Accessibility and customizability are key advantages of this resource. Users can readily obtain and modify the document to suit specific needs, eliminating the cost and effort of creating one from scratch. This empowers individuals and small businesses to manage finances effectively without specialized software or professional assistance. The readily available format promotes transparency and facilitates clear communication of financial performance to stakeholders.

Understanding the structure and application of this financial tool is essential for effective financial management. The following sections will explore the key components of a typical statement, provide guidance on how to utilize it effectively, and offer resources for locating suitable templates.

1. Accessibility

Accessibility is a defining feature of free printable income statement templates. Their availability online eliminates barriers to entry for individuals and small businesses seeking to organize their finances. Unlike proprietary software or professional accounting services, which can incur significant costs, these templates are readily available at no charge. This democratizes access to essential financial management tools, empowering users to take control of their financial well-being regardless of technical expertise or budget constraints. For instance, a small business owner can download a template in minutes, gaining immediate access to a structured framework for tracking financial performance.

This accessibility translates to practical benefits. Users can readily download and utilize a template whenever needed, facilitating timely financial analysis. This allows for proactive identification of potential issues, informed decision-making, and improved financial planning. Furthermore, the widespread availability of these templates contributes to financial literacy by providing a tangible tool for understanding and managing income and expenses. Consider a community organization seeking to educate members on basic budgeting; free printable income statement templates offer a readily accessible resource for practical application of these concepts.

While accessibility is paramount, users should exercise discernment when selecting a template. Ensuring the chosen template aligns with specific needs and adheres to relevant accounting principles is crucial. Evaluating the template’s source and verifying its credibility helps ensure accuracy and reliability. Accessibility, coupled with informed selection, empowers users to leverage these valuable tools for effective financial management.

2. Customizability

Customizability is a significant advantage of free printable income statement templates. Unlike standardized, pre-filled forms, these templates offer flexibility, allowing adaptation to diverse financial situations and reporting requirements. This adaptability is crucial for accurately reflecting the unique income streams and expense categories of various individuals, businesses, and organizations. A template designed for a freelance consultant, for instance, may require customization to accommodate project-based income, marketing expenses, and professional development costs, while a template for a retail store would necessitate modifications to track sales revenue, cost of goods sold, and inventory management expenses.

This inherent flexibility allows users to tailor categories, add or remove lines, and modify headings to precisely match their specific needs. This level of control ensures the template accurately captures all relevant financial data, providing a comprehensive and meaningful overview of financial performance. Furthermore, customizability extends to the reporting period. Users can adjust the template to reflect monthly, quarterly, or annual performance, facilitating analysis at different time scales and enabling more granular financial tracking. For example, a seasonal business might benefit from customizing a template to reflect monthly fluctuations in revenue and expenses, providing insights into peak and off-peak performance.

Leveraging the customizability of these templates promotes better financial management. By tailoring the template to specific circumstances, users gain a clearer understanding of their financial position, enabling more informed decision-making. This ability to adapt the template to evolving needs ensures its continued relevance and utility over time. However, while customizability offers significant advantages, maintaining consistency and adhering to basic accounting principles are crucial for accurate and meaningful financial reporting. Over-customization, without a clear understanding of accounting practices, can lead to inconsistencies and misrepresentations of financial data.

3. Standardized Format

A standardized format is a cornerstone of effective financial reporting, and free printable income statement templates inherently adhere to this principle. This structured approach ensures consistency and comparability, facilitating accurate analysis and informed decision-making. Utilizing a standardized format promotes clarity and understanding, enabling stakeholders to readily interpret the financial data presented.

