Ever bought or sold something significant and wished you had a clear record of the transaction? Maybe it was a used car, a piece of furniture, or even a beloved pet. In countless everyday exchanges, having a reliable document that outlines the terms of sale isn’t just a good idea; it’s often a legal necessity and provides peace of mind for both the buyer and the seller. This is where a simple yet powerful document comes into play.

A bill of sale acts as your official receipt and a record of ownership transfer. It formalizes a transaction, protecting everyone involved by clearly stating what was sold, for how much, and when. While specific types of transactions, like real estate, require highly specialized forms, many common sales can be effectively documented using a versatile and adaptable form. Understanding its importance and how to utilize it can save you future headaches.

Why You Need a Bill of Sale and What it Covers

Imagine purchasing an item, only to find out later that its previous owner disputes the sale or claims you still owe them money. Or perhaps you’re selling something and want to ensure the new owner can’t come back and claim you misrepresented the item. These scenarios highlight the critical role of a bill of sale. It’s more than just a piece of paper; it’s a legal safeguard that verifies the transfer of ownership from one party to another, clearly outlining the terms agreed upon by both sides.

At its core, a bill of sale provides indisputable proof of a transaction. It legally signifies that the seller has relinquished their rights to the item and the buyer has accepted ownership, often along with any associated responsibilities. This document can be invaluable in resolving disputes, establishing clear lines of responsibility, and even for tax purposes or registering certain items with government agencies. Without it, you’re relying solely on verbal agreements, which can be easily misinterpreted or forgotten over time.

