Utilizing such resources allows businesses to readily monitor performance, identify trends, and make informed decisions without incurring costs associated with proprietary software or professional accounting services. This accessibility empowers smaller entities and startups to maintain accurate financial records, essential for strategic planning and attracting potential investors.

The following sections delve deeper into the specific components, practical applications, and available resources related to generating these vital financial summaries.

1. Accessibility

Accessibility is a defining feature of complimentary quarterly income statement templates. Their availability online, often in easily downloadable formats like spreadsheets or word processing documents, removes financial barriers that might otherwise prevent small businesses, startups, or individuals from implementing robust financial tracking. This open access democratizes the use of structured financial reporting, allowing entities with limited resources to benefit from organized data analysis. Consider a freelance consultant, for example, who can download a template and readily track income and expenses, gaining valuable insights into profitability without investing in expensive accounting software.

This ease of access fosters better financial management practices across a wider range of users. Instead of relying on informal or ad-hoc methods, businesses can implement standardized reporting from the outset, contributing to more accurate record-keeping and improved decision-making. Furthermore, the availability of these templates in various formats ensures compatibility with different software systems, increasing their practical utility. Non-profit organizations, for instance, can leverage these templates to track donations and expenditures, demonstrating financial transparency to donors and stakeholders.

Ultimately, the accessibility of these templates promotes financial literacy and empowers individuals and organizations to take control of their finances. While professional accounting services remain crucial for complex financial situations, readily available templates offer a valuable entry point for establishing sound financial practices. This widespread availability contributes to a more informed and financially savvy ecosystem, ultimately fostering economic growth and stability.

2. Regular Monitoring

Regular monitoring of financial performance is essential for sustainable business growth and informed decision-making. A free quarterly income statement template provides a structured framework for this crucial task. By populating the template with data every three months, businesses gain a consistent snapshot of their financial health, enabling the identification of trends and potential issues before they escalate. This consistent data collection and analysis allows for proactive adjustments to strategies, operational processes, or spending, ultimately optimizing resource allocation and maximizing profitability.

Consider a retail business experiencing fluctuating sales. Regularly completing a quarterly income statement reveals seasonal trends, allowing for optimized inventory management and targeted marketing campaigns. Perhaps a manufacturing company notices a consistent increase in the cost of goods sold. Quarterly tracking isolates this trend, prompting investigation into supplier pricing or internal production inefficiencies. Without this regular monitoring, such issues might go unnoticed, potentially impacting long-term profitability and sustainability.

Regular engagement with a free quarterly income statement template cultivates a data-driven approach to financial management. This consistent practice fosters financial awareness, allowing organizations to adapt swiftly to changing market conditions or internal challenges. The insights derived from regular monitoring empower evidence-based decisions, contributing significantly to long-term financial stability and success. The ability to identify and address potential problems early on significantly reduces the likelihood of financial distress, reinforcing the crucial role of regular monitoring facilitated by these accessible templates.

3. Informed Decisions

Sound financial decisions rely on accurate and readily available data. A free quarterly income statement template provides the structured information necessary for informed decision-making. By presenting key financial metrics such as revenue, expenses, and profit margins over a consistent period, these templates offer a clear picture of an organization’s financial health. This clarity empowers stakeholders to identify areas of strength and weakness, enabling data-driven adjustments to strategies, budgets, and operational processes. For example, consistently declining profit margins, as revealed in a series of quarterly income statements, might prompt a business to review pricing strategies, explore cost-cutting measures, or invest in marketing efforts to boost sales. Without this data, decisions would be based on assumptions rather than concrete evidence, increasing the risk of ineffective or even detrimental actions.

The practical significance of this connection is substantial. Consider a small business owner seeking a loan. Presenting potential lenders with a series of organized quarterly income statements demonstrates financial transparency and responsible management, significantly increasing the likelihood of loan approval. Similarly, a non-profit organization can utilize these statements to demonstrate responsible resource allocation to donors, fostering trust and encouraging continued support. In both scenarios, the ability to make informed decisions based on readily available data is paramount to success. Furthermore, the regular use of these templates cultivates a culture of data-driven decision-making within an organization, contributing to long-term financial stability and growth.

