Accessing a no-cost, pre-designed structure for this type of report offers significant advantages. Businesses can readily organize their financial data, track performance trends, and identify areas for improvement without incurring additional expenses. This accessibility facilitates informed decision-making, contributes to effective financial management, and supports strategic planning. Furthermore, utilizing readily available resources allows businesses to allocate resources more efficiently.

This discussion will further examine the components of these reports, explore best practices for their utilization, and provide guidance on locating reliable resources.

1. Accessibility

Accessibility, in the context of complimentary year-to-date profit and loss statement templates, refers to the ease with which businesses can obtain and utilize these resources. This ease of access plays a vital role in facilitating financial management, particularly for small businesses or startups with limited resources. Removing barriers to essential financial tools allows for wider adoption and promotes sound financial practices across various organizational levels.

- Reduced Financial BarriersCost can be a significant barrier to accessing essential business tools. Free templates eliminate this obstacle, enabling organizations of all sizes to implement effective financial tracking and reporting. A small business owner, for example, can readily download a template and begin tracking financial progress without needing specialized software or accounting expertise.

- Ease of Use and ImplementationMany free templates are designed with user-friendliness in mind, often utilizing familiar spreadsheet software or offering intuitive online platforms. This simplicity allows individuals with basic spreadsheet skills to input financial data, generate reports, and analyze performance. A non-profit organization, for instance, can easily track donations and expenses, even without dedicated accounting personnel.

- Availability Across Platforms and DevicesModern templates are frequently accessible online or downloadable in various formats, compatible with different operating systems and devices. This cross-platform compatibility ensures that financial information can be accessed and managed from anywhere, anytime. A business owner traveling abroad, for instance, can still review the company’s financial performance using a mobile device.

- Wide Range of Template OptionsNumerous websites and organizations offer a diverse selection of free templates, catering to different industry needs and reporting requirements. This variety ensures that businesses can find a template that aligns with their specific operational context. A restaurant, for example, might select a template designed for the hospitality industry, while a freelance consultant might choose a simpler, more generic option.

The accessibility of these free resources empowers businesses to gain a clearer understanding of their financial standing, make informed decisions, and ultimately contribute to greater financial stability and growth. This accessibility democratizes financial management, making it easier for all businesses to implement sound accounting practices, regardless of size or budget.

2. Year-to-Date Data

Year-to-date (YTD) data forms the core of a free YTD profit and loss statement template. This data represents the cumulative financial activity from the beginning of the current fiscal or calendar year up to a specified date. The inclusion of YTD figures provides a comprehensive overview of financial performance throughout the year, enabling businesses to track progress, identify trends, and make informed decisions based on current performance. Without YTD data, the snapshot offered by a profit and loss statement would lack the crucial context necessary for effective financial management.

The relationship between YTD data and the template is symbiotic. The template provides the structure for organizing and presenting the data, while the YTD data populates the template and brings it to life. This interplay allows for the creation of a meaningful report that offers valuable insights into financial health. For example, a retail business can use YTD data within a free template to analyze sales trends throughout the year, identifying peak seasons and slow periods, which informs inventory management and marketing strategies. Similarly, a service-based company can track YTD revenue against projected targets, allowing for timely adjustments to operational plans and resource allocation. Comparing YTD performance against previous years’ data, facilitated by the template’s structured format, provides a deeper understanding of growth trajectories and potential areas for improvement.

Understanding the significance of YTD data within these templates is essential for sound financial analysis. This data provides a continuous narrative of financial activity throughout the year, offering more than a mere snapshot of a specific period. By leveraging readily available free templates, businesses can harness the power of YTD data to gain valuable insights into their financial performance, make strategic adjustments, and ultimately contribute to sustainable growth. Failure to appreciate the importance of YTD analysis can lead to reactive rather than proactive decision-making, potentially hindering growth and limiting the ability to adapt to changing market conditions.

3. Standard Structure

A standard structure is a defining characteristic of a free year-to-date profit and loss statement template. This consistent format ensures uniformity and facilitates comparability across different reporting periods and businesses. The structured layout simplifies the process of recording and analyzing financial data, enabling effective performance evaluation and informed decision-making. Without a standardized framework, financial reporting can become disorganized and difficult to interpret.

- Revenue Stream IdentificationTemplates typically segment revenue streams, allowing businesses to track income from various sources. This detailed breakdown offers insights into which areas contribute most significantly to overall revenue. For example, a software company might separate revenue from software licenses, subscriptions, and professional services. Understanding these distinctions can inform strategic decisions regarding product development and marketing efforts.