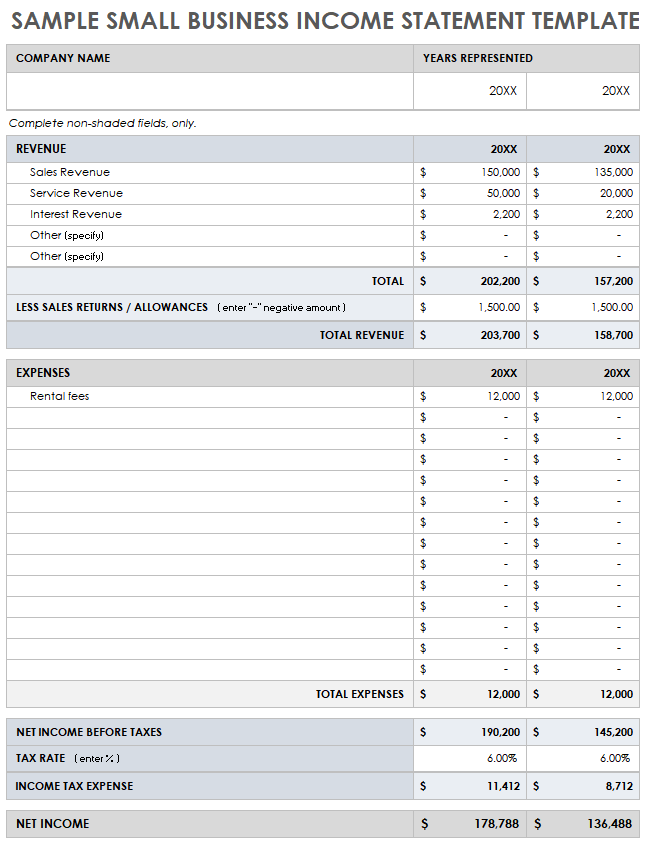

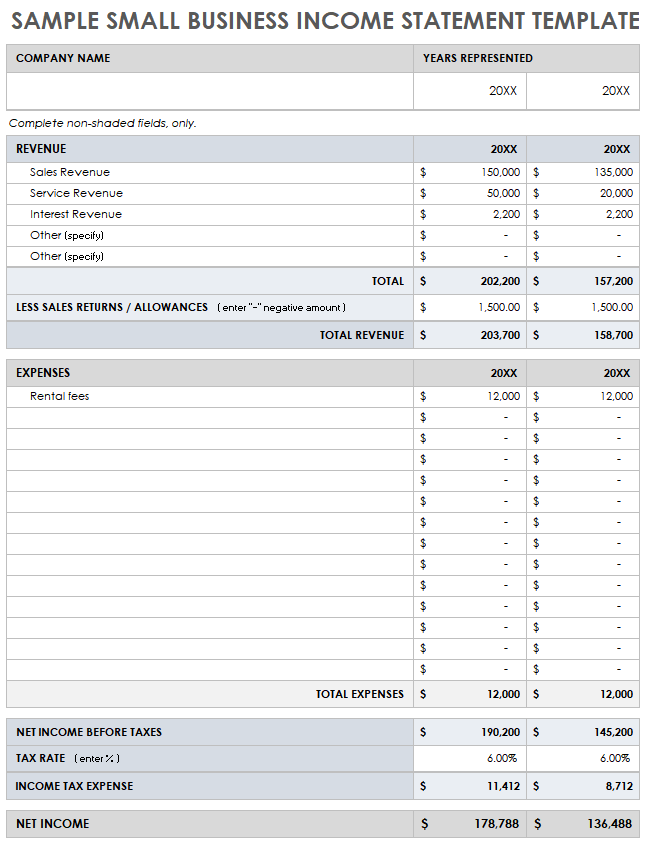

- Clear delineation of key financial elements:Templates typically segregate revenues, cost of goods sold (if applicable), operating expenses, and net income/loss into distinct sections. This clear categorization allows users to quickly grasp the relationship between different financial elements and understand the overall financial performance. For instance, separating marketing expenses from administrative expenses provides a more granular view of spending patterns and their impact on profitability. This structured presentation is crucial for identifying areas of strength and weakness within the financial operations.

- Consistent Calculation Methodology:Standardized templates employ predefined formulas and calculations for deriving key metrics such as gross profit, operating income, and net income. This consistency ensures accuracy and prevents discrepancies that might arise from using different calculation methods. For example, consistently calculating gross profit as revenue minus the cost of goods sold provides a reliable metric for evaluating production efficiency and pricing strategies.

- Comparable Reporting Periods:Templates facilitate comparisons across different reporting periods by adhering to a consistent timeframe, whether monthly, quarterly, or annually. This allows for trend analysis, performance evaluation, and identification of seasonal patterns or anomalies. Comparing income statements from consecutive quarters, for example, can reveal growth trends, identify declining sales, or highlight the impact of seasonal factors on revenue.

