Navigating the world of Value Added Tax (VAT) can often feel like deciphering a complex puzzle, especially when it comes to submitting your regular returns to HMRC. For many businesses, particularly those new to VAT registration or those seeking to streamline their accounting processes, the idea of a clear, straightforward guide or a reliable structure is incredibly appealing. Understanding precisely what information HMRC requires and how to present it correctly is crucial for avoiding penalties and ensuring smooth operations.

This is where a well-designed hmrc vat return form template can become an invaluable asset. While HMRC provides its own digital portal for submission, having a structured template for internal use, for data compilation, or simply for understanding the required fields before you log in, can make a significant difference. It’s about building confidence and efficiency into what can otherwise be a daunting task for business owners and finance teams alike.

Understanding the HMRC VAT Return Journey and Why a Template Helps

Submitting your VAT return to HMRC isn’t just a tick-box exercise; it’s a critical financial declaration that reflects your business’s sales and purchases, and the VAT you’ve charged or been charged. Essentially, you’re reporting the difference between the VAT you collected from your customers (output VAT) and the VAT you paid on your business expenses (input VAT). The goal is to determine how much VAT you owe to HMRC or, conversely, how much they owe back to you. This process, while seemingly simple in concept, requires meticulous record-keeping and an accurate transfer of figures.

The importance of accuracy cannot be overstated. Errors on your VAT return, whether accidental or intentional, can lead to investigations, penalties, and even reputational damage for your business. Late submissions or payments are also met with stern penalties. This is why many businesses seek out tools and methods to simplify and error-proof their VAT compliance, and a clear, pre-formatted template is one such effective tool. It acts as a staging ground for your data, helping you to compile and review everything before final submission.

Think of an hmrc vat return form template not as a substitute for the official HMRC portal, but as a robust preparation tool. It helps you gather all the necessary figures in the correct format, cross-reference them, and spot any inconsistencies before they become problems. This proactive approach saves time, reduces stress, and significantly lowers the risk of mistakes that could lead to financial repercussions down the line. It ensures that when you finally log into the MTD-compliant software or the HMRC portal, you’re simply transferring pre-verified data.

A well-structured template guides you through each required box, prompting you for specific information. This systematic approach ensures no critical detail is overlooked, from your total sales to your reclaimable purchases. It’s particularly helpful for those who are still getting to grips with the nuances of VAT or who prefer a tangible, organized document to work from before the digital submission. It transforms a potentially confusing task into a series of manageable steps.

