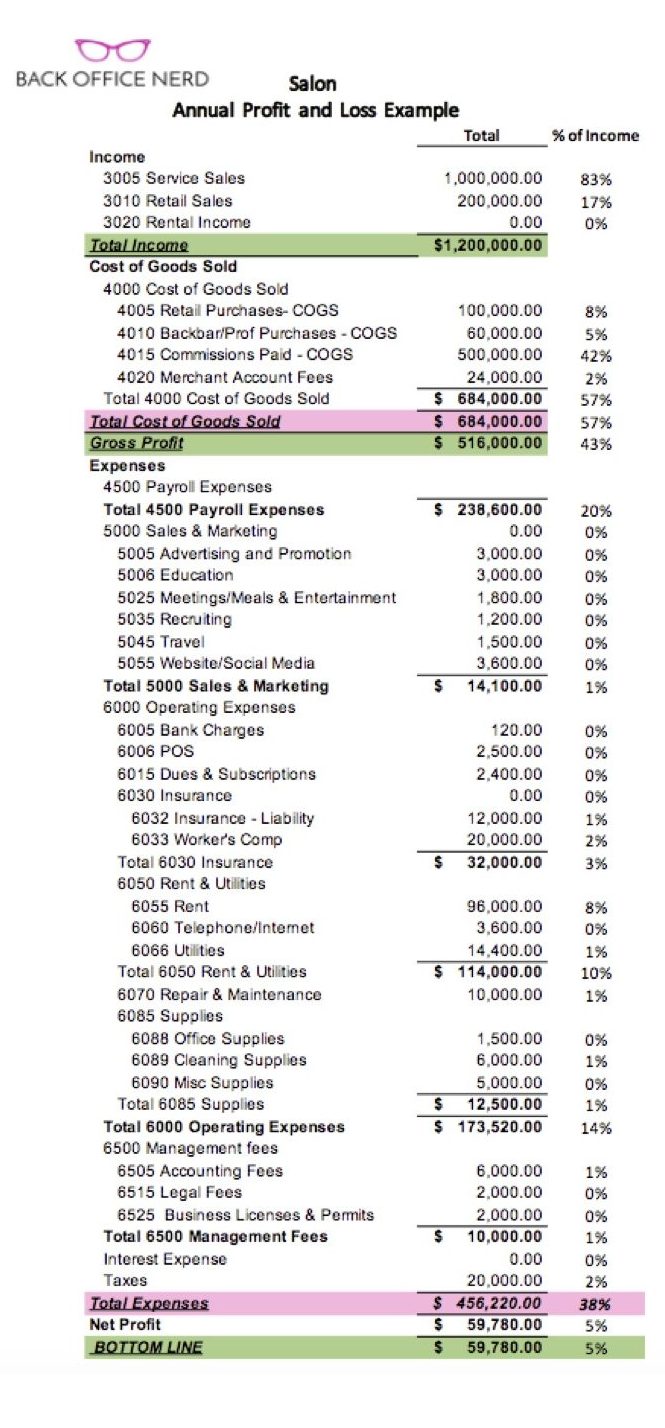

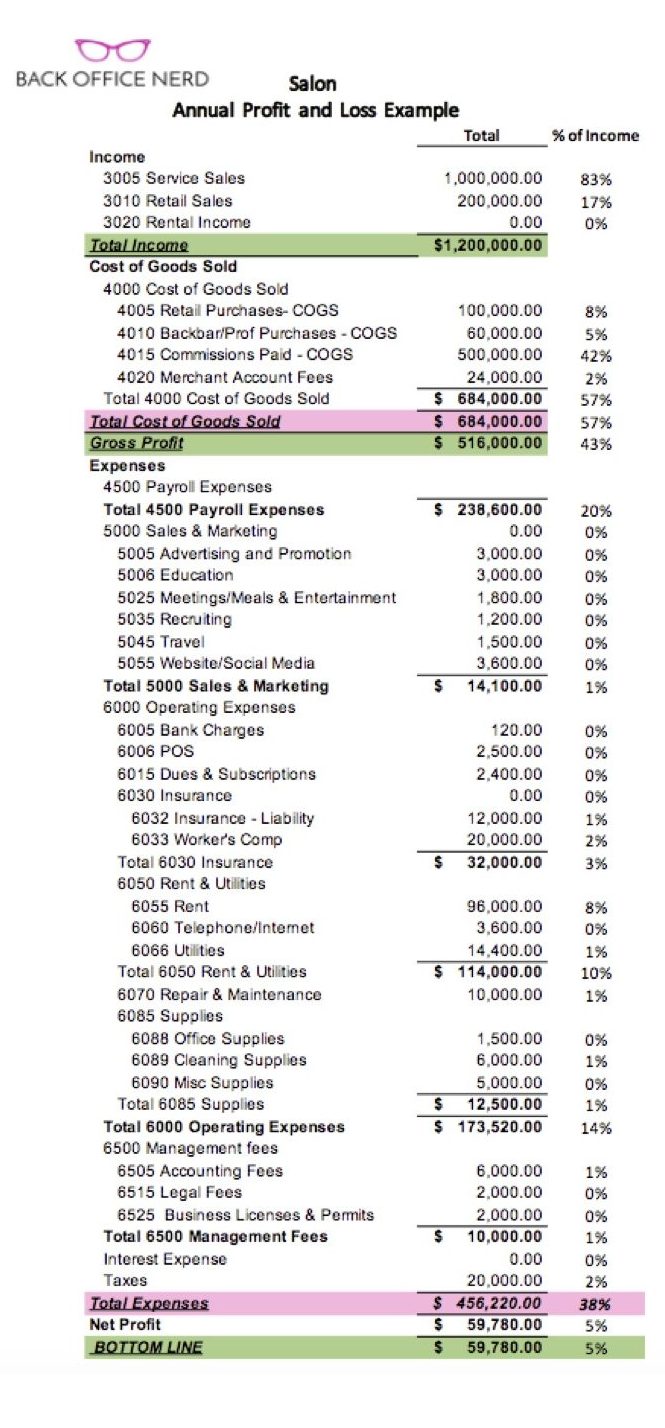

Utilizing such a structured financial overview allows salon owners to track key performance indicators, identify areas for improvement, and secure funding. Accurate financial reporting facilitates informed pricing strategies, efficient inventory management, and effective cost control measures. It also provides essential data for strategic planning, enabling businesses to adapt to market trends and maintain a competitive edge.

This understanding of financial documentation forms the foundation for exploring topics such as revenue generation, expense management, and profit maximization within the hair salon industry. Further exploration will delve into the specific components of this document, offering practical guidance on its creation and utilization for business success.

1. Revenue Streams

A clear understanding of revenue streams is fundamental to interpreting a hair salon income statement template. Accurately categorizing and analyzing these streams provides valuable insights into business performance and informs strategic decision-making.

- Service RevenueThis comprises the core income generated from various hair services offered, including haircuts, styling, coloring, and treatments. Tracking individual service revenue allows salons to identify popular services, adjust pricing strategies, and tailor service offerings to client demand. This data is crucial for assessing the overall profitability of service-based operations within the salon.

- Product SalesRevenue generated from retail product sales, such as shampoos, conditioners, styling products, and other hair care items, forms another key revenue stream. Analyzing product sales data helps determine product popularity, manage inventory effectively, and optimize pricing for maximum profitability. This data is essential for evaluating the success of retail strategies within the salon.

