Providing such organized documentation offers several advantages. It facilitates accurate tax reporting for beneficiaries, aiding compliance with both US and potentially foreign tax obligations. It also promotes transparency and accountability by offering a clear record of the trust’s activity and the beneficiary’s financial stake. This clear communication can strengthen the relationship between the trustee and beneficiary by fostering trust and understanding. Furthermore, having a readily available summary of financial information simplifies estate planning for beneficiaries and can assist in other financial decisions.

This foundation of understanding the function and utility of such statements will allow for a more in-depth exploration of related topics, such as the specific information typically included, the legal and regulatory frameworks governing these trusts and their reporting requirements, and best practices for preparation and delivery. The following sections will delve into these key areas.

1. Income Received

Accurate reporting of income received is a critical component of a foreign non-grantor trust beneficiary statement template. This information provides beneficiaries with a clear understanding of the trust’s financial performance and their share of generated income, which is essential for tax reporting and financial planning. A thorough breakdown of income received allows for greater transparency and accountability within the trust structure.

- Types of IncomeIncome generated within a foreign non-grantor trust can take various forms, including interest from bonds, dividends from stocks, rental income from real estate, and capital gains from the sale of assets. Each type of income is subject to specific tax regulations and must be accurately classified on the beneficiary statement. For example, income derived from foreign sources might be subject to different withholding tax rules than domestic income.

- Attribution of IncomeProper attribution of income is essential to ensure compliance with tax laws. The statement must clearly identify which portion of the trust’s total income is allocated to each beneficiary. This allocation is typically defined by the trust document itself and may be influenced by factors such as the beneficiary’s age, relationship to the grantor, or specific provisions outlined in the trust agreement. For instance, a trust might distribute income differently to income beneficiaries versus remainder beneficiaries.

- Timing of Income RecognitionThe timing of income recognition can impact a beneficiary’s tax liability. While a trust may earn income throughout the year, it might not be distributed to beneficiaries until a specific date. The statement must clearly indicate the period to which the reported income applies, regardless of the actual distribution date. This clarity prevents confusion and ensures consistent reporting across tax years.

- Currency ConversionFor foreign non-grantor trusts, income may be generated in a currency different from the beneficiary’s reporting currency. The statement should clearly document the original currency and the exchange rate used for conversion. This conversion process ensures accurate reporting in the beneficiary’s tax jurisdiction and provides a clear audit trail. For example, a trust earning income in Euros would need to convert that income to US Dollars for a US-based beneficiary, documenting the exchange rate used.

The detailed reporting of income received, encompassing its type, attribution, timing, and currency, provides essential information for beneficiary tax compliance and financial planning. This detailed breakdown within the statement strengthens the overall transparency and accountability of the foreign non-grantor trust.

2. Distributions Made

Clear documentation of distributions made forms a cornerstone of the foreign non-grantor trust beneficiary statement template. This section provides beneficiaries with a precise record of funds received from the trust, crucial for accurate financial reporting and effective tax planning. Understanding the nuances of distributions, including their timing, form, and tax implications, is essential for both beneficiaries and trustees.

- Timing of DistributionsThe timing of distributions can significantly impact a beneficiary’s tax liability and financial planning. Distributions might occur annually, quarterly, or at other intervals defined by the trust document. The statement must clearly specify the dates of each distribution, allowing beneficiaries to reconcile these with their personal financial records and prepare accurate tax returns. Different distribution schedules can have different tax implications depending on the jurisdiction.

- Form of DistributionDistributions can take various forms, including cash, securities, or other assets held by the trust. The statement should clearly identify the form of each distribution and provide relevant details, such as the number of shares distributed or the description of any physical assets. For example, a distribution of stock requires specifying the company, number of shares, and date of distribution. This specificity ensures transparency and aids in proper valuation for tax purposes.

- Tax Implications of DistributionsDistributions from a foreign non-grantor trust may be subject to different tax treatments depending on the nature of the income earned by the trust (e.g., interest, dividends, capital gains) and the residency of the beneficiary. The statement should clearly identify the tax character of each distribution, allowing beneficiaries to accurately report the income on their tax returns. For instance, distributions of accumulated capital gains might be taxed differently than distributions of ordinary income.

