Are you a charity or a non-profit organization looking to maximize the generosity of your donors? Or perhaps you’re a donor wondering how your contribution can go even further without costing you more? The answer often lies in Gift Aid, a fantastic scheme run by the UK government that allows charities to claim an additional 25p for every £1 donated, all at no extra cost to the donor. This means a £10 donation becomes £12.50, significantly boosting the impact of every pound you receive or give. To tap into this valuable resource, however, you need a proper declaration from your donor, and that’s where a well-crafted gift aid declaration form template becomes absolutely essential.

Having a clear, compliant, and easy-to-use gift aid declaration form template is not just a nice-to-have; it’s a fundamental tool for any charity aiming to effectively leverage Gift Aid. It simplifies the process for both the donor and the charity, ensuring that all necessary information is captured accurately and in accordance with HMRC guidelines. Without a solid template, you risk missing out on valuable funds or facing complications when submitting your claims. Let’s delve deeper into how these forms work and why having the right template is a game-changer for your fundraising efforts.

Unlocking More Impact with Gift Aid: A Win-Win for Donors and Charities

Gift Aid is a wonderful mechanism that empowers charities to increase the value of donations from UK taxpayers. When an eligible donor makes a declaration, the charity can reclaim the basic rate of income tax that the donor has already paid on their donation. This effectively means that for every pound donated, the charity receives an additional 25 pence from the government. It’s a powerful incentive that transforms a simple donation into a larger sum, directly supporting the charity’s mission and projects without any extra financial outlay from the donor themselves.

For charities, this extra income can be significant. Imagine reclaiming an additional 25% on a substantial portion of your donations; this can add up to thousands, even tens of thousands of pounds over the course of a year, providing vital funds for services, programs, and operational costs. It’s free money from the government, contingent only on securing the correct declaration from your generous supporters.

Donors also benefit, particularly higher-rate taxpayers. If you pay income tax at a higher rate (40% or 45%), you can claim the difference between the basic rate of tax (20%) and the higher or additional rate of tax on your donation. For example, if you donate £100, the charity claims £25. As a higher-rate taxpayer, you can claim back £25 from HMRC, effectively reducing your own tax bill or increasing your tax refund. This makes charitable giving even more appealing and financially savvy.

