hours down the line, prevents costly errors, and provides a clear, reliable snapshot of your company’s physical wealth. It’s a fundamental tool for sound accounting practices and operational excellence.

Essential Information to Include in Your Fixed Asset Addition Form

Designing an effective fixed asset addition form requires careful consideration of all the data points that will be valuable throughout the asset’s lifespan. While specific fields might vary slightly depending on your industry or business size, there are core pieces of information that every comprehensive form should capture. This ensures that the asset is not only recorded for accounting purposes but also for operational management, maintenance, and eventual disposal. Starting with a clear understanding of what information is needed prevents gaps in your records and makes future reporting much smoother.

The goal is to create a singular point of truth for each new asset. This form should be designed to be intuitive and easy to fill out, perhaps with dropdown menus for common categories or pre-filled fields where possible. Accessibility is key, ensuring that the person responsible for the asset acquisition, whether it’s an administrative assistant or a procurement manager, can complete it accurately without extensive training. Remember, the better the initial data capture, the less work will be required later to correct or supplement records.

Consider the journey of an asset from purchase to retirement. What information will be needed at each stage? From acquisition cost for depreciation, to serial numbers for warranty claims, to location for inventory checks, every detail plays a role. A well-constructed form acts as a mini-database for each item, providing quick access to critical facts. It eliminates the need to rummage through invoices or separate spreadsheets when auditors come knocking or when maintenance is required.

Here’s a breakdown of the crucial elements you should include:

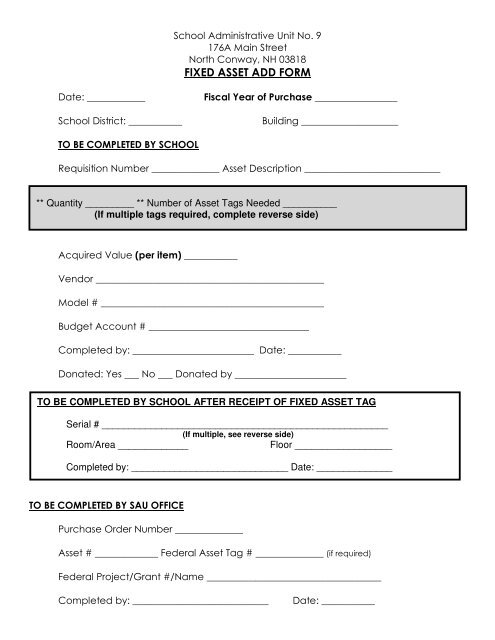

- Asset ID Number: A unique identifier for tracking.

- Asset Name/Description: A clear, concise name and detailed description of the asset.

- Acquisition Date: The exact date the asset was purchased or came into service.

- Acquisition Cost: The total cost of the asset, including purchase price, shipping, installation, etc.

- Vendor Information: Name of the supplier or seller.

- Purchase Order Number/Invoice Number: Reference to the original purchasing document.

- Category/Type: Classification of the asset (e.g., machinery, vehicle, office equipment, software).

- Department/Location: Where the asset will be primarily used or physically located.

- Useful Life (Years/Months): Estimated period the asset is expected to be useful.

- Depreciation Method: How the asset’s value will be expensed over time (e.g., straight-line, declining balance).

- Salvage Value: Estimated residual value of the asset at the end of its useful life.

- Serial Number/Model Number: Unique identifying numbers for the specific item.

- Warranty Information: Details about any applicable warranties.

- Responsible Party: Name of the individual or team accountable for the asset.

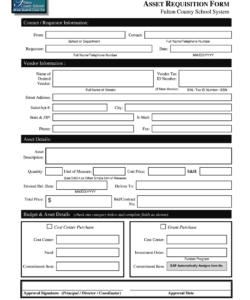

- Approval Signatures: Space for necessary departmental or financial approvals.

By incorporating these fields, your fixed asset addition form will serve as a powerful tool for managing your company’s physical resources effectively from the moment they are acquired. It’s a proactive step towards robust financial management and operational clarity.

Implementing a standardized fixed asset addition form template is a proactive step towards greater financial control and operational efficiency. It ensures that every new asset, no matter how small, is properly accounted for, providing a solid foundation for accurate financial reporting and strategic decision-making. By automating and standardizing this crucial data capture, businesses can minimize errors, streamline workflows, and ensure compliance with accounting standards.

Ultimately, having a clear and comprehensive process for managing new asset acquisitions empowers your organization with precise, real-time data. This improved visibility into your fixed assets not only simplifies audits and tax preparations but also contributes to better resource allocation and long-term financial planning, allowing your business to grow on a stable and well-managed foundation.