The ability to generate and interpret quarterly income statements fosters proactive financial management. While historical data provides valuable insights, its true power lies in informing future actions. Identifying trends, addressing challenges, and capitalizing on opportunities require consistent data analysis. Free quarterly income statement templates facilitate this process, empowering organizations of all sizes to make informed decisions that drive sustainable growth and success. This accessibility to crucial financial information levels the playing field, allowing smaller entities to compete effectively and navigate the complexities of the modern business landscape. By removing financial barriers to essential data analysis, these templates contribute to a more informed and robust economic environment.

4. Cost-Effective

Cost-effectiveness is a significant advantage of utilizing free quarterly income statement templates. Businesses, particularly startups and small enterprises operating with limited budgets, often face financial constraints that can restrict access to essential tools and resources. Proprietary accounting software or the services of professional accountants can represent a substantial expense. Free templates eliminate this financial barrier, providing access to structured financial reporting without incurring any direct cost. This allows organizations to allocate limited resources to other crucial areas such as product development, marketing, or expansion, ultimately contributing to sustainable growth and competitiveness. For example, a new restaurant can utilize a free template to track revenue and expenses during its initial months of operation, gaining valuable financial insights without the added cost of specialized accounting software.

The practical implications of this cost-effectiveness are far-reaching. Reduced overhead expenses contribute directly to improved profitability, especially crucial in the early stages of a business. Furthermore, the use of free templates fosters financial literacy and responsible management practices, promoting long-term financial health. Non-profit organizations, for instance, can leverage these free resources to maintain detailed financial records, demonstrating transparency and accountability to donors, a crucial factor for securing continued funding. The ability to track income and expenses accurately without incurring additional costs allows organizations to maximize the impact of every dollar, enhancing operational efficiency and sustainability. Moreover, the accessibility of these templates empowers individuals and smaller businesses to manage their finances effectively, contributing to a more financially stable and robust economic landscape.

In conclusion, the cost-effectiveness of free quarterly income statement templates represents a significant advantage for organizations seeking to implement sound financial practices without incurring substantial expenses. This accessibility empowers businesses and individuals to gain control of their financial health, contributing to informed decision-making, sustainable growth, and long-term prosperity. While professional accounting services remain essential for complex financial situations, free templates offer a valuable tool for establishing a foundation of responsible financial management, ultimately benefiting both individual organizations and the broader economic ecosystem. The removal of financial barriers to essential financial reporting tools promotes a more equitable and accessible business environment, fostering innovation and economic empowerment.

5. Simplified Reporting

Simplified reporting is a key benefit derived from using free quarterly income statement templates. These templates offer a pre-designed, structured format that streamlines the process of compiling and presenting financial data. Instead of manually creating spreadsheets or relying on complex accounting software, users can simply input their figures into designated fields. This standardized structure ensures consistency and reduces the likelihood of errors, particularly beneficial for those without extensive accounting expertise. For example, a small business owner can quickly generate a professional-looking income statement without needing to understand complex accounting principles or invest in expensive software.

This simplified approach to reporting has several practical implications. It saves valuable time and resources, allowing businesses to focus on core operations rather than administrative tasks. Furthermore, the standardized format facilitates easy comparison of financial performance across different quarters, enabling trend analysis and informed decision-making. Consider a non-profit organization tracking donations. Using a free template allows them to quickly generate reports for stakeholders, demonstrating transparency and accountability without dedicating excessive time to manual reporting processes. This streamlined reporting fosters greater efficiency and allows for timely insights, contributing to improved financial management and organizational effectiveness. Furthermore, the simplified nature of these templates reduces the barrier to entry for individuals and smaller organizations seeking to establish robust financial practices, fostering financial literacy and responsible resource allocation.

