Navigating the world of health savings accounts, or HSAs, can feel a bit like learning a new language. You’ve heard about their fantastic tax advantages and how they can be a powerful tool for both your current and future healthcare costs. But when it comes to actually putting money into your HSA, especially through payroll deductions, that’s where things can get a little more specific. It’s not just about deciding how much; it’s also about formalizing that decision with your employer.

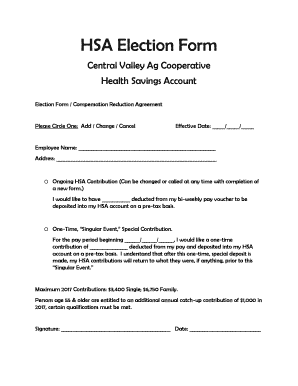

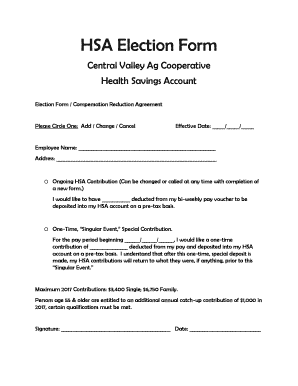

This is precisely where an HSA contribution election form comes into play. It’s the official document that tells your employer how much you want to contribute to your HSA directly from your paycheck. Having a clear, well-structured form ensures everything is processed correctly, avoiding any confusion or delays in getting those valuable pre-tax dollars into your account. Think of it as your direct line to maximizing your health savings.

Understanding the HSA Contribution Election Form

So, what exactly is an HSA contribution election form and why is it so important? Simply put, it’s the document you fill out to instruct your employer on the specific amount of money you wish to contribute to your Health Savings Account directly from your paychecks. This isn’t just a casual request; it’s a formal declaration that ensures your contributions are deducted pre-tax, which is one of the biggest benefits of an HSA. Without this form, your employer can’t legally or administratively make those deductions on your behalf. It formalizes your intent and provides a clear record for both you and your payroll department.

Employers rely on this form to accurately manage your payroll deductions and report them correctly for tax purposes. For employees, it provides a transparent way to control how much goes into their HSA, ensuring they meet their personal savings goals while adhering to annual contribution limits. This direct payroll deduction method is incredibly convenient, often leading to a “set it and forget it” approach that helps consistent saving over time. It removes the temptation to skip contributions because the money is moved before you even see it in your bank account.

The information typically requested on an HSA contribution election form includes your personal details, such as your name and employee ID, the specific HSA account number (if applicable), and most importantly, the exact amount you wish to contribute per pay period or as a lump sum. Some forms might also ask for the effective date of the election and provide options for changing or stopping contributions in the future. It’s designed to be straightforward, minimizing complexity for both the employee and the payroll administrator.

You might find yourself using this form at various times throughout your employment. Most commonly, it’s part of the annual open enrollment process when you select your benefits for the upcoming year. However, you can also often submit or update an HSA contribution election form at any time, especially if you experience a qualifying life event like a marriage, birth of a child, or a change in your health plan. Always check with your HR department for their specific policies on when and how you can adjust your contributions.

Key Elements Often Found on an HSA Contribution Election Form

- Employee identification information (Name, Employee ID, Department)

- HSA account details (Bank name, Account number, sometimes routing number)

- Contribution amount per pay period or total annual election

- Effective date of the contribution change

- Acknowledgment of annual contribution limits

- Signature lines for employee and sometimes an HR representative

The Practicality of Using an HSA Contribution Election Form Template

The real convenience of managing your HSA contributions comes from having a reliable HSA contribution election form template. Why? Because a well-designed template brings a level of standardization and clarity to the process that can save both employees and HR departments a lot of headaches. Instead of scrambling to create a form from scratch or trying to remember all the necessary details, a template provides a ready-to-use framework that ensures all critical information is captured accurately and consistently every time. This reduces errors, streamlines administration, and makes the entire process smoother for everyone involved.

For employees, a template simplifies the task of setting up or adjusting their contributions. You don’t have to wonder what information is needed; the template guides you through each required field, making the process intuitive. For employers, especially smaller businesses or those with limited HR resources, having an hsa contribution election form template can be a lifesaver. It means less time spent on administrative tasks and more time focusing on core business operations, while still maintaining compliance and providing essential benefits to their team. It’s about efficiency and reducing the burden of managing benefits paperwork.

Finding or creating a suitable template is relatively easy. Many HR software platforms offer pre-built forms that can be customized to your company’s specific needs. Alternatively, a quick search online can yield generic templates that you can adapt. When using a generic template, always ensure it includes all the essential fields specific to HSA contributions and that it aligns with any internal payroll or HR requirements your employer might have. Customizing it with your company logo and specific instructions can also enhance its professional appearance and ease of use.

When you’re filling out one of these forms, whether it’s a new election or an adjustment, accuracy is key. Double-check all numbers and account information. A small typo in an account number or contribution amount can lead to delays or incorrect deductions. It’s always a good idea to keep a copy of the completed form for your records, especially after it has been submitted and approved. This personal record helps you track your contributions and verify that they are being processed as you intended. Ensuring everything is correct from the start helps you avoid any future complications.

Effectively utilizing your HSA, starting with precise contribution elections, is a cornerstone of smart financial planning. These accounts offer a unique triple-tax advantage – tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses – making them incredibly valuable for long-term health and retirement savings. Taking the time to properly set up and manage your contributions through the correct channels ensures you fully leverage these benefits without any hitches.

Ultimately, your HSA is a powerful tool in your financial toolkit, offering flexibility and significant tax advantages for managing healthcare costs now and in the future. By understanding and properly utilizing the necessary election forms, you’re not just contributing money; you’re actively investing in your financial well-being. It’s a straightforward step that can have a profound impact on your long-term savings strategy and peace of mind.