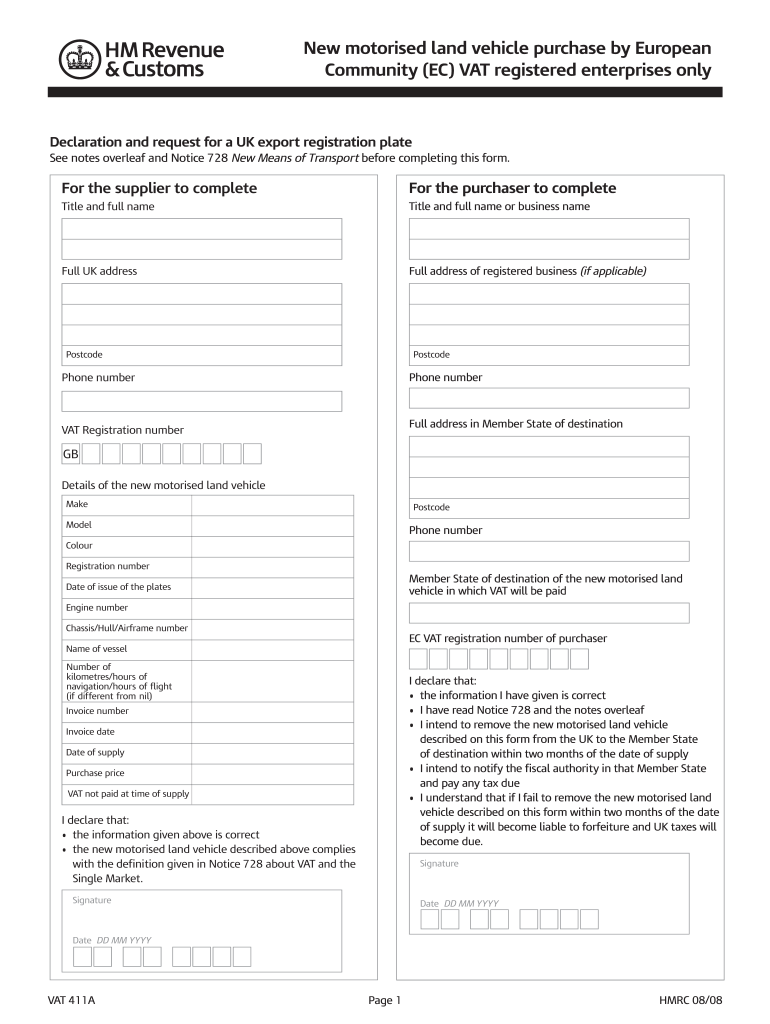

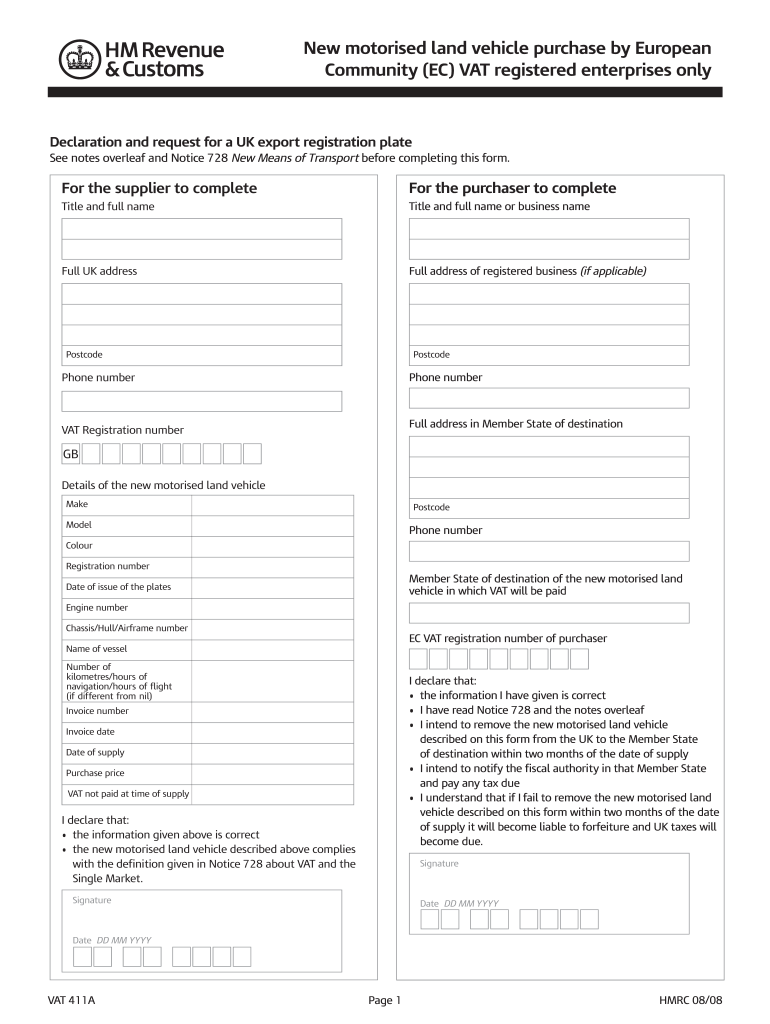

Key Sections of a Typical VAT Return Form

- Box 1: VAT due on sales and other outputs. This is the VAT you’ve charged your customers.

- Box 2: VAT due on acquisitions from other EU member states. If you’ve bought goods from businesses in the EU, this is where you declare the VAT.

- Box 3: Total VAT due (Box 1 + Box 2). This box sums up all the VAT you owe.

- Box 4: VAT reclaimed on purchases and other inputs. This is the VAT you’ve paid on your business expenses.

- Box 5: Net VAT to pay to HMRC or reclaim from HMRC (Box 3 – Box 4). This crucial box determines whether you pay HMRC or get a refund.

- Box 6: Total value of sales and other outputs excluding VAT. The total value of all your sales, without the VAT component.

- Box 7: Total value of purchases and other inputs excluding VAT. The total value of everything you’ve bought for your business, excluding VAT.

- Box 8: Total value of all supplies of goods and related costs, excluding VAT, from the UK to other EU member states. This applies to businesses making sales to the EU.

- Box 9: Total value of all acquisitions of goods and related costs, excluding VAT, from other EU member states to the UK. This applies to businesses buying from the EU.

Beyond the Template: Best Practices for VAT Compliance

While having a solid hmrc vat return form template is an excellent starting point for organizing your data, effective VAT compliance extends beyond just filling in the boxes. It encompasses a holistic approach to your financial record-keeping and understanding your VAT obligations. Your template is only as good as the data you feed into it, so ensuring that data is accurate and complete from the outset is paramount.

One of the most crucial best practices is maintaining impeccable digital records. Under Making Tax Digital (MTD) for VAT rules, most VAT-registered businesses are required to keep digital records of their transactions and submit their VAT returns using MTD-compatible software. This means moving away from manual spreadsheets for primary record-keeping and embracing digital solutions that can often auto-populate parts of your template or even your actual return. Regular reconciliation of your sales and purchase records against your bank statements is also vital to catch discrepancies early.

Another key aspect is understanding the nuances of VAT rules as they apply to your specific business. VAT can be complex, with different rates for different goods and services, rules for international trade, and schemes like the Flat Rate Scheme or Cash Accounting Scheme. Staying informed about changes in VAT legislation and how they impact your business is crucial. HMRC provides extensive guidance, and consulting with a qualified accountant or tax advisor is highly recommended for any complex scenarios or for businesses with varied income streams.

Finally, never leave your VAT return preparation to the last minute. Give yourself ample time to gather all the necessary documents, cross-check figures, and review the template before submission. This allows you to address any unexpected issues or missing information without the pressure of an imminent deadline. A proactive approach to VAT management, supported by good internal processes and potentially a reliable template, will save you a lot of headache in the long run.

Taking a structured and organized approach to your VAT obligations is one of the smartest moves you can make as a business owner. It’s not just about meeting HMRC’s requirements; it’s about gaining clarity over your financial position and ensuring smooth operations. By understanding each component of the return and preparing your figures diligently, you empower yourself to manage VAT with confidence.

Embracing tools and practices that simplify compliance, like using a helpful preparation template and ensuring your underlying records are sound, can transform VAT from a quarterly burden into a manageable, routine task. This proactive management contributes significantly to the overall financial health and stability of your business, allowing you to focus more on growth and less on compliance worries.