- Withholding Tax on DistributionsIn some cases, foreign non-grantor trusts are required to withhold tax on distributions made to beneficiaries, particularly if the beneficiary resides in a different country. The statement should clearly indicate the amount of any withholding tax applied and provide relevant details, such as the applicable tax treaty or other legal basis for the withholding. This clarity assists beneficiaries in reclaiming any applicable tax credits or deductions in their home jurisdiction.

Comprehensive reporting of distributions made, encompassing timing, form, tax implications, and withholding, forms a crucial part of the foreign non-grantor trust beneficiary statement template. This level of detail ensures transparency, simplifies tax reporting for beneficiaries, and contributes to the overall effectiveness of trust administration.

3. Current Value

The “Current Value” component of a foreign non-grantor trust beneficiary statement template represents the total value of the beneficiary’s interest in the trust at a specific point in time. This figure is essential for understanding the overall financial health of the trust and the growth or decline of the beneficiary’s holdings. Accurate valuation is crucial for various reasons, including informing investment decisions, facilitating estate planning, and determining potential tax liabilities. The valuation process considers all assets held within the trust, applying appropriate market valuations or accepted appraisal methodologies. For instance, publicly traded securities are valued based on their current market price, while real estate holdings might require professional appraisals.

Several factors influence the current value calculation. Market fluctuations directly impact the value of assets held within the trust. For example, a decline in the stock market can decrease the overall value of a trust heavily invested in equities. Similarly, changes in interest rates can affect the value of fixed-income securities. Additionally, the trust’s investment strategy, including diversification across different asset classes, plays a significant role. A diversified portfolio might mitigate losses in one area with gains in another. Expenses incurred by the trust, such as management fees or legal costs, also influence the net asset value available to beneficiaries. Understanding these influencing factors allows beneficiaries to assess the trust’s performance and make informed decisions regarding their financial future.

Accurate and timely reporting of current value offers significant practical benefits. It allows beneficiaries to track the growth of their investments and make informed decisions about their overall financial strategy. For example, knowledge of the current value can inform decisions related to retirement planning, charitable giving, or other significant financial commitments. Furthermore, understanding the current value is crucial for estate planning purposes, allowing beneficiaries to assess potential inheritance tax liabilities and make appropriate arrangements. This information also provides a basis for loan applications or other financial transactions where demonstrating asset value is necessary. Finally, accurate current value reporting promotes transparency and accountability within the trust structure, fostering a stronger relationship between the trustee and beneficiaries.

4. Tax Identification Number (TIN)

The Tax Identification Number (TIN) plays a crucial role in the context of a foreign non-grantor trust beneficiary statement template. Accurate inclusion of the TIN, both for the trust itself and for each beneficiary, ensures proper tax reporting and compliance with relevant regulations. This unique identifier facilitates efficient tracking of financial transactions and aids tax authorities in verifying the accuracy of reported information. Omitting or incorrectly reporting the TIN can lead to processing delays, penalties, and complications in tax administration.

- Trust’s TINThe trust’s TIN, often an Employer Identification Number (EIN) in the United States, identifies the trust as a distinct taxable entity. Inclusion of the trust’s EIN on the beneficiary statement allows for accurate tracking of income earned and distributions made by the trust. This information is essential for reconciling trust activities with beneficiary tax reporting and ensuring compliance with Internal Revenue Service (IRS) regulations. For example, the EIN enables the IRS to verify that the trust has filed required tax returns and paid applicable taxes.

- Beneficiary’s TINEach beneficiary’s TIN, typically a Social Security Number (SSN) for US citizens or an Individual Taxpayer Identification Number (ITIN) for non-citizens, allows for proper attribution of income and distributions. This ensures that beneficiaries are correctly assessed for tax liabilities related to their trust distributions. Accurate reporting of the beneficiary’s TIN is essential for preventing mismatches and discrepancies in tax records. For instance, the IRS uses the SSN or ITIN to match income reported on the beneficiary statement with the income declared on individual tax returns.

