Navigating the world of tax and financial compliance can sometimes feel like deciphering a complex puzzle, and among the many pieces you might encounter, the HMRC self-certification form is a significant one. This document is typically requested by financial institutions, like your bank or investment firm, as part of their obligation to comply with international tax transparency regulations. It’s designed to gather essential information about your tax residency status, ensuring that financial data can be correctly exchanged between countries, ultimately helping to combat tax evasion and promote global transparency.

While the idea of self-certifying your tax status might seem straightforward, the specifics can vary depending on your individual circumstances and the financial institution’s particular requirements. Understanding the purpose behind these forms and knowing what information you need to provide is key to a smooth process. You might find yourself looking for an hmrc self certification form template to get a head start, or simply to understand the typical structure of such a document.

Understanding the Need for HMRC Self-Certification

When your bank or financial advisor asks you to complete a self-certification form, they aren’t doing it just for fun. They are legally required to collect this information under international agreements designed to increase tax transparency and combat cross-border tax evasion. The two primary frameworks driving this requirement are the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA).

The Common Reporting Standard, or CRS, is a global standard developed by the Organisation for Economic Co-operation and Development (OECD). It mandates that financial institutions in participating jurisdictions collect and report information on financial accounts held by non-residents to their local tax authorities. These authorities then automatically exchange that information with the tax authorities in the account holder’s country of residence. It’s a broad, multilateral system aimed at creating a level playing field for tax compliance worldwide.

FATCA, on the other hand, is a United States law with a similar goal: to prevent tax evasion by US persons holding financial accounts outside of the US. Under FATCA, non-US financial institutions are required to report information about financial accounts held by US persons to the US Internal Revenue Service (IRS), either directly or through their local tax authority via intergovernmental agreements. While similar in principle to CRS, FATCA is specifically focused on identifying and reporting on US taxpayers.

