Navigating the world of hard money lending can feel a bit like a high-stakes treasure hunt. Speed is often of the essence, and both lenders and borrowers are looking for efficiency and clarity. Whether you’re a seasoned investor seeking quick capital for a flip, or a lender trying to streamline your application process, the initial steps are crucial. Getting the right information upfront can save countless hours, prevent misunderstandings, and ultimately, accelerate the entire funding process.

Imagine a scenario where every potential loan application arrives with all the necessary details neatly organized, allowing for swift evaluation. This isn’t just a pipe dream; it’s entirely achievable with the right tools. A well-crafted hard money intake form template acts as your digital or physical gatekeeper, ensuring that only complete and relevant information makes its way into your pipeline. It’s about setting expectations and gathering vital data efficiently, right from the very first interaction.

Why a Hard Money Intake Form Template is Your Best Asset

In the fast-paced world of hard money, time literally translates into money. Every minute spent chasing missing documents or clarifying vague details is a minute lost on a potential deal. That’s where a specialized hard money intake form template becomes an indispensable tool. It serves as the initial filter, capturing all critical information from a potential borrower in a structured, consistent manner. This uniformity is key; it allows lenders to quickly compare applications, assess risks, and make informed decisions without unnecessary delays.

Think about the sheer volume of inquiries a busy hard money lender might receive. Without a standardized intake process, each inquiry becomes a unique, time-consuming puzzle. Employees might spend hours in back-and-forth emails or phone calls just to gather the basic facts needed for an initial assessment. This not only burdens staff but also frustrates potential borrowers who are often working against tight deadlines themselves. A comprehensive intake form streamlines this, making the process smoother for everyone involved.

Beyond efficiency, a well-designed form also enhances professionalism. It tells potential borrowers that you’re organized, serious, and have a clear process in place. This builds trust and confidence, which are vital in any financial transaction, especially in the less conventional sphere of hard money lending. It helps to set realistic expectations from the outset, clearly outlining what information is required before a loan can even be considered.

