Howdy, homeowner! Ever found yourself staring at a pile of papers, wondering where to even begin after a minor disaster strikes your humble abode? Whether it’s a leaky roof, a mischievous tree falling on your fence, or even a slip-up in your kitchen leading to water damage, the thought of filing an insurance claim can be pretty daunting. It often feels like navigating a labyrinth of paperwork and complicated questions.

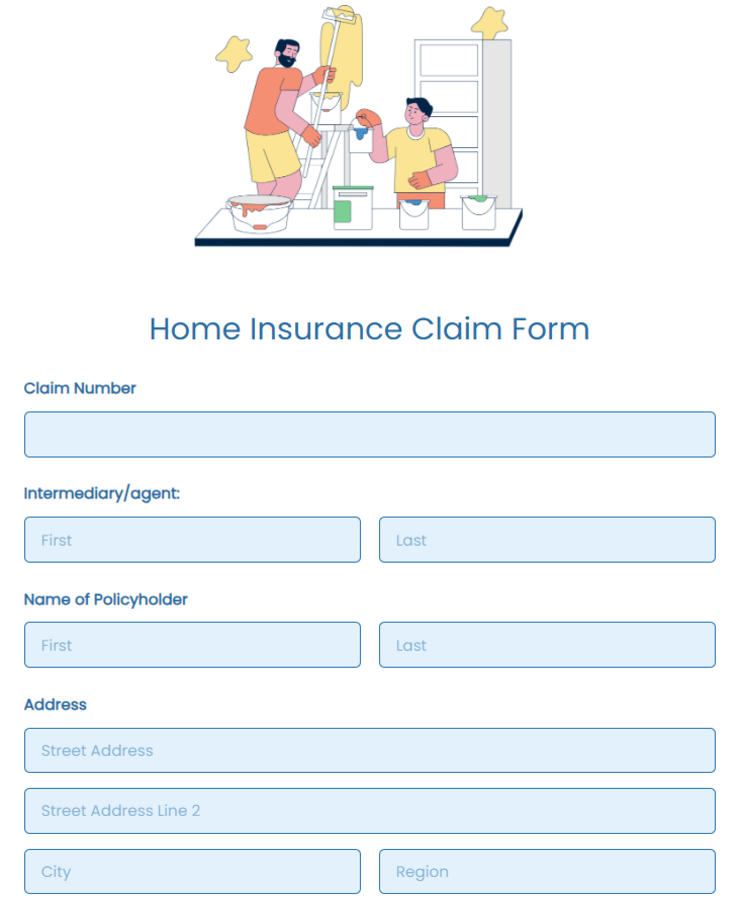

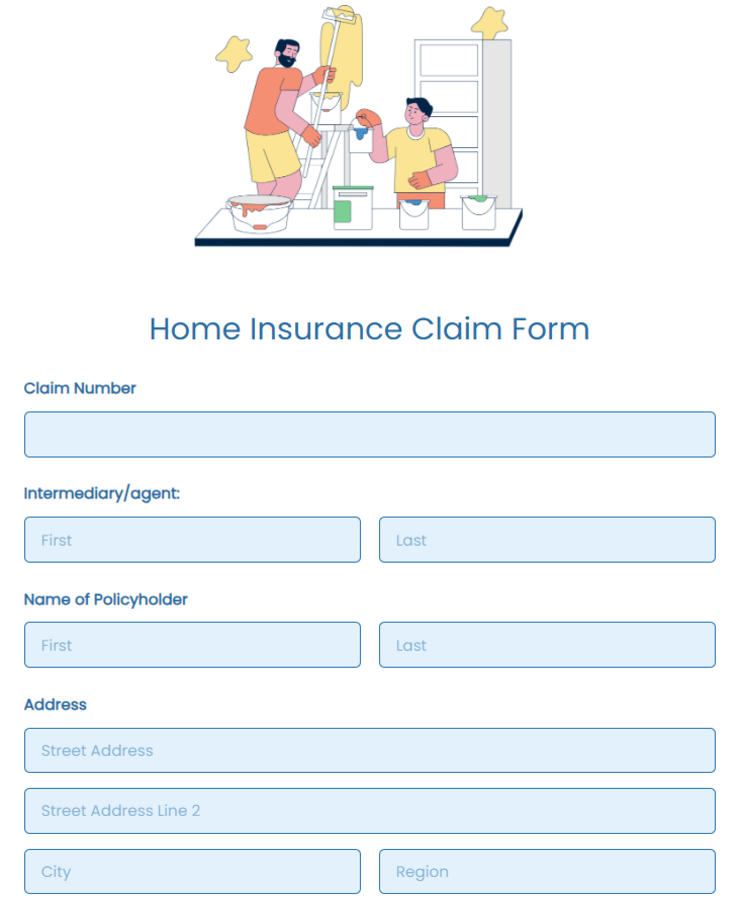

But what if there was a way to simplify this process? A clear, concise guide that walks you through each step, ensuring you don’t miss any crucial details? That’s precisely what a well-structured homeowners insurance claim form template can offer. It acts as your personal roadmap, making the journey from incident to resolution much smoother and less stressful. Let’s explore how having such a template at your fingertips can transform a potentially overwhelming situation into a manageable task.

