Navigating the world of home insurance can feel a bit overwhelming, especially when you’re just starting to look for the right policy. One of the first steps you’ll encounter is the home insurance quote form. This essential tool helps insurance providers gather the necessary information to give you an accurate price for your coverage. But what exactly goes into a well-designed form, and why is it so important for both you and the insurance company?

Understanding the elements of an effective home insurance quote form template can significantly streamline the process. Whether you’re an insurance professional looking to optimize your intake process or a homeowner curious about what details are needed, a comprehensive and intuitive form is key. It ensures all relevant data is collected efficiently, leading to faster and more precise quotes for potential policyholders.

Crafting the Perfect Home Insurance Quote Form

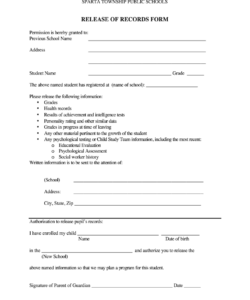

Creating a truly effective home insurance quote form is about more than just listing questions. It is about understanding the user journey and anticipating what information is needed at each step. A well-structured form should be intuitive, easy to navigate, and clearly communicate why each piece of information is requested. This transparency builds trust and encourages applicants to provide accurate data, which is crucial for delivering a precise quote.

The goal is to balance thoroughness with simplicity. While you need enough detail to assess risk and calculate premiums, an overly long or complex form can deter potential customers. Think about breaking it down into logical sections, making it feel less daunting. For instance, start with basic contact information, then move to property details, and finally, delve into specifics about desired coverage and historical data.

A good home insurance quote form template acts as the foundation for your sales process, serving as the initial point of contact for many prospective clients. It gathers all the critical information up front, allowing your team to focus on personalized advice and closing sales rather than chasing missing details. Moreover, a well-thought-out form can highlight key aspects of homeownership that influence insurance, such as security features or home upgrades, encouraging applicants to think about these factors.

