Utilizing such a document offers several advantages. It allows individuals to readily assess their financial health, identify areas for improvement, and track progress toward financial goals. Access to a no-cost option empowers individuals to take control of their finances without incurring additional expenses. This accessibility promotes broader financial literacy and responsible financial management.

The following sections will explore the key components typically included in these documents, offer guidance on completing them accurately, and discuss how this information can be leveraged for effective financial planning and analysis.

1. Accessibility

Accessibility is a critical factor in the efficacy of complimentary personal financial statement form templates. Removing cost barriers significantly broadens access to these essential financial tools. This widespread availability empowers individuals across diverse socioeconomic backgrounds to engage in proactive financial management. For example, a young adult entering the workforce or a family facing financial constraints can utilize a free template to organize their finances without incurring additional expenses, a crucial step towards achieving financial stability.

Furthermore, accessibility extends beyond mere cost. Digital accessibility, ensuring compatibility with assistive technologies, is paramount for inclusivity. Templates available in multiple formats (e.g., printable, downloadable spreadsheets) cater to varying technological literacy levels and preferences. This multifaceted approach to accessibility maximizes the potential user base, fostering wider financial literacy and responsible financial practices across communities.

Ultimately, accessible financial tools, such as complimentary personal financial statement form templates, play a crucial role in promoting financial well-being. By lowering barriers to entry and ensuring broad inclusivity, these resources empower individuals to take control of their financial lives, regardless of their background or circumstances. This contributes to more informed financial decision-making and a more financially secure population.