- Membership or Package DealsSome salons offer memberships or package deals that provide clients with discounted services or products in exchange for a recurring fee or upfront payment. This revenue stream, while potentially less consistent than individual service or product sales, can contribute significantly to overall income and client retention. Its inclusion on the income statement allows for analysis of its impact on long-term financial stability.

- Other RevenueThis category encompasses any additional income generated outside of core services and product sales. Examples might include revenue from renting chair space to other stylists, commissions from partnerships with beauty product suppliers, or income from specialized events or workshops held at the salon. Tracking these diverse revenue sources provides a comprehensive view of the salons overall financial performance.

By carefully analyzing each of these revenue streams within the context of the income statement, salon owners can gain a comprehensive understanding of their business’s financial health, identify areas for growth, and implement strategies for maximizing profitability. This granular approach to revenue analysis is essential for making informed decisions and ensuring long-term success.

2. Service Sales

Service sales represent the core revenue driver for most hair salons and hold significant weight within the income statement template. Accurately recording and analyzing service-based revenue is crucial for understanding profitability and making informed business decisions. This involves itemizing each service offeredhaircuts, coloring, styling, treatments, etc.and tracking the revenue generated by each. The income statement template provides the structure for this detailed tracking, allowing salon owners to identify high-performing services, assess pricing strategies, and monitor trends in client preferences. For example, if data reveals a significant increase in revenue from balayage services, the salon might consider investing in specialized training for stylists or adjusting pricing to maximize profitability. Conversely, declining revenue from a particular service might signal a need to re-evaluate its market appeal or marketing approach.

