Utilizing a pre-built framework offers several advantages. It saves time and effort compared to creating one from scratch, ensures adherence to standard accounting practices, and facilitates clear financial reporting. This accessibility empowers users to readily analyze their financial standing, identify areas for improvement, and present organized financial information to stakeholders, potential investors, or lenders.

Understanding the structure and benefits of these readily available resources is essential for effective financial management. The following sections delve deeper into practical applications, offering guidance on selecting and customizing templates, and highlighting key elements to consider for accurate and insightful financial analysis.

1. Accessibility

Accessibility, a critical aspect of utilizing financial templates, ensures that these valuable tools are readily available to a broad spectrum of users, regardless of their technical expertise or financial resources. This democratization of financial management tools empowers individuals and organizations to make informed decisions based on accurate and organized financial data.

- Cost-EffectivenessFree templates eliminate financial barriers, enabling startups, small businesses, and individuals with limited budgets to access essential financial management tools. This removes the cost hurdle associated with proprietary software or professional accounting services, leveling the playing field for financial planning and analysis.

- Ease of AccessTemplates are often readily available online, downloadable within minutes. This immediate access eliminates delays associated with procuring software or seeking professional assistance, allowing users to quickly begin organizing and analyzing their financial data. For example, a freelancer can readily download a template to track income and expenses without needing complex accounting software.

- User-FriendlinessMany free templates are designed with simplicity in mind, utilizing straightforward layouts and terminology accessible to users without advanced accounting knowledge. Clear instructions and intuitive design minimize the learning curve, enabling users to quickly grasp the template’s functionality and effectively manage their finances.

- Platform IndependenceTemplates typically function across various software platforms and operating systems. Whether using spreadsheet software, word processing applications, or online tools, users can generally adapt and utilize these templates, maintaining flexibility and control over their financial data regardless of their chosen technology.

The accessibility of these templates promotes greater financial literacy and empowers informed decision-making across diverse user groups. By removing barriers to entry, free templates contribute to a more equitable and transparent financial landscape, fostering better financial management practices for individuals, small businesses, and organizations alike.

2. Standardized Format

Standardized formatting within financial templates ensures consistency and comparability, crucial for effective financial analysis and reporting. Adherence to established accounting principles allows for clear communication of financial performance within and across organizations.

- Uniform StructurePre-designed templates adhere to a uniform structure, presenting financial information in a consistent order. This standardized layout facilitates quick comprehension and comparison across different periods or entities. Revenue, cost of goods sold, operating expenses, and net income are typically presented in a predictable sequence, simplifying analysis and interpretation. For example, comparing income statements across multiple quarters becomes straightforward due to the consistent placement of key data points.

- Common TerminologyStandardized templates utilize common financial terminology, ensuring clarity and understanding across diverse audiences. Using established terms like “gross profit,” “operating income,” and “net income” minimizes ambiguity and facilitates effective communication with stakeholders, investors, or lenders. This shared vocabulary ensures everyone interprets the financial data similarly, regardless of their accounting background.

- Compliance with Accounting PrinciplesTemplates are often designed in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensuring compliance with industry best practices. This adherence to established accounting standards enhances the reliability and credibility of the financial information presented, promoting trust and transparency. This is particularly important when sharing financial statements with external parties, such as banks or investors.

- Comparability and BenchmarkingThe standardized format allows for easy comparison of financial performance across different periods within an organization or against industry benchmarks. Tracking key metrics over time or against competitors facilitates identifying trends, assessing performance, and making informed strategic decisions. For instance, a business can compare its profit margins to industry averages using standardized income statement data.

The standardized format of these templates enhances financial transparency and allows for meaningful analysis. By adhering to established conventions and accounting principles, these templates promote clear communication and facilitate informed decision-making based on reliable financial data.

3. Customizability

Customizability is a significant advantage of free sample income statement templates. While standardization ensures consistency, the ability to adapt these templates to specific needs enhances their practical value across diverse contexts. Adapting a generic template to reflect unique business requirements transforms a basic framework into a powerful tool for financial management.

