Keeping track of your business’s financial transactions might feel like a complex puzzle at times, especially when you’re dealing with a constant flow of money in and out. Every single financial event, from selling a product to paying a utility bill, needs to be recorded meticulously to ensure your books are accurate and your business health is clear. Without a structured way to do this, things can quickly become messy, leading to errors and a lot of headaches come tax season.

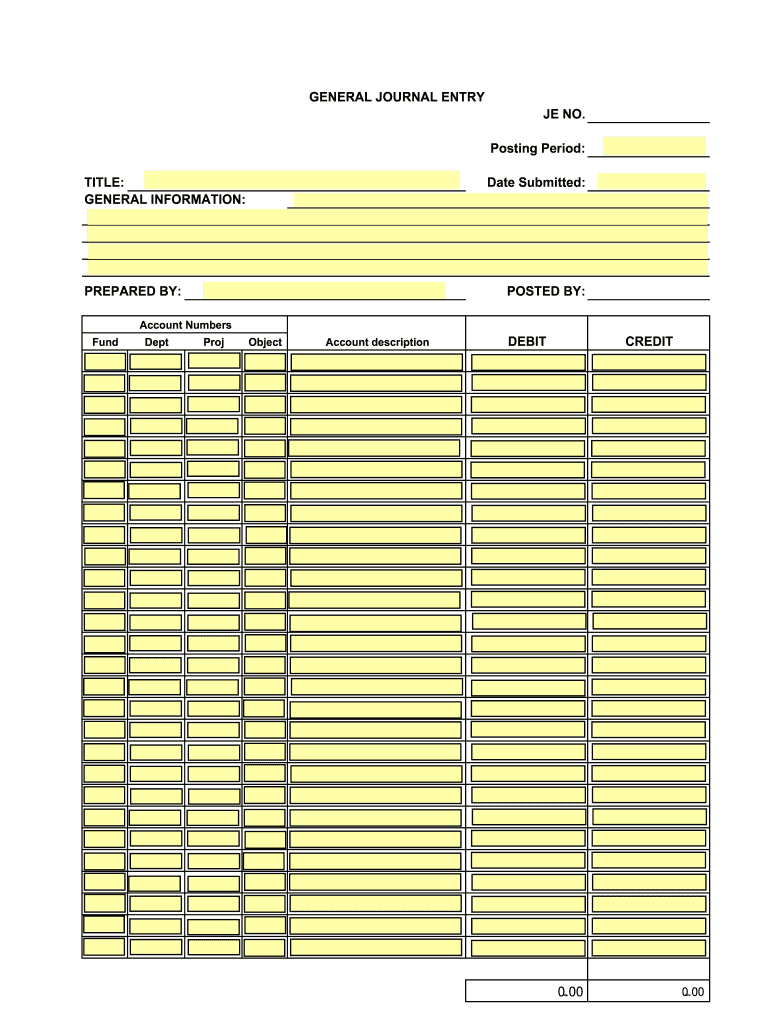

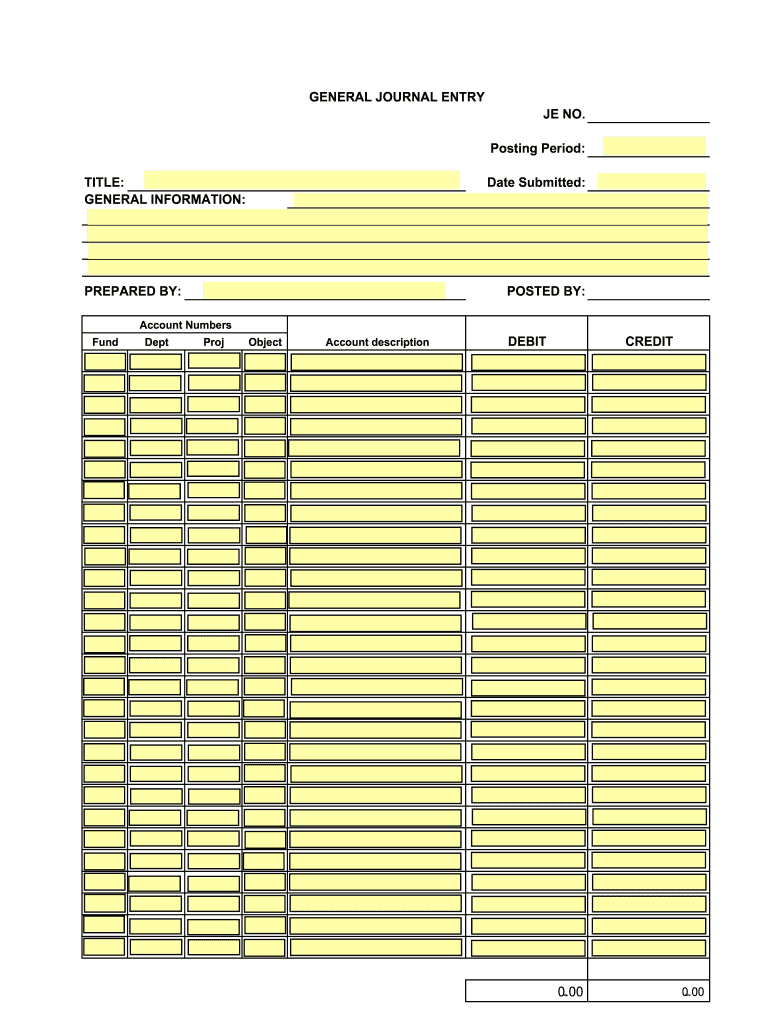

This is precisely where a good system comes into play. Imagine having a straightforward, easy-to-use tool that guides you through recording each transaction properly, ensuring nothing is missed and everything is categorized correctly. A well-designed general journal entry form template does exactly that. It transforms what could be a daunting task into a manageable and even intuitive process, helping you maintain pristine financial records without needing to be an accounting wizard.

