Accessibility and cost-effectiveness are key advantages. Utilizing such a resource eliminates the need for manual creation or expensive software purchases. This empowers businesses, particularly startups and small enterprises, to efficiently manage finances and gain a clear understanding of their financial standing without significant upfront investment. This readily available tool allows for quick generation and analysis, facilitating timely adjustments to business strategies.

Understanding the structure and benefits of these statements lays the groundwork for exploring broader financial management topics. Considerations such as accurate data entry, interpretation of results, and integration with other financial tools will further enhance the utility of this valuable resource.

1. Accessibility

Accessibility is a defining characteristic of effective online financial tools. For profit and loss templates, accessibility translates to availability across diverse platforms and devices. This ubiquitous access empowers business owners and financial managers to monitor performance anytime, anywhere, using computers, tablets, or smartphones. This eliminates geographical restrictions and promotes real-time financial oversight, fostering proactive decision-making. For instance, a traveling sales representative can immediately update sales figures, allowing management to instantly assess the impact on overall profitability.

Beyond device compatibility, accessibility also encompasses ease of use. Intuitive interfaces, clear instructions, and readily available support resources contribute to a seamless user experience, regardless of technical expertise. This democratizes access to essential financial management tools, enabling even those without specialized training to benefit. Consider a small business owner without an accounting background; an accessible template allows them to independently track and understand their financial position without needing to hire external help, saving valuable resources.

The practical significance of accessibility lies in its ability to drive informed decision-making. Timely access to financial data, coupled with user-friendly tools, facilitates regular monitoring and prompt identification of potential issues. This proactive approach allows for swift corrective action, mitigating risks and maximizing profitability. Accessibility, therefore, serves as a cornerstone for effective financial management, contributing directly to business success and sustainability. However, maintaining data security across multiple access points presents an ongoing challenge, requiring robust security measures to safeguard sensitive financial information.

2. Cost-effectiveness

Cost-effectiveness represents a critical advantage of utilizing free online profit and loss statement templates. Eliminating the financial burden associated with proprietary software or outsourced accounting services allows businesses to allocate resources more strategically. This is particularly beneficial for startups and small enterprises operating with limited budgets. The ability to access and utilize professional-grade financial tools without incurring costs directly impacts profitability and long-term sustainability. For example, a newly established e-commerce business can leverage a free template to track sales and expenses from the outset, gaining valuable financial insights without diverting funds from essential operational activities like marketing or inventory.

Beyond initial cost savings, these templates offer ongoing cost-effectiveness. Regular updates, often included with reputable free resources, ensure compliance with evolving accounting standards and best practices. This eliminates the need for costly software upgrades or ongoing consultant fees, further enhancing long-term value. Consider a non-profit organization relying on grants and donations; utilizing a free template that automatically incorporates updated reporting requirements ensures compliance without incurring additional expenses, allowing them to maximize the impact of their limited resources.

While cost-effectiveness is a significant driver for adoption, maintaining data accuracy and security requires diligent management. Free templates typically rely on user-entered data, increasing the risk of human error. Implementing robust data validation processes and secure storage practices are crucial for mitigating these risks. Additionally, integrating free templates with other business systems may require technical expertise or incur integration costs, factors to consider when evaluating long-term viability. Ultimately, recognizing both the advantages and potential limitations of cost-effectiveness contributes to informed decision-making regarding financial tool selection and implementation.

3. Standardized Format

Standardized formatting within free online profit and loss statement templates ensures consistency and comparability. This structured approach facilitates clear financial reporting, enabling stakeholders to quickly grasp key performance indicators. Adherence to established accounting principles ensures data integrity and allows for meaningful analysis, both internally for management decision-making and externally for investors, lenders, or regulatory bodies.

- Consistent StructureConsistent presentation of revenue, expenses, and net income/loss allows for easy tracking of financial performance over time. This standardized structure facilitates trend analysis and identification of potential issues. For example, consistent categorization of operating expenses allows for direct comparison across reporting periods, highlighting any significant fluctuations that warrant further investigation.

- ComparabilityStandardized templates enable benchmarking against industry averages or competitors. This provides valuable context for evaluating performance and identifying areas for improvement. A restaurant, for example, can compare its profit margins to industry benchmarks to assess its operational efficiency and pricing strategy.