The relationship between service sales and the income statement template is further strengthened by the ability to analyze service revenue against associated costs. By comparing service revenue with the cost of labor, products used, and other related expenses, salons can determine the true profitability of each service. This granular level of analysis allows for informed decisions regarding pricing adjustments, service menu optimization, and resource allocation. For instance, if the cost of providing a specific treatment consistently outweighs the revenue generated, the salon may choose to discontinue the service, adjust pricing, or explore alternative product options to improve profitability. Understanding this relationship is essential for maximizing overall financial performance.

Effective management of service sales data within the income statement template is critical for long-term success in the hair salon industry. This detailed analysis provides actionable insights into service performance, profitability, and client preferences, empowering salon owners to make data-driven decisions that optimize resource allocation, enhance marketing strategies, and ultimately, drive revenue growth. Ignoring or inaccurately recording service sales data can lead to misinformed business decisions and hinder long-term financial stability.

3. Product Sales

Product sales represent a crucial secondary revenue stream within a hair salon business model. Their contribution to overall profitability is directly reflected in the income statement template, providing valuable insights into retail performance and informing inventory management strategies. Understanding the nuances of product sales data within this financial document is essential for maximizing revenue and achieving sustainable growth.

- Retail Product CategoriesCategorizing retail productsshampoos, conditioners, styling products, hair accessories, etc.within the income statement template allows for granular analysis of sales performance. This breakdown reveals which product categories contribute most significantly to revenue, informing purchasing decisions and marketing strategies. For example, if styling products consistently outperform shampoos in sales, the salon might consider expanding its styling product offerings or implementing targeted promotions.

- Inventory ManagementThe income statement template facilitates effective inventory management by tracking product sales against the cost of goods sold (COGS). This comparison reveals the profitability of individual products and overall product lines, helping salons optimize stock levels and minimize waste. Identifying slow-moving items allows for timely price adjustments or strategic promotions to reduce inventory holding costs and maximize return on investment.

- Pricing StrategiesAnalyzing product sales data within the income statement template informs effective pricing strategies. By understanding which products generate the highest profit margins, salons can adjust pricing accordingly. This data-driven approach ensures competitive pricing while maximizing profitability. For instance, higher-margin products can absorb slight price increases without significantly impacting sales volume, contributing to increased overall revenue.

- Sales Trends and SeasonalityTracking product sales over time reveals trends and seasonality, providing valuable insights for forecasting future demand and adapting inventory levels accordingly. The income statement template, used as a historical record, allows salons to anticipate peak seasons for specific products and adjust purchasing strategies to meet anticipated demand. For example, recognizing a surge in sales of sun-protection hair products during summer months allows the salon to proactively increase stock levels to capitalize on seasonal demand.

Integrating product sales data into the hair salon income statement template provides a comprehensive overview of retail performance. This data-driven approach empowers salon owners to make informed decisions regarding inventory management, pricing strategies, and marketing efforts, ultimately optimizing this key revenue stream and contributing to the salon’s overall financial success. Ignoring or inaccurately recording product sales data can lead to missed opportunities for growth and hinder long-term profitability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a hair salon and are crucial components of the income statement template. Accurately tracking and analyzing these expenses is essential for understanding profitability, identifying areas for cost optimization, and making informed business decisions. A comprehensive understanding of operating expenses allows salon owners to maintain financial stability and achieve sustainable growth.

- Rent and UtilitiesThese fixed costs encompass the rental payments for the salon space and essential utilities like electricity, water, and heating/cooling. These expenses typically remain relatively consistent and form a significant portion of the overall operating costs. Accurately recording these expenses within the income statement template is crucial for calculating profit margins and assessing the overall financial viability of the salons location and operations.

- Salaries and CommissionsThis category includes all compensation paid to stylists, assistants, receptionists, and other staff members. These costs can be fixed (salaries) or variable (commissions based on sales or services performed). Tracking these expenses within the income statement template provides insight into labor costs as a percentage of overall revenue, enabling salon owners to evaluate staffing efficiency and adjust compensation structures as needed.

- Supplies and InventoryThis encompasses the cost of hair products, styling tools, cleaning supplies, and other consumables used in daily operations. Effective inventory management is crucial for controlling these expenses. The income statement template allows for analysis of supply costs relative to revenue generated, helping salon owners identify potential areas for cost savings through bulk purchasing, supplier negotiations, or alternative product sourcing.

- Marketing and AdvertisingExpenses related to promoting the salon and attracting new clients, including online advertising, print materials, and promotional events, fall under this category. Tracking these expenses within the income statement template allows salon owners to assess the return on investment for various marketing efforts and optimize advertising strategies for maximum impact. This analysis can inform decisions about allocating marketing budgets effectively and maximizing client acquisition.

