Navigating the world of financial claims can sometimes feel a bit like wading through treacle, especially when you’re dealing with something as specific as Payment Protection Insurance (PPI). If you suspect you were mis-sold PPI by HSBC, you’re not alone. Many people have successfully reclaimed money they were due, and a key step in this process is often having the right tools to present your case clearly. That’s where something like a well-structured hsbc ppi claim form template can become incredibly useful, guiding you through the necessary details.

This article aims to demystify the process for you. We’ll explore why having a good template matters, what information you’ll need to gather, and how to effectively put together your claim to give yourself the best possible chance of a positive outcome. Remember, while a template provides structure, the heart of your claim lies in the details you provide, so let’s get into what makes for a compelling case.

Understanding Your PPI Claim and What to Include

Before you even think about filling out an hsbc ppi claim form template, it’s really important to understand what PPI was and why you might have been mis-sold it. PPI was designed to cover loan repayments in specific circumstances, like illness or redundancy. However, it was widely mis-sold, often to people who didn’t need it, couldn’t claim on it, or weren’t even aware they had it. Knowing the common reasons for mis-selling will help you articulate your own situation more effectively.

Typical reasons for mis-selling include being pressured into buying it, being told it was compulsory, not being asked about pre-existing medical conditions, or being self-employed when the policy wouldn’t cover you. Reflecting on how your policy was sold to you, or if you were even informed about it, is a crucial first step. Gathering any old paperwork related to your HSBC loans, credit cards, or mortgages where PPI might have been attached can provide vital evidence, even if you think you’ve shredded everything over the years. HSBC, like other banks, should have records, but having your own documents helps speed things along.

