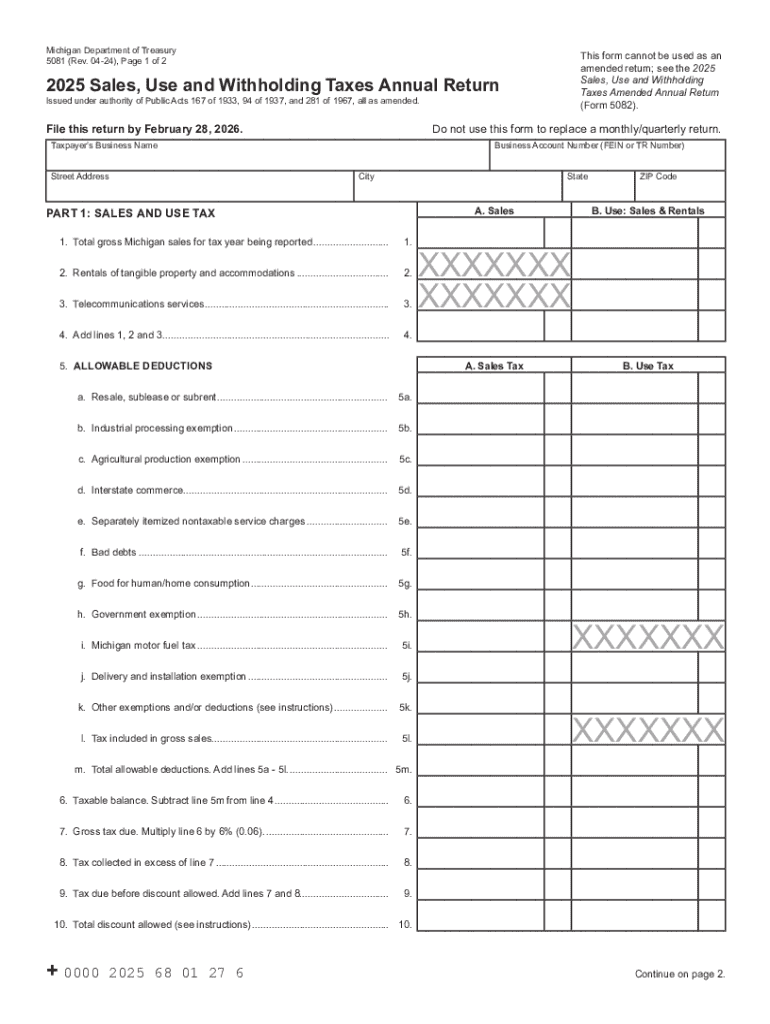

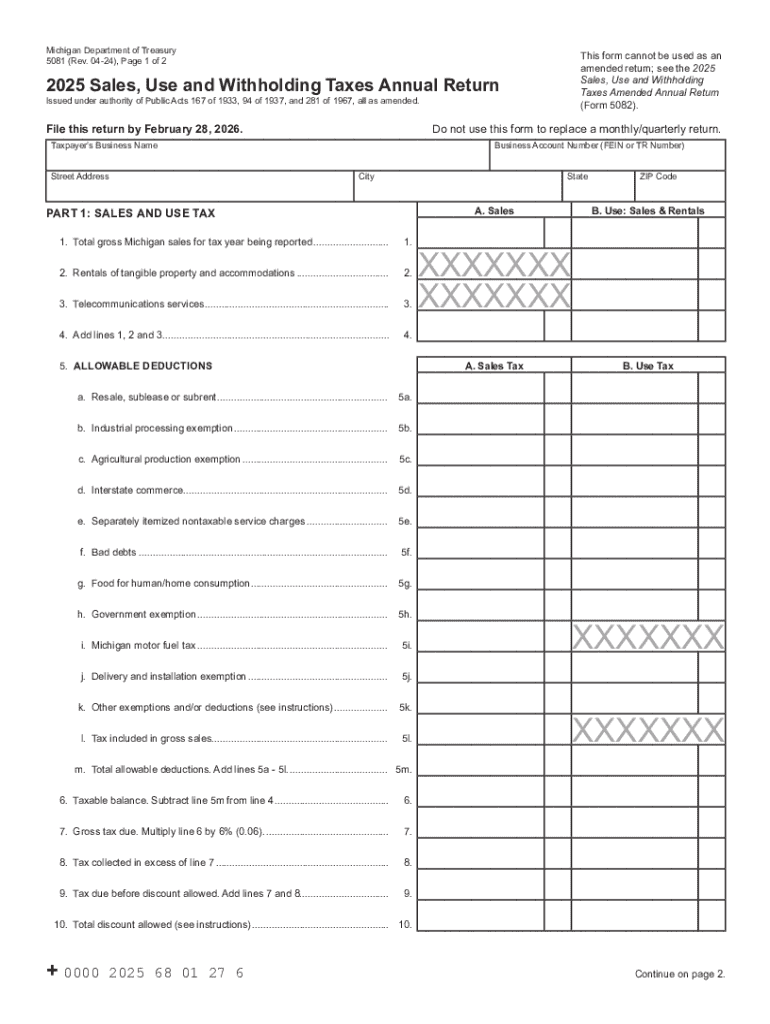

Navigating the world of tax forms can often feel like deciphering a complex puzzle, especially when it comes to state-specific documents. If you’ve found yourself in Michigan, dealing with business transactions, sales, or purchases, you might have come across Form 5081. This crucial document, officially known as the Michigan Sales and Use Tax Certificate of Exemption, plays a vital role in determining sales tax responsibilities for various entities and situations. Understanding its nuances is key to ensuring compliance and potentially saving your business or organization a significant amount of money.