Essential Sections for Your Home Insurance Quote Form

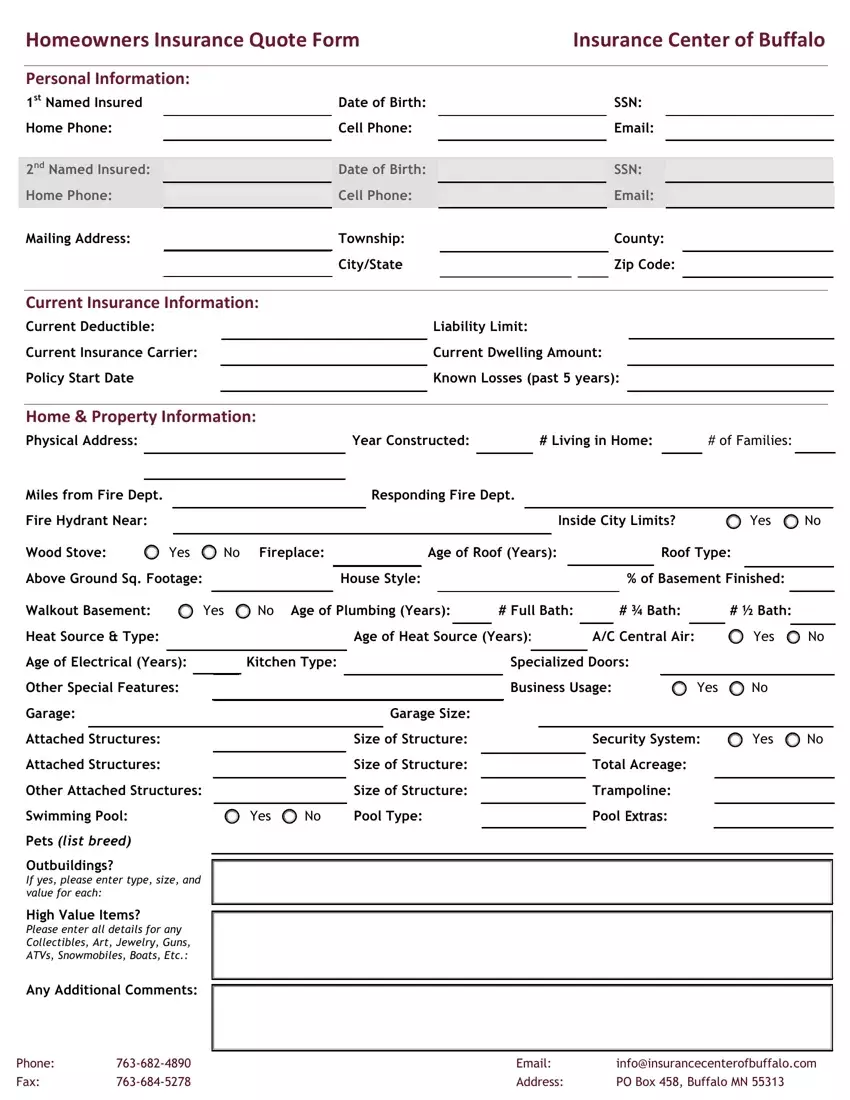

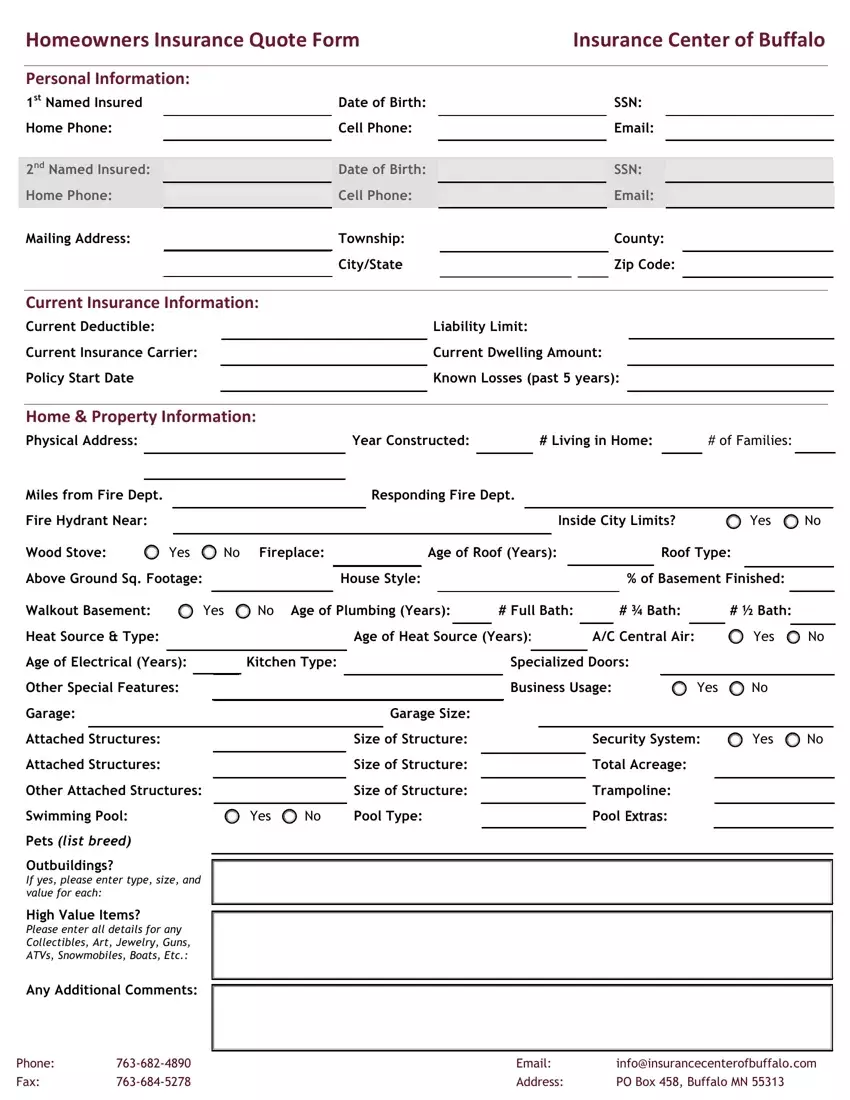

To ensure you gather all the necessary data without overwhelming the user, consider segmenting your home insurance quote form template into these core areas:

