Supporting your favourite charities is a wonderful way to make a difference in the world. But did you know there’s a simple way to make your donations go even further, without costing you an extra penny? It’s all thanks to Gift Aid, a fantastic scheme run by the UK government that allows charities to claim an additional 25p for every £1 you donate, provided you’re a UK taxpayer. This means a £10 donation effectively becomes £12.50 for the charity!

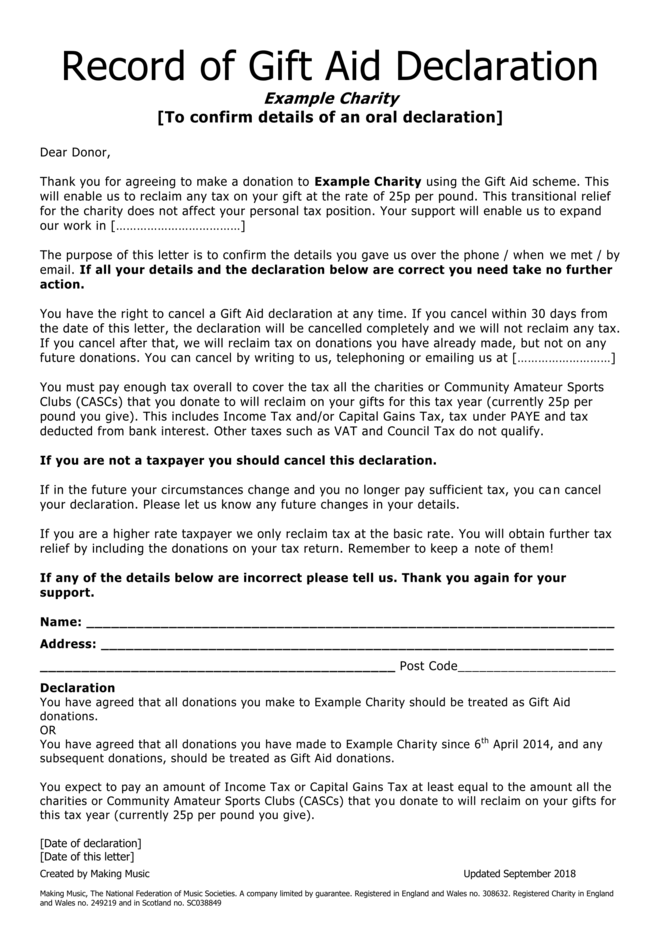

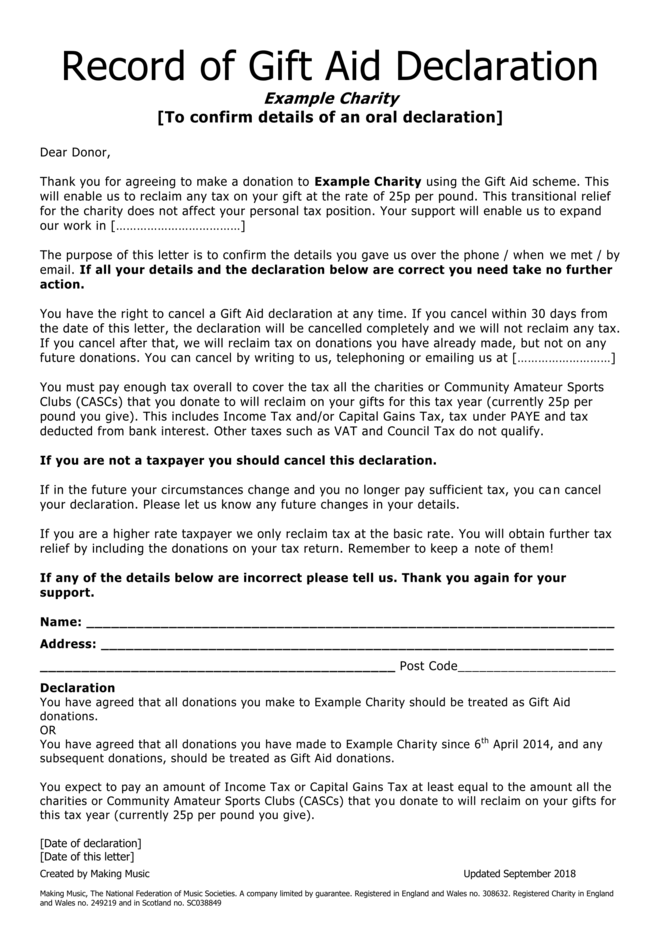

To unlock this extra funding, charities need a valid Gift Aid declaration from you. This is where a well-designed and easy-to-use gift aid claim form template becomes indispensable. Whether you’re a charity looking to streamline your donation process or a generous donor curious about how your contributions are maximised, understanding this vital document is key. Let’s explore what makes an effective template and how it empowers charitable organisations to do more good.

