Utilizing a standardized form for childcare costs offers several advantages. It simplifies the often complex process of organizing these expenses, reduces the likelihood of errors, and ultimately maximizes potential tax benefits. This can result in significant financial relief for families, especially those with multiple dependents or high childcare costs.

The following sections will delve deeper into the specifics of utilizing these valuable resources, covering topics such as eligible expenses, required documentation, and how to effectively integrate these records into the tax filing process.

1. Accessibility

Accessibility of childcare expense record forms is paramount for ensuring equitable access to potential tax benefits. Ease of access significantly impacts a taxpayer’s ability to accurately track expenses and claim applicable deductions or credits. This section explores key facets of accessibility related to these essential forms.

- Format AvailabilityTemplates should be available in various formats (e.g., printable PDFs, downloadable spreadsheets, online fillable forms) to cater to diverse technological capabilities and preferences. A parent accessing a template on a mobile device may require a different format than someone using a desktop computer. Offering multiple formats ensures inclusivity and removes potential barriers.

- Language AccessibilityProviding templates in multiple languages reflects the diverse population and ensures equitable access to information. A family primarily speaking Spanish, for example, would benefit from a Spanish-language version of the form. This removes language barriers and facilitates accurate record-keeping.

- Platform CompatibilityTemplates should function correctly across various devices and operating systems (e.g., smartphones, tablets, computers). Compatibility issues can create significant hurdles, especially for individuals with limited access to specific technologies. Ensuring compatibility maximizes accessibility across different platforms.

- Clear Instructions and SupportUser-friendly instructions, FAQs, and accessible customer support channels are essential for navigating the form and addressing potential questions. A single parent with limited time might need clear, concise instructions to effectively utilize the template. Comprehensive support resources empower individuals to utilize the forms effectively.

These facets of accessibility collectively contribute to a more equitable and user-friendly experience. Simplified access to these resources directly impacts individuals’ ability to organize childcare expenses effectively and claim associated tax benefits. Ultimately, improved accessibility promotes greater financial well-being for families utilizing childcare services.

2. Accuracy

Accuracy in completing childcare expense records is paramount for maximizing potential tax benefits and avoiding potential complications during tax season. A free daycare tax statement template provides a structured framework that promotes accuracy, but diligent record-keeping practices remain crucial. Incorrect or incomplete information can lead to reduced benefits or even audits, underscoring the need for meticulous data entry and verification.

Consider a scenario where a taxpayer miscalculates the total childcare expenses paid during the year. This error, even if unintentional, could result in claiming an incorrect deduction amount. Using a template helps organize the data, but the individual bears the responsibility of entering correct figures for provider payments, dates of service, and qualifying child information. Similarly, omitting required supporting documentation, such as receipts or provider tax identification numbers, can jeopardize the validity of the claim. Therefore, while a template aids in organization, the accuracy of the information entered remains the taxpayer’s responsibility.

The practical significance of accurate record-keeping extends beyond simply maximizing deductions. Maintaining accurate records facilitates a smoother tax filing process, reduces the likelihood of inquiries from tax authorities, and provides a clear financial overview of childcare expenditures. Furthermore, accurate record-keeping can be essential for demonstrating eligibility for specific tax credits or subsidies. While a free daycare tax statement template offers a valuable tool for organization, the commitment to accuracy ensures these benefits are fully realized and potential complications avoided.

3. Organization

Organized record-keeping is fundamental to effectively utilizing a complimentary childcare expense record form. A structured approach ensures all necessary information is readily available, simplifying tax preparation and maximizing potential benefits. Disorganized records can lead to missed deductions, increased stress during tax season, and potential complications with tax authorities. This section explores key facets of organization related to childcare expense tracking.

- Chronological OrderingMaintaining records in chronological order provides a clear timeline of expenses, simplifying reconciliation with provider statements and facilitating accurate reporting. For example, arranging receipts by date allows for easy verification against monthly statements. This chronological approach streamlines the process of identifying and rectifying discrepancies.

- Categorization of ExpensesCategorizing expenses, such as separating payments for different children or different types of care (e.g., daycare, after-school programs), enhances clarity and allows for a more granular understanding of childcare costs. A family utilizing both daycare and a summer camp program would benefit from categorizing these expenses separately. This granular approach facilitates accurate reporting for specific tax benefits tied to different types of childcare.

- Digital vs. Physical RecordsChoosing a record-keeping system (digital spreadsheets, dedicated software, physical files) that aligns with individual preferences and technological capabilities is crucial for maintaining consistency. While digital records offer searchability and backup capabilities, physical files might be preferable for individuals who prefer tangible documentation. Selecting the appropriate system ensures consistent record-keeping practices.