- Industry SpecificityDifferent industries have unique revenue and expense categories. A retail business, for example, might need to itemize cost of goods sold, whereas a service-based business would not. Customizability allows users to add, remove, or modify line items to accurately reflect the nuances of their specific industry. This ensures the income statement provides a relevant and accurate representation of financial performance.

- Size and ComplexityA small business may require a simpler template compared to a larger corporation with complex operations. Customizability allows users to adjust the level of detail within the template. A startup might only need basic revenue and expense categories, while a multinational corporation requires more granular tracking. This adaptability caters to diverse organizational structures and reporting needs.

- Reporting PeriodTemplates can be customized to reflect varying reporting periods, whether monthly, quarterly, or annually. This flexibility enables users to track financial performance over different timeframes, facilitating short-term and long-term financial analysis. For example, a business might use monthly income statements to monitor cash flow and annual statements for year-over-year performance comparisons.

- Currency and LanguageAdapting templates to reflect specific currency and language requirements enhances accessibility for international businesses or organizations operating in multilingual environments. This customizability ensures accurate reporting and facilitates clear communication across geographical boundaries. For example, a company operating in multiple countries can adapt the template to reflect local currency and language conventions.

Customizability enhances the practical utility of free sample income statement templates. This adaptability empowers users to tailor the template to their specific requirements, ensuring relevant, accurate, and insightful financial reporting across diverse industries, organizational structures, and reporting periods. This ultimately enables better financial management and informed decision-making.

4. Time-saving resource

Efficiency in financial management is paramount. Leveraging pre-designed income statement templates offers significant time savings compared to manual creation, allowing resources to be allocated to analysis and strategic decision-making rather than tedious formatting and formula construction.

- Elimination of Manual FormattingCreating an income statement from scratch involves considerable time spent on formatting, ensuring correct placement of headings, labels, and calculations. Templates eliminate this initial setup phase, providing a ready-to-use framework. The time saved can be redirected towards data entry and analysis. For instance, instead of spending an hour setting up the spreadsheet structure, users can immediately begin inputting financial data.

- Pre-built Formulas and CalculationsTemplates incorporate pre-built formulas for calculating key metrics such as gross profit, operating income, and net income. This automation eliminates the need for manual calculations and reduces the risk of errors. The time saved can be dedicated to interpreting the results and making informed decisions based on the calculated figures. For example, automatically calculating profit margins allows for immediate analysis of profitability without manual formula entry.

- Rapid Data Entry and AnalysisWith the structure and formulas in place, data entry becomes a streamlined process. Users can quickly populate the template with their financial figures and immediately access calculated results. This rapid turnaround time facilitates timely financial reporting and analysis, enabling proactive decision-making. For example, monthly financial reports can be generated quickly, enabling prompt identification of trends and potential issues.

- Focus on Interpretation and Decision-MakingBy automating formatting and calculations, templates free up valuable time, allowing users to focus on interpreting the financial data and making informed business decisions. Rather than getting bogged down in spreadsheet mechanics, users can dedicate their energy to strategic planning and financial analysis. For example, time saved can be allocated to analyzing cost structures and identifying areas for potential cost reduction.

The time saved through the use of free sample income statement templates translates directly into increased efficiency in financial management. This efficiency empowers businesses and individuals to allocate more time to strategic planning, analysis, and ultimately, improved financial outcomes. This shift in focus from tedious tasks to strategic analysis contributes significantly to better financial health and informed decision-making.

5. Financial Clarity

Financial clarity, a cornerstone of sound financial management, is significantly enhanced through the utilization of free sample income statement templates. These templates provide a structured framework for organizing financial data, enabling users to gain a clear and comprehensive understanding of their financial performance. This understanding is essential for informed decision-making, strategic planning, and overall financial health.

- Performance TrackingTemplates facilitate consistent tracking of revenue and expenses, providing a clear picture of profitability over specific periods. This allows for the identification of trends, such as increasing or decreasing sales, rising costs, or fluctuating profit margins. For example, a business can readily identify seasonal sales patterns by comparing income statements across multiple quarters. Understanding these patterns allows for proactive adjustments to inventory management, marketing strategies, and staffing levels.