In conclusion, simplified reporting, facilitated by free quarterly income statement templates, represents a significant advantage for organizations of all sizes. Streamlined data entry and standardized formats contribute to increased efficiency, reduced errors, and improved financial transparency. This simplified approach empowers businesses to focus on core operations while maintaining accurate and accessible financial records, crucial for sustainable growth and informed decision-making. By removing complexity from the reporting process, these templates democratize access to essential financial management tools, promoting a more financially literate and stable economic landscape.

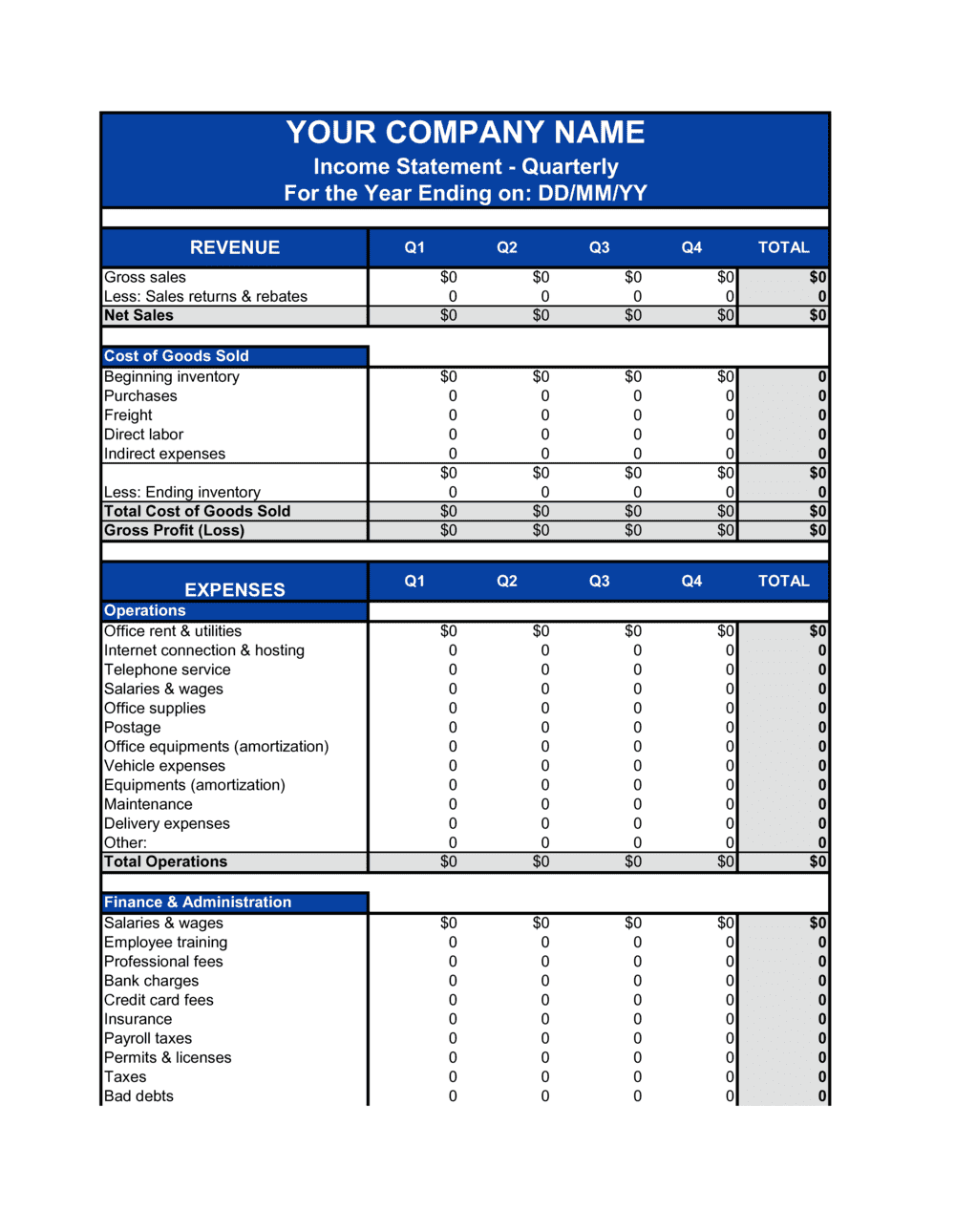

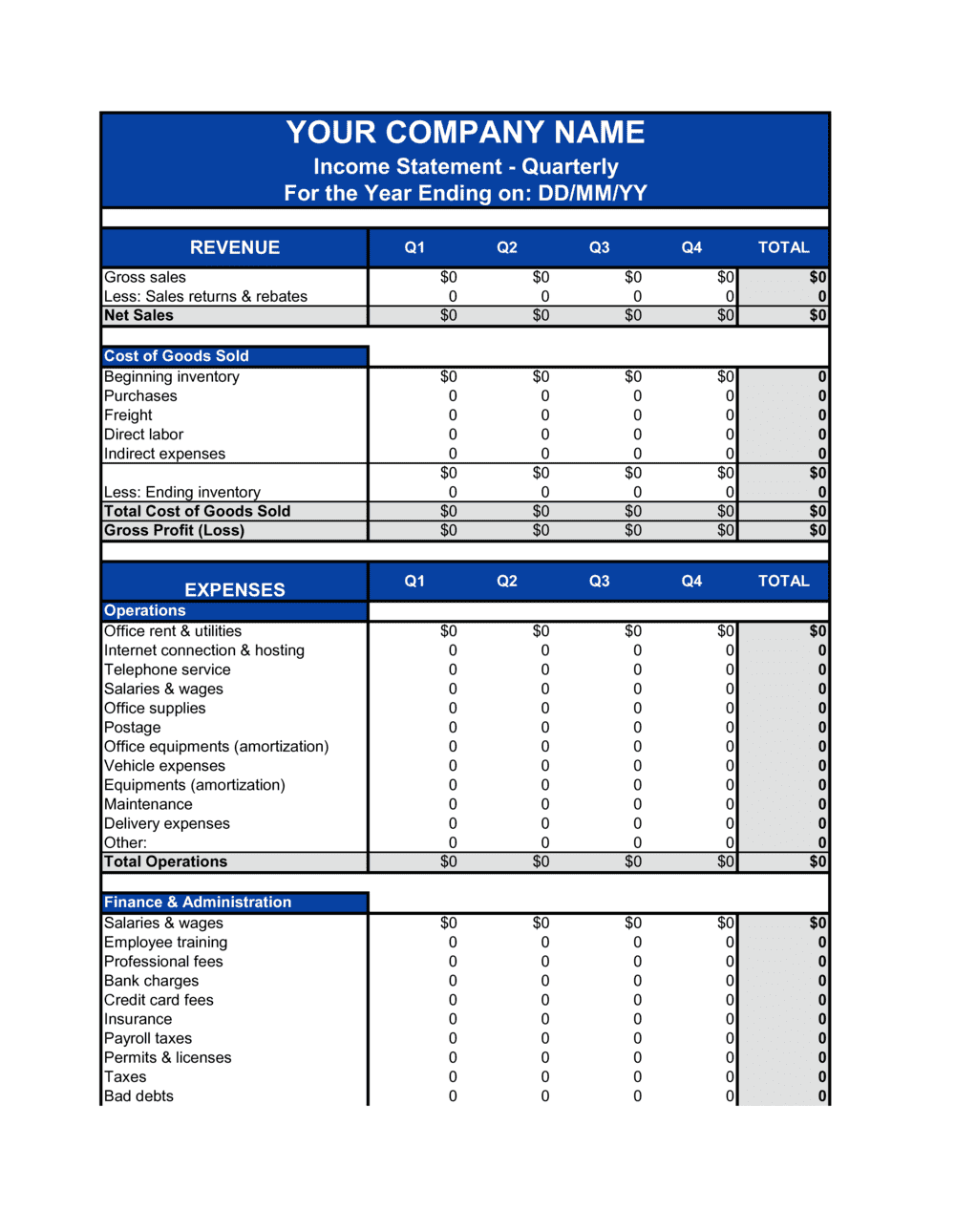

Key Components of a Quarterly Income Statement Template

A well-structured quarterly income statement template provides a clear and organized overview of financial performance. Several key components contribute to this comprehensive financial picture.