- ComplianceAdherence to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) ensures compliance with regulatory requirements. This is crucial for attracting investors, securing loans, and maintaining transparency. A publicly traded company, for instance, must adhere to specific reporting standards when publishing its financial statements.

- Simplified AnalysisStandardized data organization facilitates the use of analytical tools and software. This streamlines financial reporting processes and enables deeper insights into profitability drivers. Automated calculation of key ratios like gross profit margin or net profit margin allows for efficient performance evaluation.

Leveraging the standardized format of free online profit and loss statement templates empowers businesses to present financial information clearly and consistently. This fosters transparency, improves comparability, and supports informed decision-making, ultimately contributing to enhanced financial management and sustainable growth. However, businesses with unique operational structures or reporting requirements may need to adapt standard templates to fully reflect their specific circumstances, balancing standardization with customization.

4. Customizability

Adaptability to specific business needs is a critical factor when selecting a profit and loss statement template. Customizability allows businesses to tailor these templates to reflect unique operational structures, industry-specific requirements, and individual reporting preferences. This ensures relevance and maximizes the utility of the template as a financial management tool.

- Chart of Accounts ModificationThe ability to modify the chart of accountsthe listing of all accounts used in the general ledgeris crucial for accurately reflecting a business’s financial activities. A retail business, for example, might need to add specific accounts for cost of goods sold, while a service-based business might require detailed accounts for different service categories. This tailored approach ensures accurate tracking of revenue and expenses, enabling meaningful financial analysis.

- Reporting Period AdjustmentsFlexibility in defining reporting periods allows businesses to analyze performance over varying timeframes. While monthly reporting is common, some businesses may require weekly or quarterly analysis. A seasonal business, for example, might benefit from analyzing profitability over specific seasons to understand peak performance and plan inventory accordingly.

- Integration with Existing SystemsCompatibility with existing accounting software or other business tools streamlines data entry and reporting processes. Exporting data to spreadsheet software or importing data from point-of-sale systems enhances efficiency and reduces manual effort. A business using cloud-based accounting software, for instance, can benefit from a template that integrates directly with their existing system, automating data transfer and reducing data entry errors.

- Visual CustomizationWhile functionality is paramount, visual customization can enhance readability and presentation. Options for adjusting fonts, colors, and layout contribute to creating professional-looking reports suitable for internal review, investor presentations, or loan applications. A consulting firm, for example, might customize the visual presentation of their profit and loss statement to align with their brand identity when presenting financial performance to clients.

Customizability enhances the practical value of free online profit and loss statement templates by aligning them with specific business requirements. This tailored approach improves data accuracy, simplifies reporting, and ultimately facilitates more informed financial decision-making. However, excessive customization can compromise the standardized structure and comparability benefits of these templates. Maintaining a balance between customization and standardization is essential for maximizing their effectiveness.

5. Data Analysis

Data analysis transforms the raw figures within a free online profit and loss statement template into actionable insights. Analyzing the data contained within these statements is crucial for understanding financial performance, identifying trends, and making informed decisions. This process bridges the gap between simply recording financial activity and leveraging that information for strategic advantage.

- Trend IdentificationAnalyzing profit and loss data over multiple reporting periods reveals trends in revenue, expenses, and profitability. Identifying upward or downward trends allows for proactive adjustments to business strategies. For example, consistently declining sales in a specific product category might prompt a business to re-evaluate its marketing strategy or discontinue the product. Understanding these trends empowers businesses to anticipate future performance and make data-driven decisions.

- Cost ManagementDetailed analysis of expense categories helps pinpoint areas of potential cost savings. Identifying and controlling rising expenses is crucial for maintaining profitability. For instance, a significant increase in operating expenses could trigger a review of vendor contracts or operational efficiencies. This granular analysis allows for targeted cost-cutting measures without compromising essential business functions.

- Performance EvaluationCalculating key performance indicators (KPIs) such as gross profit margin, net profit margin, and operating expense ratio provides a quantitative assessment of financial health. Comparing these KPIs against industry benchmarks or previous periods offers valuable insights into overall performance. A restaurant, for example, might track its food cost percentage to evaluate menu pricing and inventory management effectiveness.

