Dealing with a home insurance claim can feel like navigating a complex maze, especially when you’re already under stress from damage or loss to your property. It’s never something you want to experience, but unfortunately, life throws unexpected challenges our way. When disaster strikes, whether it’s a burst pipe, a fire, or damage from a storm, the last thing you want to worry about is scrambling to find the right information or fill out confusing paperwork.

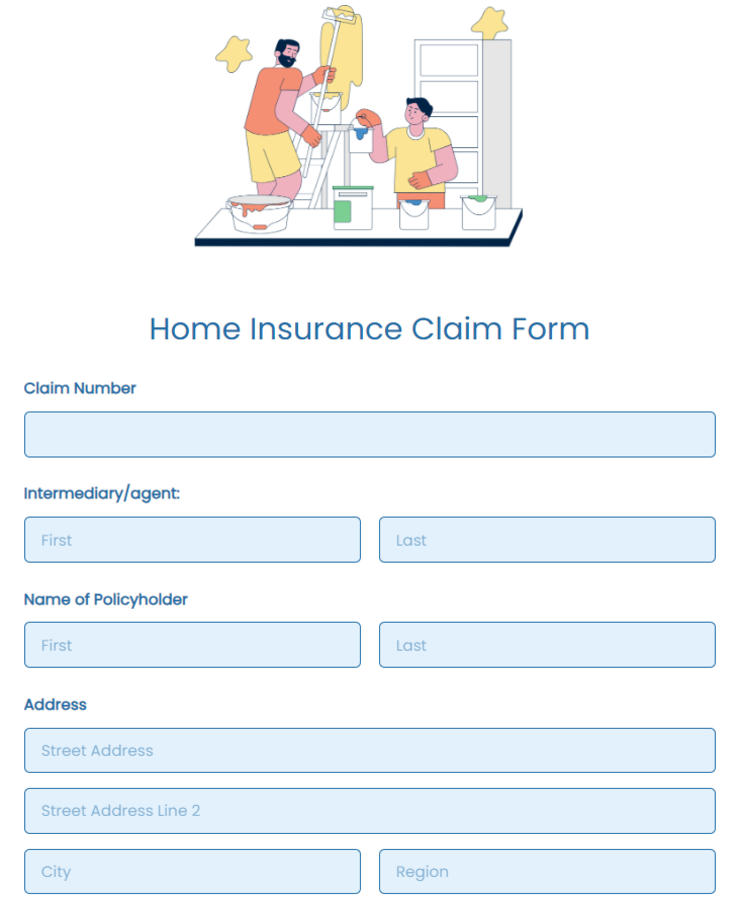

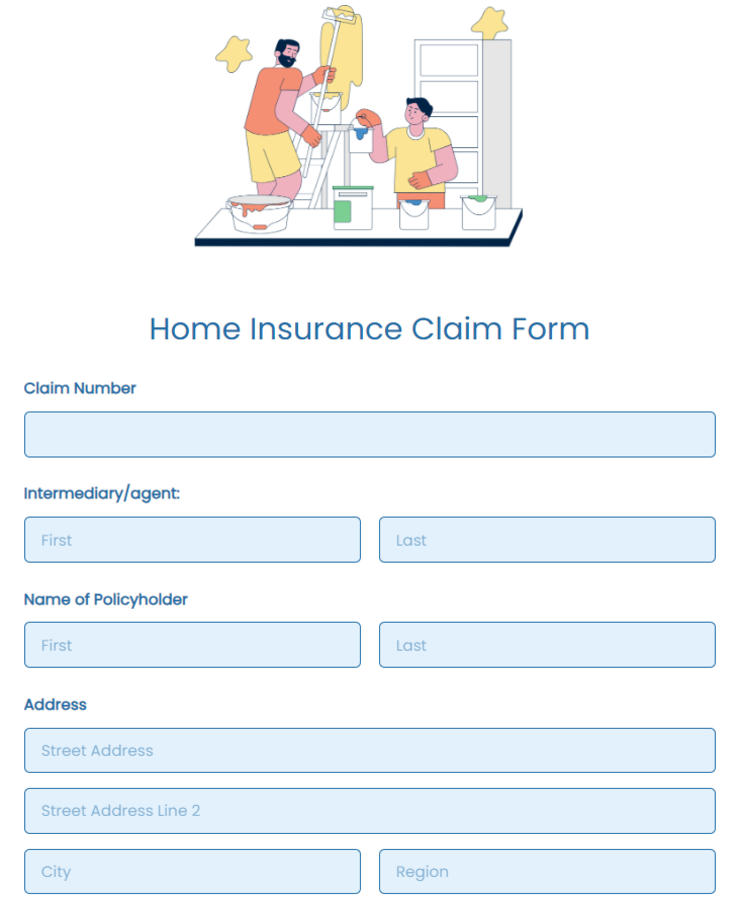

That’s where being prepared truly makes a difference. Having a clear, easy-to-use home insurance claim form template at your fingertips can significantly ease the burden. It acts as your personalized checklist and guide, ensuring you gather all the necessary details accurately and efficiently, making the entire claim process smoother and less daunting.