Effective management of operating expenses is directly linked to a salon’s profitability. By meticulously tracking these costs within the income statement template, salon owners gain a clear understanding of their financial performance and can identify opportunities for cost optimization. This data-driven approach to expense management is essential for achieving financial stability, maximizing profit margins, and ensuring the long-term success of the salon. Neglecting or inaccurately recording operating expenses within the template can lead to misinformed business decisions and hinder financial growth.

5. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing revenue within a hair salon. Its accurate representation within the income statement template is crucial for determining gross profit and understanding overall profitability. COGS provides valuable insights into product pricing strategies, inventory management, and the financial viability of retail operations.

- Product CostsThis encompasses the purchase price of all retail products sold by the salon, including shampoos, conditioners, styling products, and hair accessories. Accurately tracking product costs is essential for calculating profit margins on individual items and assessing the overall profitability of retail operations. For example, if a salon purchases a shampoo for $5 and sells it for $15, the product cost is $5, and the gross profit is $10. This information is critical for making informed pricing decisions and optimizing inventory levels.

- Professional SuppliesBeyond retail products, COGS also includes the cost of professional supplies used in providing services, such as hair color, perms, and styling products used during appointments. These costs, while often less significant than retail product costs, contribute to the overall cost of service delivery and must be accurately accounted for within the income statement template. For example, the cost of hair color used for a client’s appointment contributes to the COGS for that specific service.

- Inventory ValuationProper inventory valuation methods, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), impact COGS calculations within the income statement. The chosen method determines how the cost of goods is assigned to sold items, influencing reported profit margins and inventory values. Consistency in applying the chosen valuation method is crucial for accurate financial reporting and comparability across accounting periods.

- Relationship to Gross ProfitCOGS is directly related to gross profit, a key metric for evaluating a salon’s financial health. Gross profit is calculated by subtracting COGS from total revenue. Accurately calculating COGS is therefore fundamental to understanding a salon’s profitability and its ability to cover operating expenses. A higher COGS will result in a lower gross profit, highlighting the importance of effective cost management within retail operations.

Accurate calculation and representation of COGS within the hair salon income statement template provides critical insights into the financial performance of retail operations. By understanding the components of COGS and their impact on profitability, salon owners can make data-driven decisions regarding product pricing, inventory management, and overall business strategy. This granular level of analysis is essential for optimizing revenue streams, controlling costs, and ensuring long-term financial stability. Overlooking or misrepresenting COGS can lead to inaccurate financial reporting and hinder informed decision-making.

6. Profitability Analysis

Profitability analysis, a cornerstone of financial management, relies heavily on data derived from the hair salon income statement template. This analysis provides crucial insights into a salon’s financial health, enabling informed decisions that drive sustainable growth and long-term success. Understanding the connection between profitability analysis and this financial document is essential for salon owners seeking to optimize performance and achieve financial objectives.

- Gross Profit MarginGross profit margin, calculated as (Revenue – COGS) / Revenue, reveals the profitability of core operations after accounting for direct costs. The income statement provides the necessary data pointsrevenue and COGSfor this calculation. A healthy gross profit margin indicates efficient cost management and effective pricing strategies. For a hair salon, a declining gross profit margin might signal rising product costs or inefficient service delivery, requiring adjustments to pricing or operational processes.

- Net Profit MarginNet profit margin, calculated as Net Profit / Revenue, reflects the overall profitability after all expenses, including operating costs, are considered. Data extracted from the income statementtotal revenue and all expense categoriesfeeds this calculation. Net profit margin provides a comprehensive view of the salon’s financial health and its ability to generate profit after all expenses are covered. A low net profit margin might indicate excessive operating expenses or ineffective revenue generation strategies, requiring a thorough review of expense management practices and revenue streams.

- Break-Even AnalysisUtilizing data from the income statement, break-even analysis determines the point at which revenue equals total costs. This analysis helps salon owners understand the minimum sales volume required to cover all expenses and avoid losses. By identifying the break-even point, salons can set realistic sales targets and make informed decisions about pricing, service offerings, and expense management. For example, a salon with high fixed costs might need to implement strategies for increasing service volume or average transaction value to reach profitability.

- Trend AnalysisAnalyzing income statement data over multiple periods enables trend analysis, providing insights into revenue growth, expense patterns, and overall profitability trends. This historical perspective is crucial for identifying potential financial challenges or opportunities. Consistent growth in revenue coupled with controlled expenses indicates positive financial health, while declining revenue or escalating expenses warrant further investigation and corrective action. For instance, a consistent increase in supply costs without a corresponding increase in revenue might signal a need for more efficient inventory management or renegotiation of supplier contracts.