- Secure StorageProtecting sensitive information, both physical and digital, is paramount. Physical documents should be stored in a secure location, while digital records require appropriate password protection and backup measures. This safeguards against data loss and unauthorized access, ensuring the long-term availability and integrity of these crucial records.

These organizational strategies significantly enhance the usability of a complimentary childcare expense record form. By implementing these practices, individuals can effectively leverage these resources to streamline tax preparation, maximize potential benefits, and maintain a clear financial overview of childcare expenditures.

4. Tax Compliance

Tax compliance, concerning childcare expenses, requires meticulous record-keeping and accurate reporting. A complimentary childcare expense record form serves as a valuable tool for achieving this compliance. It provides a structured framework for documenting expenses, ensuring all necessary information is readily available for tax filing. This proactive approach minimizes the risk of errors, omissions, and potential issues with tax authorities.

- Substantiating Claimed ExpensesAccurate records, facilitated by a template, are crucial for substantiating claimed deductions or credits related to childcare expenses. For instance, if audited, taxpayers must provide documentation supporting the amounts claimed. Organized records, including receipts and provider information, directly address this requirement, demonstrating compliance and mitigating potential challenges.

- Adhering to IRS GuidelinesUtilizing a template aids in adhering to specific IRS guidelines regarding eligible expenses, required documentation, and reporting procedures. For example, understanding and documenting the provider’s tax identification number is a crucial compliance requirement. A template prompts users to gather and record this information, ensuring adherence to regulations.

- Avoiding Penalties and InterestAccurate and organized record-keeping minimizes the risk of errors that could lead to penalties or interest charges. Incorrectly claiming deductions can result in financial penalties. A template promotes accuracy, mitigating this risk and supporting compliant tax filing.

- Facilitating Smooth AuditsIn the event of an audit, well-organized records, often facilitated by a template, simplify the process and demonstrate proactive compliance. Providing readily available documentation streamlines the audit process, reducing potential stress and complications. This preparedness underscores a commitment to accurate reporting and reinforces tax compliance.

Utilizing a complimentary childcare expense record form demonstrates a proactive approach to tax compliance. By adhering to these principles, taxpayers can confidently navigate the complexities of childcare-related tax benefits, minimize potential issues, and ensure financial peace of mind.

5. Financial Relief

Financial relief, often a significant concern for families utilizing childcare services, is directly impacted by the effective use of a complimentary childcare expense record form. These templates facilitate access to potential tax deductions and credits specifically designed to alleviate the financial burden of childcare costs. The connection between these resources and financial relief lies in the ability to accurately track and report eligible expenses, maximizing potential tax benefits. For instance, a single parent working full-time and relying heavily on daycare services could experience significant financial strain. Meticulous record-keeping, using a template, allows this individual to accurately calculate and claim the Child and Dependent Care Credit, potentially receiving a substantial reduction in their tax liability. This directly translates into financial relief, freeing up funds for other essential needs.

The practical significance of this connection is amplified when considering the cumulative effect of childcare expenses over time. These costs can represent a substantial portion of a family’s budget. By diligently tracking expenses and leveraging available tax benefits, families can significantly reduce their overall childcare burden. Consider a two-income household with multiple children in daycare. The annual cost of care can be considerable. Accurate record-keeping, facilitated by a template, empowers this family to maximize their eligible deductions, resulting in potentially thousands of dollars in tax savings annually. This financial relief can be instrumental in achieving financial stability and supporting long-term financial goals.

In conclusion, the connection between financial relief and complimentary childcare expense record forms is crucial for families navigating the often substantial costs of childcare. These templates empower families to access available tax benefits, effectively reducing their financial burden and promoting greater financial well-being. Understanding and utilizing these resources is essential for maximizing financial relief and achieving long-term financial stability. While the template itself doesn’t provide direct financial assistance, it serves as the key to unlocking potential tax benefits that directly translate into tangible financial relief.

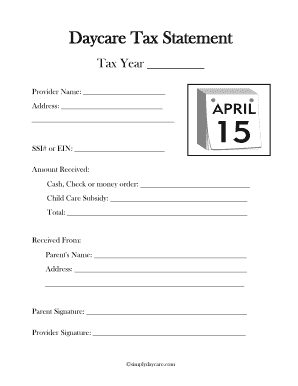

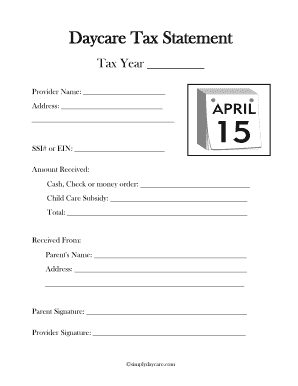

Key Components of a Complimentary Childcare Expense Record Form

Effective utilization of a complimentary childcare expense record form requires understanding its core components. These components ensure accurate record-keeping, facilitate compliance with tax regulations, and maximize potential tax benefits. The following elements are crucial for comprehensive documentation of childcare expenditures.

