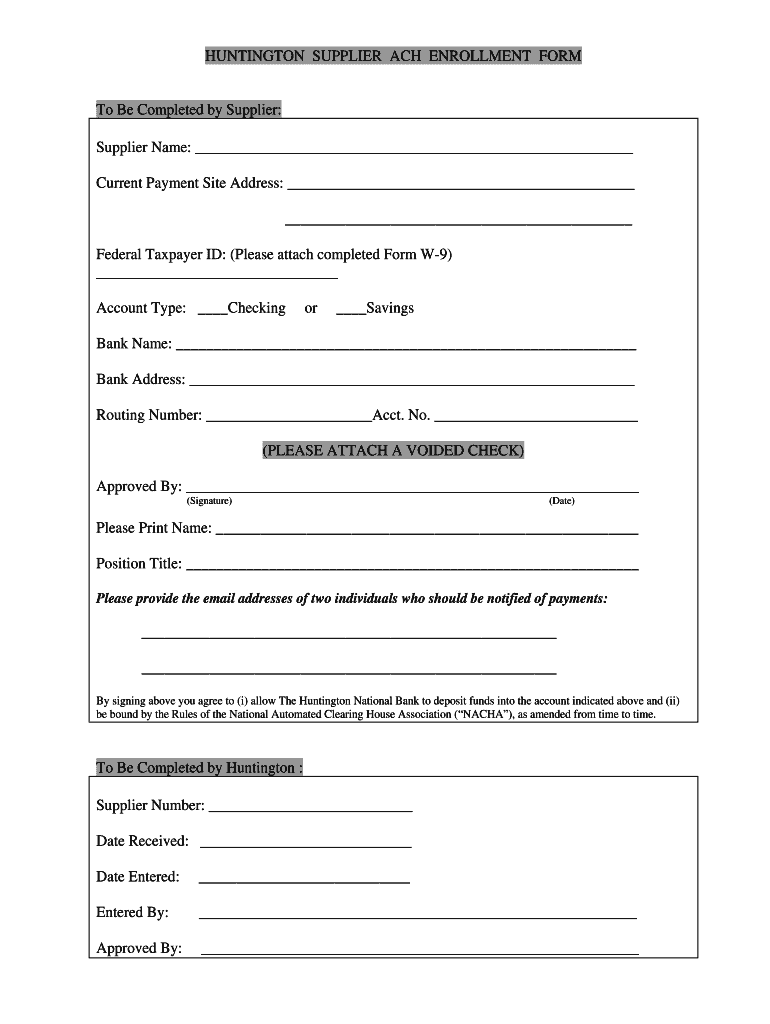

Navigating the world of electronic payments can sometimes feel a bit like deciphering a complex code, especially when you need to ensure every detail is perfectly aligned. For businesses and individuals alike, Automated Clearing House (ACH) payments have become an indispensable tool for everything from direct deposits to vendor payments, offering a reliable and cost-effective alternative to traditional checks or wire transfers. When you’re dealing with a reputable institution like Huntington Bank, understanding how to properly initiate these payments is key to smooth financial operations. Often, the path to hassle-free transactions begins with having the right form or template.

Whether you’re setting up recurring payments, making a one-time transfer, or managing payroll, accuracy is paramount. A well-structured form helps ensure that all necessary banking details, recipient information, and transaction specifics are captured correctly, minimizing errors and delays. While Huntington Bank provides robust online platforms and support for ACH services, having a clear template to organize your data beforehand can be a significant advantage, streamlining your process and giving you peace of mind that your payments will go through without a hitch.

Understanding ACH Payments and Why a Template Matters

ACH payments are essentially electronic transfers between bank accounts, processed through the ACH network. This system is a backbone of modern finance, facilitating billions of transactions annually, from direct deposit paychecks and Social Security benefits to bill payments and business-to-business transactions. Unlike wire transfers, which are typically real-time and more expensive, ACH transactions are batched and processed in cycles, making them a more economical choice for many routine payments. For anyone regularly interacting with Huntington Bank for such transactions, appreciating the mechanics of ACH is the first step towards efficiency.