- International TINsFor foreign beneficiaries, their respective country’s tax identification number equivalent is required for reporting purposes. Including the appropriate international TIN allows tax authorities in both the trust’s jurisdiction and the beneficiary’s jurisdiction to properly track and reconcile cross-border financial flows related to the trust. This international cooperation is crucial for preventing tax evasion and ensuring compliance with global tax regulations. For instance, a beneficiary residing in the United Kingdom would provide their National Insurance Number for accurate reporting.

- TIN and Information Reporting RequirementsThe TIN is a key element in various international information reporting requirements, such as the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). These regulations mandate the reporting of financial accounts held by foreign persons to prevent tax evasion. Accurate TIN reporting facilitates compliance with these requirements and ensures that relevant information is exchanged between tax authorities. This information exchange promotes transparency and helps to maintain the integrity of the global financial system.

Accurate reporting of TINs, both for the trust and each beneficiary, is fundamental to the integrity and utility of a foreign non-grantor trust beneficiary statement template. Proper TIN inclusion facilitates transparent tax reporting, aids compliance with international regulations, and ultimately contributes to the efficient administration of trusts with global connections.

5. Trustee Contact Information

Trustee contact information forms a critical component of a foreign non-grantor trust beneficiary statement template. Providing clear and accessible contact details facilitates communication between the trustee and beneficiaries, fostering transparency and enabling efficient administration of the trust. This information empowers beneficiaries to seek clarification, raise questions, and address concerns related to the trust’s management and their individual interests. Absent readily available contact information, communication breakdowns can occur, potentially leading to misunderstandings, disputes, and delays in resolving important matters.

- Primary Contact DetailsInclusion of the trustee’s primary contact details, such as a direct phone number, email address, and physical mailing address, allows beneficiaries to readily communicate routine inquiries or time-sensitive matters. For example, a beneficiary might contact the trustee to inquire about upcoming distributions, request clarification on tax reporting, or notify the trustee of a change in personal contact information. These accessible communication channels streamline interactions and ensure that information flows efficiently between the trustee and beneficiaries.

- Secondary Contact PersonDesignating a secondary contact person, along with their contact details, provides an alternative communication channel in situations where the primary trustee is unavailable or unable to respond promptly. This redundancy ensures continuity in communication and prevents delays in addressing beneficiary inquiries. For instance, if the primary trustee is traveling or dealing with an urgent matter, the secondary contact person can provide assistance or relay information, ensuring that beneficiaries’ concerns are addressed in a timely manner.

- Secure Communication MethodsFor sensitive information or complex inquiries, the trustee may offer secure communication methods, such as a dedicated portal or encrypted email. These secure channels protect confidential information and ensure that sensitive communications remain private. For example, discussions regarding significant financial transactions or changes to the trust’s structure might necessitate a higher level of security to protect the interests of all parties involved.

- Preferred Communication Method and AvailabilitySpecifying the trustee’s preferred communication method and general availability further enhances communication efficiency. This information guides beneficiaries in choosing the most appropriate channel and managing expectations regarding response times. For example, stating that email inquiries are preferred and typically responded to within one business day sets clear expectations and allows for efficient communication flow. Similarly, indicating specific days and times for phone calls helps beneficiaries avoid unnecessary attempts to reach the trustee outside of available hours.

The inclusion of comprehensive trustee contact information within the foreign non-grantor trust beneficiary statement template underscores the importance of open communication and accessible support for beneficiaries. This transparency strengthens the trustee-beneficiary relationship, facilitates efficient trust administration, and ensures that beneficiaries have the necessary resources to understand and manage their interests within the trust structure.

6. Trust Details

Inclusion of pertinent trust details within a foreign non-grantor trust beneficiary statement template provides crucial context for beneficiaries, enabling a comprehensive understanding of their relationship to the trust and its overall operation. These details illuminate the trust’s purpose, structure, governing rules, and relevant dates, empowering beneficiaries to make informed decisions and effectively manage their interests. Absence of such details can create ambiguity, hindering beneficiaries’ ability to understand their rights and responsibilities within the trust structure.

