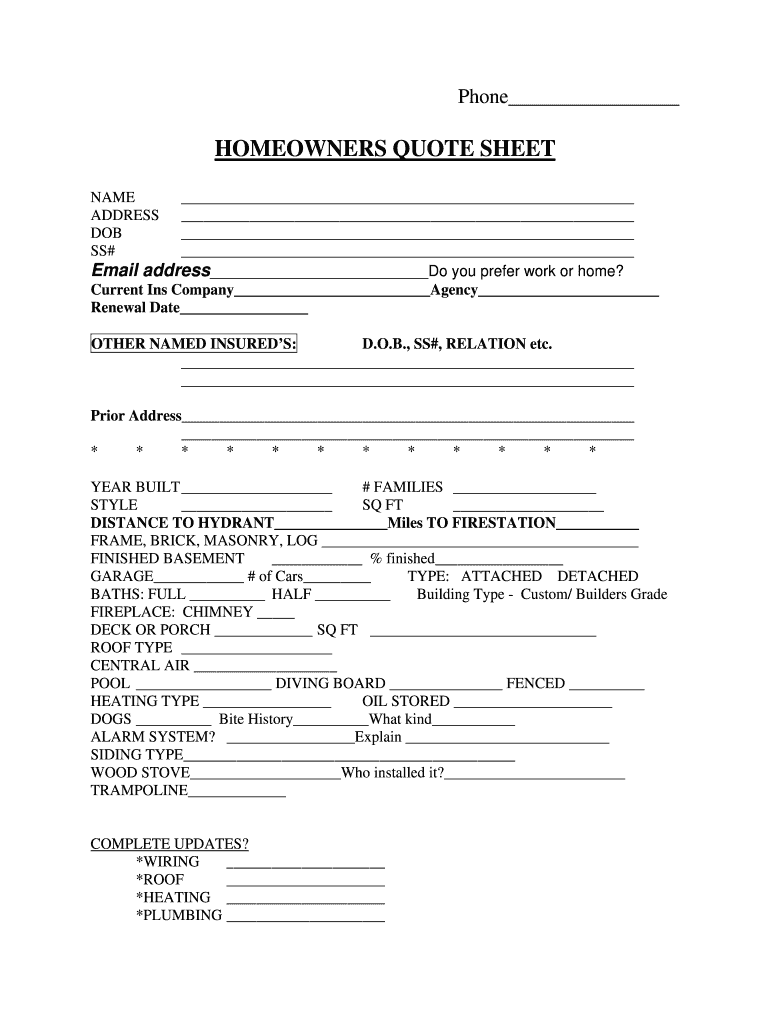

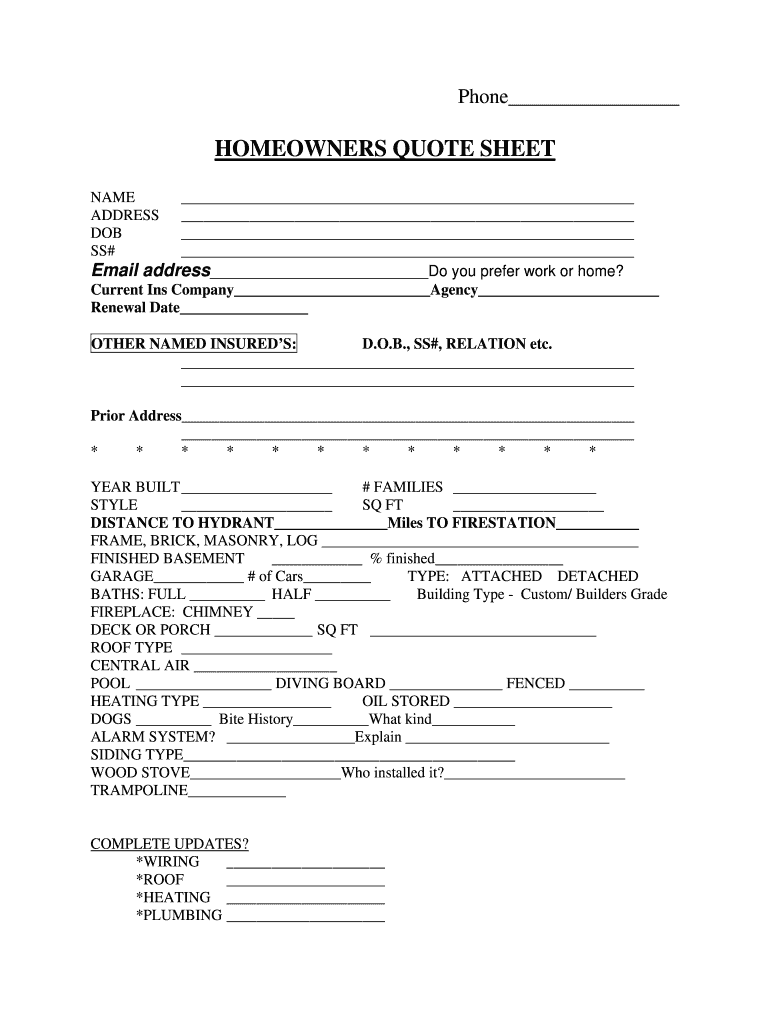

Getting the right homeowners insurance is a crucial step for any property owner, and often, the first interaction you have with an insurance provider is through a quote form. Whether you are an individual homeowner seeking coverage or an insurance agent streamlining your intake process, having a well-designed homeowners insurance quote form template can make all the difference. It ensures that all necessary information is collected efficiently, leading to accurate quotes and a smoother experience for everyone involved.

A thoughtfully structured form not only simplifies the data collection process but also helps in setting clear expectations about the information required for a comprehensive assessment. It bridges the gap between the homeowner’s needs and the insurer’s ability to provide a tailored policy, transforming a potentially confusing task into a straightforward conversation.

What Makes a Great Homeowners Insurance Quote Form Template?

A truly effective homeowners insurance quote form template is designed with both clarity and comprehensive data capture in mind. It needs to be user-friendly, guiding the applicant through each section without overwhelming them, while simultaneously ensuring that no critical piece of information is missed by the insurer. The best templates balance simplicity with thoroughness, making the process feel less like a chore and more like a clear pathway to protection.

The foundation of a good template lies in its ability to systematically gather all the essential details required to accurately assess risk and calculate premiums. This includes specifics about the property itself, the homeowner’s personal information, and the desired coverage levels. Without these core elements, an insurance provider cannot generate a reliable quote, making the entire exercise fruitless.

Key Sections to Include

Each of these sections plays a vital role in determining the overall risk profile of the property and, consequently, the cost of the insurance policy. For instance, the age of the roof or the presence of advanced security features can significantly impact premiums. A detailed form ensures that these factors are considered upfront, preventing surprises later in the process. Whether you are distributing this form digitally or in print, ensuring that each field is clearly labeled and easy to understand is paramount for a seamless user experience.