2. Standardized Structure

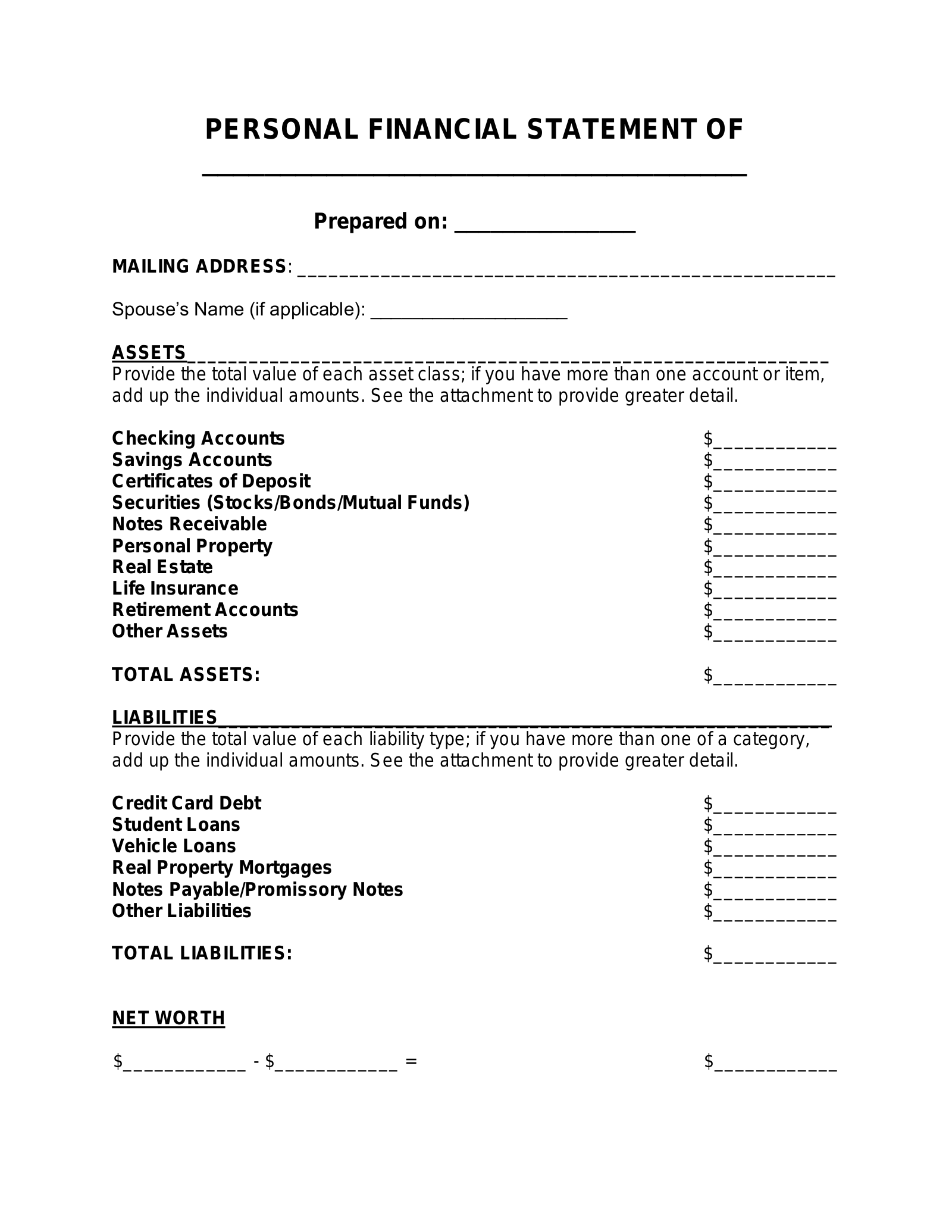

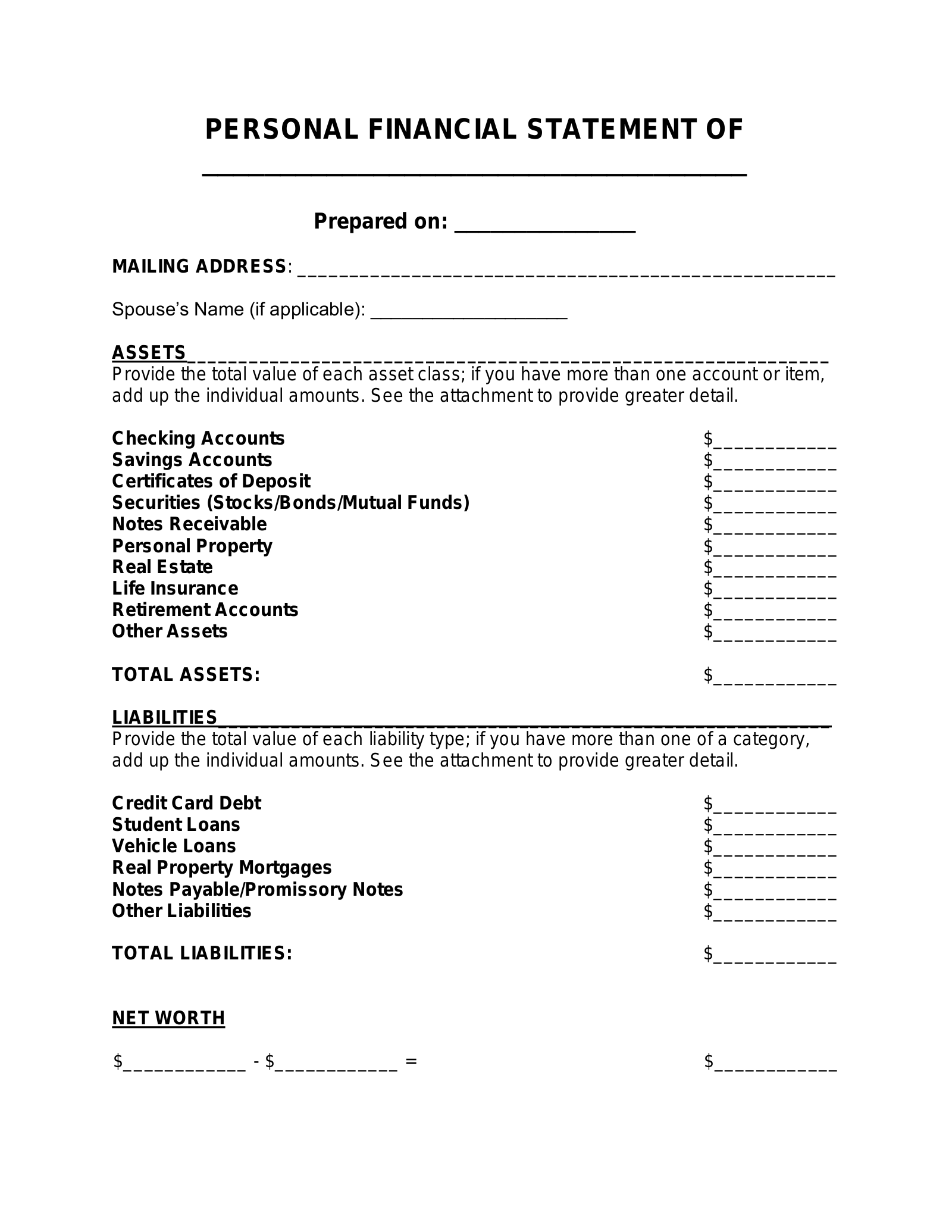

A standardized structure is a defining feature of effective complimentary personal financial statement form templates. This consistent format facilitates clear organization and efficient analysis of financial data. Uniformity across different templates ensures data comparability and simplifies the process of understanding one’s financial position, regardless of the specific template chosen.