- Forecasting and BudgetingHistorical profit and loss data serves as a foundation for developing realistic financial forecasts and budgets. Understanding past performance allows for more accurate projections of future revenue and expenses, which are essential for strategic planning and resource allocation. A rapidly growing tech startup, for instance, can use historical data to forecast future hiring needs and allocate resources accordingly.

Data analysis elevates free online profit and loss statement templates from static records to dynamic tools for financial management. By extracting meaningful insights from the data, businesses gain a deeper understanding of their financial position, identify opportunities for improvement, and make informed decisions that drive profitability and sustainable growth. Integrating data analysis with regular review of these statements further amplifies their value, fostering a proactive and data-driven approach to financial management.

6. Decision Support

Effective decision-making relies on accurate, timely, and accessible financial information. Free online profit and loss statement templates provide this crucial foundation, empowering businesses to make informed decisions that drive profitability and sustainable growth. These templates facilitate data-driven decision-making across various operational areas, from pricing and cost management to investment and expansion strategies.

- Pricing StrategiesProfit and loss data reveals the direct impact of pricing decisions on profitability. Analyzing cost of goods sold, operating expenses, and profit margins informs pricing adjustments. For example, if a product line consistently shows low profit margins, data analysis can support decisions to increase prices, reduce production costs, or discontinue the product altogether. Informed pricing strategies maximize revenue potential while maintaining healthy profit margins.

- Cost ManagementTracking expenses through a profit and loss statement allows for identification of areas where cost optimization is possible. Analyzing trends in operating expenses, such as rent, utilities, and marketing costs, enables businesses to identify and control unnecessary spending. For instance, consistently rising marketing costs coupled with stagnant sales might prompt a review of marketing campaign effectiveness and resource allocation. Effective cost management directly impacts profitability and resource efficiency.

- Investment DecisionsDemonstrated profitability, as evidenced in the profit and loss statement, strengthens applications for funding. Investors and lenders rely on these statements to assess financial health and growth potential. A consistent record of profitability increases the likelihood of securing loans or attracting investors, enabling business expansion and strategic investments. Accurate and readily available financial data enhances credibility and fosters trust with financial stakeholders.

- Resource AllocationProfit and loss data informs resource allocation decisions across the business. Identifying profitable product lines or service offerings allows for strategic allocation of resources to maximize returns. For example, a business might choose to invest more heavily in a high-performing product line, allocating additional resources to marketing, research and development, or production. Data-driven resource allocation optimizes resource utilization and drives revenue growth.

Free online profit and loss statement templates serve as a crucial decision support tool, empowering businesses to leverage financial data for strategic advantage. By providing a clear and accessible overview of financial performance, these templates facilitate informed decisions related to pricing, cost management, investment strategies, and resource allocation. Regularly reviewing and analyzing these statements fosters a data-driven approach to management, contributing directly to business success and long-term sustainability. Integrating this data with other key performance indicators and market analysis further enhances decision-making capabilities.

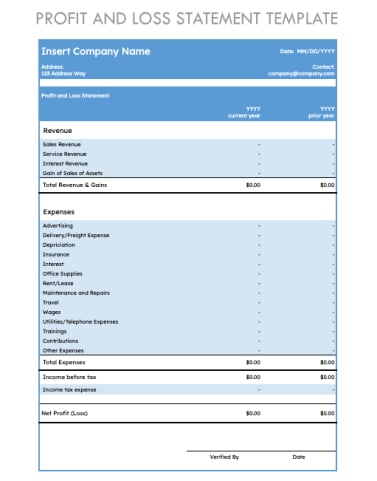

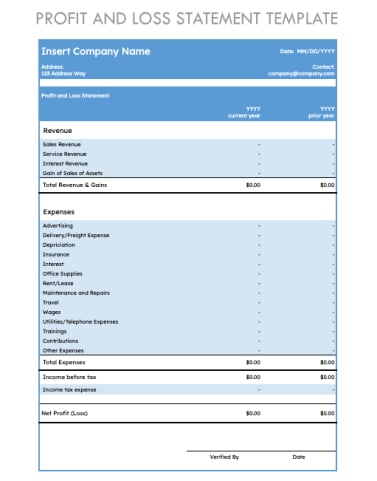

Key Components of a Profit and Loss Statement

Essential elements comprise a comprehensive profit and loss statement, providing a structured overview of financial performance. Understanding these components is crucial for accurate interpretation and effective utilization in decision-making.