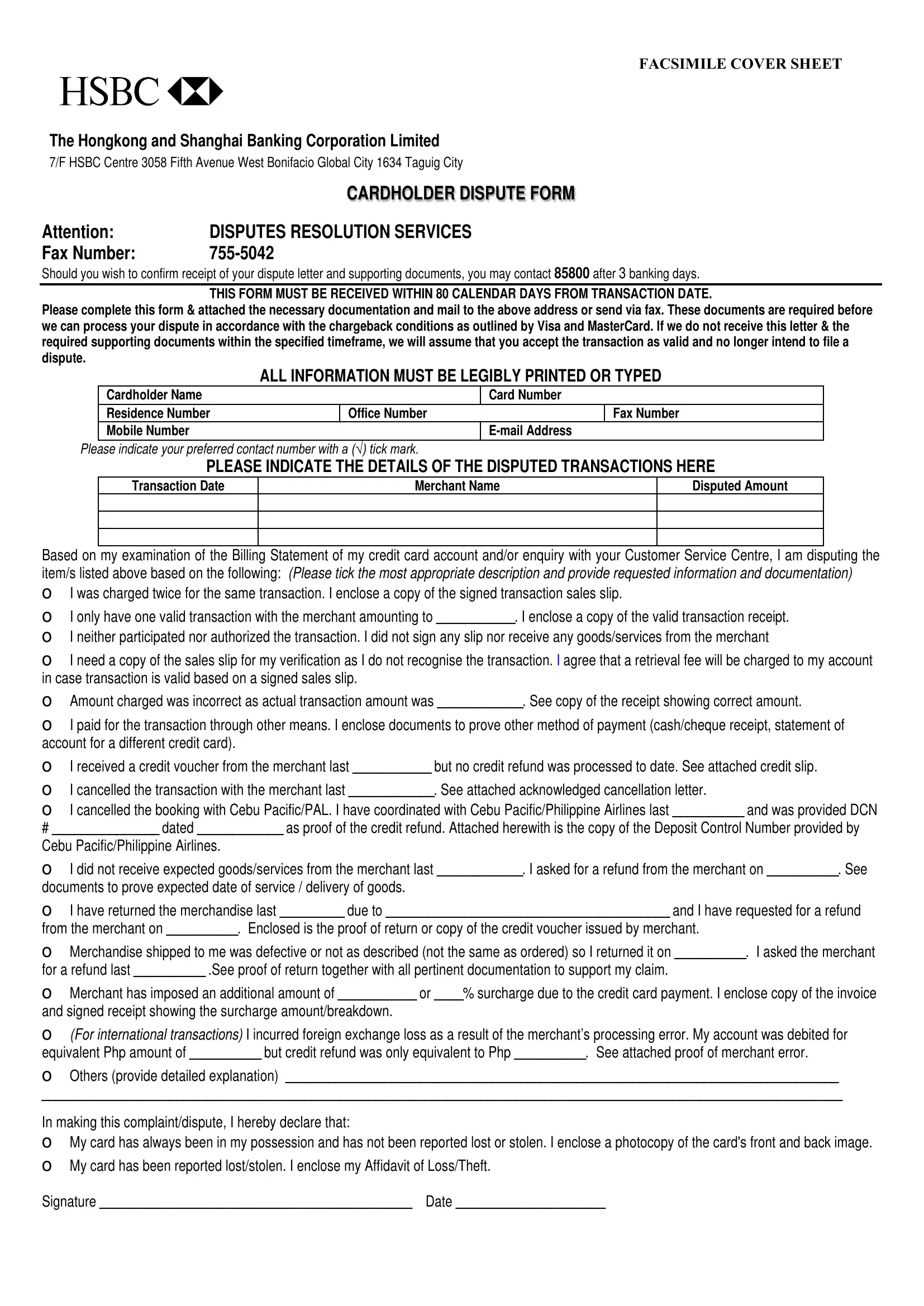

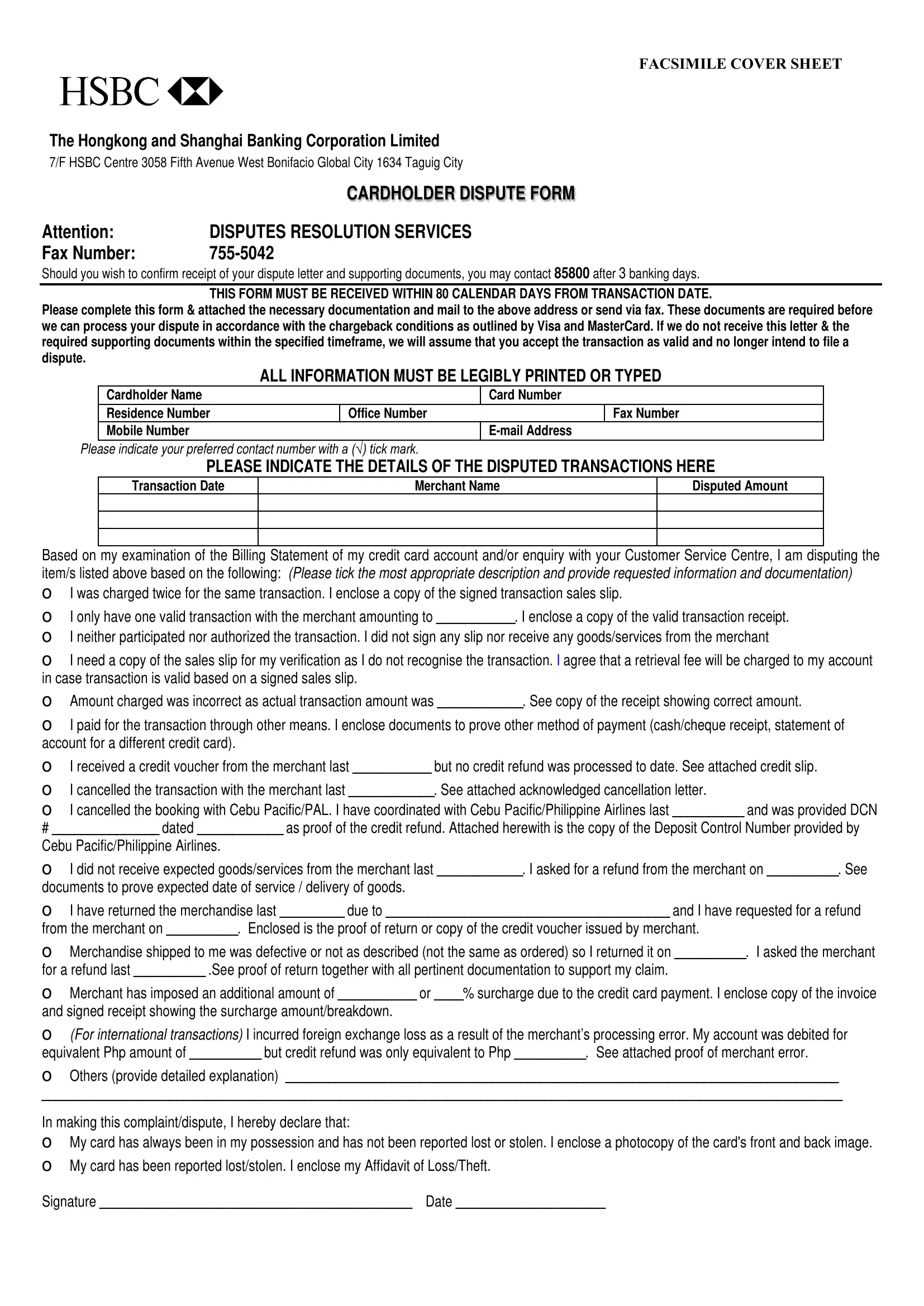

When you’re preparing your claim, clarity and factual accuracy are paramount. A template helps ensure you don’t miss any critical sections, but it’s your specific details that will make the claim stand out. You’ll need to clearly state which accounts or agreements you believe had PPI attached. Include account numbers, the approximate dates of the agreements, and the type of product (e.g., personal loan, credit card, mortgage). The more precise you can be, the easier it will be for HSBC to locate your records and investigate your complaint thoroughly. Don’t be afraid to explain in your own words why you feel the PPI was mis-sold, providing specific examples if you remember them.

Consider the emotional impact or financial detriment caused by the mis-selling, even if it feels difficult to quantify. Did paying for PPI prevent you from saving or cause financial strain? These details, while not strictly necessary for every claim, can add weight to your complaint and paint a fuller picture of the impact. The goal is to provide a complete and persuasive narrative of your experience, making it clear why you deserve compensation.

Key Information and Documents for Your Claim

To successfully complete any hsbc ppi claim form template, you’ll need to gather specific pieces of information and, ideally, any supporting documents you might have. Even if you don’t have everything, start with what you do have, as banks often retain extensive records. Here’s a helpful list to guide you:

- Your full name and current address

- Previous addresses if they were associated with the accounts in question

- Date of birth

- Contact telephone number and email address

- Account numbers for any loans, credit cards, mortgages, or other financial products where you suspect PPI was included (even if you only have an old statement with a partial number, it can help)

- Approximate dates when the accounts were opened and, if applicable, when they were closed

- Specific reasons why you believe the PPI was mis-sold to you (e.g., “I was not informed I was buying PPI,” “I was told it was mandatory,” “I was self-employed and the policy wouldn’t cover me”)

- Any supporting documentation you might possess, such as old policy documents, loan agreements, or bank statements showing PPI payments (even digital copies are useful)

Crafting Your Claim and What Happens Next

Once you have all your information ready, the process of filling out an hsbc ppi claim form template becomes much smoother. While there isn’t one universal official “template” from HSBC for PPI, many consumer advice websites and financial ombudsman services provide excellent guides and template letters that can be adapted. These templates generally ensure you cover all the necessary points, giving your claim the professional structure it needs. It’s often better to send your complaint in writing, either by post or through an online complaint portal if HSBC offers one. Keeping a copy for your own records is also crucial.