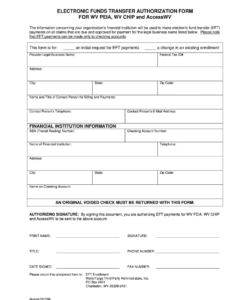

- Personal Information: This includes the applicant’s full name, contact details (phone, email), and current address. It is the most basic yet fundamental part of any application.

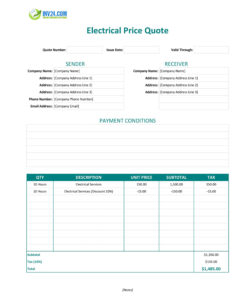

- Property Details: Here, you will ask for the property’s full address, construction year, type of home (single-family, condo, townhouse), square footage, and any unique features like swimming pools or detached structures. Questions about the roof’s age and material are also highly relevant.

- Coverage Preferences: This section allows the applicant to specify their desired coverage limits for dwelling, personal property, liability, and additional living expenses. It might also include questions about desired deductibles.

- Claims History and Security Features: Inquiring about past insurance claims within a certain period (e.g., the last five years) helps assess risk. Additionally, asking about security systems, fire alarms, or other protective measures can help identify potential discounts.

- Occupancy and Usage: Understanding if the home is owner-occupied, a rental, or a secondary residence is important. Questions about business use of the property also fall into this category.

Optimizing Your Template for User Experience and Data Accuracy

Beyond simply including the right questions, the way your home insurance quote form template is presented and functions makes a significant difference. A smooth user experience ensures higher completion rates and more accurate data submissions. Consider responsive design to make sure your form looks and works great on any device, from desktops to smartphones. Many people access these forms on their mobile devices, so easy navigation and clear input fields are non-negotiable.

Implementing conditional logic can dramatically improve the user experience. This means showing or hiding questions based on previous answers. For example, if someone indicates they do not have a pool, subsequent questions about pool fencing or maintenance can be automatically hidden. This makes the form feel shorter and more relevant to each individual, reducing cognitive load and the chances of a user abandoning the form.

Furthermore, integrate real-time validation for common errors. If a field requires a numeric input, provide immediate feedback if text is entered instead. Suggesting common formats for dates or phone numbers can also reduce errors. Auto-filling known information, like city and state based on a zip code, can save time and improve accuracy as well. These small touches contribute to a professional and user-friendly experience.

Finally, think about the backend integration. A well-designed template should seamlessly feed the collected data into your CRM or policy management system. This automation minimizes manual data entry errors and speeds up the quoting process. Providing a clear progress indicator, like “Step 1 of 4,” can also keep users engaged and motivated to complete the entire form, knowing how much more is left to do.

By investing time into creating a comprehensive yet user-friendly home insurance quote form, you are not just building a data collection tool; you are enhancing your customer’s first impression of your service. A thoughtful design can make the process of securing insurance feel less like a chore and more like a straightforward, helpful step toward protecting their most valuable asset. It’s about building a bridge of clarity and convenience between you and your future policyholders.

The benefits extend beyond the initial quote. A well-organized form provides a clear record of the information used to generate a policy, which can be invaluable for future reference or in the event of a claim. It sets a professional tone from the very beginning, showcasing your commitment to efficiency and customer satisfaction, paving the way for a long-lasting relationship built on trust and reliability.