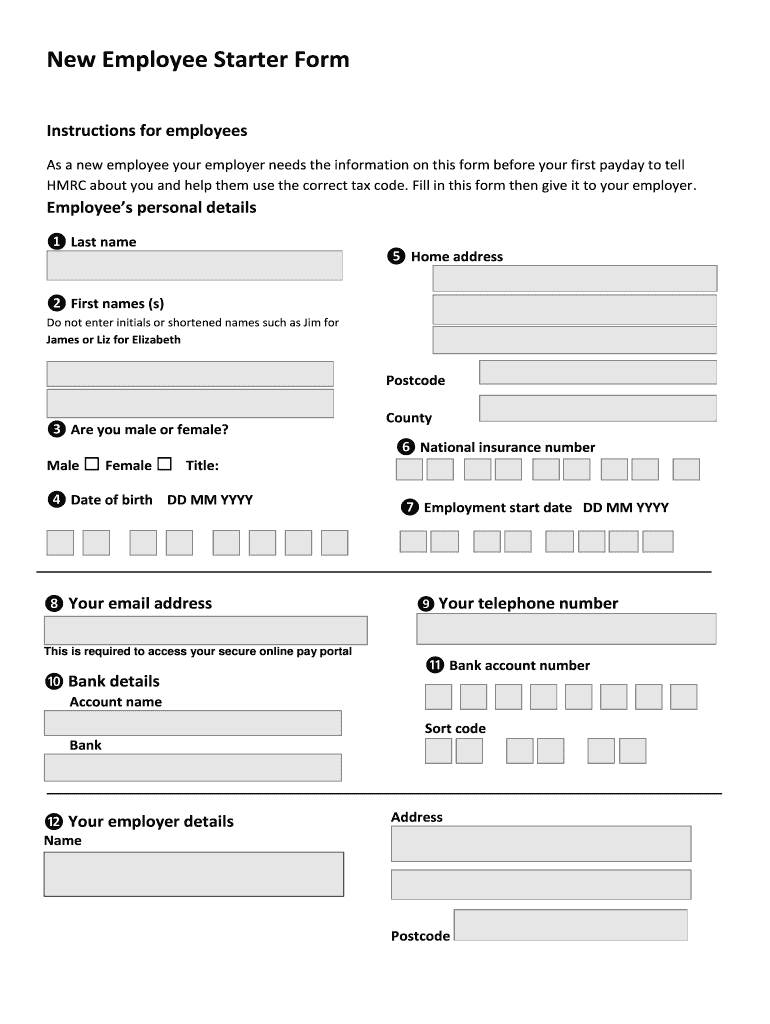

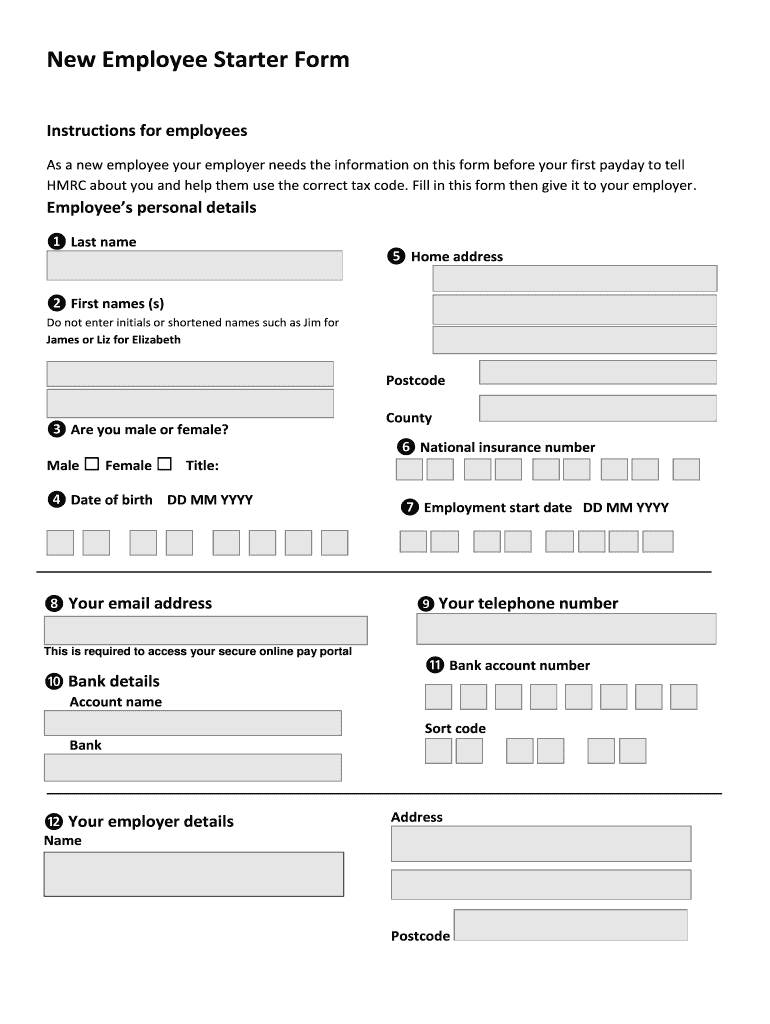

Bringing a new team member on board is an exciting time for any business. It signifies growth, new ideas, and fresh energy. However, amidst the excitement of introductions and training, there’s a crucial administrative step that often feels like a puzzle: gathering all the necessary information for HMRC, the UK’s tax authority. Getting this right from the outset is not just about compliance; it sets the foundation for accurate payroll, correct tax deductions, and a smooth start for your new employee. It can feel a bit daunting, but with the right tools, it doesn’t have to be.