When writing your explanation, be concise but thorough. Avoid jargon and stick to the facts as you remember them. If you don’t remember specific dates, use “approximately” or “around.” The key is to be truthful and provide enough detail for HSBC to investigate your case fully. Remember, your claim isn’t about blaming individuals but about holding the institution accountable for what happened. A well-articulated claim, even without an official hsbc ppi claim form template, carries significant weight if it clearly outlines the grounds for mis-selling.

After you submit your claim, HSBC has a set period to respond, usually eight weeks. During this time, they will investigate your complaint. They may contact you for more information or to clarify details. It’s important to respond promptly to any such requests to avoid delays. They might offer you a settlement, reject your claim, or explain why they believe PPI was correctly sold. If you’re offered a settlement, review it carefully to ensure it seems fair, taking into account the premium paid plus statutory interest. If your claim is rejected, don’t despair; you have further options.

If you’re unhappy with HSBC’s final response, or if they haven’t responded within the eight-week timeframe, your next step is to escalate your complaint to the Financial Ombudsman Service (FOS). The FOS is an independent body that resolves disputes between consumers and financial businesses. They will review your case impartially and make a decision. Their service is free for consumers, and their decisions are binding on the financial institution. Many successful PPI claims were ultimately resolved through the FOS, even after initial rejections from banks.

- Submit your claim to HSBC, preferably in writing.

- Await HSBC’s final response, which should arrive within eight weeks.

- If unhappy with the response or no response, escalate to the Financial Ombudsman Service (FOS).

- Provide all relevant documentation and explanations to the FOS.

- Await the FOS’s decision, which is binding on HSBC.

Making a PPI claim can seem daunting at first, but with a clear understanding of the process and the right information at your fingertips, it becomes much more manageable. Taking the time to gather your details and present your case clearly is an investment in potentially reclaiming money that was rightfully yours.

Whether you’re starting from scratch or revisiting an old concern, remember that persistence often pays off. Many individuals have successfully navigated this path, and with the right approach, you could be among them. Good luck with your claim!