Benefits of Using a Standardized Homeowners Insurance Quote Form Template

Adopting a standardized homeowners insurance quote form template offers a multitude of advantages for both insurance seekers and providers. For insurance companies and agents, it streamlines the initial data collection phase, drastically reducing the time spent on administrative tasks and allowing more focus on client consultation and policy tailoring. This consistency in data input also helps in training new staff, as the process remains uniform across the organization.

Moreover, a consistent template minimizes the chances of errors and omissions in data collection. When every applicant provides information in the same structured format, it becomes easier to process, analyze, and compare details across different applications. This standardization leads to greater accuracy in quoting, which is beneficial for both parties as it reduces the likelihood of discrepancies or disputes down the line.

From a homeowner’s perspective, a clear and consistent template simplifies what can often feel like a complex process. They know exactly what information is required, which helps them gather all necessary documents beforehand, speeding up their application. The familiarity of a well-structured form enhances the overall customer experience, building trust and confidence in the insurance provider. It removes the guesswork and makes the journey towards securing a policy feel straightforward and transparent.

Finally, a standardized template supports compliance efforts and makes it easier for insurers to meet regulatory requirements related to data collection. It also empowers homeowners to easily compare quotes from multiple providers, as they are providing similar information sets to each, allowing for a more apples-to-apples comparison. This level playing field benefits consumers by encouraging competitive pricing and ensuring they receive the best possible coverage for their needs.

Navigating the world of property protection can be daunting, but with the right tools, it becomes much simpler. A thoughtfully designed form acts as a crucial first step, setting the stage for a transparent and efficient process that benefits everyone involved.

Ultimately, the goal is to make the experience of securing vital property coverage as smooth and stress-free as possible. By providing clarity and structure from the outset, the path to a secure home becomes clear and easily achievable for all homeowners.