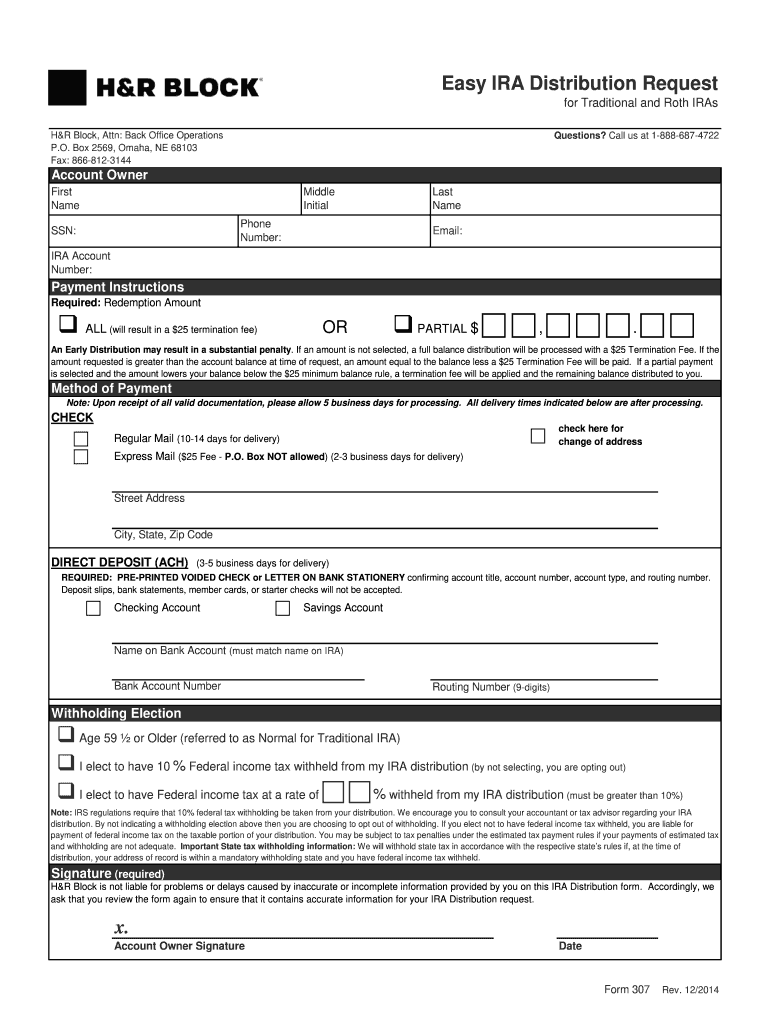

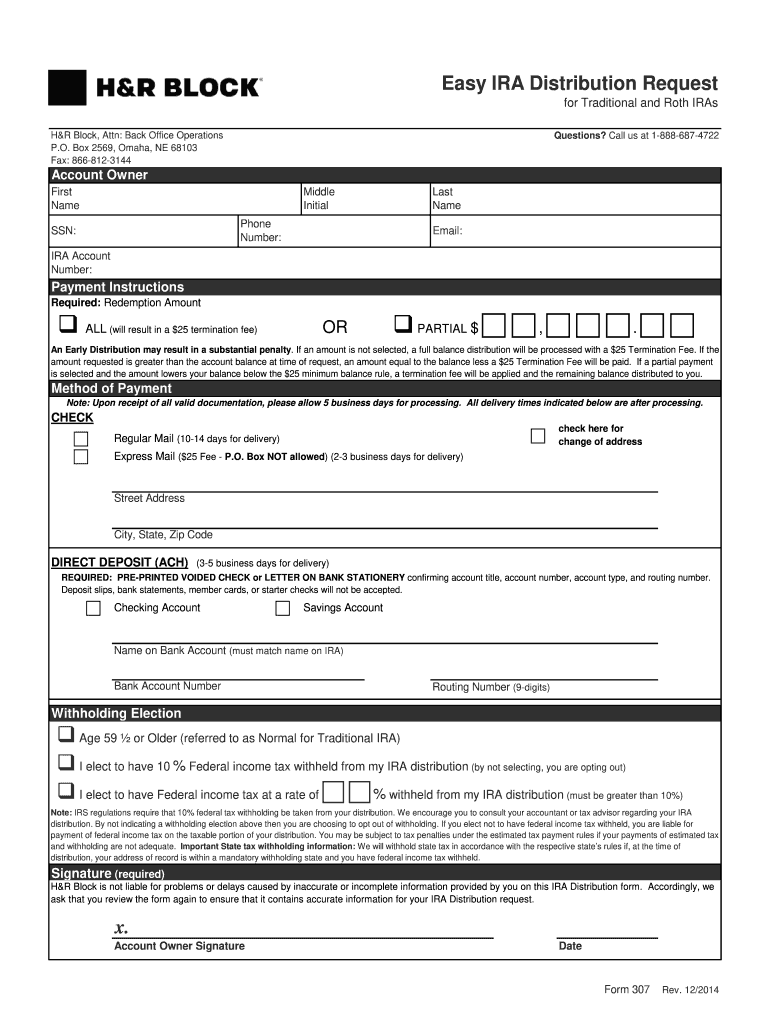

Navigating the world of taxes can often feel like deciphering a complex puzzle, with forms that seem to have a language of their own. Many taxpayers seek reliable ways to simplify this annual task, and for a great number of us, H&R Block emerges as a trusted partner. They’ve built a reputation for helping millions of people successfully file their taxes, offering various services designed to ease the burden.