Why a Home Insurance Claim Form Template is Your Best Friend

Imagine the scenario: your basement floods, or a tree falls on your roof. In that moment of distress, your mind is racing. Where do you start? What information does your insurance company need? A pre-prepared home insurance claim form template brings instant order to the chaos. It provides a structured framework, guiding you through each piece of information required, from the basic facts of your policy to the intricate details of the damage sustained. This clarity can save you precious time and prevent costly mistakes or omissions that could delay your claim.

Beyond just organization, a template ensures you don’t overlook any critical details when you’re under pressure. Stress can make it difficult to think clearly, and forgetting a small but important piece of information, like the exact date and time of the incident or a specific policy number, can lead to back-and-forth communication with your insurer. By having dedicated sections for every piece of data, your template acts as a reliable memory aid, ensuring completeness from the get-go.

Key Sections to Include in Your Template

- Your Personal Information: Full name, address, contact numbers, and email.

- Policy Details: Your insurance company’s name, policy number, and the type of coverage (e.g., homeowner, renter).

- Date and Time of Incident: As precise as possible.

- Description of Damage or Loss: A detailed, factual account of what happened, how it happened, and what was damaged or lost.

- Supporting Documentation Checklist: A reminder to include photos, videos, police reports (if applicable), repair estimates, and receipts for temporary repairs.

- Witness Information (if any): Names and contact details of anyone who witnessed the incident.

- Declaration and Signature: Space for your signature to confirm the accuracy of the information provided.

Accuracy and completeness are paramount when filling out any claim form. Even the best template is only as useful as the information you put into it. Take your time to fill in every section thoroughly, ensuring all dates, times, and descriptions are as precise as possible. Remember, the clearer and more comprehensive your initial submission, the faster your insurer can process your claim.

Proactive preparation is always the best strategy. Creating or downloading a home insurance claim form template and familiarizing yourself with its contents before you ever need it will put you miles ahead when the unexpected occurs. Keep it in an easily accessible place, perhaps alongside your policy documents, so it’s ready at a moment’s notice.

Navigating the Claim Process with Your Prepared Template

Once you’ve experienced an event that might lead to a claim, your first priority is always safety. After ensuring everyone is safe and secure, and once the immediate crisis has passed, your pre-filled or partially completed home insurance claim form template becomes an invaluable tool. It prompts you to start documenting everything immediately, which is crucial because memories can fade, and details can be forgotten over time.

Your template will guide you to systematically gather all the necessary information, from taking detailed photos and videos of the damage before any cleanup begins, to noting down every item lost or destroyed. It helps you remember to keep receipts for any emergency repairs you undertake to prevent further damage, and to secure valuable items if possible. This organized approach can significantly reduce the back-and-forth needed with your insurance adjuster.

- Contact Your Insurer Promptly: The sooner you notify them, the better. Many policies have specific timeframes for reporting claims.

- Document Everything: Use your template as a guide to take comprehensive photos and videos of all damage.

- Keep Records: Hold onto any receipts for temporary repairs or living expenses if you’re displaced.

- Fill Out Your Template Thoroughly: Transfer all the information you’ve gathered onto your home insurance claim form template.

- Submit with Supporting Documents: Send your completed form along with all photos, videos, and other evidence.

After you submit your claim, your insurance company will typically assign an adjuster to assess the damage. Having your template already filled out with all the pertinent details means you can provide them with a clear, concise summary right away. This level of organization speaks volumes and often leads to a more streamlined assessment process, as the adjuster has all the information they need from the outset.

Maintain open communication with your insurer throughout the process. Keep copies of all correspondence, including emails and notes from phone calls. Your template serves as a robust record of what you’ve submitted, allowing you to easily reference specific details if questions arise. This proactive and organized approach, anchored by your pre-prepared template, empowers you to navigate the claim process with confidence and efficiency.

Having a well-organized home insurance claim form template is more than just a piece of paper; it’s a powerful tool for peace of mind. It transforms a potentially overwhelming situation into a manageable process, ensuring you’re prepared for the unexpected and can secure the support you need quickly and efficiently.

By investing a little time now to prepare, you equip yourself with the confidence to face future challenges head-on. It’s about taking control and empowering yourself to navigate life’s inevitable bumps with grace and efficiency, knowing you have a robust plan in place.