1. Revenue: This section details all income generated from business operations, including sales, services rendered, and any other income streams. Accurate revenue reporting is fundamental to assessing overall financial performance. Different revenue streams should be clearly delineated to provide a granular view of income generation.

2. Cost of Goods Sold (COGS): Direct costs associated with producing goods or services are outlined here. This includes raw materials, direct labor, and manufacturing overhead. COGS is crucial for calculating gross profit and understanding production efficiency.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of core business operations before accounting for indirect expenses. This metric is a key indicator of production efficiency and pricing strategy effectiveness.

4. Operating Expenses: This section encompasses all indirect costs incurred in running the business, including rent, utilities, marketing, salaries, and administrative expenses. Categorizing operating expenses provides insight into cost drivers and areas for potential optimization.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for all operating costs. This metric is a key indicator of overall operational efficiency and management effectiveness.

6. Other Income/Expenses: This section accounts for non-operating income and expenses, such as interest income, investment gains or losses, and one-time expenses. Including these items provides a comprehensive view of all financial activity affecting the business.

7. Net Income/Loss: The final calculation, representing the overall profit or loss for the given period, is derived by adding other income and subtracting other expenses from operating income. Net income/loss is the ultimate measure of financial performance and provides a basis for evaluating business health and sustainability.

Accurate reporting and analysis of these components provide a comprehensive understanding of financial performance, enabling informed decision-making and contributing to long-term business success. This structured overview facilitates effective financial management and strategic planning.

How to Create a Free Online Profit and Loss Statement Template

Creating a readily available, no-cost profit and loss statement template involves several key steps. These steps ensure a structured, accurate, and user-friendly tool for financial analysis.

1: Define the Reporting Period: Specify the timeframe covered by the statement (e.g., month, quarter, year). A clearly defined reporting period ensures consistency and allows for accurate performance comparison over time.

2: Establish Revenue Categories: Create distinct categories for different revenue streams (e.g., product sales, service fees, subscriptions). Clear categorization facilitates analysis of individual revenue streams and identification of key revenue drivers.

3: Outline Cost of Goods Sold (COGS): Detail all direct costs associated with producing goods or services. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and understanding production efficiency.

4: Categorize Operating Expenses: Establish categories for all indirect costs, including rent, utilities, marketing, salaries, and administrative expenses. Detailed categorization facilitates cost management and identification of areas for potential savings.

5: Calculate Key Metrics: Include formulas for calculating gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income – Other Expenses). Automated calculations ensure accuracy and efficiency.

6: Design a User-Friendly Layout: Organize the template in a clear, logical manner, ensuring easy data entry and readability. A visually appealing and intuitive layout enhances user experience and promotes regular use.

7: Choose a Distribution Method: Select a suitable format for distribution (e.g., spreadsheet software, online form). Consider accessibility, compatibility with existing systems, and data security when choosing a distribution method.

8: Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Solicit feedback and refine the template based on user experience and evolving business needs. Continuous improvement ensures the template remains a relevant and effective tool.

Developing a robust and accessible profit and loss statement template requires careful planning and execution. Attention to detail in each step ensures the creation of a valuable tool for financial analysis, supporting informed decision-making and contributing to long-term business success. Regularly reviewing and updating the template maintains its relevance and effectiveness in a dynamic business environment.

Readily available, no-cost profit and loss statement templates offer invaluable support for financial management, providing a structured framework for tracking revenue, expenses, and profitability. Accessibility, cost-effectiveness, and customizability empower businesses of all sizes to leverage these tools for enhanced financial analysis. Understanding key components, data analysis techniques, and the role of these templates in decision support is crucial for maximizing their utility. Accurate data entry and consistent usage are essential for generating reliable insights and driving informed financial decisions.

Effective financial management hinges on readily available tools and a commitment to consistent monitoring and analysis. Leveraging these accessible resources empowers businesses to gain a deeper understanding of their financial performance, identify areas for improvement, and make data-driven decisions that contribute to long-term sustainability and growth. Regular review and analysis of financial statements are crucial for proactive management and navigating the complexities of the modern business landscape.