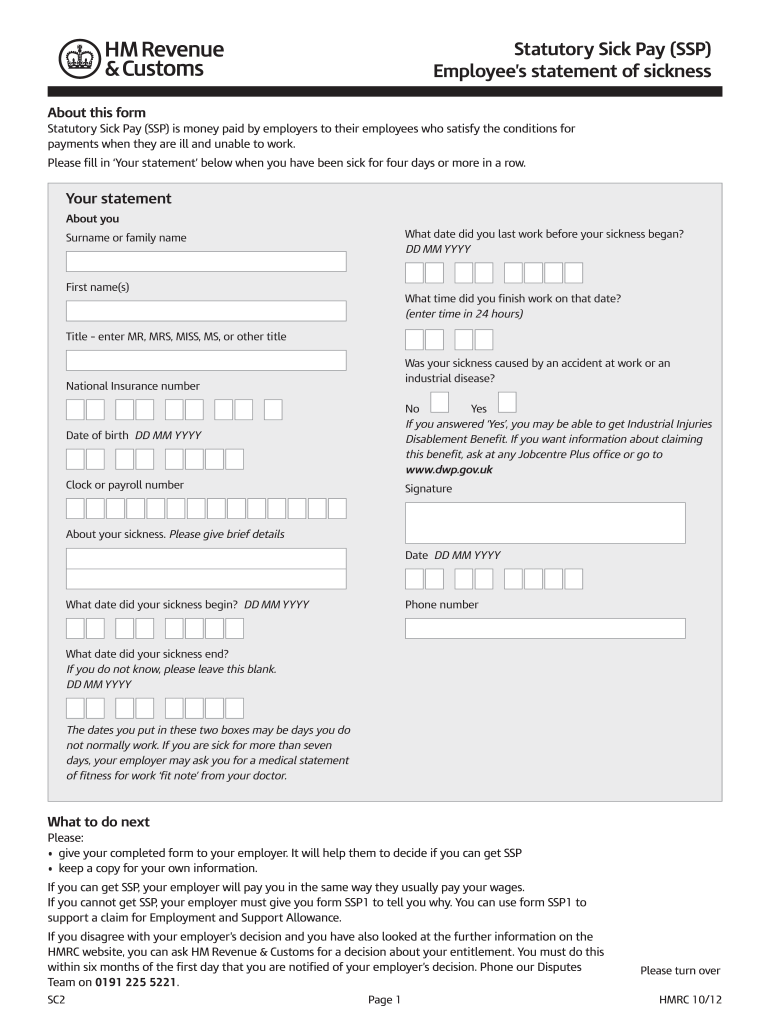

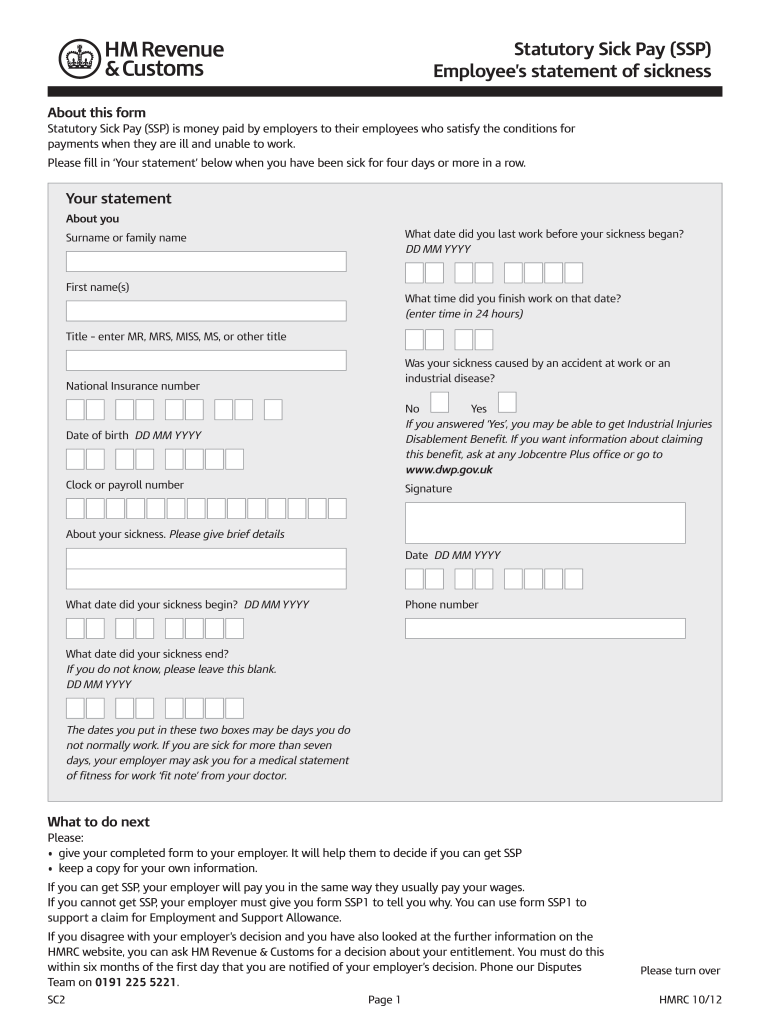

So, when you’re asked to complete a self-certification form, it’s essentially your declaration of where you are considered tax resident and what your Tax Identification Number (TIN) is. This information allows your financial institution to determine whether your account needs to be reported under CRS, FATCA, or both, ensuring they meet their legal obligations and you remain compliant with international tax transparency efforts.

Key Information Requested

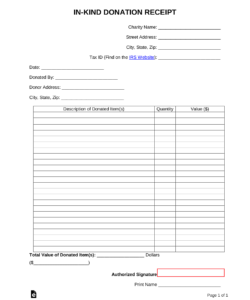

While the exact layout might differ, a typical self-certification form will ask for fundamental details about your identity and tax status. Here’s a general overview of the core information you’ll usually need to provide:

- Your full legal name and current residential address.

- Your date of birth and place of birth.

- All countries where you are considered a tax resident. This is crucial as you might be tax resident in more than one country.

- The Tax Identification Number (TIN) for each country of tax residency. For UK residents, this is usually your National Insurance Number.

- If you do not have a TIN for a particular country where you are tax resident, you will likely need to provide a reason for its absence.

Navigating Your HMRC Self Certification Form Template

Once you understand why these forms are necessary, the next step is often to approach completing one. While searching for an hmrc self certification form template might give you a general idea of the structure, it is critically important to remember that the form you must complete will typically be provided directly by your financial institution. They might have a specific format, and they are the ones who need to collect the information in a way that aligns with their internal systems and reporting obligations.

When you receive the form, take your time to read through it carefully. Accuracy is paramount here. Any errors or omissions could lead to delays, further requests for information, or even potential issues with your tax status reporting. If you’re unsure about any question, don’t guess. It’s always better to seek clarification from the financial institution that issued the form. They are best placed to guide you through their specific requirements and ensure your submission is correct.

One common area of confusion is determining your tax residency, especially if you have lived or worked in multiple countries, or if you hold dual citizenship. Tax residency rules can be complex and vary from country to country. If you are uncertain about your tax residency status for any particular country, it’s advisable to consult with a qualified tax advisor. They can provide professional guidance based on your unique circumstances, helping you complete the form accurately and confidently.

After completing and submitting the form, it’s a good practice to keep a copy for your own records. This ensures you have a reference of the information you provided. Remember, your tax residency status can change over time. If your circumstances alter – for example, if you move to a different country or your employment situation changes significantly – you may need to update your self-certification with your financial institutions. Proactive communication helps maintain your compliance and ensures smooth financial operations.

Completing a self-certification form for HMRC and other global tax transparency initiatives might seem like an added layer of administrative burden, but it plays a crucial role in the international effort to ensure fair taxation and prevent illicit financial flows. By accurately providing the requested information, you contribute to a more transparent global financial system, which ultimately benefits everyone.

Approaching these forms with diligence and a clear understanding of their purpose can make the process much smoother. While an hmrc self certification form template can offer a helpful visual guide, remember that the precise form from your financial institution is the one that matters. Don’t hesitate to ask questions if anything is unclear, as ensuring accuracy is the best path forward for both you and your financial providers.