- Categorized Expense TrackingStandard templates categorize expenses, such as cost of goods sold, operating expenses, and administrative expenses. This categorization allows businesses to monitor spending patterns and identify areas for potential cost reduction. A manufacturing company, for example, can track raw material costs, labor costs, and factory overhead separately, facilitating better control over production expenses.

- Calculated Metrics and SubtotalsPre-built formulas within templates automatically calculate key metrics like gross profit, operating income, and net income. These calculations simplify the analysis process and provide a clear picture of overall profitability. A retail business, for example, can readily determine its gross profit margin by using the template’s pre-calculated fields, facilitating comparisons with industry benchmarks.

- Consistent Time Period ReportingTemplates adhere to a consistent time period, typically the fiscal or calendar year, ensuring comparability across reporting periods. This consistency allows businesses to track performance trends and identify seasonal variations. A seasonal business, like a landscaping company, can analyze YTD performance to understand revenue fluctuations throughout the year, allowing for better resource allocation and planning for subsequent periods.

The standard structure offered by free YTD profit and loss statement templates provides a robust framework for financial reporting. This structured approach ensures clarity, consistency, and comparability, enabling businesses to effectively analyze financial data, make informed decisions based on performance trends, and ultimately contribute to sustainable growth and financial stability. By leveraging the standardized format of these templates, businesses can streamline their financial management processes and gain valuable insights into their operational efficiency and profitability.

4. Financial Clarity

Financial clarity, a critical outcome of utilizing a free year-to-date profit and loss statement template, signifies a comprehensive understanding of an organization’s financial performance. This clarity stems from the organized presentation of revenue, expenses, and resulting profit or loss within a specific timeframe. A well-structured template facilitates this clarity by providing predefined categories and calculations, enabling businesses to readily assess their financial health and make informed decisions. Without such a template, financial data can remain disjointed and difficult to interpret, hindering effective analysis and strategic planning.

Consider a small e-commerce business. Utilizing a free YTD profit and loss statement template allows the owner to track sales revenue, cost of goods sold, marketing expenses, and other operational costs within a structured format. This organized presentation clarifies profitability drivers, identifies areas of high expenditure, and facilitates informed decisions regarding pricing strategies, inventory management, and marketing investments. For instance, if the template reveals a high marketing spend relative to sales, the owner can investigate the effectiveness of current marketing campaigns and adjust strategies accordingly. Conversely, robust sales growth evident within the template might encourage further investment in product development or expansion into new markets.

Achieving financial clarity through the use of these templates is not merely an organizational benefit; it is often a requirement for securing external funding or attracting investors. Presenting a clear and concise financial overview demonstrates fiscal responsibility and instills confidence in stakeholders. Furthermore, this clarity promotes internal transparency and accountability, enabling teams to understand their contributions to the overall financial performance. Challenges may arise if data is entered inconsistently or inaccurately. Therefore, maintaining data integrity is paramount for ensuring the accuracy and reliability of the insights derived from the template. Ultimately, leveraging these free resources contributes significantly to a more robust and informed approach to financial management, enabling data-driven decision-making and fostering sustainable growth.

5. Cost-effectiveness

Cost-effectiveness is a significant advantage associated with free year-to-date profit and loss statement templates. These templates eliminate the financial burden typically associated with acquiring proprietary software or outsourcing financial reporting. This cost savings allows businesses, especially startups and small enterprises with limited budgets, to allocate resources more strategically, focusing on core operations, marketing, and expansion. The direct impact of utilizing a free template is a reduction in operational expenses, contributing directly to improved profitability and financial stability. For example, a new restaurant can utilize a free template to manage its finances during its crucial initial stages, diverting saved funds towards inventory, staff training, or marketing initiatives.

Beyond the direct cost savings, free templates offer indirect benefits that contribute to overall cost-effectiveness. The readily available nature of these templates reduces the time and resources required to set up complex accounting systems. This efficiency translates to reduced labor costs and allows personnel to focus on revenue-generating activities rather than administrative tasks. Consider a freelance consultant who can readily download and utilize a free template to manage client invoices and expenses, minimizing time spent on administrative overhead and maximizing billable hours. Furthermore, using a standardized template can reduce errors in financial reporting, minimizing potential costs associated with inaccuracies and audits.