- Expense ManagementCategorizing expenses within a structured template enables in-depth analysis of spending patterns. This detailed breakdown allows for identification of areas where costs can be reduced or optimized. For instance, a restaurant owner can analyze food costs, labor expenses, and overhead to identify opportunities for improving efficiency and profitability. This granular view of expenses empowers informed decisions regarding pricing strategies, vendor negotiations, and operational adjustments.

- Profitability AnalysisTemplates automate the calculation of key profitability metrics, such as gross profit margin, operating profit margin, and net profit margin. readily available calculations allow for quick assessment of overall financial health and identification of areas for improvement. For example, a declining net profit margin might indicate pricing pressures, rising costs, or inefficient operations, prompting further investigation and corrective action.

- Informed Decision-MakingClear and readily available financial data empowers informed decision-making. Understanding profitability, expense trends, and overall financial performance allows businesses to make strategic choices regarding pricing, investments, expansion plans, and cost management initiatives. For example, consistently strong profit margins might justify investment in new product development or market expansion, while declining profitability might necessitate cost-cutting measures or operational adjustments.

By providing a structured framework for organizing and analyzing financial data, free sample income statement templates directly contribute to enhanced financial clarity. This clarity is foundational for effective financial management, enabling informed decision-making, strategic planning, and ultimately, achieving financial objectives. These accessible tools empower individuals and organizations to take control of their finances and make informed decisions that contribute to long-term financial success.

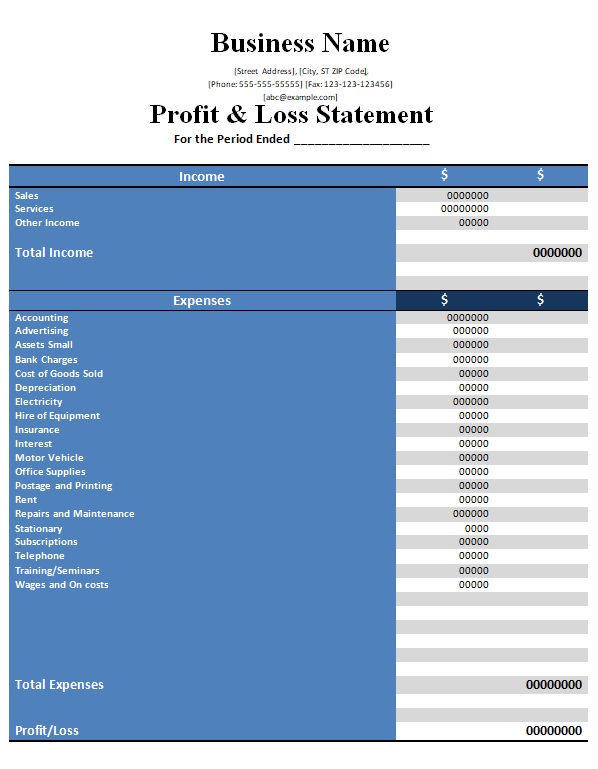

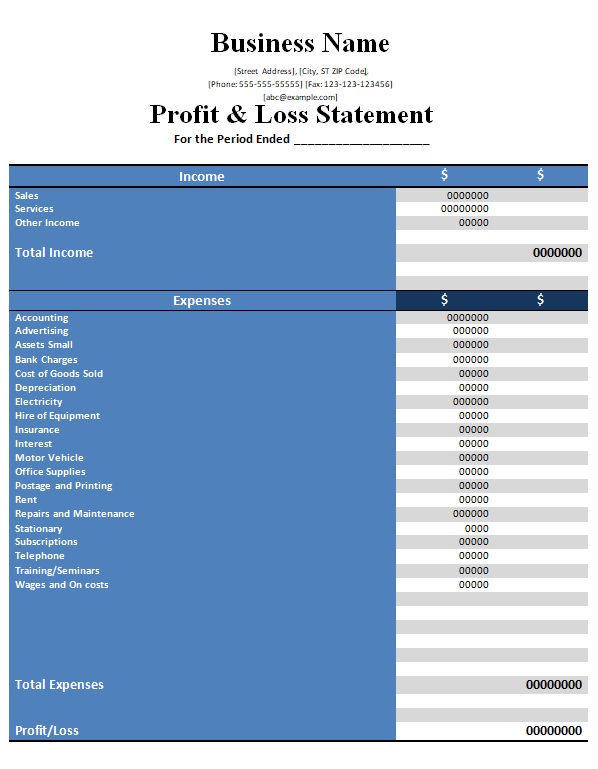

Key Components of an Income Statement Template

Understanding the core components of an income statement template is essential for accurate financial reporting and analysis. These components provide a structured overview of financial performance, enabling informed decision-making.