When you are looking for an hr block tax form template, you are likely searching for more than just a blank document to fill out. What most people truly desire is a guided process, one that makes understanding and completing their tax forms straightforward and accurate. This quest for clarity often leads to platforms that effectively serve as a template, providing structure and support every step of the way.

Understanding the H&R Block Approach to Tax Forms

When you hear the term “tax form template,” it is important to understand what that often means in the context of a service like H&R Block. Instead of a downloadable, fill-in-the-blanks PDF, H&R Block provides an interactive experience that guides you through the necessary questions, automatically populating the correct forms in the background. This sophisticated approach acts as a dynamic template, ensuring that every piece of information lands in its proper place on the relevant IRS or state tax document. It removes the guesswork from form identification and section completion, a common point of frustration for many taxpayers.

Think of it less as a static hr block tax form template and more as a smart assistant that customizes the form-filling process based on your individual tax situation. Whether you are reporting income from a W-2, detailing deductions, or declaring self-employment earnings, the H&R Block system prompts you for the specific information needed for each form. This not only streamlines the process but also significantly reduces the chance of errors that can arise from manually completing complex tax documents. The underlying technology ensures compliance with the latest tax laws, adapting to any changes year after year.

This guided interview process is particularly beneficial because it helps taxpayers avoid overlooking important deductions or credits they might be eligible for. Rather than searching for an elusive hr block tax form template to print, users input their data, and the software intelligently determines which forms are required. This comprehensive methodology means that whether you need a Schedule C for business income, a Schedule A for itemized deductions, or a Form 1040, the system builds it for you piece by piece, ensuring nothing is missed.

Ultimately, H&R Block transforms the daunting task of form completion into a manageable, step-by-step procedure. It’s a far cry from the days of wrestling with paper forms and instruction booklets. The platform serves as a highly intelligent guide, ensuring that your tax return is complete, accurate, and ready for submission, giving you peace of mind.

Common Forms Simplified by H&R Block

- Form 1040: The main individual income tax form.

- Schedule A: Itemized Deductions.

- Schedule C: Profit or Loss from Business Sole Proprietorship.

- Schedule D: Capital Gains and Losses.

- Form W-2: Wage and Tax Statement.

- Form 1099: Various income types, such as interest, dividends, or independent contractor payments.

Leveraging H&R Block Resources for Seamless Filing

Beyond simply guiding you through forms, H&R Block provides a wealth of resources that collectively enhance your tax preparation experience. These resources act as an extended template, offering explanations, advice, and even professional assistance when you need it. Whether you are a first-time filer or have complex financial situations, their comprehensive support system is designed to provide clarity and confidence throughout the entire tax season. This includes access to articles, FAQs, and even direct communication with tax professionals, ensuring that you are never left guessing.

The software itself is continually updated to reflect the latest tax laws and regulations, meaning that the “template” you are using is always current and compliant. This automatic updating saves you the time and effort of staying abreast of every tax code change, a task that can be overwhelming for most individuals. It is this commitment to up-to-date information that truly solidifies H&R Block’s position as a reliable aid in preparing your taxes correctly.

Moreover, H&R Block offers various ways to file, catering to different preferences. You can opt for their online software, download desktop versions, or even visit one of their many physical locations for in-person assistance. Each option provides the same underlying intelligent “template” system, allowing you to choose the method that best suits your comfort level and schedule. This flexibility makes tax preparation accessible to a wider range of people, ensuring that help is always within reach.

By leveraging H&R Block’s full suite of services, you are not just getting a tool to fill out forms; you are gaining a partner in your tax journey. Their comprehensive approach, from intuitive data entry to expert review options, streamlines the entire process. This enables you to navigate the complexities of tax season with efficiency and confidence, knowing that your return is accurately prepared and submitted.

Choosing a service like H&R Block for your tax preparation needs can transform a potentially stressful annual obligation into a manageable task. Their guided process, acting as a dynamic and intelligent form template, helps ensure accuracy and compliance without requiring you to become a tax expert yourself. It is about simplifying the process so you can focus on what matters most.

Ultimately, the goal is to file an accurate return with minimal hassle, and H&R Block delivers on that front by providing a structured yet adaptable framework for all your tax forms. With their support, you can approach tax season with a newfound sense of clarity and confidence, knowing your financial responsibilities are handled efficiently.