While free templates offer substantial cost advantages, limitations exist. Complex businesses with sophisticated reporting requirements might find free templates insufficient. Scalability can also be a concern as business grows. Integrating these templates with other business systems might also present challenges. However, for many small businesses and startups, the benefits of cost-effectiveness outweigh these limitations. Understanding the financial implications of leveraging free resources empowers businesses to make informed decisions and maximize resource allocation, contributing to sustainable growth and long-term financial health. The judicious use of these templates represents a practical approach to financial management, allowing businesses to operate efficiently while maintaining a focus on core business objectives.

6. Informed Decisions

Informed decisions represent the culmination of effective financial management, enabled by readily accessible tools such as free year-to-date profit and loss statement templates. These templates empower stakeholders to move beyond simple data awareness and engage in proactive, data-driven decision-making. By providing a clear and concise overview of financial performance, these resources facilitate strategic planning, operational adjustments, and ultimately, contribute to sustainable growth. Without access to organized financial data, decisions become reactive and based on assumptions rather than concrete evidence.

- Strategic PlanningAccurate YTD financial data, organized within a structured template, provides the foundation for effective strategic planning. Analyzing revenue trends, expense patterns, and profitability metrics allows businesses to identify growth opportunities, anticipate potential challenges, and develop informed strategies. For example, consistent growth in a specific product line, evident within the YTD statement, might justify investment in expanding that product line’s market reach. Conversely, declining profitability, revealed through the template’s analysis, could prompt a review of pricing strategies or operational efficiencies.

- Performance EvaluationFree YTD profit and loss statement templates facilitate objective performance evaluation by providing quantifiable metrics. Businesses can assess their progress against established targets, identify areas of strength and weakness, and implement corrective actions based on data-driven insights. A retail business, for instance, can use the template to evaluate the effectiveness of promotional campaigns by analyzing the impact on sales revenue and profit margins. This data-driven approach to performance evaluation replaces guesswork with concrete evidence, leading to more effective and impactful business decisions.

- Resource AllocationEffective resource allocation relies heavily on a clear understanding of financial performance. Free YTD templates provide this clarity, enabling businesses to allocate resources strategically, maximizing returns on investment. Identifying profitable areas of the business through YTD analysis allows for focused investment, while underperforming areas can be addressed through resource reallocation or process optimization. A technology company, for example, might redirect resources from a less profitable project, identified through the YTD statement, to a high-growth area, optimizing resource utilization and maximizing overall return.

- Investor CommunicationClear and concise financial reporting is crucial for communicating with investors and securing funding. Free YTD templates provide a professional and readily understandable format for presenting financial performance to potential investors. This transparency builds trust and demonstrates financial responsibility, increasing the likelihood of securing investment. A startup, for example, can leverage a well-structured YTD profit and loss statement to showcase its financial trajectory and attract seed funding, demonstrating its potential for growth and return on investment.

The ability to make informed decisions, facilitated by free YTD profit and loss statement templates, represents a significant advantage in today’s competitive business landscape. By leveraging these accessible resources, businesses gain a deeper understanding of their financial health, empowering them to make strategic decisions that drive growth, enhance profitability, and ensure long-term sustainability. Failing to leverage readily available financial data limits a business’s ability to adapt, innovate, and thrive in a dynamic market environment.