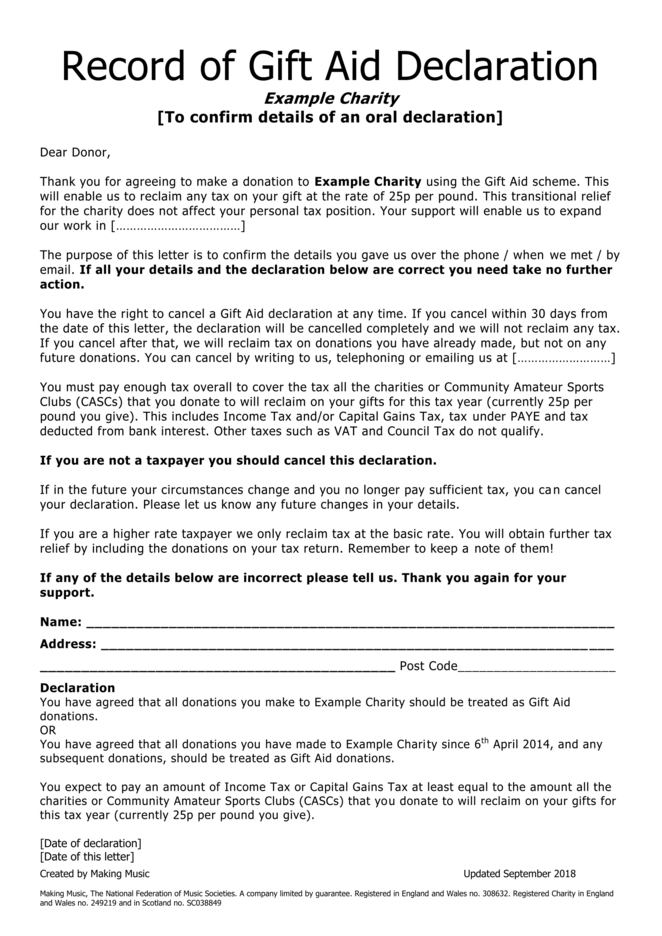

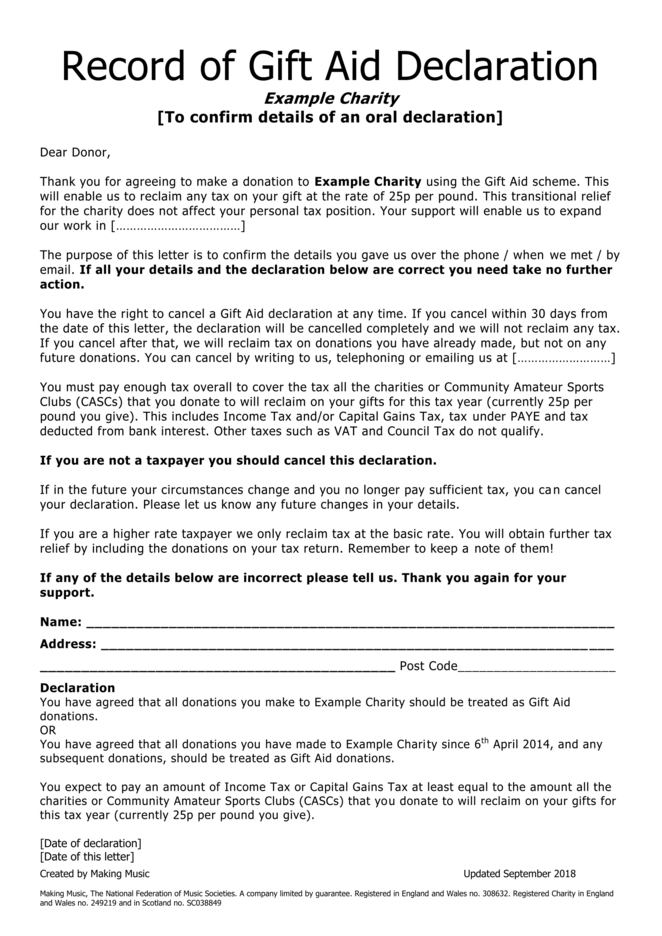

The cornerstone of this entire process is the Gift Aid declaration. It’s the donor’s official confirmation that they are a UK taxpayer and wish for the charity to reclaim the tax on their donation. Without this specific declaration, HMRC cannot process the claim, and the charity misses out on the additional funds. This highlights why a well-designed and compliant gift aid declaration form template is indispensable for all charities engaging with UK donors.

Key Elements of an Effective Gift Aid Declaration Form Template

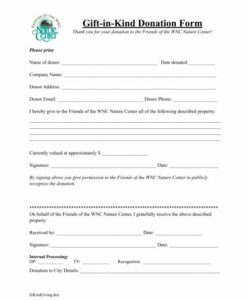

When creating or choosing a gift aid declaration form template, it’s crucial to include all the necessary information to ensure compliance and ease of processing. A robust template should be clear, concise, and leave no room for ambiguity. Here are the vital components:

- Charity’s Name: Clearly state the name of the charity that will be receiving the donation and claiming Gift Aid.

- Donor’s Details: Full name and home address of the donor. These details are essential for HMRC to identify the donor and verify their taxpayer status.

- Declaration Statement: A clear statement confirming the donor is a UK taxpayer and understands that if they pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all their donations in that tax year, it is their responsibility to pay any difference.

- Donation Scope: The form should specify whether the declaration applies to a single donation, all donations made in the past four years, or all donations made in the future. Offering options provides flexibility for donors.

- Date of Declaration: The date the declaration is made.

- Donor’s Signature: The donor’s physical or electronic signature, signifying their agreement to the terms.

- Consent for Communication (Optional but Recommended): Space to opt-in or opt-out of future communications, aligning with data protection regulations.

Building Your Perfect Gift Aid Declaration Form Template

Designing or adapting a gift aid declaration form template might seem like a small task, but its impact on your charity’s fundraising can be immense. A user-friendly and compliant template encourages more donors to complete the declaration, thereby increasing your Gift Aid claims. Think about accessibility; the template should be easy to understand for everyone, regardless of their familiarity with tax regulations. Using plain language and clear instructions can make a significant difference in completion rates.

Consider the different ways your donors might interact with the form. Will it primarily be a paper form handed out at events, or will you need a digital version embedded on your website for online donations? A versatile gift aid declaration form template can be adapted for both scenarios. For digital forms, ensuring mobile responsiveness and integration with your donation platform is key to a seamless donor experience. Remember that a smooth process minimizes friction and maximizes the likelihood of a completed declaration.

Customization is also a powerful tool. While the core elements of a gift aid declaration form template are legally prescribed, you can brand the form with your charity’s logo, colors, and specific messaging. This reinforces your identity and builds trust with donors. A professionally presented form reflects positively on your organization and demonstrates your commitment to good governance. Think about adding a small section that explains how the extra funds will be used, providing an immediate connection between their declaration and the tangible impact it creates.

Finally, always stay updated with HMRC’s Gift Aid guidance. Regulations can change, and what was compliant last year might need slight adjustments this year. Regularly reviewing your gift aid declaration form template ensures that it remains valid and effective, preventing any issues when you submit your claims. Keeping meticulous records of completed declarations, whether digital or physical, is also paramount for audit purposes and efficient claim processing.

By investing time in creating or refining your gift aid declaration form template, you’re not just creating a piece of paper or a digital page; you’re building a vital bridge that connects donor generosity with increased financial resources for your charitable work. This simple yet powerful tool is fundamental to unlocking the full potential of Gift Aid, ensuring that every donation goes further and makes a greater impact. Empower your donors to help your cause even more, and watch as your fundraising efforts flourish.