Key Information a Generic Bill of Sale Form Template Should Include

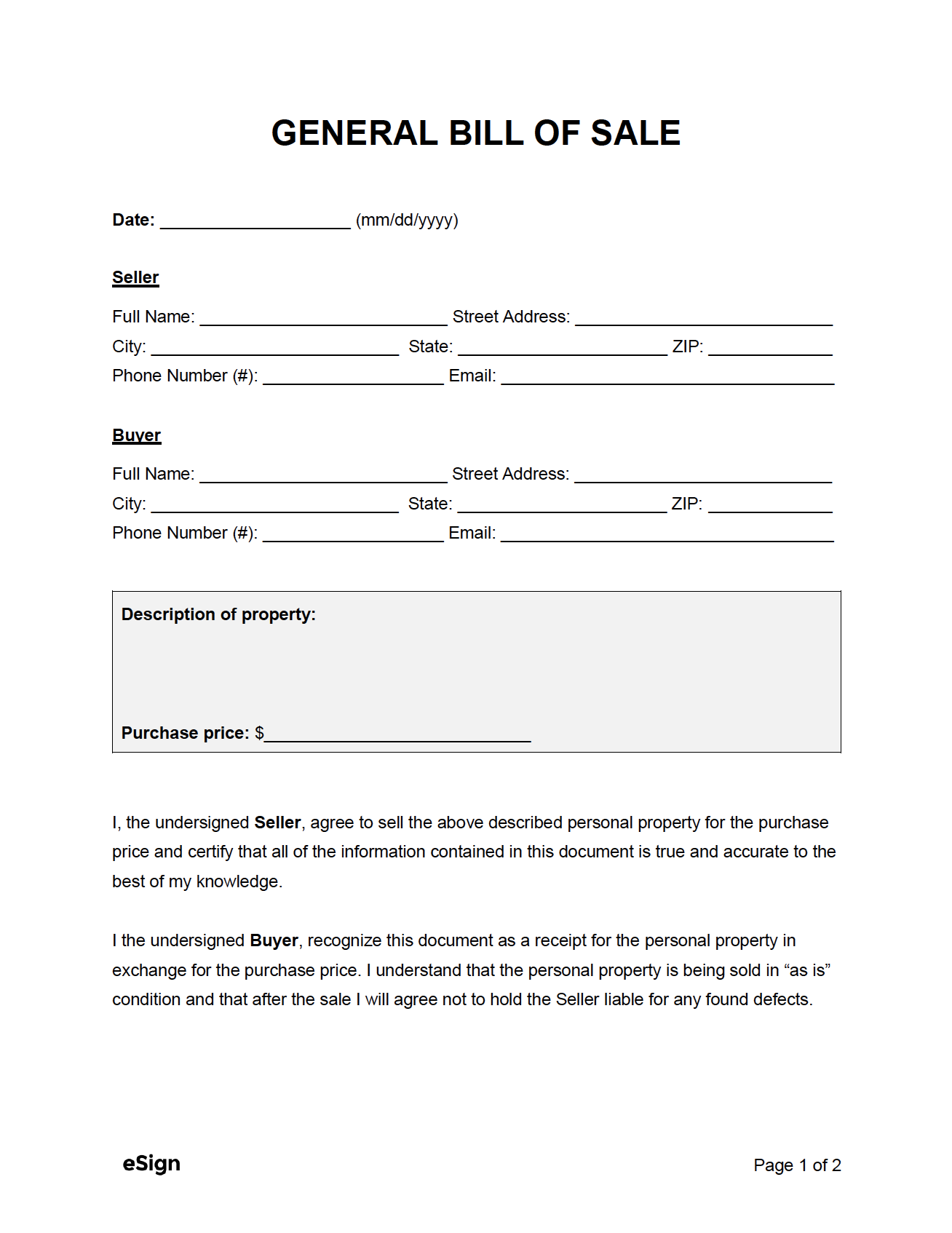

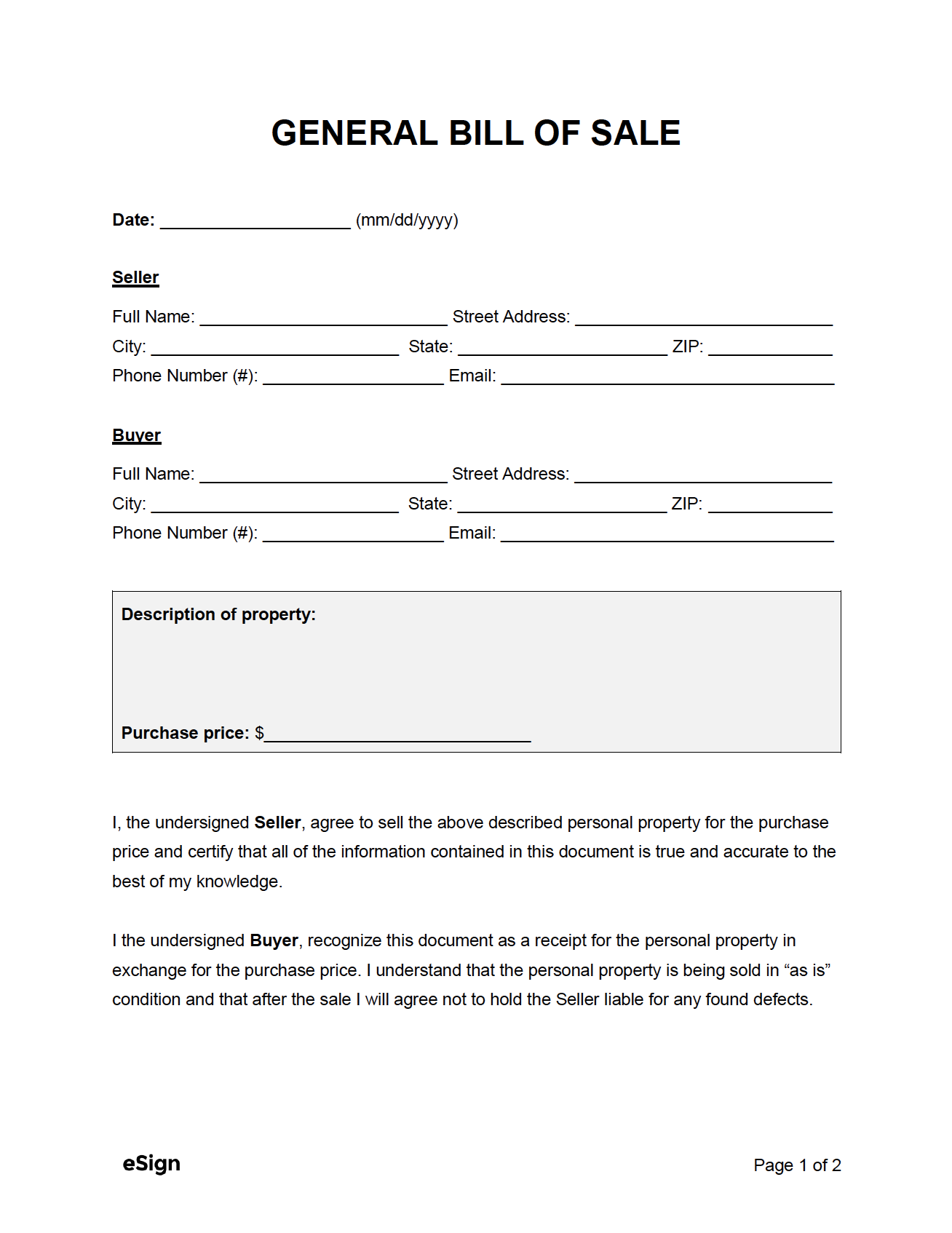

While the beauty of a generic form lies in its adaptability, certain pieces of information are universally important for it to be effective. When you’re looking for or filling out a generic bill of sale form template, make sure it covers the following essential details:

- Full legal names and addresses of both the buyer and the seller. This ensures clear identification of all parties involved in the transaction.

- A detailed description of the item being sold. Be specific – include make, model, serial number, color, condition, and any unique identifiers to prevent confusion.

- The agreed-upon purchase price. Clearly state the amount in both numbers and words, and specify the currency.

- The date of the sale. This is crucial for establishing the exact moment of ownership transfer.

- Signatures of both the buyer and the seller, ideally with a witness signature if possible, and the date each signature was obtained.

Including these elements transforms a simple agreement into a robust legal document. It provides a clear, undeniable record of who sold what to whom, for how much, and when. This level of detail helps prevent misunderstandings and provides a solid reference point should any questions or challenges arise in the future.

Finding and Using Your Generic Bill of Sale Form Template

Now that you understand the immense value of this document, you might be wondering where to get your hands on a reliable generic bill of sale form template. Fortunately, they are widely available and often free. Many legal websites, government agencies (for specific types of sales), and even office supply stores offer printable or downloadable versions. When choosing one, look for a template that is clear, easy to understand, and allows for sufficient space to enter all necessary information without feeling cramped.