Understanding the Essence of a Gift Aid Declaration

At its heart, a Gift Aid declaration is a crucial piece of paper (or digital record) that serves as your formal statement to a charity, confirming you are a UK taxpayer and wish for your donations to be treated as Gift Aid. This declaration is what enables the charity to reclaim basic rate tax on your donation from HMRC (HM Revenue & Customs). Without it, they simply cannot claim that extra 25% that could fund vital services or projects.

It’s not just a formality; it’s a legal requirement. HMRC demands a clear and unambiguous declaration to process a charity’s Gift Aid claim. This means the form needs to capture specific information accurately. Charities must be able to demonstrate that they have received a valid declaration from the donor for each claim they submit, which underscores the importance of a clear and compliant template.

Key Information Your Template Must Capture

For any Gift Aid declaration to be valid, it must contain certain core details. A good gift aid claim form template will guide donors through providing this information effortlessly, ensuring compliance and reducing errors. Here are the essentials:

- Donor’s Full Name: This allows the charity to identify the donor accurately.

- Donor’s Home Address: Including the postcode, as this is used by HMRC for verification purposes.

- Confirmation of UK Taxpayer Status: A clear statement that the donor understands they are a UK taxpayer and have paid enough UK income tax or capital gains tax to cover the Gift Aid claimed on all their donations in the relevant tax year. This is a critical point that often causes confusion.

- Declaration Statement: A clear statement from the donor consenting for their donation(s) to be treated as Gift Aid. This can cover past, present, and future donations, simplifying the process for recurring givers.

- Date of Declaration: Essential for record-keeping and linking declarations to specific donation periods.

Ensuring these elements are prominently featured and clearly understood by the donor is paramount. The simpler and more explicit your template, the less likely you are to encounter issues when making a claim.

Crafting Your Perfect Gift Aid Claim Form Template

Designing or selecting the right gift aid claim form template is a strategic move for any charity. A well-crafted template standardises the collection of essential information, makes the process seamless for donors, and most importantly, ensures your charity can confidently reclaim the maximum amount of Gift Aid possible. It saves time, reduces administrative burdens, and minimises the risk of errors that could lead to rejected claims by HMRC.

What defines a ‘perfect’ template? It’s one that balances user-friendliness with strict adherence to HMRC guidelines. It should be intuitive for the donor, perhaps using clear checkboxes or fillable fields, and contain clear explanations about what Gift Aid is and the donor’s responsibilities. Avoid jargon where possible, or provide concise definitions. The layout should be clean and uncluttered, encouraging completion rather than confusion.

Consider the medium too. Will your template primarily be used as a physical print-out at events, or is it designed for online submission? Digital forms can be incredibly efficient, automatically capturing data and reducing manual entry errors. However, a paper-based gift aid claim form template can still be vital for certain demographics or situations, like street fundraising. Whichever format you choose, ensure it’s accessible and easy to understand for everyone.

Finally, think about integration. Can your template easily feed into your donor management system? Automating the collection and processing of Gift Aid declarations can dramatically improve efficiency. Regular review of your template against current HMRC guidance is also crucial, as regulations can sometimes change. By investing time in creating or sourcing an optimal gift aid claim form template, charities can significantly boost their income and focus more on their core mission, ultimately making a greater impact through the generosity of their supporters.

Harnessing the power of Gift Aid is one of the most effective ways for charities to amplify the generosity of their donors. The seemingly simple act of completing a declaration form is the linchpin that allows charities to access significant additional funding from the government, turning every £1 donated into £1.25. This incremental gain, when multiplied across thousands of donors, adds up to a substantial income stream that fuels charitable work across the nation.

By providing a clear, compliant, and user-friendly declaration process, whether through a physical document or a digital interface, organisations not only ensure their eligibility to claim but also foster trust and transparency with their supporters. Simplifying this vital step empowers donors to maximise their impact effortlessly, allowing charities to focus on what they do best: creating positive change and serving their communities.