- Universal Understandability:The standardized format of these templates ensures that the financial information presented is easily understood by various stakeholders, including business owners, investors, lenders, and tax authorities. This common language of financial reporting facilitates clear communication and reduces the risk of misinterpretation. A potential investor, for instance, can readily assess the financial health of a business using a standardized income statement, regardless of the specific industry or business model.

By adhering to a standardized format, free printable income statement templates provide a reliable and universally understood framework for assessing financial performance. This consistency enables meaningful comparisons across different periods, facilitates informed decision-making, and promotes transparency in financial reporting. This, in turn, contributes to improved financial management and better outcomes for individuals and businesses alike. Furthermore, the standardized structure simplifies the task of transferring data to more complex accounting software if and when the need arises, ensuring a smooth transition as financial operations scale.

4. Cost-effectiveness

Cost-effectiveness is a critical advantage of free printable income statement templates. Eliminating the financial burden associated with proprietary accounting software or professional bookkeeping services makes these templates a particularly attractive option for budget-conscious individuals, startups, and small businesses. This affordability allows resources to be allocated to other critical areas of operation, such as marketing, product development, or customer service. Consider a startup operating on a limited budget; utilizing a free template allows them to track financial performance without diverting funds from essential growth initiatives. This cost-effectiveness is amplified by the fact that these templates require no ongoing subscription fees or licensing costs, providing long-term financial benefits. Furthermore, the time saved by not having to manually create a statement from scratch contributes to overall cost savings, as time represents a valuable resource, especially in resource-constrained environments.

Beyond direct monetary savings, the simplicity and accessibility of these templates contribute to indirect cost reductions. The ease of use reduces the need for extensive training or specialized personnel to manage financial records. This eliminates expenses associated with professional development or outsourcing accounting tasks. For example, a small business owner can independently manage financial tracking using a free template, eliminating the need to hire a dedicated bookkeeper. This self-sufficiency fosters greater control over financial data and promotes a deeper understanding of the business’s financial health. Moreover, readily available online resources and tutorials further enhance cost-effectiveness by providing readily accessible support and guidance for utilizing these templates effectively.

While cost-effectiveness is a significant benefit, recognizing potential limitations is essential. For complex financial operations or businesses with high transaction volumes, free printable templates may lack the advanced features and automation capabilities of dedicated accounting software. In such cases, the time required for manual data entry and analysis might outweigh the initial cost savings. However, for individuals, freelancers, and small businesses with relatively straightforward financial structures, free printable income statement templates offer a valuable and cost-effective solution for essential financial management. Understanding these limitations and selecting the appropriate financial management tools based on specific needs ensures optimal resource allocation and informed financial decision-making.

5. Simplicity

Simplicity is a defining characteristic of free printable income statement templates, contributing significantly to their accessibility and utility. These templates offer a straightforward structure, presenting essential financial information in a clear and concise manner. This streamlined approach eliminates unnecessary complexity, making them readily understandable and usable for individuals with varying levels of financial expertise. Unlike complex accounting software that often requires specialized training or technical knowledge, these templates can be utilized effectively with minimal instruction. Consider a small business owner without a formal accounting background; a simple income statement template allows them to track revenue and expenses without needing to navigate complex software interfaces or decipher intricate accounting jargon.

This inherent simplicity translates to several practical advantages. The straightforward format reduces the likelihood of errors during data entry and analysis. Clear labeling of income and expense categories minimizes confusion and ensures accurate categorization of financial transactions. Furthermore, the simplified structure facilitates efficient data entry and analysis, saving valuable time and resources. This streamlined process allows users to focus on interpreting the financial data and making informed decisions rather than grappling with complex software or intricate calculations. For example, a freelancer can quickly populate a simple template with project income and related expenses, readily calculating profit margins and identifying areas for potential cost savings. This efficiency empowers users to gain a clear understanding of their financial position without requiring extensive time or effort.