- Categorization of AssetsStandardized templates typically categorize assets into distinct types, such as liquid assets (e.g., cash, checking accounts), investments (e.g., stocks, bonds), and fixed assets (e.g., real estate, vehicles). This categorization allows for a granular view of asset allocation and facilitates informed decision-making regarding investment strategies and liquidity management.

- Classification of LiabilitiesLiabilities are similarly categorized, often distinguishing between short-term liabilities (e.g., credit card debt, upcoming bills) and long-term liabilities (e.g., mortgages, student loans). This distinction aids in assessing debt burden and prioritizing repayment strategies based on interest rates and repayment timelines.

- Net Worth CalculationStandardized templates provide a clear and consistent method for calculating net worth (assets minus liabilities). This standardized calculation ensures accuracy and allows for meaningful tracking of net worth changes over time, providing insights into the effectiveness of financial strategies.

- Date SpecificationThe inclusion of a date field emphasizes that a personal financial statement represents a snapshot of one’s finances at a specific point in time. This reinforces the importance of regularly updating the statement to track financial progress and adapt strategies as needed.

The standardized structure of these templates contributes significantly to their usability and effectiveness. By providing a consistent framework for organizing and analyzing financial data, these templates empower individuals to gain a clear understanding of their financial standing and make informed decisions to improve their financial well-being. This structured approach facilitates more effective financial planning and contributes to greater financial stability.

3. Net Worth Calculation

Net worth calculation forms the core of a free personal financial statement form template. A template facilitates this crucial calculation by providing a structured framework for listing assets and liabilities. The difference between total assets and total liabilities represents net worth, offering a concise summary of one’s financial position. This understanding is fundamental to sound financial planning. For instance, a positive net worth signifies financial health and the capacity to absorb unexpected financial shocks, whereas a negative net worth indicates a need for strategic adjustments to spending and debt management. Consider a scenario where an individual uses a template to calculate their net worth. They list assets like a home valued at $300,000 and investments totaling $50,000. Liabilities include a mortgage of $200,000 and student loans of $20,000. The resulting net worth of $130,000 provides a clear indicator of their financial standing.

Regular net worth calculation, enabled by these templates, allows individuals to track financial progress over time. Observing an increasing net worth indicates effective financial management, while a declining net worth signals the need for adjustments. This consistent monitoring allows for proactive financial decision-making and course correction. For example, a decrease in net worth might prompt an individual to explore options for debt consolidation or to adjust investment strategies for better returns. The ability to quantify progress motivates adherence to financial goals and reinforces positive financial behaviors.

In summary, net worth calculation, facilitated by free personal financial statement form templates, provides a critical metric for assessing financial health and tracking progress. This understanding empowers individuals to make informed decisions regarding budgeting, investing, and debt management. Regularly utilizing these templates to calculate net worth offers a quantifiable measure of financial success, motivating responsible financial behavior and contributing to long-term financial well-being. The accessibility and structured format of these templates make this crucial aspect of financial planning readily available to a broad audience, promoting wider financial literacy and responsible financial practices.

4. Asset Documentation

Accurate asset documentation is a cornerstone of effective financial management, and a free personal financial statement form template provides the structure to organize and record this crucial information. A comprehensive record of assets allows for a realistic assessment of net worth, informs investment strategies, and supports informed financial decision-making. Meticulous documentation is also essential for insurance purposes, estate planning, and potential loan applications.

- Liquid AssetsLiquid assets, such as checking and savings accounts, money market funds, and certificates of deposit, represent readily available funds. Documenting these assets, including account numbers, financial institutions, and current balances, provides a clear picture of short-term financial resources. This information is essential for budgeting, emergency planning, and short-term investment decisions. For instance, knowing the exact amount available in a savings account allows for informed decisions regarding potential down payments or emergency fund allocation.

- InvestmentsInvestment assets, including stocks, bonds, mutual funds, and retirement accounts, require detailed documentation. Recording the type of investment, the financial institution or brokerage firm, account numbers, and current valuations provides a comprehensive overview of long-term financial holdings. This detailed record is crucial for tracking investment performance, making informed decisions about asset allocation, and planning for long-term financial goals like retirement. For example, documenting the performance of a specific stock portfolio over time informs decisions regarding future investment strategies.