Profitability analysis, driven by data from the hair salon income statement template, provides essential insights for strategic decision-making. By understanding these key metrics and their interrelationships, salon owners can optimize pricing strategies, manage expenses effectively, and drive sustainable growth. This data-driven approach to financial management is crucial for achieving long-term success within the competitive hair salon industry.

Key Components of a Hair Salon Income Statement Template

A well-structured income statement template provides a clear and organized overview of a hair salon’s financial performance. Understanding the key components allows for accurate analysis and informed decision-making.

1. Revenue: This section details all income generated from services and product sales. Subcategories within revenue often include haircuts, styling, coloring treatments, retail product sales, and potentially membership fees or package deals. Accurate revenue recording is fundamental to assessing overall financial performance.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with generating revenue. For a hair salon, this includes the cost of products used in services (e.g., hair color, perms) and the cost of retail products sold to clients. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue – COGS, gross profit represents the profit generated after accounting for direct costs. This metric is a key indicator of operational efficiency and pricing effectiveness.

4. Operating Expenses: This section details all costs associated with running the salon, excluding COGS. Key categories typically include rent, utilities, salaries, marketing and advertising expenses, and general administrative costs. Careful tracking of operating expenses is essential for managing overhead and maximizing profitability.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income represents the profit generated from core business operations after accounting for both direct and indirect costs. This metric provides insight into the salon’s profitability before considering taxes and other non-operating expenses.

6. Other Income/Expenses: This section captures any income or expenses not directly related to core operations, such as interest income or expenses, gains or losses from asset sales, or one-time extraordinary items. While often less significant than operating income, these items contribute to the overall financial picture.

7. Net Income: This bottom-line figure represents the salon’s final profit after accounting for all revenue, expenses, and other income/expenses. Net income is a crucial indicator of overall financial performance and the salon’s ability to generate sustainable profits.

A thorough understanding of these components and their interrelationships allows salon owners to gain valuable insights into their financial performance, enabling informed decisions regarding pricing strategies, cost management, and overall business strategy. This comprehensive analysis is crucial for optimizing profitability and ensuring long-term financial stability.

How to Create a Hair Salon Income Statement Template

Creating a tailored income statement template requires a systematic approach. Following these steps ensures a comprehensive and accurate financial document.

1. Choose a Time Period: Define the reporting period, whether it’s a month, quarter, or year. Consistent reporting periods facilitate accurate trend analysis and performance comparisons.

2. Categorize Revenue Streams: Establish clear categories for all revenue sources, including service sales (haircuts, coloring, styling), product sales (retail products, professional supplies), and any other income streams (memberships, rentals). Detailed categorization allows for precise revenue tracking and analysis.

3. Itemize Cost of Goods Sold (COGS): Accurately track all direct costs associated with revenue generation. This includes the cost of retail products sold and professional supplies used in services.

4. Detail Operating Expenses: List all indirect costs incurred in running the salon. Categorize expenses into rent and utilities, salaries and wages, marketing and advertising, and general administrative costs. Accurate expense tracking is crucial for managing overhead.

5. Calculate Gross Profit: Subtract COGS from total revenue to determine gross profit. This key metric reflects the profitability of core operations after accounting for direct costs.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This figure reflects the salon’s profitability from core operations after considering both direct and indirect costs.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income/expense or gains/losses from asset sales. While often less significant than operating activities, these items contribute to the overall financial picture.

8. Determine Net Income: Calculate net income by adding other income and subtracting other expenses from operating income. This bottom-line figure represents the salon’s overall profit after considering all revenue and expenses.

By systematically organizing revenue streams, expenses, and resulting profit calculations, a comprehensive income statement offers valuable insights into financial performance and informs strategic decision-making for sustained growth.

Effective financial management is crucial for success in the competitive hair salon industry. A dedicated income statement template provides the necessary framework for tracking revenue streams, managing expenses, and analyzing profitability. Understanding the components of this financial documentrevenue categorization, cost of goods sold, operating expenses, and profit calculationsempowers salon owners to make data-driven decisions. Accurate and consistent use of this template enables informed pricing strategies, optimized inventory management, and effective cost control measures, ultimately contributing to long-term financial stability and sustainable growth.

The income statement template serves as a powerful tool for navigating the complexities of financial management within the hair salon industry. Regular review and analysis of this document provide valuable insights into business performance, enabling proactive adjustments to operational strategies and maximizing the potential for sustained profitability. This commitment to financial awareness positions salons for long-term success in a dynamic and competitive market.