Navigating the world of health savings accounts, or HSAs, can initially seem a bit complex, but once you understand their incredible benefits, you’ll see why they’ve become such a popular choice for health savings and retirement planning. These tax-advantaged accounts allow individuals with high-deductible health plans to save and invest money for qualified medical expenses, all while enjoying triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for eligible expenses. For both employers offering HSAs and employees contributing to them, clarity and ease of process are paramount.

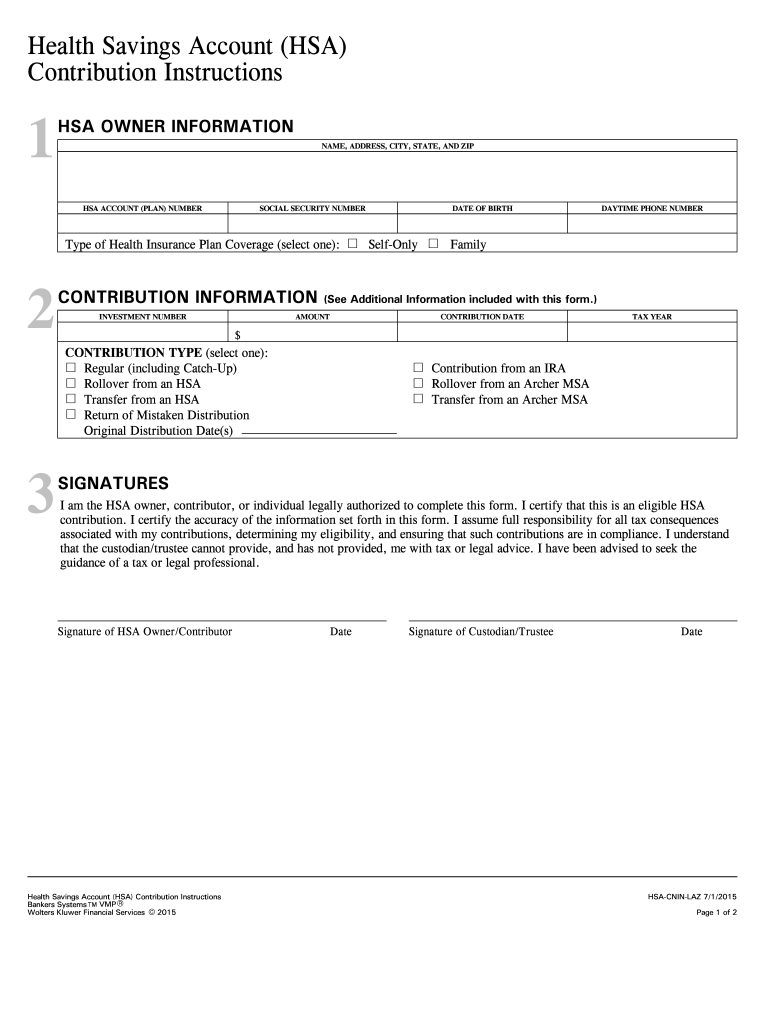

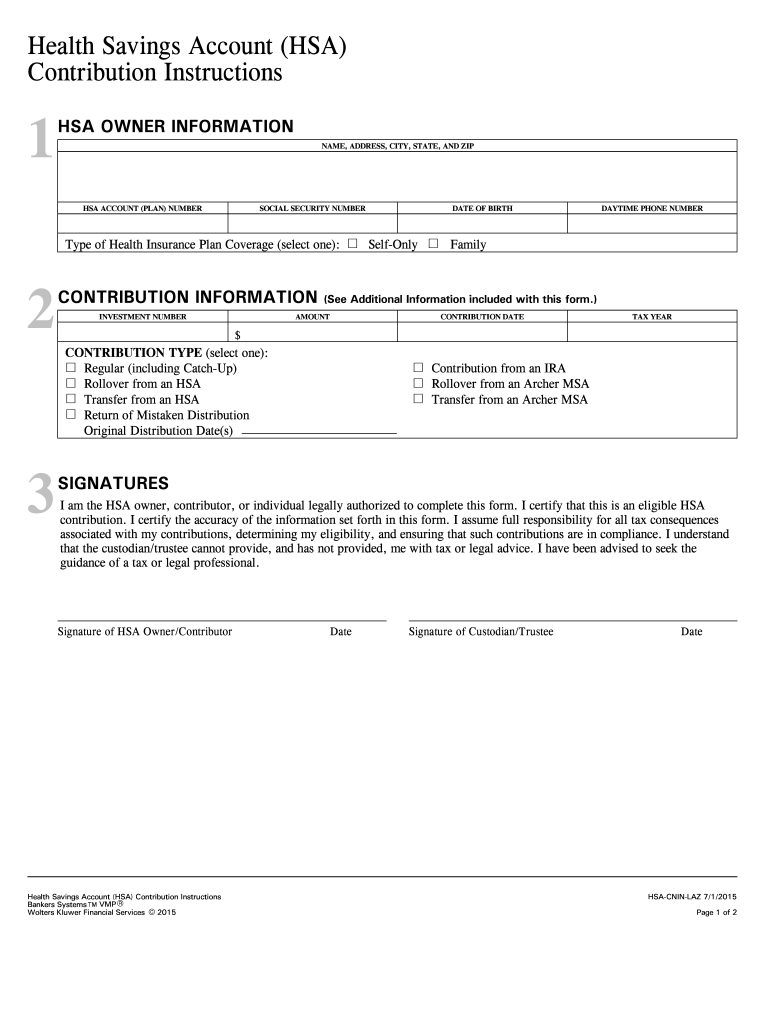

One of the most crucial elements in ensuring a smooth and compliant HSA experience is the proper documentation of contributions. This is where an effective HSA employee contribution form template comes into play. It acts as a standardized roadmap, ensuring that all necessary information is captured accurately, whether contributions are made through payroll deductions or direct employee deposits. A well-designed template streamlines administrative tasks, reduces errors, and provides a clear record for both the employee and the employer, making the entire process far more manageable.

What an HSA Employee Contribution Form Template Is and Why You Need One

An HSA employee contribution form template is essentially a standardized document used by employers to facilitate and track employee contributions to their Health Savings Accounts. It serves as a formal agreement and instruction sheet, detailing how much an employee wishes to contribute, the frequency of these contributions (e.g., per pay period), and often provides authorization for payroll deductions. For employers, it simplifies the administrative burden of managing numerous individual requests, ensuring consistency across the board. For employees, it offers a clear and straightforward method to set up or modify their HSA contributions.

The necessity of having a robust HSA employee contribution form template cannot be overstated. From an employer’s perspective, it provides a vital paper trail for auditing purposes, helps maintain compliance with IRS regulations, and streamlines the payroll process by centralizing contribution instructions. Without a standardized template, managing various ad-hoc requests could lead to errors, delays, and significant administrative headaches. It acts as a professional tool that reflects an organized and compliant approach to employee benefits.

For employees, this template brings clarity and control. It allows them to easily understand the process for initiating or adjusting their contributions, ensuring their contributions are correctly allocated to their HSA. This transparency builds trust and encourages greater participation in the HSA program, empowering employees to take charge of their healthcare savings. The form typically requires key personal details, account information, and the specific contribution amount, leaving no room for ambiguity.

Furthermore, a well-structured HSA employee contribution form template helps in communicating critical information about contribution limits and eligibility. While the form itself primarily focuses on the mechanics of contributions, its presence often prompts employees to better understand the rules surrounding their HSA, leading to more informed financial decisions. It becomes a foundational piece of the entire HSA benefit offering, facilitating efficient and compliant financial transactions between the employee, employer, and the HSA custodian.