Many individuals and businesses search for a “completed form template” to guide them through the process, hoping to streamline what can sometimes be an intimidating task. While an actual completed form that perfectly matches your unique situation might not exist due to the varying nature of exemptions and personal details, having a clear, well-structured guide, much like a template, can certainly make the process far less daunting. This article aims to break down the essentials of Form 5081, providing the insights you need to confidently fill out your own.

Understanding Michigan Form 5081 and Its Purpose

Michigan Form 5081 is essentially a declaration used by purchasers to claim an exemption from Michigan sales or use tax on certain purchases. It is not something you file directly with the state in most cases; rather, it is given to the seller at the point of sale. The seller then keeps this certificate on file as proof that they did not collect sales tax on a transaction that was legitimately exempt. This protects the seller from potential liability while ensuring the purchaser correctly applies for their exemption.

The core purpose of this form is to document why a particular transaction is free from sales or use tax. Without a properly completed Form 5081, a seller is generally required to collect sales tax on taxable goods and services. Therefore, both buyers and sellers benefit from a clear understanding and correct execution of this document, ensuring smooth transactions and adherence to state tax laws.

It is important to remember that not all purchases are exempt, and not all entities qualify for exemptions. The form itself lists various reasons for exemption, ranging from sales for resale to purchases by governmental units, nonprofit organizations, or for specific agricultural or industrial purposes. Knowing which exemption applies to your situation is the first critical step in correctly completing the form and asserting your tax-exempt status.

Improperly claiming an exemption or failing to provide this form when required can lead to complications, including audits and potential penalties for either the buyer or the seller. This highlights the significance of treating Form 5081 with the seriousness it deserves and understanding its legal implications. It is more than just a piece of paper; it is a legal declaration.

Who Typically Utilizes Form 5081?

Several types of entities and situations commonly necessitate the use of Form 5081. It serves as a blanket certificate, meaning it can be used for ongoing transactions with the same vendor, or as a single-transaction certificate, depending on the nature of the purchase and the agreement between buyer and seller. Here are some common users:

- Businesses purchasing goods for resale: If you buy inventory that you intend to sell to customers, those purchases are generally exempt from sales tax.

- Manufacturers purchasing materials for processing: Raw materials or components that become part of a product for sale are often exempt.

- Nonprofit organizations and governmental units: Many charitable, educational, religious, or governmental bodies are exempt from sales and use taxes on purchases made to fulfill their organizational purposes.

- Agricultural producers: Certain purchases made by farmers for agricultural production may be exempt.

- Businesses purchasing equipment or machinery used directly in industrial processing or agricultural production.

The Benefits of Using a Completed Form 5081 Template

While an exact completed form 5081 michigan completed form template tailored precisely to your specific details isn’t generally something you’d find and simply copy, the concept of a “template” is incredibly valuable. It represents a guiding structure, a pre-filled example, or a clear instructional set that shows you exactly what information goes where and how common scenarios are handled. This kind of template offers numerous advantages for anyone who needs to complete this form, whether for the first time or as a regular part of their business operations.

One of the primary benefits is the reduction of errors. Tax forms can be confusing, and even a small mistake can lead to delays or compliance issues. A well-designed template or instructional guide illustrates where each piece of information belongs, from your business name and address to your tax ID number and the specific reason for exemption. By following a clear example, you can minimize the chances of misinterpreting instructions or entering data in the wrong fields.

Furthermore, using the principles of a completed form 5081 michigan completed form template significantly speeds up the process. Instead of starting from scratch and puzzling over each section, you can quickly identify the necessary fields and gather the required information. This is particularly beneficial for businesses that frequently make tax-exempt purchases, as it standardizes their internal process and ensures consistency across all their exemption certificates.

Consider a template as your personal roadmap for accurate form completion. It helps you anticipate the questions, understand the terminology, and ensure you have all the supporting documentation or information ready before you even begin filling out the official form. This proactive approach saves time and reduces stress, especially when deadlines are looming or you are making a critical purchase.

- Increased Accuracy: Minimizes common mistakes and ensures all required fields are addressed.

- Time Savings: Streamlines the process by providing a clear structure and examples.

- Improved Compliance: Helps ensure you meet all state requirements for claiming tax exemptions.

- Reduced Stress: Makes a complex task feel more manageable and less intimidating.

- Better Documentation: Guides you in understanding what details are essential for proper record-keeping.

Mastering Michigan Form 5081 is a straightforward process once you understand its purpose and how to correctly complete it. By leveraging structured guidance and understanding the specifics of your exemption, you can ensure that your transactions are compliant with Michigan’s sales and use tax laws. This diligence not only avoids potential issues down the line but also contributes to efficient financial management for your business or organization.

Ultimately, whether you are a first-time user or an experienced business owner, having a clear understanding of the form 5081 michigan completed form template concept empowers you to navigate tax exemptions with confidence. It transforms what could be a source of confusion into a clear, manageable task, allowing you to focus on your core activities while maintaining impeccable tax records.