Navigating the world of real estate can often feel like deciphering a complex legal puzzle. When you’re buying or selling property, one of the most crucial documents you’ll encounter is the general warranty deed. This isn’t just a piece of paper; it’s the legal backbone of your property transfer, offering significant protections to the buyer. Understanding its purpose and knowing how to properly prepare one is key to a smooth and secure transaction.

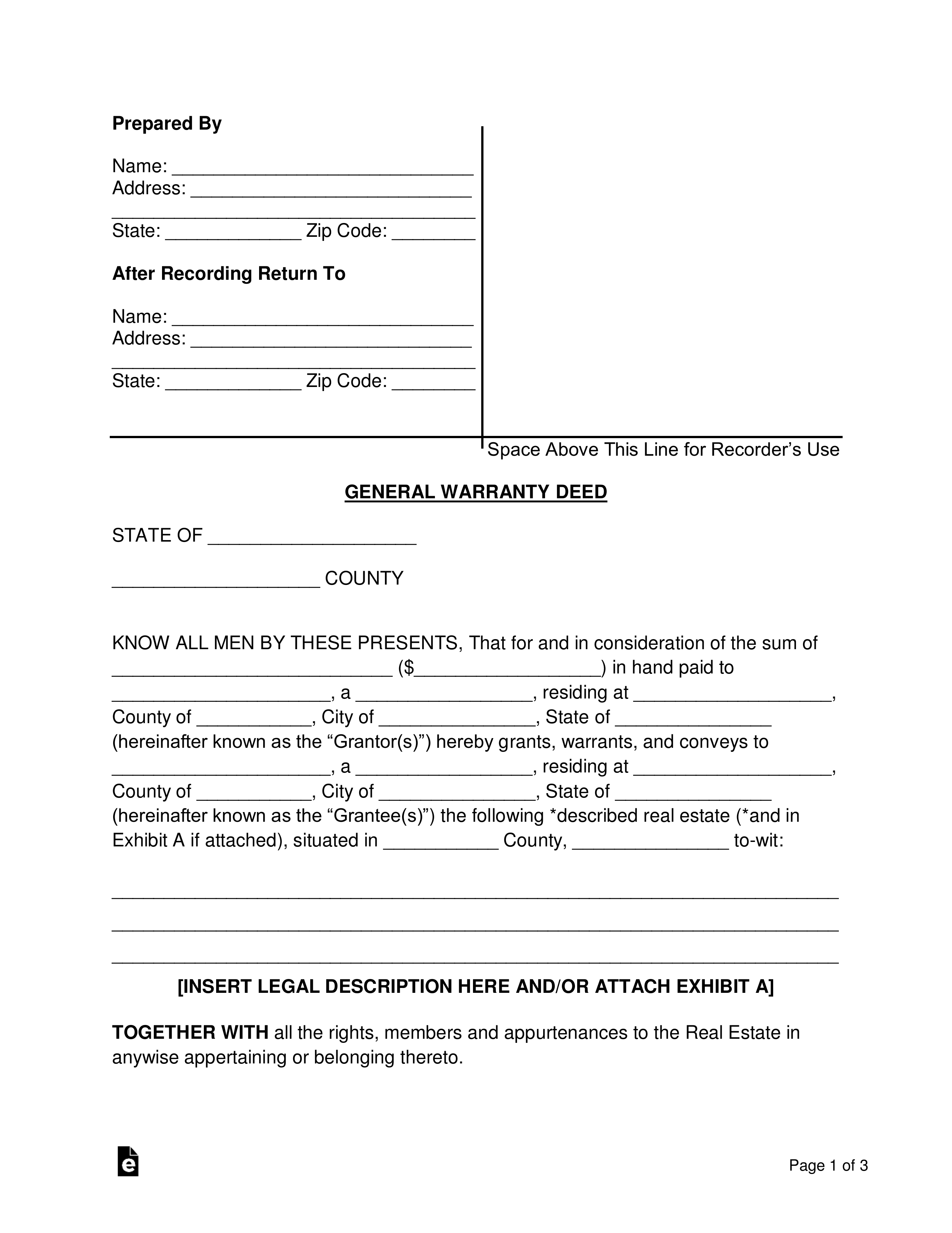

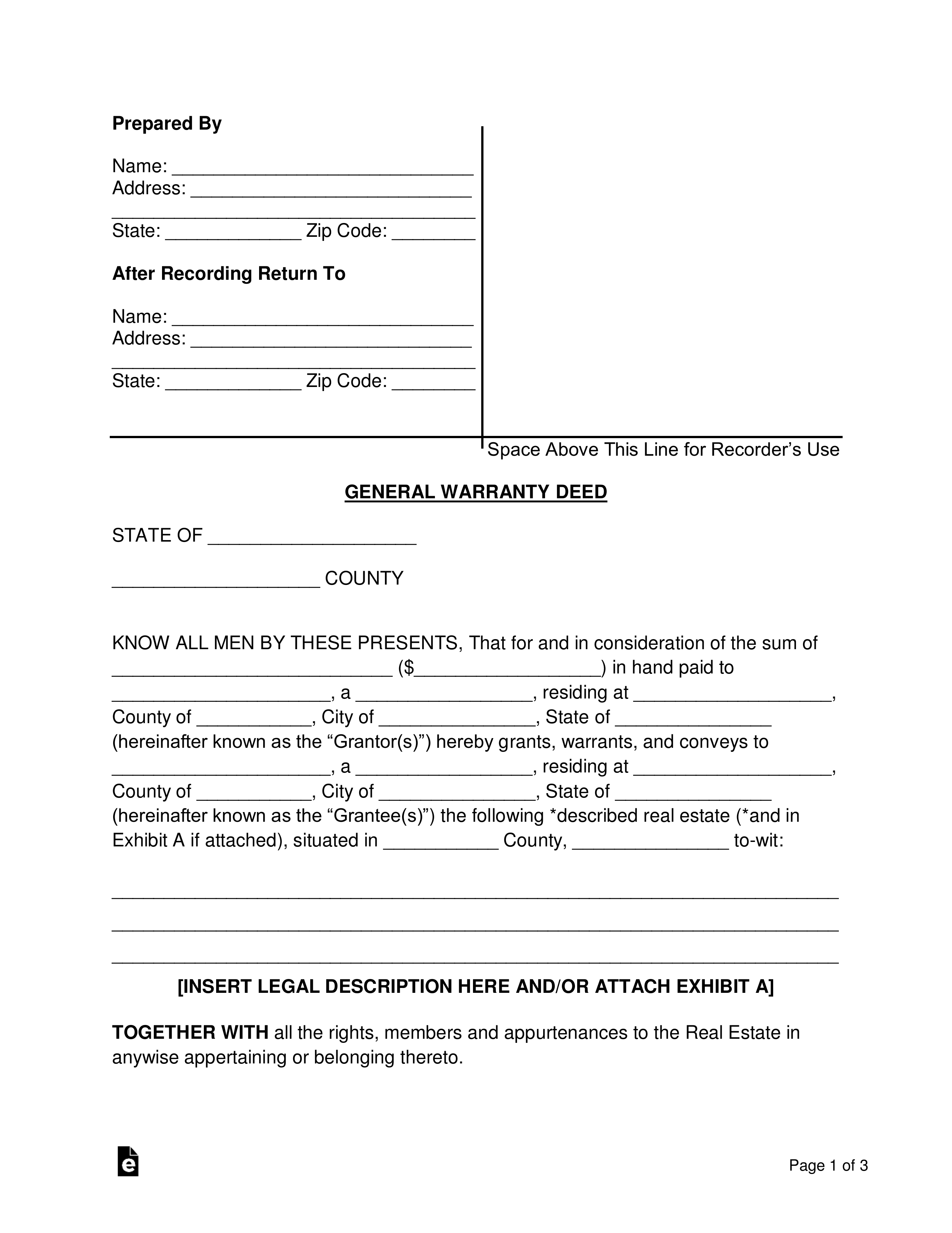

Fortunately, you don’t always need to start from scratch. A reliable general warranty deed form template can be an incredibly valuable tool, providing a structured framework that guides you through the necessary details. It helps ensure that all the legal requisites are met, safeguarding both the grantor (seller) and the grantee (buyer) in the process. Let’s delve deeper into what makes this document so important and how a well-chosen template can simplify its creation.

What Exactly Is a General Warranty Deed?

At its core, a general warranty deed is a legal instrument used to transfer title to real estate from one party to another. What sets it apart from other types of deeds, like a quitclaim deed or a special warranty deed, are the comprehensive promises, or "warranties," it provides from the grantor to the grantee. These aren’t just polite assurances; they are legally binding covenants that offer the highest level of protection to the buyer.

These warranties essentially guarantee that the grantor holds clear title to the property and has the full legal right to sell it. More specifically, the deed assures the grantee that there are no undisclosed encumbrances (like liens or mortgages) against the property, that the grantee will have quiet enjoyment of the property (meaning no one else has a superior claim to it), and that the grantor will defend the title against any past or future claims. This extensive protection is why it’s often preferred in arm’s-length transactions between unrelated parties.

