Ever found yourself on the receiving end of a generous non-cash donation, like office furniture, art supplies, or even a professional service, and then wondered how to properly document it? You’re not alone. Managing these “gifts in kind” can sometimes feel a bit different from handling cash donations, primarily because their value isn’t as straightforward. Yet, proper documentation is absolutely crucial for both the donor, who might need it for tax purposes, and your organization, for accurate record-keeping and accountability.

That’s where a well-designed gift in kind donation form template becomes your best friend. It streamlines the process, ensures all necessary information is captured, and provides a professional receipt that acknowledges the donor’s generosity while meeting compliance requirements. Think of it as your reliable assistant for managing valuable non-monetary contributions, making sure no detail is missed and everyone involved has the documentation they need.

Why a Gift In Kind Donation Form Template is Essential for Nonprofits

A robust gift in kind donation form template is more than just a piece of paper or a digital document; it’s a fundamental tool for any nonprofit organization. Its importance stems from several critical areas, primarily legal compliance, accurate financial reporting, and effective donor stewardship. Without a standardized process, tracking and valuing these unique contributions can quickly become chaotic, leading to potential issues with auditors or even challenges for your donors during tax season.

For donors, especially in regions like the United States, receiving proper documentation for non-cash contributions is vital for claiming deductions. The IRS, for instance, has specific requirements for substantiating charitable contributions, and a detailed form from your organization serves as that official proof. It clearly outlines what was donated, when, and by whom, establishing a clear record that supports their charitable intent and helps them navigate their tax obligations without a hitch.

Key Information to Include in Your Template

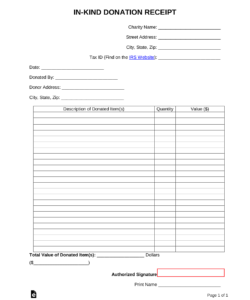

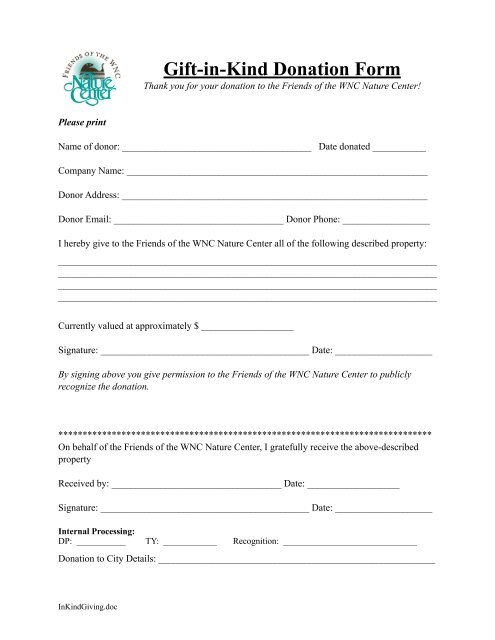

To be truly effective, your gift in kind donation form template needs to capture a comprehensive set of data points. This information ensures legal compliance, facilitates accurate internal record-keeping, and provides the donor with all the details they need. Crafting a form that is both thorough and easy to complete is key to encouraging its use and maintaining good administrative practices.

- **Donor Information:** Full name, address, email, and phone number. This allows for proper identification and future communication.

- **Organization Information:** Your nonprofit’s name, address, and EIN (Employer Identification Number), which is crucial for tax purposes.

- **Item Description:** A detailed description of the donated item or service, including its condition, quantity, and any unique identifiers.

- **Date of Donation:** The exact date the gift was received by the organization.

- **Estimated Value:** While the organization cannot provide a valuation for tax purposes, donors often provide an estimate. It’s important to state clearly on the form that the organization does not determine the fair market value for the donor’s tax purposes.

- **Intended Use:** Briefly mention how the organization plans to use the donation, which can be reassuring for donors.

- **Signatures and Dates:** Spaces for both the donor’s signature (acknowledging the accuracy of their contribution) and an authorized representative from your organization (confirming receipt).

- **Disclaimer:** A clear statement advising the donor to consult with a tax professional regarding the valuation and deductibility of their gift.

By including these critical fields, your gift in kind donation form template becomes an invaluable asset, safeguarding your organization and supporting your generous donors effectively.

Crafting Your Perfect Gift In Kind Donation Form Template: Best Practices

Developing a user-friendly and comprehensive gift in kind donation form template involves more than just listing fields. It’s about creating a smooth experience for both your donors and your staff. The goal is to make the process as straightforward as possible, encouraging complete and accurate information while reflecting your organization’s professionalism. Consider both digital and printable versions to accommodate various donor preferences, ensuring accessibility for all.

One key best practice is to keep the form clear and concise. While it needs to be thorough, it shouldn’t feel overwhelming. Use clear headings, simple language, and logical flow. Avoid jargon or overly technical terms that might confuse donors. Remember, many donors are simply trying to do good, and a complex form can be a deterrent. A well-structured layout with ample space for writing or typing information greatly enhances usability.

Another important aspect is customization. While a general gift in kind donation form template provides a solid foundation, tailoring it to your specific organizational needs can be beneficial. For instance, if you frequently receive certain types of items, you might include specific sub-sections or checkboxes relevant to those categories. This level of detail, while minor, can significantly improve internal tracking and make it easier for your team to process the donation efficiently.

Finally, integrate the form seamlessly into your donor acknowledgment process. Once the form is completed and signed, ensure it’s promptly filed and that a copy (or the original, depending on your process) is provided to the donor. This swift follow-up reinforces their positive experience and demonstrates your organization’s appreciation and professionalism. Consider automating parts of this process using CRM software if possible, which can save time and reduce errors.

- **Simplicity is Key:** Design the form with an intuitive layout and clear instructions.

- **Digital & Printable Options:** Offer flexibility for how donors can complete and submit the form.

- **Branding:** Include your organization’s logo and branding to maintain a consistent professional image.

- **Automate Where Possible:** Use online forms with auto-fill features for returning donors.

- **Educate Donors:** Provide a brief explanation of what “gift in kind” means and why the form is necessary.

Having a solid system for documenting gifts in kind helps your organization maintain impeccable records and ensures legal compliance, building trust with your supporters and auditors alike. It also frees up valuable time for your team, allowing them to focus more on your mission rather than administrative hurdles.

Investing time in creating an effective template for these non-monetary contributions truly pays dividends. It enhances donor relations, streamlines internal operations, and positions your nonprofit as a transparent and well-managed entity, ready to accept and appreciate generosity in all its forms.