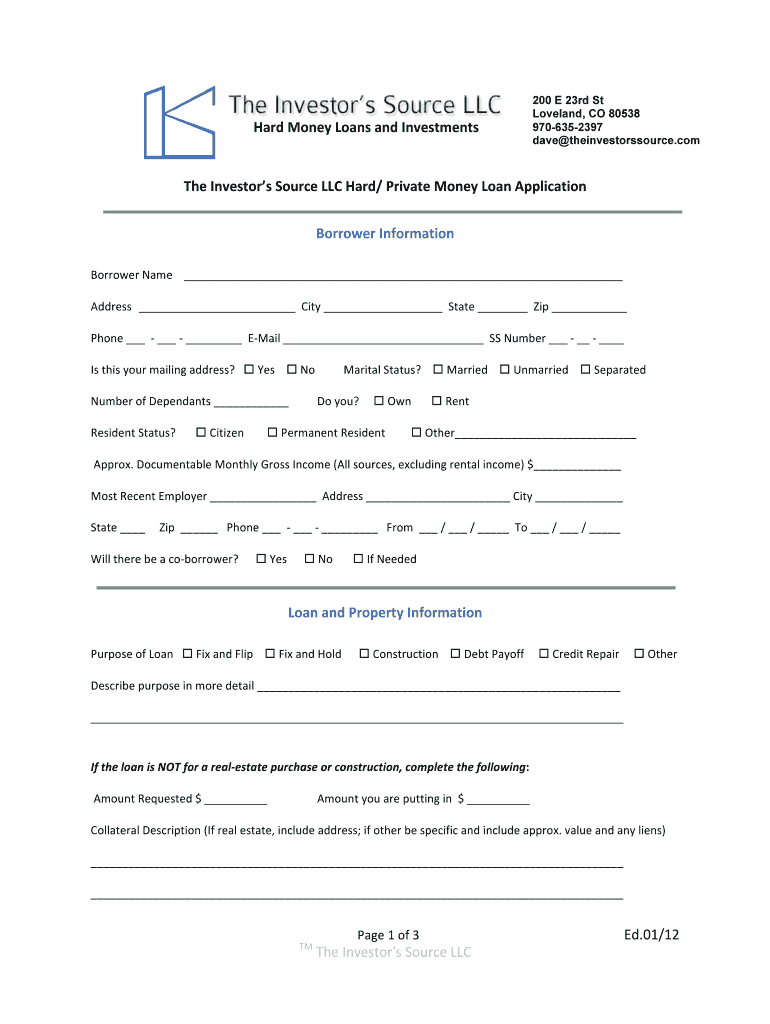

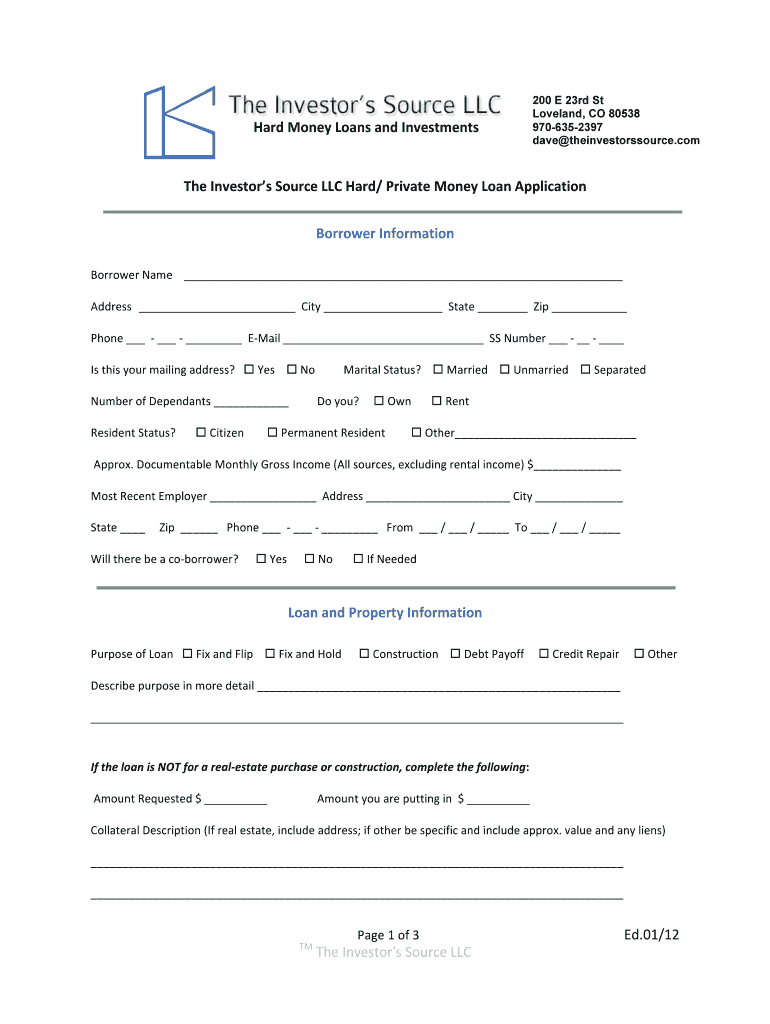

Essential Components to Include

Creating an effective form means understanding what information is truly vital for a hard money loan assessment. It’s more than just name and contact details; it delves into the specifics of the deal and the borrower’s capability. Here are some key areas you’ll want to cover:

- Borrower contact and entity details (individual, LLC, corporation)

- Property address and type (residential, commercial, land)

- Loan amount requested and purpose (purchase, refinance, rehab)

- Property value and purchase price (if applicable)

- Current debt on the property (if refinancing)

- Estimated rehab budget and timeline (if applicable)

- Exit strategy for the loan (sale, refinance)

- Borrower’s experience with real estate investing

- Any specific timeline or urgency for funding

By including these detailed fields, you’re not just collecting data; you’re building a comprehensive profile of the potential deal and the borrower, enabling a much faster and more accurate initial review.

Crafting Your Ideal Intake Process

Developing your own hard money intake form template isn’t just about listing questions; it’s about designing a user experience that benefits both the applicant and your lending team. Consider how the form will be presented: will it be a downloadable PDF, an online form integrated into your website, or a simple questionnaire shared via email? Digital forms, for example, can offer validation features, ensuring that required fields are completed and that data formats are correct, which significantly reduces errors and follow-up work.

Think about the flow of the questions. Start with general information and progressively move towards more specific, detailed inquiries. This makes the form less intimidating for the applicant and ensures they don’t get bogged down by complex questions too early. Providing clear instructions for each section and even offering examples can also greatly improve the quality of the submitted information. Remember, the goal is to make it as straightforward as possible for the borrower to provide exactly what you need.

Furthermore, consider what happens after the form is submitted. Is there an automated acknowledgment? Does it trigger an internal notification to your underwriting team? Integrating the form with your Customer Relationship Management (CRM) system can be a game-changer, allowing for instant data transfer, tracking of application status, and automated follow-ups. This level of automation can free up valuable time for your team, allowing them to focus on analysis and deal structuring rather than administrative tasks.

Finally, don’t be afraid to iterate. The first version of your hard money intake form template might not be perfect, and that’s okay. Gather feedback from your team and even from applicants. Are there common questions they ask after submission? Are certain fields consistently left blank or filled incorrectly? Use this feedback to refine your form, making it even more effective over time. A continuously improved intake process is a sign of a robust and adaptable lending operation.

Implementing a robust system for capturing initial loan inquiries is more than just good practice; it’s a strategic move that enhances efficiency, reduces friction, and allows your team to focus on the core business of lending. By standardizing the information gathering process, you create a clearer path for both potential borrowers and your internal operations, ensuring that promising deals don’t get lost in a sea of disorganized data.

Ultimately, having a streamlined and comprehensive intake mechanism ensures you receive all the necessary details upfront, paving the way for quicker evaluations and faster funding decisions. This proactive approach not only benefits your operational flow but also significantly improves the overall experience for those seeking capital, positioning your firm as a reliable and highly efficient partner in the competitive hard money landscape.