1. Revenue: This section details all income generated from sales of goods or services. It represents the top line of the income statement and serves as the starting point for calculating profitability. Accuracy in reporting revenue is critical for assessing overall financial performance.

2. Cost of Goods Sold (COGS): Applicable to businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. Analyzing gross profit provides insights into production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. These include salaries, rent, utilities, marketing, and administrative costs. Careful tracking of operating expenses is crucial for managing overhead and optimizing profitability.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of core business operations after accounting for all operating costs. This metric provides a clear view of the company’s earnings from its primary activities.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. Including these items provides a comprehensive view of the overall financial picture.

7. Net Income: This bottom-line figure represents the final profit or loss after accounting for all revenues, expenses, and other income/expenses. Net income is a key indicator of overall financial performance and is often used to assess the health and profitability of a business.

Accurate and comprehensive data within these components provides a clear and concise overview of financial performance, facilitating informed decision-making and strategic planning. Analyzing these elements individually and collectively allows for a thorough understanding of profitability, cost structures, and overall financial health. This structured approach to financial reporting is essential for effective management and long-term success.

How to Create a Free Sample Income Statement Template

Creating a free sample income statement template involves structuring a standardized framework that allows users to input their financial data for analysis. This process combines established accounting principles with customizable features to cater to diverse needs.

1. Define the Reporting Period: Specify the timeframe covered by the income statement, whether monthly, quarterly, or annually. A clearly defined reporting period ensures consistency and facilitates accurate comparisons.

2. Establish Core Components: Include essential sections such as Revenue, Cost of Goods Sold (if applicable), Gross Profit, Operating Expenses, Operating Income, Other Income/Expenses, and Net Income. These components provide a structured overview of financial performance.

3. Incorporate Formulas: Automate calculations for key metrics like Gross Profit, Operating Income, and Net Income using formulas. Automated calculations ensure accuracy and save time.

4. Add Customizable Fields: Allow users to add, remove, or modify line items within expense categories to cater to industry-specific needs and varying levels of complexity. Customizable fields ensure the template’s relevance across diverse contexts.

5. Provide Clear Labels and Instructions: Use concise and descriptive labels for each section and line item. Include clear instructions on how to use the template effectively. Clear guidance ensures users can accurately input their data and interpret the results.

6. Choose an Accessible Format: Utilize a widely accessible format, such as a spreadsheet or a word processing document, to ensure compatibility across different software platforms. Accessibility maximizes usability for a broad audience.

7. Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Refine the template based on testing results and user feedback. Testing guarantees the template’s reliability and effectiveness.

By adhering to these steps, a robust and adaptable income statement template can be created, providing a valuable tool for financial management and analysis. This structured approach ensures accuracy, promotes clarity, and facilitates informed financial decision-making.

Access to free sample income statement templates provides a valuable resource for individuals and organizations seeking to understand and manage their financial performance. From the standardized format and inherent customizability to the significant time savings and resulting financial clarity, leveraging these templates empowers informed decision-making. Understanding the core components, creation process, and practical applications of these templates is fundamental to sound financial practice. These readily available tools facilitate efficient and accurate financial reporting, enabling users to analyze trends, manage expenses, and gain a comprehensive overview of their financial health.

Effective financial management relies on accurate and accessible data. Utilizing these freely available resources fosters financial literacy and promotes responsible financial practices. The insights gained from consistent and organized financial reporting contribute to improved decision-making, ultimately leading to greater financial stability and success. Embracing these tools represents a proactive step towards securing a sound financial future.