While simplicity is a key strength, recognizing its potential limitations is crucial. Free printable income statement templates, in their pursuit of simplicity, may lack the advanced features and functionalities of sophisticated accounting software. They may not be suitable for complex businesses with numerous revenue streams, intricate expense categories, or high transaction volumes. In such scenarios, the need for detailed tracking and analysis might necessitate the use of more robust accounting tools. However, for individuals, freelancers, and small businesses with relatively straightforward financial operations, the inherent simplicity of these templates offers a valuable tool for effective financial management. Understanding this balance between simplicity and functionality allows users to choose the most appropriate tool based on their specific needs and circumstances. Ultimately, the simplicity of these templates democratizes access to essential financial management tools, empowering a wider range of individuals and businesses to take control of their financial well-being.

Key Components of an Income Statement Template

Effective financial analysis requires a clear understanding of the core components within a standardized income statement template. These components provide a structured framework for organizing and interpreting financial data.

1. Revenue: This section represents the total income generated from sales of goods or services during a specific period. It reflects the top-line earnings before any deductions. Accuracy in recording revenue is crucial for assessing overall financial performance.

2. Cost of Goods Sold (COGS): Applicable to businesses selling physical products, COGS encompasses direct costs associated with producing goods, including raw materials, labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of core business operations before accounting for operating expenses. Analyzing gross profit trends provides insights into pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses expenses incurred in running the business, such as rent, salaries, marketing, and administrative costs. Categorizing and tracking operating expenses is crucial for identifying areas for potential cost reduction.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for day-to-day operational costs. This metric provides a clearer picture of the core business’s earning power.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. Including these items provides a comprehensive view of overall financial performance.

7. Net Income: Representing the bottom line, net income is calculated by adding other income and subtracting other expenses from operating income. This figure reflects the final profit or loss after considering all income and expense streams. Net income is a key indicator of financial health and sustainability.

A comprehensive income statement offers a structured view of financial performance, enabling informed decision-making through analysis of key metrics and identification of areas for improvement. Careful attention to each component ensures accurate and insightful financial reporting.

How to Create a Free Printable Income Statement Template

Creating a customizable and effective income statement template involves a structured approach, ensuring clarity and accuracy in financial reporting. The following steps outline the process.

1. Determine the Reporting Period: Specify the timeframe covered by the income statement (e.g., monthly, quarterly, annually). This defines the scope of the financial data included.

2. Define Revenue Categories: Establish clear categories for different revenue streams. This ensures accurate tracking and analysis of income sources. For example, a business might categorize revenue by product line or service type.

3. Outline Cost of Goods Sold (COGS): If applicable, specify the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead.

4. Categorize Operating Expenses: Create distinct categories for operating expenses, such as rent, salaries, marketing, and administrative costs. Detailed categorization facilitates analysis and cost control.

5. Include Other Income and Expenses: Account for income or expenses not directly related to core operations, such as interest income or investment gains/losses.

6. Establish Calculation Formulas: Define formulas for calculating key metrics: Gross Profit (Revenue – COGS), Operating Income (Gross Profit – Operating Expenses), and Net Income (Operating Income + Other Income – Other Expenses). Accurate formulas ensure reliable results.

7. Design the Template Layout: Organize the template with clear headings and labels for each section. A well-structured layout enhances readability and facilitates data entry. Consider using a tabular format for clear presentation.

8. Test and Refine: Before widespread use, test the template with sample data to ensure accuracy and functionality. Refine the template based on testing results to optimize its effectiveness.

A well-designed template provides a structured framework for organizing financial data, enabling accurate analysis and informed financial management. Regular review and refinement ensure the template remains relevant and effective in meeting evolving business needs.

Free printable income statement templates offer a readily accessible, customizable, and cost-effective solution for organizing financial data. Their standardized format facilitates consistent tracking and analysis of revenue, expenses, and profitability. Understanding the key components, from revenue and cost of goods sold to operating expenses and net income, is crucial for effective utilization. Leveraging these templates empowers individuals and businesses to gain valuable insights into financial performance, enabling informed decision-making and improved financial management.

Accurate financial record-keeping is fundamental to sound financial health. Utilizing available resources, such as free printable income statement templates, represents a proactive step towards achieving financial clarity and control. Regular monitoring and analysis of financial data, facilitated by these templates, contribute to long-term stability and informed financial strategies. This empowers informed decisions, fostering sustainable growth and financial well-being.