That’s where a well-designed starter form comes into play. Think of it as your secret weapon for a stress-free onboarding experience. Instead of scrambling for details or missing crucial tax-related information, a comprehensive template ensures you capture everything HMRC needs, right when you need it. It’s all about efficiency, accuracy, and providing a clear, professional process for your newest hire.

Understanding the P45, P46, and Starter Checklist

When you hire someone new, one of the first things on your HR or payroll checklist should be obtaining their tax details. Historically, this involved either a P45 from their previous employer or a P46 form if they didn’t have one. The P45 is essentially a record of an employee’s pay and the tax deducted from it in the current tax year, issued by their previous employer when they leave a job. It’s incredibly valuable because it helps you, as the new employer, set up their tax code correctly from day one, avoiding over or underpayment of tax.

However, not every new employee arrives with a P45. Perhaps they’ve been out of work for a while, it’s their first job, or they simply misplaced it. This is where the New Starter Checklist (often referred to simply as the Starter Checklist) becomes your go-to document. HMRC introduced this checklist to streamline the process, effectively replacing the need for a P46. It allows employees to declare their current employment status and any other sources of income, ensuring they are placed on the correct tax code without a P45.

The Starter Checklist asks a series of straightforward questions that help HMRC determine the right tax code for your new employee. This includes asking if this is their first job since April 6th, if they have another job, or if they are receiving certain benefits or pensions. Their answers guide you in selecting the appropriate declaration (Statement A, B, or C) for HMRC, which is then used to assign a provisional tax code until HMRC issues a formal one.

Accurate completion of this form is paramount. Incorrect information can lead to employees paying too much or too little tax, resulting in frustrating adjustments later on for both them and your payroll department. It’s about getting it right from the very beginning to ensure compliance and a smooth financial start for your team member.

Key Sections on an HMRC New Employee Starter Form Template

* Employee personal details (name, address, National Insurance number)

* Previous employment details (P45 information or declaration)

* Declaration of other income or benefits

* Student loan details

* National Insurance contributions status

Streamlining Your Onboarding with an Effective Template

Imagine a world where collecting new employee information isn’t a headache. That’s the power of an effective HMRC new employee starter form template. Instead of recreating forms from scratch every time, or worse, risking non-compliance by missing key details, a robust template provides a consistent, reliable framework. It ensures you capture all the necessary data for HMRC, while also giving your new hires a professional and clear initial experience with your company’s administrative processes. This efficiency saves valuable HR and payroll time, allowing you to focus on integrating your new talent rather than chasing paperwork.

Beyond just the HMRC requirements, a well-thought-out template can be integrated into your wider onboarding workflow. You can customize it to include other internal necessities, like emergency contact details, bank information for payroll, or even initial IT setup preferences. This holistic approach means one comprehensive form handles multiple administrative needs, reducing the number of different documents an employee has to fill out and improving the overall efficiency of your HR operations.

In today’s digital age, the best starter forms are often digital themselves. An online hmrc new employee starter form template can be incredibly powerful, allowing new hires to complete information securely before their first day. This not only streamlines data collection but also minimizes errors through validation rules and reduces the need for manual data entry, which is a common source of mistakes. Digital forms can also seamlessly integrate with your payroll software, pushing data directly into the system, further enhancing accuracy and compliance.

Ultimately, your goal is to make the administrative side of onboarding as simple and clear as possible for everyone involved. Providing clear instructions on how to complete the form, explaining why certain information is needed, and being available to answer questions will go a long way in ensuring accurate data submission. This proactive approach ensures that your business remains compliant with HMRC regulations while simultaneously providing a positive and organized experience for your newest team members.

* Ensure it is always up-to-date with current HMRC guidelines.

* Provide clear instructions for new hires.

* Consider using an online version for easier data collection and integration.

* Train HR staff on how to review and process the forms correctly.

Getting your new employee’s tax and National Insurance details right from the very beginning is more than just a box-ticking exercise; it’s a fundamental part of responsible employer practice. A systematic approach, facilitated by a comprehensive starter template, not only ensures compliance with HMRC regulations but also builds trust with your new team members by demonstrating professionalism and accuracy.

By investing time in creating or adopting a reliable template, you’re setting the stage for smooth payroll operations, accurate tax deductions, and a positive financial start for your employees. This proactive measure significantly reduces administrative burden and allows you to focus on the truly important aspects of welcoming new talent into your thriving business.