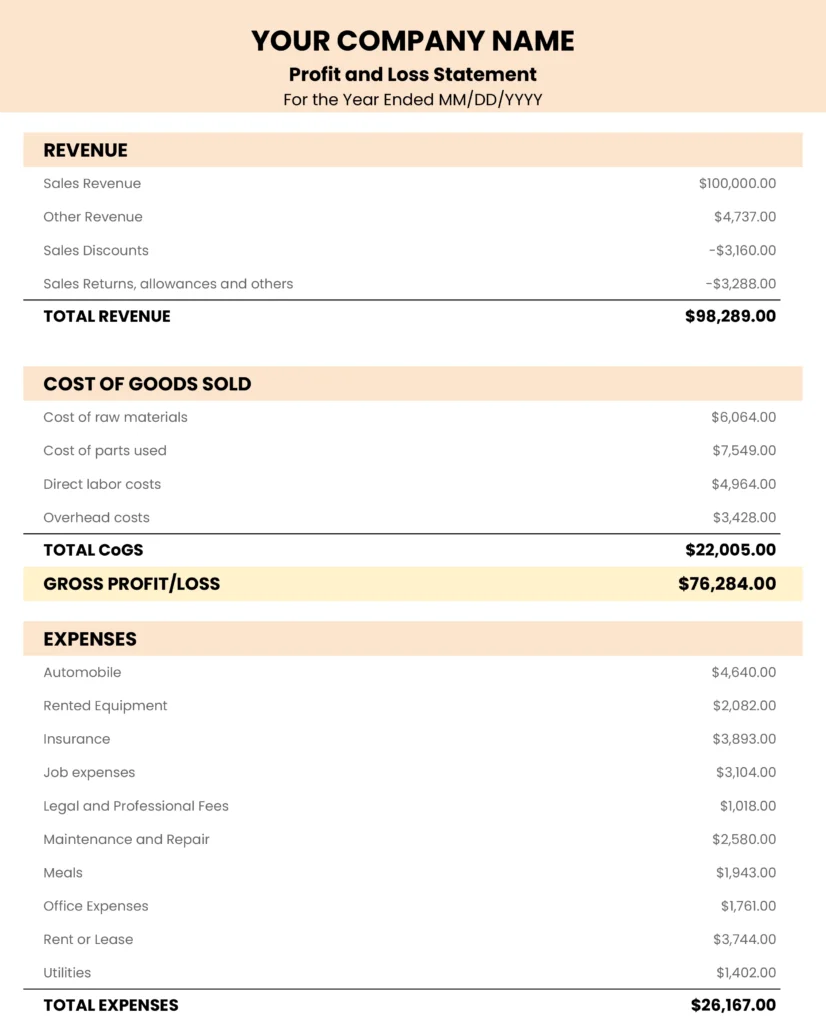

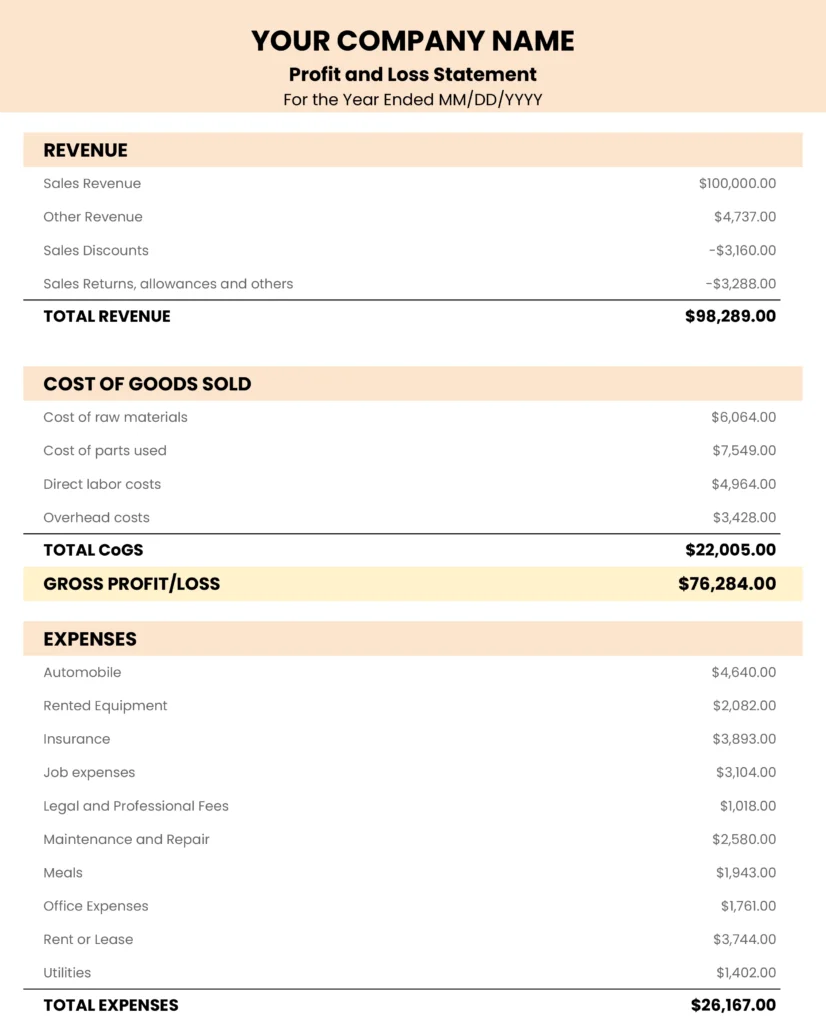

Key Components of a Year-to-Date Profit and Loss Statement

Essential elements comprise a comprehensive year-to-date profit and loss statement, providing a structured overview of financial performance. Understanding these components is crucial for accurate interpretation and analysis.