1. Revenue: This section details all income generated during the quarter. Subsections may categorize revenue streams for more granular analysis, providing insights into the primary drivers of income.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before accounting for operating expenses. This metric provides insight into pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include rent, salaries, marketing, and administrative costs. Categorizing these expenses provides a detailed view of operational expenditures.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income represents the profitability of the business after accounting for all operating costs. This metric provides a clear picture of the core business’s financial performance.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. Inclusion of these items provides a more comprehensive picture of overall financial performance.

7. Income Before Taxes: This represents the net income after considering all operating and non-operating income and expenses but before accounting for income tax obligations.

8. Net Income: The final and most important figure, net income represents the profit or loss after all expenses and taxes have been deducted. This bottom-line figure provides the clearest indication of overall financial performance during the quarter.

Careful consideration of these components ensures a comprehensive and accurate representation of financial performance, enabling informed decision-making and strategic planning.

How to Create a Quarterly Income Statement Template

Creating a quarterly income statement template provides a structured approach to monitoring financial performance. The following steps outline the process of developing a template suitable for tracking income and expenses over a three-month period.

1: Define Reporting Period: Clearly establish the start and end dates for the quarter. Consistent reporting periods facilitate accurate comparisons and trend analysis over time.

2: Structure Revenue Section: Create a section for revenue streams. Categorize revenue sources for detailed analysis. This allows for identification of key revenue drivers and potential areas for growth.

3: Incorporate Cost of Goods Sold (COGS): If applicable, include a section for COGS. This section should detail all direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit margins.

4: Calculate Gross Profit: Deduct COGS from total revenue to arrive at gross profit. This metric provides a key indicator of core business profitability before operating expenses are considered.

5: Detail Operating Expenses: Create a comprehensive section for operating expenses. Categorize expenses such as rent, salaries, marketing, and administrative costs for detailed analysis. This breakdown allows for identification of areas for potential cost optimization.

6: Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This figure reflects the profitability of the core business after all operating costs are considered.

7: Include Other Income/Expenses: Add a section for other income and expenses not directly related to core business operations, such as interest income or investment gains/losses. This provides a more comprehensive view of overall financial health.

8: Calculate Income Before Taxes: Sum operating income and other income/expenses to arrive at income before taxes. This metric reflects profitability before accounting for tax obligations.

9: Deduct Income Taxes: Subtract estimated income tax expense to arrive at net income. This final figure represents the overall profit or loss for the quarter after all expenses and taxes have been accounted for.

10: Format for Clarity: Organize the template with clear labels, consistent formatting, and logical flow. This enhances readability and facilitates efficient data entry and analysis. Consider using a spreadsheet program for automated calculations and formula implementation.

A well-structured template provides a clear and concise overview of financial performance, enabling informed decision-making and strategic planning. Regular use of this template promotes consistent data collection and analysis, crucial for monitoring trends, identifying potential issues, and optimizing resource allocation.

Regularly utilizing these readily available resources empowers organizations to maintain accurate financial records, track performance, and make informed decisions. From startups to established businesses, non-profits to freelance professionals, access to this structured financial data provides a crucial foundation for sustainable growth and informed financial management. Understanding key components, such as revenue streams, cost of goods sold, operating expenses, and net income, provides valuable insights into an organization’s overall financial health. The accessibility of these no-cost templates removes financial barriers, enabling wider adoption of robust financial practices and contributing to a more financially literate ecosystem.

Leveraging the insights derived from consistent use of these templates empowers organizations to navigate the complexities of the financial landscape. Proactive financial management, driven by data-backed decision-making, is essential for long-term success. Regular monitoring, facilitated by these accessible tools, enables early identification of potential challenges and opportunities, contributing to a more stable and prosperous future for businesses and individuals alike. Embracing these readily available resources equips organizations with the tools necessary to thrive in a competitive and ever-evolving economic environment.