- Fixed AssetsFixed assets, such as real estate, vehicles, and valuable personal property (e.g., jewelry, art), represent tangible, long-term holdings. Documenting these assets, including ownership details, purchase dates and prices, and current estimated market values, provides a comprehensive record of significant possessions. This information is crucial for insurance purposes, estate planning, and understanding the overall composition of ones net worth. For instance, accurate documentation of a property’s value is essential when applying for a home equity loan.

- Intangible AssetsIntangible assets, such as intellectual property, copyrights, and patents, represent non-physical assets with potential future value. While often more complex to value, documenting these assets, including ownership details and any associated legal documentation, is important for a complete understanding of ones financial portfolio. This documentation can be crucial in business valuations or in situations involving licensing or royalty agreements.

By providing a structured framework for documenting these diverse asset categories, a free personal financial statement form template empowers individuals to gain a comprehensive understanding of their financial standing. This organized approach to asset documentation facilitates informed decision-making regarding budgeting, investing, estate planning, and other crucial financial matters. Regularly updating this documentation within the template ensures an accurate and current reflection of ones financial position, promoting sound financial practices and long-term financial well-being.

5. Liability Tracking

Effective financial management necessitates a clear understanding of liabilities, and a free personal financial statement form template provides a structured framework for tracking these financial obligations. Accurate liability tracking enables informed decision-making regarding debt management, budgeting, and overall financial planning. By providing a dedicated space to document and categorize various liabilities, these templates empower individuals to gain a comprehensive overview of their financial obligations and develop strategies for reducing debt and improving financial health.

- Short-Term LiabilitiesShort-term liabilities, typically due within one year, include credit card balances, utility bills, medical bills, and short-term loans. Tracking these obligations within a template allows for an assessment of immediate financial demands. For example, documenting upcoming credit card payments and utility bills facilitates accurate budgeting and prioritization of payments. Understanding short-term debt obligations is crucial for managing cash flow and avoiding late payment penalties.

- Long-Term LiabilitiesLong-term liabilities, extending beyond one year, typically include mortgages, student loans, auto loans, and personal loans. Documenting these obligations, including loan terms, interest rates, and outstanding balances, provides a clear picture of long-term debt burden. For instance, tracking the remaining balance and interest rate on a mortgage allows for informed decisions regarding refinancing or extra payments to accelerate principal reduction. Understanding long-term debt is essential for long-term financial planning and achieving financial goals like homeownership or financial independence.

- Categorization and AnalysisTemplates facilitate categorization of liabilities, enabling a granular view of debt composition. This categorization allows for analysis of debt by type, interest rate, and repayment schedule. For example, separating high-interest debt from low-interest debt highlights areas where focused debt reduction efforts can yield the greatest impact. This analysis can inform decisions regarding debt consolidation or prioritization of high-interest debt repayment.

- Impact on Net WorthAccurate liability tracking is essential for accurate net worth calculation. By providing a structured space to document all liabilities, the template ensures a realistic assessment of net worth. Understanding the impact of liabilities on net worth emphasizes the importance of debt management in achieving financial health. For instance, observing a decrease in net worth due to increasing liabilities might prompt an individual to re-evaluate spending habits and explore options for debt reduction.

By providing a structured framework for documenting and analyzing liabilities, free personal financial statement form templates empower individuals to take control of their debt and make informed decisions regarding financial management. This organized approach to liability tracking fosters a deeper understanding of financial obligations, promotes responsible debt management practices, and contributes to improved financial well-being. Regularly updating liability information within the template allows for continuous monitoring of debt and facilitates proactive adjustments to financial strategies as needed.

6. Financial Snapshot

A free personal financial statement form template facilitates the creation of a crucial financial snapshot. This snapshot represents a concise overview of an individual’s financial position at a specific point in time, encompassing assets, liabilities, and net worth. This summarized view allows for a clear understanding of current financial health and forms the basis for informed financial planning. Consider an individual seeking to assess their eligibility for a mortgage. A completed template provides the lender with a concise snapshot of their financial standing, enabling a swift and informed decision. This same snapshot also empowers the individual to understand their borrowing capacity and make informed decisions about the size and type of mortgage they can afford.

The financial snapshot derived from a template offers several practical advantages. It provides a baseline for tracking financial progress over time. By comparing snapshots from different periods, individuals can assess the effectiveness of their financial strategies and make adjustments as needed. For example, a regular increase in net worth over several snapshots indicates positive financial trajectory. Conversely, a stagnant or declining net worth might signal the need for adjustments to spending habits, debt management strategies, or investment approaches. This dynamic use of financial snapshots transforms the template from a static document into a tool for ongoing financial monitoring and improvement.