Key trust details typically included within the statement encompass the trust’s name, date of establishment, governing jurisdiction, and primary purpose. For instance, a trust named “The Smith Family Trust,” established on January 1, 2020, under the laws of the Cayman Islands, for the purpose of providing for the education of beneficiaries, clearly outlines the trust’s fundamental attributes. Further details might include the names and contact information of the grantor(s) and current trustees. Clarification of the distribution schedule, whether discretionary or mandatory, provides beneficiaries with essential information regarding anticipated distributions. Finally, a summary of the trust’s investment strategy, including asset allocation and risk tolerance, offers valuable insight into the management of trust assets and potential future growth. Consider a trust invested primarily in emerging market equities; this strategy carries higher risk but potentially higher returns compared to a trust invested in government bonds. Understanding this investment approach allows beneficiaries to assess the trust’s long-term prospects and align their personal financial plans accordingly.

Clear and comprehensive inclusion of trust details empowers beneficiaries to engage actively with the trust structure. This enhanced understanding facilitates effective communication with the trustee, enabling beneficiaries to ask informed questions, raise concerns, and ensure alignment between the trust’s operation and their personal financial goals. Furthermore, these details are essential for accurate tax reporting and compliance, providing beneficiaries with the necessary information to fulfill their obligations in various jurisdictions. Finally, detailed trust information strengthens transparency and accountability within the trust structure, fostering trust and confidence among all stakeholders.

Key Components of a Foreign Non-Grantor Trust Beneficiary Statement Template

A comprehensive beneficiary statement template ensures clarity and transparency in the administration of a foreign non-grantor trust. Key components provide beneficiaries with the necessary information to understand their interests and fulfill their reporting obligations.

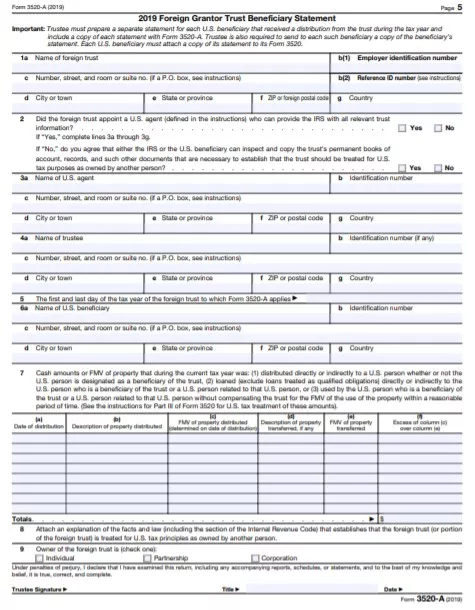

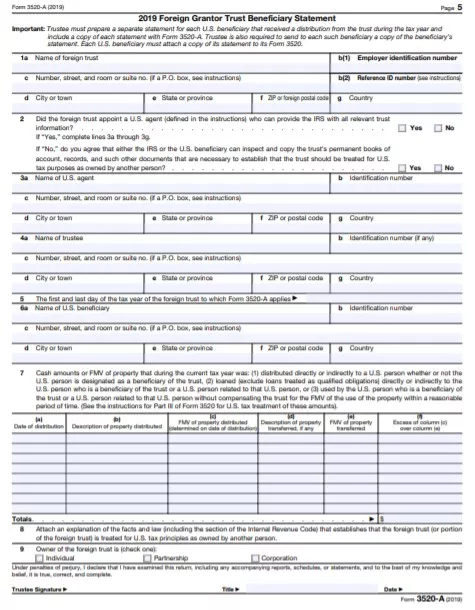

1. Trust Identification: This section identifies the trust by its full legal name, jurisdiction of formation, and tax identification number (TIN). This information is essential for distinguishing the trust from other entities and ensuring accurate tax reporting.

2. Beneficiary Identification: This section clearly identifies the beneficiary by name, address, and TIN. Accurate beneficiary identification is crucial for proper allocation of income and distributions, and for compliance with reporting requirements.