Why a Homeowners Insurance Claim Form Template is Your Best Friend

Imagine the stress of a sudden event that damages your home. Your mind is likely racing, and remembering every single piece of information your insurance company will need can be incredibly tough. This is where a robust homeowners insurance claim form template truly shines. It provides a structured framework, guiding you to collect all necessary data systematically, from the initial details of the incident to the specific damages incurred. This organization not only saves you time but also reduces the chances of errors or omissions that could delay your claim.

Having a template readily available means you can begin gathering information almost immediately after an incident. This speed is critical, as many insurance policies have deadlines for reporting claims. Furthermore, the template prompts you for precise details, such as dates, times, descriptions of damage, and affected areas. This level of detail helps ensure accuracy in your report, which in turn helps the insurance adjuster understand the full scope of your loss quickly. It streamlines communication and prevents back-and-forth queries that can prolong the claims process.

Beyond just speed, a comprehensive template ensures consistency. It reminds you to document everything, from minor cosmetic damage to major structural issues. This complete picture is essential for fair compensation. Without a homeowners insurance claim form template, it’s easy to overlook smaller details that, when combined, can add up to a significant loss. It acts as a checklist, ensuring no stone is left unturned when you’re documenting the impact on your property.

Think of a template as a preparatory tool, a proactive measure that gives you peace of mind. You don’t want to be scrambling for information when you’re already dealing with the aftermath of an unexpected event. By understanding the typical sections of such a template beforehand, you can even preemptively gather some basic information, like your policy number and contact details, ensuring you’re ready should the need arise. It’s about being prepared, not scared.

Key Sections You’ll Find in a Useful Template

A good homeowners insurance claim form template typically covers several crucial areas to ensure all pertinent information is captured. Knowing these sections helps you prepare and collect the right details efficiently:

- Personal and Policy Information: Your name, contact details, policy number, and the effective dates of your policy.

- Incident Details: Date, time, and specific location of the incident, along with a detailed description of what happened.

- Description of Damage: A thorough account of all damaged property, including photos or videos if available. Be specific about affected rooms, items, and estimated repair costs.

- Contact Information for Witnesses or Emergency Services: If police, fire department, or other emergency personnel were involved, their contact details and report numbers are crucial.

- Claim History: Sometimes, a template might ask for previous claim history to provide context, though this is less common for initial forms.

Steps to Take When Filling Out Your Claim Template

Once you have your homeowners insurance claim form template in hand, the very first step, even before you start writing, is to ensure the safety of yourself and your family. After any incident, your immediate priority should be securing your property from further damage if it’s safe to do so, and documenting everything. This means taking plenty of photographs and videos of the damage from various angles before any cleanup or temporary repairs begin. These visual records are incredibly valuable and will support the written details you provide in your claim.

With safety measures addressed and initial documentation complete, it’s time to systematically go through your template. Start by filling in your personal and policy information accurately. Then, move to the incident details section. Be as precise as possible with dates, times, and a narrative description of what occurred. Avoid emotional language and stick to the facts. Refer to your policy documents to understand what types of damage are covered and what information your insurer specifically requires for those types of claims.

This is arguably the most critical part: detailing the damage. Use your template to list every affected item and area. Don’t underestimate the importance of seemingly minor damage; even small issues can lead to larger problems later if not addressed. If you have receipts or appraisals for high-value items, gather them. The more evidence and specific details you can provide, the smoother the assessment process will be for your insurance adjuster. Remember, the template is there to prompt you for this crucial information, so use it as your guide.

Once you’ve meticulously filled out your template and attached all supporting documentation (photos, videos, police reports, repair estimates), it’s time to submit it to your insurance provider. Make sure you understand their preferred submission method – whether it’s online, via email, or by mail. Always keep a copy of everything you send for your own records. After submission, stay organized and be prepared for follow-up questions from your adjuster. They may need additional information or wish to schedule an on-site inspection. Being ready with your organized records, facilitated by your template, will make these interactions much more efficient.

Tips for a Smooth Claim Process

To ensure your claim progresses as efficiently as possible, consider these additional tips:

- Read Your Policy: Before an incident, understand what your policy covers and excludes.

- Act Quickly: Report the claim to your insurer as soon as safely possible.

- Document Everything: Photos, videos, receipts, and any communication with your insurer.

- Don’t Make Permanent Repairs Too Soon: Only do temporary fixes to prevent further damage until your adjuster assesses the loss.

- Be Honest and Detailed: Provide accurate information; any misrepresentation can jeopardize your claim.

- Keep Records: Maintain a dedicated file for all claim-related documents and communications.

Navigating the aftermath of property damage can be a challenging experience, but having the right tools can make all the difference. A well-prepared homeowners insurance claim form template isn’t just a piece of paper; it’s a strategic asset that empowers you to approach the claims process with confidence and clarity. It helps you stay organized, ensures you provide all necessary details, and ultimately contributes to a quicker and more efficient resolution with your insurance provider.

By utilizing such a template, you’re taking a proactive step towards protecting your home and your financial well-being. It simplifies a complex situation, allowing you to focus on rebuilding and restoring your peace of mind. So, arm yourself with this invaluable resource, and face any unexpected events knowing you have a clear path forward.