1. Reporting Period: Clearly identifies the specific timeframe covered by the statement, typically the beginning of the fiscal or calendar year up to the current date. This specification ensures data relevance and facilitates comparison across periods.

2. Revenue: Details all income generated during the reporting period. This section often includes subcategories to distinguish between different revenue streams, providing a granular view of income sources.

3. Cost of Goods Sold (COGS): Represents direct costs associated with producing goods or services sold. Accurate COGS calculation is crucial for determining gross profit and understanding profitability.

4. Gross Profit: Calculated as Revenue minus COGS. This key metric reflects the profitability of core business operations before considering other expenses.

5. Operating Expenses: Encompasses all costs incurred in running the business, excluding COGS. Examples include salaries, rent, marketing, and administrative expenses. Categorization within operating expenses provides insight into cost drivers.

6. Operating Income: Derived by subtracting operating expenses from gross profit. This metric reflects the profitability of the business after accounting for operational costs.

7. Other Income/Expenses: Captures income or expenses not directly related to core business operations, such as interest income, investment gains, or losses.

8. Net Income: Represents the final profit or loss after considering all revenue and expenses, including other income and expenses. This bottom-line figure provides a comprehensive measure of overall financial performance during the reporting period.

Accurate data within these structured components provides a robust tool for evaluating financial performance, identifying trends, and guiding strategic decision-making.

How to Create a Free Year-to-Date Profit and Loss Statement Template

Creating a free year-to-date profit and loss statement template involves structuring a document to effectively track and analyze financial performance throughout the year. The following steps outline the process.

1. Define the Reporting Period: Clearly specify the start and end dates for the year-to-date period. This ensures data accuracy and facilitates comparisons across different periods.

2. Establish Revenue Categories: Create distinct categories for various revenue streams. This detailed breakdown allows for analysis of individual income sources and identification of key revenue drivers.

3. Outline Cost of Goods Sold (COGS): If applicable, define the direct costs associated with producing goods or services. Accurate COGS categorization is essential for calculating gross profit.

4. Incorporate Operating Expense Categories: Establish categories for different types of operating expenses, such as salaries, rent, marketing, and administrative costs. This categorization enables tracking of spending patterns and identification of potential cost-saving opportunities.

5. Include Formulas for Key Metrics: Incorporate formulas to automatically calculate gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income – Other Expenses). Automated calculations ensure accuracy and efficiency in reporting.

6. Add Sections for Other Income and Expenses: Include sections to capture income or expenses not directly related to core operations, such as interest income or investment gains/losses. This provides a comprehensive view of financial performance.

7. Format for Clarity and Readability: Ensure the template is visually clear and easy to navigate. Use clear labels, consistent formatting, and logical organization to facilitate interpretation and analysis. Consider incorporating visual aids, such as charts or graphs, to enhance data presentation.

8. Test and Refine: Before widespread use, populate the template with sample data to verify formulas and functionality. Refine the template based on testing results and feedback to ensure it meets specific reporting needs. Regularly reviewing and updating the template ensures continued accuracy and relevance as business operations evolve.

A well-structured template, encompassing these components, allows for consistent tracking and analysis of financial performance, facilitating informed decision-making and contributing to long-term financial health. Utilizing readily available spreadsheet software or online platforms simplifies the creation and implementation process.

Access to complimentary year-to-date profit and loss statement templates offers significant advantages for businesses seeking to understand and manage their financial performance. Leveraging these resources provides a structured approach to tracking revenue and expenses, calculating key profitability metrics, and gaining insights into financial trends throughout the year. The readily available nature of these templates, combined with their standardized format, facilitates informed decision-making, contributes to operational efficiency, and supports sustainable growth. From startups to established enterprises, the ability to analyze year-to-date financial data empowers organizations to navigate the complexities of the business landscape with greater clarity and control.

Effective financial management remains a cornerstone of long-term business success. Utilizing available resources, such as free year-to-date profit and loss statement templates, represents a proactive approach to financial stewardship, enabling organizations to monitor performance, identify areas for improvement, and make data-driven decisions that contribute to sustained profitability and growth. Embracing these tools empowers businesses to navigate the complexities of the financial landscape with confidence and foresight.