The beauty of ACH lies in its efficiency and cost-effectiveness, but its precision relies heavily on accurate data. Every routing number, account number, and recipient name must be exact. Missing a digit or mistyping a name can lead to a rejected payment, causing delays, administrative headaches, and potentially missed deadlines or late fees. This is precisely where the concept of a dedicated form or a well-designed template comes into play. It acts as a structured checklist, guiding you through all the necessary fields, so nothing is overlooked before you initiate the payment with your bank, in this case, Huntington Bank.

Imagine you’re managing multiple vendor payments or setting up direct debit for numerous clients. Trying to remember every piece of information for each transaction, or simply jotting it down on a piece of scratch paper, is an open invitation for errors. A standardized form ensures consistency and completeness. It allows you to collect and verify all critical details in one place before you ever log into your online banking portal or submit a file to Huntington Bank. This pre-organization is a powerful tool for preventing common mistakes and ensuring a smooth payment flow.

Moreover, using a consistent template for your ACH payments can significantly improve your record-keeping. When you have a standardized document for each transaction, it becomes much easier to audit payments, track their status, and resolve any discrepancies that might arise. This level of organizational clarity is invaluable for both personal financial management and robust business accounting, making your interactions with Huntington Bank’s ACH services more transparent and reliable.

Key Information Needed for an ACH Payment

- **Your Bank Information (Originator):** This includes your Huntington Bank account number and routing number from which the payment will be debited.

- **Recipient Bank Information (Receiver):** The recipient’s bank name, routing number, and account number.

- **Recipient Details:** The full legal name of the individual or business receiving the payment.

- **Payment Type:** Whether it’s a debit (pulling money from someone else’s account) or a credit (sending money to someone else’s account).

- **Amount:** The exact dollar amount of the payment.

- **Effective Date:** The date the payment should be processed.

- **Purpose of Payment:** A brief description or memo for the transaction.

Finding and Utilizing Your Huntington Bank ACH Payment Form Template

While Huntington Bank itself offers secure online portals and direct file submission options for ACH, they might not provide a single, universal “huntington bank ach payment form template” downloadable for external use in the traditional sense, as much of their system is integrated electronically. However, this doesn’t mean you can’t create or find a highly effective template to prepare your data. Many businesses choose to design their own internal forms, often using spreadsheet software or simple word processing documents, tailored to their specific needs while ensuring all necessary fields for an ACH payment are covered. This self-created template can then serve as your primary data collection tool.

A good starting point for building your own template is to review the information required by Huntington Bank when you initiate an ACH payment through their online banking platform or speak with a representative about setting up ACH services. You’ll quickly notice a consistent set of data points they ask for. By mirroring these fields in your personal or business template, you ensure compatibility and completeness. Additionally, various financial software solutions and accounting platforms often include built-in ACH payment features that guide you through data entry, acting as a dynamic template themselves.

When utilizing any form or template, whether it’s one you’ve created or one provided by a third-party software, meticulous data entry is non-negotiable. Double-check every number and letter, especially routing and account numbers. A common practice is to have a second person review the information before submission, acting as an extra layer of verification. This simple step can prevent costly errors and the inconvenience of payment reversals or rejections, which can sometimes incur fees from the bank.

Furthermore, consider adding fields to your template that are helpful for your own internal record-keeping, even if they aren’t strictly required by Huntington Bank for the ACH transfer itself. This could include things like an internal reference number, the department responsible for the payment, or specific project codes. The more comprehensive your template, the more valuable it becomes as a tool for both preparing payments and maintaining accurate financial records for your business or personal finances.

Ultimately, whether you’re handling a few occasional transfers or managing a high volume of transactions, having a clear and comprehensive approach to ACH payment preparation is invaluable. By organizing your information consistently and accurately, you’re not just making a payment; you’re building a foundation for efficient financial operations. This proactive approach ensures that your transactions with Huntington Bank are processed smoothly, reliably, and without unnecessary hurdles, contributing to your overall financial well-being and operational success.

Embracing the convenience of electronic payments means embracing precision. The effort you put into using or creating a thorough template pays dividends in saved time, reduced stress, and accurate financial reporting. It’s a small but mighty step toward mastering your financial flows and ensuring your funds move exactly where and when they need to be, every single time.