In contrast, a quitclaim deed offers no warranties at all, merely transferring whatever interest the grantor might have. A special warranty deed offers limited warranties, only covering issues that arose during the grantor’s ownership. The general warranty deed, however, stands out for its comprehensive coverage, tracing the title back to its origins and providing a solid foundation of ownership for the new buyer.

Given the significant legal weight of this document, using an accurate and complete general warranty deed form template is paramount. It helps ensure that all the necessary legal language is included and properly articulated, minimizing the risk of future disputes or legal challenges related to the property’s title. A well-crafted template acts as a checklist, ensuring no critical element is overlooked.

Key Elements to Look for in Your Template

- **Grantor and Grantee Information:** Full legal names and addresses of both the seller (grantor) and the buyer (grantee).

- **Legal Description of the Property:** A precise and unambiguous description of the land, often taken from the previous deed or a survey, including lot, block, subdivision, county, and state.

- **Consideration:** The amount of money or other valuable consideration exchanged for the property.

- **Granting Clause:** Language that clearly indicates the transfer of ownership (“does hereby grant, bargain, sell, and convey”).

- **Warranty Covenants:** Explicit statements of the five key warranties: seisin (right to convey), quiet enjoyment, against encumbrances, further assurances, and warranty forever.

- **Execution and Acknowledgment:** Spaces for the grantor’s signature(s) and a notary public’s seal and signature, affirming the grantor’s identity and voluntary signing.

- **Recording Information:** Sometimes includes a section for the property’s parcel identification number or recording instructions for the county clerk’s office.

Finding and Customizing Your General Warranty Deed Form Template

Finding a suitable general warranty deed form template typically begins with understanding your specific state’s requirements. Real estate laws, including the precise wording and formatting for deeds, can vary significantly from state to state, and even sometimes by county. Reliable sources include reputable legal form websites, state bar association websites, and resources provided by title companies or real estate attorneys. It’s always best to seek out a template that is specifically designed for your jurisdiction.

Once you’ve obtained a template, the next step is customization. This involves carefully filling in all the blanks with the specific details of your transaction. You’ll need accurate legal names of all parties involved, the precise legal description of the property, the agreed-upon sale price (consideration), and the date of the transfer. Precision is key here; even small errors can lead to big problems down the line, potentially invalidating the deed or causing delays in recording.

While a template is an excellent starting point, it’s generally not a substitute for professional legal advice, especially for complex transactions or if you have any doubts about the property’s title history. A template serves as a standardized document, but an attorney can provide guidance tailored to your unique circumstances, ensuring the deed fully protects your interests and complies with all local regulations. They can also perform a title search to verify the property’s history.

The process of using a general warranty deed form template typically involves several steps to ensure a smooth and legally sound transfer.

- **Obtain the Correct Template:** As mentioned, ensure it’s suitable for your state and the specific type of deed.

- **Gather Information:** Collect all necessary details, including full legal names, addresses, marital status of grantors (if applicable), the property’s complete legal description, and the exact consideration amount.

- **Fill in the Blanks Carefully:** Input all information accurately into the template. Double-check spelling and figures.

- **Review Thoroughly:** Read through the entire document multiple times to catch any errors or omissions. It’s also wise to have another trusted individual review it.

- **Sign Before a Notary:** The grantor(s) must sign the deed in the presence of a notary public. The notary will verify their identity and witness their signature, then apply their seal and signature.

- **Record the Deed:** After signing and notarization, the deed must be recorded with the county recorder’s office (or equivalent) in the county where the property is located. This provides public notice of the transfer of ownership.

Utilizing a template can save time and reduce costs compared to having a deed drafted from scratch. It provides a structured, legally sound format that, when correctly filled out and executed, stands as a testament to the ownership transfer and the valuable protections offered by a general warranty deed.

Transferring property ownership is a significant event, and employing a meticulously prepared general warranty deed form template is a critical step in ensuring peace of mind for both the buyer and the seller. This document, with its robust covenants, forms the bedrock of secure property rights, affirming the buyer’s unencumbered ownership. By using a reliable template, you are empowering yourself with a foundational legal instrument that streamlines the process.

Ultimately, whether you’re buying your dream home or selling an investment property, approaching the general warranty deed with diligence and accuracy is paramount. While a template provides an excellent framework, always remember the value of precision and, when in doubt, the benefit of professional legal advice to ensure your property transaction is executed flawlessly and stands strong for years to come.