Ever found yourself wondering how to best protect your business or event from unforeseen incidents? It’s a common concern for anyone stepping into the world of operations, where everyday activities, no matter how carefully planned, can sometimes lead to unexpected bumps. That’s where the idea of managing potential risks comes into play, ensuring you have a safety net for those ‘what if’ moments.

Navigating the complexities of legal responsibilities and participant agreements can feel like a daunting task. Without clear documentation, you might be leaving yourself vulnerable. Fortunately, there’s a straightforward tool that can help simplify this crucial aspect of risk management: a well-crafted general insurance liability form template. It’s designed to provide clarity and protection for everyone involved, setting clear expectations and mitigating potential disputes before they even arise.

Why Every Business Needs a Robust Liability Form

In today’s fast-paced environment, businesses of all sizes, from local shops to large event organizers, face a constant stream of potential liabilities. Imagine someone slipping on a wet floor, a participant getting injured during an activity, or even property damage occurring during a service you provide. These aren’t just minor inconveniences; they can escalate into significant legal and financial challenges if not properly addressed.

Without adequate documentation, proving that participants understood and accepted certain risks becomes incredibly difficult. This lack of clear understanding can lead to costly lawsuits, damage to your reputation, and immense stress. A liability form acts as a foundational agreement, clearly outlining the responsibilities of both parties and acknowledging the inherent risks of certain activities or services.

Think of a liability form as your first line of defense. It’s a proactive step that demonstrates your commitment to safety and transparency, while also setting boundaries for what you are and are not responsible for. It helps manage expectations and can often prevent minor incidents from turning into major legal battles.

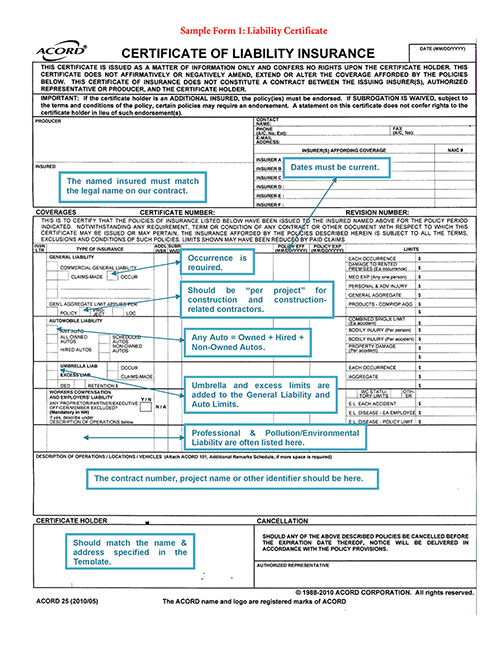

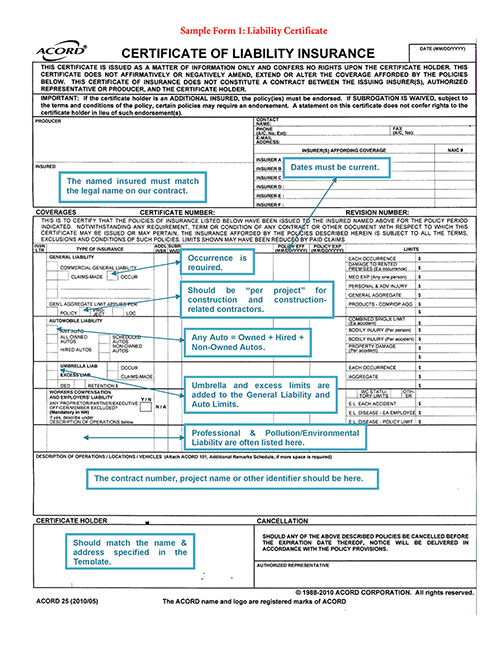

Key Components of an Effective Liability Form

- Participant Information: Basic details of the person agreeing to the terms.

- Description of Activities/Services: A clear outline of what the participant will be engaging in.

- Acknowledgement of Risks: Explicit statements identifying potential hazards and the participant’s understanding of them.

- Release of Liability: A clause where the participant agrees not to hold your entity responsible for certain injuries or damages.

- Assumption of Risk: Where the participant explicitly states they are voluntarily assuming the risks involved.

- Indemnification Clause: An agreement by the participant to protect your entity from claims arising from their actions.

- Signature Block: Spaces for signatures, dates, and witness details, making the agreement legally binding.

While a general insurance liability form template provides an excellent starting point, it’s crucial to tailor it to your specific needs and industry. Always consider consulting with a legal professional to ensure your form is compliant with local laws and adequately covers your unique operational risks.

Navigating the Process of Customizing Your Liability Template

Once you’ve decided that a liability form is essential for your operations, the next logical step is to find and adapt a suitable general insurance liability form template. The internet offers a wealth of resources, but the key isn’t just downloading the first one you find. It’s about understanding that a template is merely a framework that needs to be built upon to truly serve your specific protective needs.

Tailoring the template means delving into the specifics of your business. Are you running a physical fitness class? Hosting an outdoor event? Providing consultancy services? Each scenario carries its own set of unique risks and legal considerations. For instance, a form for a rock-climbing gym will need to detail risks like falls and equipment failure, whereas a form for a photography studio might focus more on property damage or privacy clauses.

Moreover, local and state regulations play a significant role in the validity and enforceability of liability waivers. What might be standard practice in one region could be challenged or even invalidated in another. This is precisely why seeking legal counsel familiar with your industry and jurisdiction is not just recommended, but often critical, before finalizing and implementing any liability form.

Finally, implementing the form effectively involves more than just having it signed. It includes ensuring your staff understands its importance, knowing where to securely store completed forms, and establishing clear procedures for when and how the forms are to be used. Whether you opt for physical copies or digital solutions, maintaining an organized and accessible record is vital for both compliance and quick reference should an incident occur.

Having a well-defined and legally sound liability form is more than just a piece of paper; it’s an integral part of your risk management strategy. It helps you articulate boundaries, informs participants of potential dangers, and can provide a strong defense should a claim ever arise. This proactive approach not only safeguards your assets but also contributes significantly to your peace of mind.

By investing time in customizing and properly implementing a liability form, you’re building a stronger, more resilient foundation for your business or event. It empowers you to operate with greater confidence, knowing that you have taken a crucial step in preparing for the unexpected, allowing you to focus on delivering your best services and experiences.