Navigating the world of health insurance can feel like trying to solve a complex puzzle, especially when you’re simply trying to understand your options and get an accurate quote. Whether you’re an individual looking for coverage, a small business owner aiming to provide benefits, or an insurance professional streamlining their intake process, having a clear, comprehensive method for gathering information is crucial. That’s where a well-designed form comes into play, making the initial steps much smoother for everyone involved.

Think about it: before you can even begin to compare plans, you need to know what details are relevant to your situation. Are you single or do you have a family? What’s your income bracket? Do you have specific medical needs? All these factors influence the type of plans available and their associated costs. A structured approach, like using a dedicated health insurance marketplace quote form template, ensures that no vital piece of information is missed, allowing for more precise and personalized recommendations.

Why a Tailored Form is Indispensable for Your Health Insurance Search

When you’re sifting through the myriad of health insurance options, the sheer volume of information can be overwhelming. Each plan has different deductibles, copays, out-of-pocket maximums, and network restrictions. Before you even get to those specifics, however, you need to determine your eligibility for various subsidies, special enrollment periods, and plan categories. This foundational data gathering is precisely where a robust health insurance marketplace quote form template proves its worth, acting as your first line of defense against confusion.

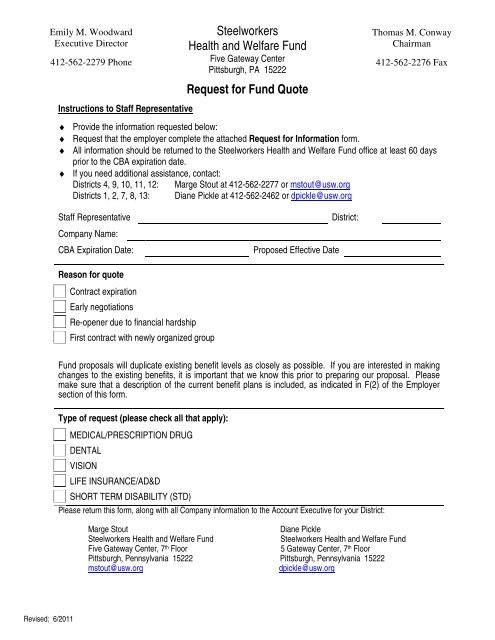

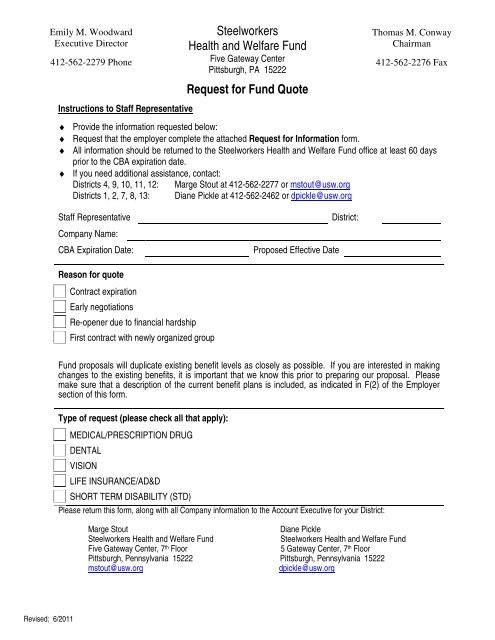

Having a standardized form helps both consumers and providers. For consumers, it simplifies the process by guiding them through the necessary questions without missing critical details. It empowers them to provide all the relevant facts upfront, reducing back-and-forth communication. For agents, brokers, or marketplace navigators, it ensures consistency in data collection, leading to more efficient quote generation and accurate plan recommendations.

Consider the benefits from a practical standpoint. Without a structured form, you might forget to ask about household income, which is vital for calculating premium tax credits and cost-sharing reductions. Or you might overlook questions about existing medical conditions that could influence plan choice, even though pre-existing conditions cannot be denied coverage. A template acts as a checklist, ensuring thoroughness every single time.

Key Information to Include in Your Template

- Applicant Details: Full name, date of birth, gender, social security number (optional but helpful for some verifications), contact information (phone, email, address).

- Household Information: Marital status, number of dependents, relationship to applicant, their dates of birth.

- Income Information: Estimated annual household income, sources of income. This is crucial for determining eligibility for subsidies.

- Current Coverage Status: Are they currently insured? If so, what type of plan and why are they seeking new coverage?

- Special Enrollment Period (SEP) Triggers: If outside the open enrollment period, details of qualifying life events (e.g., marriage, birth of a child, loss of other coverage, moving).

- Health Needs: General health status, specific doctors or hospitals they wish to keep, prescription medications (for checking formulary coverage, though not for underwriting).

By including these core elements, your health insurance marketplace quote form template becomes a powerful tool, not just for collecting data, but for laying the groundwork for truly informed decisions about health coverage.

Designing and Utilizing Your Quote Form Template Effectively

Once you understand the importance of a comprehensive health insurance marketplace quote form template, the next step is to consider its design and how it will be implemented. A well-designed form is intuitive, easy to complete, and clearly communicates what information is needed and why. This isn’t just about functionality; it’s about the user experience, which can significantly impact completion rates and the quality of the data gathered.

When creating your template, think about the flow of questions. Start with basic demographic information, then move to household details, followed by income, and finally, specific health or enrollment needs. Use clear, simple language, avoiding jargon where possible. If a technical term must be used, provide a brief explanation. Consider using conditional logic for digital forms, where subsequent questions appear only if relevant based on previous answers. For example, if someone indicates they are married, then questions about a spouse’s details would appear.

Accessibility is another key consideration. Ensure your form is usable by individuals with varying levels of digital literacy and potentially disabilities. This means using clear fonts, sufficient contrast, and ensuring that online versions are keyboard-navigable and screen-reader friendly. Providing options for both digital and printable versions can also cater to a wider audience, acknowledging that not everyone prefers or has access to online submission.

Best Practices for Implementation

- Test Thoroughly: Before widely deploying your form, test it with a diverse group of users to identify any confusing questions or technical glitches.

- Provide Instructions: Include clear instructions at the beginning of the form, explaining its purpose and estimated completion time.

- Ensure Data Security: If collecting sensitive information like Social Security numbers or income, ensure the platform used is secure and compliant with privacy regulations (e.g., HIPAA).

- Follow Up Thoughtfully: Once the form is submitted, have a clear process for follow-up, whether it’s an automated email confirmation or a personalized call to discuss quotes.

- Regularly Update: Health insurance regulations and marketplace rules change frequently. Review and update your template periodically to ensure it remains accurate and relevant.

By meticulously designing and thoughtfully implementing your health insurance marketplace quote form template, you create a streamlined, efficient, and user-friendly experience that benefits both those seeking coverage and and those providing it. It transforms a potentially daunting task into a manageable and transparent process, setting the stage for successful health insurance enrollment.

Ultimately, whether you’re a consumer seeking coverage or a professional guiding them, the journey to finding the right health insurance plan doesn’t have to be a bewildering ordeal. By leveraging a well-structured form, you empower individuals with the means to provide accurate information, leading to precise quotes and suitable plan recommendations. It’s about clarity, efficiency, and ensuring that every person can navigate their options with confidence.

Embracing a systematic approach to information gathering not only saves time but also significantly improves the quality of the outcomes. It paves the way for informed decisions, helping individuals secure the coverage they need to protect their health and financial well-being. A thoughtful approach to this initial step can make all the difference in the often-complex world of healthcare coverage.