Every thriving business, big or small, eventually acquires significant assets that are crucial for its operations. We’re talking about things like new machinery, computer systems, vehicles, or even office furniture. These aren’t just everyday office supplies; they represent substantial investments that need careful consideration and formal approval. This isn’t just about spending money; it’s about making strategic decisions that impact your company’s future financial health and operational efficiency.

Navigating the process of acquiring these “fixed assets” can sometimes feel a bit like walking through a maze. Without a clear pathway, things can get messy, lead to overspending, or even result in the wrong assets being purchased. That’s where a well-designed fixed asset approval form template comes into play. It acts as your guide, ensuring every acquisition is thoroughly vetted, approved by the right people, and perfectly aligns with your budget and business goals. Let’s dive into why this seemingly simple document is a powerhouse for financial control and operational clarity.

What is a Fixed Asset Approval Form and Why Do You Need One?

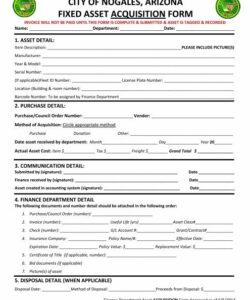

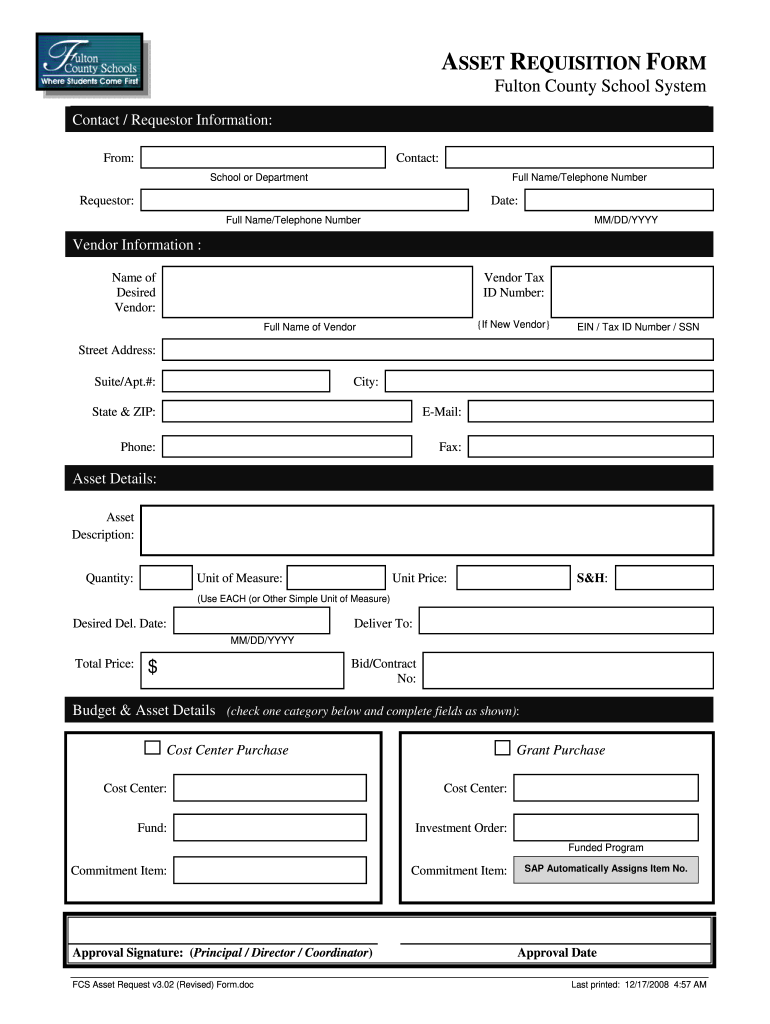

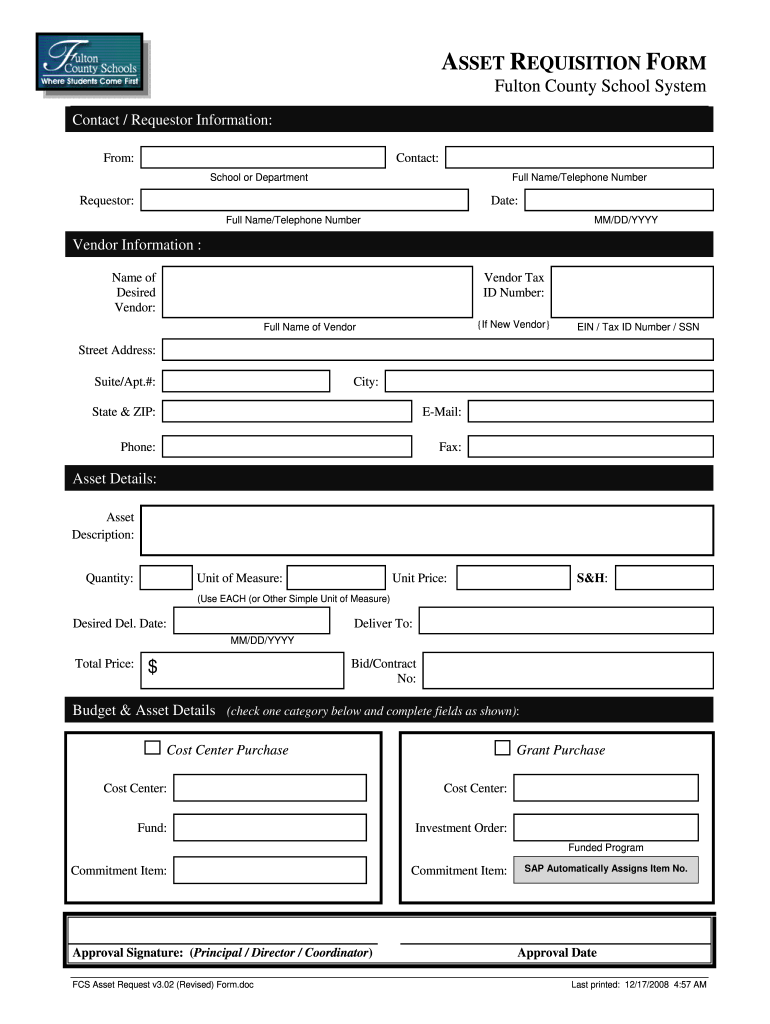

At its core, a fixed asset approval form is a standardized document used within an organization to request, justify, and obtain official approval for the purchase or acquisition of a fixed asset. Think of it as a formal proposal that outlines why a particular asset is needed, what its cost will be, and who needs to sign off on it before any funds are committed. It serves as a critical first step in the asset lifecycle management process, ensuring that no significant capital expenditure happens without proper oversight.

The need for such a form stems from the fundamental principle of financial governance. Without a structured approval process, businesses risk uncontrolled spending, potential fraud, and a lack of accountability. Imagine a scenario where various departments independently purchase expensive equipment without a centralized system; it could lead to duplicate purchases, budget overruns, and assets sitting idle because they weren’t truly needed. This form prevents such chaos by bringing order and transparency to all capital expenditure decisions.

Beyond preventing financial mishaps, a robust approval form fosters a culture of responsible spending and strategic planning. It forces requesters to think critically about the necessity of an asset, its return on investment, and its alignment with the company’s long-term objectives. For approvers, it provides all the necessary information at a glance, enabling informed decision-making. It also creates a clear audit trail, which is invaluable for internal reviews, external audits, and demonstrating compliance with financial regulations.

So, what exactly makes a fixed asset approval form effective? It’s all about including the right information fields that guide both the requester and the approver through the decision-making process. A good template will prompt for details that are essential for evaluating the request comprehensively, ensuring nothing important is overlooked.

Key Components of an Effective Fixed Asset Approval Form Template

- Requester Information: Department, name, contact details.