Key Elements of a Comprehensive HSA Contribution Form

- Employee Information: Full name, employee ID, contact details.

- HSA Account Details: Account number and name of the HSA custodian.

- Contribution Authorization: Specific dollar amount per pay period or a lump sum.

- Frequency of Contributions: Weekly, bi-weekly, monthly, etc.

- Effective Date: When the contributions should begin or change.

- Employee Signature and Date: Confirmation of agreement and understanding.

- Employer Section: For internal tracking and processing notes.

How to Effectively Use and Customize Your HSA Employee Contribution Form Template

Once you have an HSA employee contribution form template, the next step is to implement it effectively within your organization. The process typically begins with making the template readily accessible to all eligible employees, whether through an internal HR portal, a shared drive, or physical copies. Clear communication about the availability and purpose of the form is crucial. Employees should be guided on how to fill it out accurately, emphasizing the importance of providing correct HSA account details and desired contribution amounts to avoid any processing delays or misallocations.

Customization is often key to making any template truly fit your specific organizational needs. While a generic HSA employee contribution form template provides a solid foundation, you might want to brand it with your company logo, include specific internal codes, or add a section for employer contributions if your company also contributes to employee HSAs. Tailoring the form ensures that it aligns with your existing HR and payroll systems, making the integration seamless and reducing the need for manual adjustments down the line.

Beyond simply filling out the form, establishing a clear submission and processing procedure is vital. This includes defining where employees should submit completed forms (e.g., HR department, payroll specialist), the turnaround time for processing changes, and how employees will be notified once their contribution adjustments have been implemented. Efficient record-keeping, whether digital or physical, is also paramount for compliance and future reference. Regularly reviewing these processes can help identify bottlenecks and improve overall efficiency.

Furthermore, consider adding supplementary information alongside the form. This could include a brief FAQ about HSA contribution limits for the current year, a reminder about the tax advantages, or contact information for your benefits administrator or HSA custodian. Providing comprehensive resources ensures employees are well-informed and can make the most of their HSA benefits. A well-managed process surrounding your HSA employee contribution form template not only simplifies administration but also enhances the perceived value of your employee benefits package.

By leveraging a well-designed and properly implemented form, organizations can significantly simplify the management of Health Savings Accounts, providing a clear and efficient pathway for employees to save for their healthcare needs. This structured approach benefits everyone involved, fostering a more organized and compliant benefits administration environment. Embracing such a tool is a step towards more streamlined and user-friendly employee benefit offerings.