A comprehensive financial snapshot, facilitated by a free template, is essential for various financial endeavors. It informs investment decisions, supports loan applications, assists in budgeting, and contributes to effective estate planning. Understanding the components of this snapshotassets, liabilities, and net worthand their interrelationships empowers individuals to make informed decisions aligned with their financial goals. While creating a financial snapshot can be complex, utilizing a free template simplifies the process and makes this crucial tool accessible to a broader audience. This increased accessibility promotes wider financial literacy and empowers individuals to take control of their financial well-being.

Key Components of a Personal Financial Statement Form Template

A comprehensive personal financial statement form template provides a structured framework for organizing crucial financial data. Understanding these key components is essential for effectively utilizing the template and gaining a clear overview of one’s financial position.

1. Personal Information: This section typically includes basic identifying information such as name, address, and contact details. Accurate personal information ensures the document is clearly attributed and readily identifiable.

2. Date: Specifying the date is crucial as it establishes the point in time for the financial snapshot. This reinforces the understanding that financial statements represent a specific moment and should be updated regularly.

3. Assets: This section encompasses all items of value owned, categorized into liquid assets (e.g., cash, checking accounts), investments (e.g., stocks, bonds), and fixed assets (e.g., real estate, vehicles). Accurate asset documentation, including current valuations, is essential for determining net worth.

4. Liabilities: This section details all outstanding debts and financial obligations, categorized into short-term liabilities (e.g., credit card debt) and long-term liabilities (e.g., mortgages). Accurate liability documentation is crucial for calculating net worth and understanding debt burden.

5. Net Worth Calculation: The template facilitates net worth calculation by providing a structured framework for subtracting total liabilities from total assets. This calculation offers a concise summary of one’s overall financial health.

Accurate completion of these core components provides a comprehensive overview of one’s financial standing, enabling informed decision-making regarding budgeting, investing, and debt management. Regular updates ensure the financial snapshot remains current and relevant for ongoing financial planning.

How to Create a Free Personal Financial Statement Form Template

Creating a personal financial statement form template provides a structured approach to organizing financial data. The following steps outline the process of developing a comprehensive template.

1: Define the Scope: Determine the specific purpose of the template. A template for personal use may require different levels of detail compared to one intended for loan applications or business valuations.

2: Personal Information Section: Include fields for essential identifying information: full name, current address, contact phone number, and email address. This ensures clear attribution and facilitates easy identification.

3: Date Field: Incorporate a prominent date field. This emphasizes the time-specific nature of the financial statement and encourages regular updates.

4: Asset Section: Create categorized sections for listing assets. Include subcategories for liquid assets (cash, checking/savings accounts), investments (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Provide fields for describing each asset, its current value, and relevant account details.

5: Liabilities Section: Establish categorized sections for listing liabilities. Include subcategories for short-term liabilities (credit card debts, utility bills) and long-term liabilities (mortgages, student loans). Provide fields for describing each liability, its current balance, interest rate, and payment terms.

6: Net Worth Calculation Section: Incorporate a formula to automatically calculate net worth by subtracting total liabilities from total assets. Clearly label this section to highlight its significance.

7: Formatting and Accessibility: Design the template with clear headings, labels, and consistent formatting for ease of use. Consider accessibility requirements, ensuring compatibility with various software and assistive technologies. Offering multiple formats (e.g., printable PDF, downloadable spreadsheet) enhances accessibility.

8: Regular Review and Updates: Emphasize the importance of regularly reviewing and updating the template to reflect changes in financial circumstances. A regularly updated template provides a consistently accurate financial snapshot.

A well-designed template provides a clear and organized overview of one’s financial position. Consistent use and regular updates support informed financial decision-making and contribute to long-term financial well-being. Accessibility considerations ensure broader usability and promote wider financial literacy.

Access to complimentary, structured resources for organizing financial data empowers informed decision-making. Understanding assets, liabilities, and net worthkey components of these resourcesprovides a foundation for sound financial planning. Standardized templates facilitate consistent tracking and analysis, promoting effective debt management and strategic investment choices. Regular utilization and accurate data entry maximize the benefits of these accessible tools.

Financial well-being hinges on informed choices and proactive management. Leveraging available resources, particularly those offering structured guidance at no cost, represents a crucial step towards achieving financial goals. Consistent engagement with these tools fosters financial literacy and empowers individuals to navigate complex financial landscapes with greater confidence and control. Embracing accessible resources positions individuals for long-term financial security and stability.