- Asset Details: Description of the asset, proposed vendor, quantity, estimated cost, justification for purchase, expected useful life.

- Financial Impact: Budget code, funding source, projected impact on financial statements.

- Approvals: Spaces for various levels of management approval, including department head, finance, and sometimes executive leadership.

- Date and Tracking: Date of request, unique request ID, and status updates (approved, rejected, pending).

How a Fixed Asset Approval Form Template Streamlines Your Business Operations

Implementing a standardized fixed asset approval form template can dramatically streamline your business operations, making the process of acquiring new assets far more efficient and less prone to errors. Instead of ad-hoc requests via email or casual conversations, everyone knows exactly what information is required and what steps need to be followed. This clarity reduces back-and-forth communication, speeds up the approval cycle, and ensures that all necessary stakeholders are involved from the outset.

This structured approach significantly aids in better decision-making. When a request comes in through a comprehensive template, decision-makers aren’t just looking at a price tag. They’re reviewing a detailed justification, understanding the asset’s strategic importance, and seeing its financial implications. This holistic view empowers them to make choices that truly benefit the company, whether it’s approving a crucial piece of machinery that boosts productivity or deferring an unnecessary purchase that saves budget.

Furthermore, a well-used fixed asset approval form template becomes an invaluable part of your audit trail. Every approved acquisition leaves a paper or digital footprint, clearly documenting who requested what, why it was needed, who approved it, and when. This transparency is critical for internal accountability, demonstrating compliance during financial audits, and even for tracing asset history should there be questions or issues down the line. It transforms a potentially chaotic process into a verifiable, transparent workflow.

To truly maximize the benefits, consider digitizing your fixed asset approval form template if you haven’t already. Moving from paper to an electronic system can automate routing, allow for digital signatures, and provide real-time tracking of request statuses. This not only enhances efficiency but also reduces the chances of forms getting lost or misfiled. Regularly review your template to ensure it still meets your business needs and adapt it as your organization grows or its asset management policies evolve.

Ultimately, having a clear and consistent process for approving fixed asset acquisitions is more than just good practice; it’s a strategic imperative. It ensures that every significant investment is thoughtfully considered, properly justified, and aligns perfectly with your financial goals and operational needs. This level of control is fundamental for maintaining financial health and fostering sustainable growth.

By bringing structure to your capital expenditure process, you empower your teams to make informed decisions, optimize resource allocation, and build a robust foundation for future success. It’s about ensuring that your business spends wisely, invests intelligently, and operates with maximum efficiency.