Why a General Journal Entry Form Template is Your Accounting Lifesaver

In the world of accounting, precision is paramount. Every debit must have a corresponding credit, and every transaction needs a clear, chronological record. Trying to keep all of this straight purely in your head, or even in a haphazard spreadsheet, is an invitation for mistakes. A dedicated general journal entry form template acts as your financial roadmap, guiding you to input all necessary information in a consistent manner, thereby greatly reducing the chance of errors and ensuring compliance with basic accounting principles. It’s like having a personal assistant dedicated to keeping your ledger tidy and accurate.

Think of the time saved when you don’t have to constantly remember what information needs to be captured for each transaction. With a template, the fields are already laid out for you. This standardization not only makes the initial entry faster but also simplifies the process of reviewing and auditing your financial activities later on. You can quickly spot trends, reconcile accounts, and even prepare for financial reports with much less effort, as all the foundational data is perfectly organized.

Key Components of an Effective Template

An effective general journal entry form template isn’t just a blank page; it’s structured with specific fields designed to capture every detail crucial for accurate financial recording. Understanding these components is vital to making the most out of your template and ensuring your financial records are complete and auditable.

- Date: This is fundamental. Every transaction needs a precise date to maintain chronological order, which is essential for financial reporting and auditing.

- Journal Entry Number: A unique identifier for each entry. This helps in tracking and referencing specific transactions later on, making cross-referencing much simpler.

- Account Names: This section is where you list the specific accounts affected by the transaction, such as Cash, Accounts Receivable, Sales Revenue, or Rent Expense.

- Debit: The amount entered here represents the increase in assets or expenses, or a decrease in liabilities, equity, or revenue.

- Credit: The amount entered here represents the decrease in assets or expenses, or an increase in liabilities, equity, or revenue. Remember, for every debit, there must be an equal credit.

- Description/Explanation: A brief yet clear explanation of the transaction. This narrative context is invaluable for anyone reviewing the entry, including yourself in the future, auditors, or tax professionals.

- Reference (Optional): This could be a check number, invoice number, or any other reference related to the transaction, linking it back to source documents.

By systematically filling in these fields, you ensure that each transaction is recorded with all the necessary details, maintaining the integrity and clarity of your financial records. It creates a complete and easily understandable audit trail.

Implementing and Customizing Your General Journal Entry Form Template

Once you have a general journal entry form template, the next step is to integrate it seamlessly into your daily operations. Consistency is key here. Make sure everyone involved in recording financial transactions understands how to use the template correctly and adheres to its structure. This might involve a quick training session to ensure everyone is on the same page regarding what information goes into each field and why it’s important. Over time, consistent use will build good habits and further streamline your bookkeeping processes.

One of the great advantages of a template is its adaptability. While the core components are standard, you can certainly customize your general journal entry form template to better suit your specific business needs. This could involve adding your company logo for a professional touch, creating dropdown menus for frequently used account names in a digital version, or even adding custom fields relevant to your industry. For instance, a retail business might add a field for "Point of Sale (POS) reference" while a service business might include "Client Project ID."

Whether you prefer to use a physical printout or a digital version in a spreadsheet program like Excel or Google Sheets, the principles remain the same. Digital templates offer the added benefit of easy duplication, automatic calculations (for balancing debits and credits), and simple storage and retrieval. Many accounting software solutions also incorporate similar template-like structures for their transaction entries, making the transition to more sophisticated systems easier if you’re already familiar with the basic template concept.

Ultimately, regularly utilizing your general journal entry form template is about fostering a discipline of accurate and systematic financial record-keeping. It’s not just about filling in boxes; it’s about building a robust foundation for your business’s financial health. This consistent practice allows you to accurately track your financial performance, make informed business decisions, and ensure compliance with financial regulations, setting you up for long-term success.

Adopting a structured approach to your financial records, particularly through the consistent use of a general journal entry form template, can significantly transform how you manage your business’s money. It takes the guesswork out of bookkeeping and replaces it with a clear, systematic process that empowers you with accurate, real-time financial insights. This proactive approach ensures that your financial data is always reliable and ready for review whenever you need it.

By simplifying the recording of every financial ebb and flow, you gain unparalleled clarity into your business’s economic standing. This clarity is invaluable for strategic planning, budgeting, and ultimately, for guiding your business towards sustainable growth and prosperity. It’s a small investment in time and structure that yields immense returns in peace of mind and financial control.