One of the greatest advantages of a generic bill of sale form template is its versatility. Unlike highly specialized forms, a well-designed generic version can be adapted for a wide array of personal property transactions. Whether you are selling an old bicycle, a piece of artwork, a set of tools, or even a puppy, the fundamental structure of the form remains the same. You simply tailor the “item description” section to fit whatever you are buying or selling, ensuring all pertinent details about that specific item are thoroughly documented.

Filling out the template correctly is just as important as having it. Before any money changes hands or items are exchanged, both parties should sit down together and meticulously complete every field. Double-check all names, addresses, and especially the description of the item and the agreed-upon price. Any discrepancies, even minor ones, could potentially invalidate the document or lead to future complications. It is also wise to ensure that both parties fully understand all clauses and terms within the document before signing.

Once completed and signed, each party should receive an original copy. It’s not enough to just complete the form; retaining this record is paramount. Keep your copy in a safe place, perhaps alongside other important financial or legal documents. This simple act provides continued protection and easy access to proof of ownership or sale should you ever need it for insurance claims, tax purposes, or to resolve any future disputes. It offers enduring peace of mind, knowing your transaction is fully documented.

In the grand scheme of life, formalizing transactions might seem like an extra step, but the protection and clarity a well-executed bill of sale provides are immeasurable. It transforms a potentially ambiguous exchange into a clear, legally recognized agreement, safeguarding the interests of both the buyer and the seller. This simple document truly acts as an indispensable tool for anyone navigating personal property sales, offering security and transparency in every deal.

By taking a few moments to properly document your purchases and sales, you’re not just creating paperwork; you’re building a foundation of trust and accountability. It’s an easy and effective way to ensure smooth transactions and avoid potential conflicts down the line, allowing everyone involved to move forward with confidence and a clear understanding of their rights and responsibilities.