1. Provider Information: This section captures essential details about the childcare provider, including name, address, tax identification number (TIN), and contact information. Accurate provider information is crucial for verifying legitimacy and ensuring proper reporting to tax authorities.

2. Qualifying Child/Dependent Information: This component documents information about the child or dependent receiving care, including name, date of birth, and social security number. This information establishes eligibility for specific tax benefits tied to dependent care.

3. Dates of Service: Accurate recording of service dates is essential for determining the period for which expenses are being claimed. This information helps align expenses with the relevant tax year and ensures accurate reporting.

4. Payment Information: This section details the amount paid for childcare services, including the date of payment and payment method. Precise payment records are crucial for substantiating claimed expenses and calculating potential deductions or credits.

5. Additional Expenses: Some templates accommodate additional childcare-related expenses, such as transportation costs or fees for educational materials. Including these details ensures a comprehensive record of all eligible childcare expenditures.

6. Supporting Documentation: While not directly part of the template, maintaining supporting documentation, such as receipts and invoices, is crucial for validating claimed expenses. These records serve as evidence in case of audits and substantiate the accuracy of reported information.

These components, when accurately and consistently documented, enable taxpayers to effectively utilize complimentary childcare expense record forms. This organized approach simplifies tax preparation, ensures compliance, and maximizes the potential for financial relief through applicable tax benefits. The structured format provided by these forms contributes to a more efficient and accurate tax filing process.

How to Create a Free Daycare Tax Statement Template

Creating a template for tracking childcare expenses requires careful consideration of essential components to ensure accurate record-keeping and maximize potential tax benefits. The following steps outline the process of developing a comprehensive and user-friendly template.

1. Define the Purpose: Clearly define the template’s purpose, specifying the tax benefits it aims to support (e.g., Child and Dependent Care Credit). This focus ensures the template captures all necessary information relevant to specific tax requirements.

2. Determine Required Information: Identify the essential data points needed for accurate record-keeping and tax compliance. This typically includes provider information, child/dependent details, dates of service, payment amounts, and any additional eligible expenses.

3. Choose a Format: Select a suitable format for the template, considering accessibility and ease of use. Options include spreadsheets, word processing documents, or online forms. The chosen format should facilitate clear organization and easy data entry.

4. Structure the Template: Organize the template logically, grouping related information and using clear headings. This structure ensures ease of navigation and facilitates accurate data entry. A well-structured template minimizes errors and promotes efficient record-keeping.

5. Incorporate Instructions and Guidance: Include clear instructions and guidance within the template, explaining each field and providing examples where necessary. This helps users accurately complete the template and understand the relevance of each data point.

6. Test and Refine: Thoroughly test the template to ensure functionality and usability. Gather feedback from potential users to identify areas for improvement and refine the template accordingly. This iterative process ensures the final version is effective and user-friendly.

7. Ensure Accessibility: Provide the template in accessible formats (e.g., printable PDFs, downloadable spreadsheets) to accommodate diverse needs and technological capabilities. Accessibility ensures equitable access to the template and promotes inclusivity.

A well-designed template facilitates accurate and organized record-keeping, enabling individuals to substantiate childcare expenses, comply with tax regulations, and maximize potential tax benefits. The template serves as a crucial tool for managing childcare costs and accessing available financial relief.

Accurate documentation of childcare expenses is crucial for families seeking to maximize potential tax benefits and alleviate the financial burden of childcare. Complimentary childcare expense record forms provide a structured framework for tracking these expenses, ensuring compliance with tax regulations and facilitating access to applicable deductions or credits. These resources empower families to organize crucial financial information, substantiate claims, and navigate the complexities of tax season with greater confidence. Access to user-friendly templates, coupled with diligent record-keeping practices, contributes significantly to financial well-being for families utilizing childcare services.

Effective utilization of these readily available resources represents a proactive approach to financial planning and can significantly impact a family’s financial stability. By embracing organized record-keeping and leveraging available tax benefits, families can mitigate the financial strain of childcare, freeing up resources for other essential needs. The accessibility and ease of use of these templates underscore their importance in promoting financial wellness and empowering families to navigate the complexities of childcare expenses effectively.