Navigating the intricacies of payroll can often feel like a complex puzzle, especially when it comes to managing various deductions. Whether it is for benefits, taxes, or other employee-elected contributions, a clear and standardized process is essential for any organization. This is where a well-structured form becomes invaluable, ensuring accuracy, compliance, and transparency for both the company and its employees. Having a reliable tool to manage these financial adjustments can significantly streamline administrative tasks and prevent potential misunderstandings.

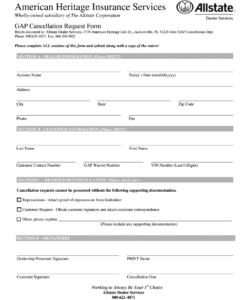

For businesses, ensuring every deduction is properly authorized and documented isn’t just good practice; it’s a legal necessity. Employees, on the other hand, benefit from knowing exactly what is being taken from their paycheck and why. A well-designed generac payroll deduction form template serves as that crucial bridge, simplifying the entire process and providing a clear record of every agreement. It helps maintain order in an otherwise potentially chaotic aspect of human resources and accounting.

Understanding the Generac Payroll Deduction Process

Payroll deductions are a fundamental part of compensation, encompassing everything from mandatory taxes to voluntary contributions like health insurance premiums or retirement savings. For employees, these deductions collectively determine their net pay. For employers, meticulously tracking and remitting these funds to the correct recipients is a significant responsibility, requiring precision and strict adherence to regulations. Any errors can lead to compliance issues, fines, and even disputes with employees.

To manage this complexity efficiently, a structured approach is paramount. This is where the concept of a dedicated form comes into play. It provides a standardized method for employees to authorize deductions and for the company to record them. Think of it as a formal agreement that outlines the specific amount, purpose, and duration of each deduction, offering a clear paper trail that benefits all parties involved, especially during audits or inquiries.

A specific generac payroll deduction form template can be tailored to meet the unique needs of a company, ensuring all relevant information is captured consistently. This not only speeds up the data entry process but also minimizes the chances of human error. It acts as a single source of truth for all payroll-related deductions, helping HR and payroll departments operate more smoothly and effectively. Having a template also ensures that no critical piece of information is overlooked, which is vital for compliance.

Common Types of Payroll Deductions

Understanding the different categories of deductions is key to creating a comprehensive form. These can broadly be categorized into mandatory and voluntary deductions:

- Mandatory Deductions: These are typically required by law and include federal income tax, state income tax (where applicable), Social Security, and Medicare (FICA taxes). Wage garnishments, ordered by a court for debts like child support or unpaid taxes, also fall under this category.

- Voluntary Deductions: These are elected by the employee and often relate to benefits and savings plans. Examples include health insurance premiums, dental and vision insurance, 401(k) or other retirement plan contributions, flexible spending accounts (FSAs), health savings accounts (HSAs), life insurance premiums, union dues, and charitable contributions.

Creating and Utilizing Your Generac Payroll Deduction Form Template Effectively

Designing an effective generac payroll deduction form template is about more than just listing deduction types; it’s about creating a user-friendly and legally sound document. The template should be clear, concise, and easy for employees to understand and complete. It should also include all necessary fields for internal processing and auditing. A well-crafted template becomes a significant asset, improving efficiency and reducing the likelihood of errors that can complicate payroll management.

When you set out to create or customize your template, consider the various scenarios under which an employee might need to authorize a deduction. This could range from initial onboarding where they select benefits, to mid-year changes in their insurance coverage, or even setting up a new retirement contribution. The form should be versatile enough to handle these different situations while maintaining its core structure and clarity. It’s an investment in smoother operations.

Once your template is developed, consistent utilization is key. Ensure all employees are aware of where to access it and how to submit completed forms. Digital solutions, such as an online portal or a fillable PDF, can further enhance efficiency, making the process almost entirely paperless. Providing clear instructions and possibly even a brief guide on how to complete the form can also prevent common mistakes and reduce the need for follow-up questions from the HR or payroll team.

Ultimately, a robust generac payroll deduction form template simplifies a complex administrative task, ensuring accuracy and compliance. It empowers employees by providing them with a clear way to manage their pay deductions, while giving employers peace of mind that all necessary authorizations are in place and properly documented. This leads to a more organized and error-free payroll system for everyone involved, fostering trust and clarity in financial matters.

- Employee Identification Information: Full name, employee ID, department.

- Deduction Type: Clear checkboxes or dropdowns for common deductions (e.g., Health Insurance, 401(k), Union Dues, etc.).

- Deduction Amount or Percentage: Space to specify the exact amount or percentage to be deducted per pay period.

- Effective Date: When the deduction should begin.

- Reason for Deduction: (e.g., New Enrollment, Change in Coverage, Termination of Deduction).

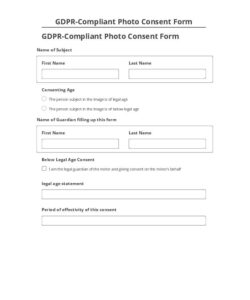

- Authorization Statement: A clear statement where the employee acknowledges and authorizes the deduction.

- Employee Signature and Date: Mandatory for legal validity.

- Employer/Payroll Department Signature and Date: For internal verification.

Implementing a standardized form for payroll deductions is more than just an administrative convenience; it’s a critical component of sound financial management and employee relations. By providing a clear, consistent, and legally compliant way to manage these essential transactions, organizations can minimize errors, enhance transparency, and ensure that every paycheck accurately reflects agreed-upon deductions. This level of precision contributes significantly to operational efficiency and builds confidence among the workforce.

The foresight to invest in and properly utilize such a resource not only streamlines internal processes but also safeguards against potential discrepancies and misunderstandings. It creates a seamless experience for both the payroll department and the employees, ensuring that financial contributions towards benefits or savings are handled with the utmost accuracy and professionalism. Embracing these best practices ultimately leads to a more harmonious and well-managed workplace.