3. Reporting Period: The statement must specify the exact period covered by the reported information, typically a calendar year or fiscal year. Defining the reporting period prevents ambiguity and ensures consistency across financial records.

4. Income Summary: A detailed breakdown of income generated by the trust during the reporting period is crucial. This includes specifying the types of income (interest, dividends, capital gains, etc.), the source of income, and the amount attributed to the beneficiary.

5. Distributions: This section details all distributions made to the beneficiary during the reporting period. Information includes the date of each distribution, the amount distributed, the form of distribution (cash, securities, etc.), and any applicable withholding tax.

6. Current Value: The statement should present the current market value of the beneficiary’s interest in the trust as of the reporting date. This figure reflects the beneficiary’s share of the trust’s assets and is essential for financial planning and tax purposes.

7. Trustee Information: Contact details for the trustee, including name, address, phone number, and email address, facilitate communication between the trustee and beneficiary regarding trust administration and reporting.

Accurate and comprehensive reporting through these key components ensures transparency and accountability in the management of foreign non-grantor trusts, enabling beneficiaries to understand their financial position and comply with relevant tax obligations.

How to Create a Foreign Non-Grantor Trust Beneficiary Statement Template

Creating a robust template ensures consistent and accurate reporting for foreign non-grantor trusts. A well-structured template benefits both trustees and beneficiaries by streamlining communication and facilitating compliance.

1: Define the Reporting Period: Clearly establish the timeframe covered by the statement, whether a calendar year or fiscal year. Consistent reporting periods facilitate accurate tracking of income and distributions.

2: Trust Identification: Include the full legal name of the trust, its jurisdiction of formation, and its tax identification number (TIN). This information distinguishes the trust and ensures proper tax identification.

3: Beneficiary Identification: Record the full legal name, address, and TIN of the beneficiary. Accurate beneficiary identification is essential for proper allocation of income and distributions.

4: Income Summary Table: Create a table to detail income generated by the trust during the reporting period. Columns should include income type (interest, dividends, capital gains, etc.), source, and the amount attributable to the beneficiary. This structured presentation enhances clarity and allows for easy review.

5: Distributions Table: Develop a table outlining all distributions made to the beneficiary. Include columns for the date of distribution, amount, form of distribution (cash, securities, etc.), and any applicable withholding tax. A tabular format improves organization and readability.

6: Current Value Calculation: Outline the method for calculating the current market value of the beneficiary’s interest as of the reporting date. Specify any valuation methodologies or professional appraisals used. Transparency in valuation builds trust and allows beneficiaries to understand their holdings.

7: Trustee Contact Information: Provide the trustee’s name, address, phone number, and email address. Accessible contact information facilitates communication and ensures beneficiaries can readily seek clarification.

8: Trust Details Section: Include relevant details about the trust, such as the date of establishment, governing jurisdiction, primary purpose, and a brief summary of the investment strategy. This contextual information allows beneficiaries to understand the trust’s overall operation.

A well-designed template, incorporating these elements, facilitates clear communication, accurate reporting, and efficient administration of foreign non-grantor trusts. Regular updates and revisions ensure the template remains aligned with evolving regulatory requirements and best practices.

Accurate and comprehensive reporting within the framework of a standardized form for individuals benefiting from trusts established outside the United States, excluding those classified as grantor trusts for US tax purposes, is critical for transparency, compliance, and effective trust administration. This documentation provides beneficiaries with essential financial information regarding income, distributions, and current value, while also offering crucial details about the trust itself, including its tax identification number, trustee contact information, and relevant trust details. Understanding the components, creation, and practical application of these statements empowers beneficiaries to manage their interests effectively and fulfill their reporting obligations.

Given the complexity of international tax regulations and the potential implications for both trustees and beneficiaries, ongoing diligence in maintaining accurate records and adhering to best practices is essential. Consultation with qualified legal and financial professionals is strongly recommended to navigate the specific requirements governing foreign non-grantor trusts and ensure optimal compliance and trust administration.