A structured approach to cash flow reporting enhances comparability across different entities and reporting periods. This consistency allows stakeholders, including investors and creditors, to analyze financial performance more effectively and make informed decisions. Furthermore, adherence to a standard framework promotes transparency and accountability in financial reporting, contributing to greater trust in the capital markets.

This article will further explore the specific requirements of IAS 7, delving into the classifications of cash flows and providing practical guidance on preparing a compliant statement. Examples and illustrative scenarios will be used to demonstrate the standard’s application in various contexts.

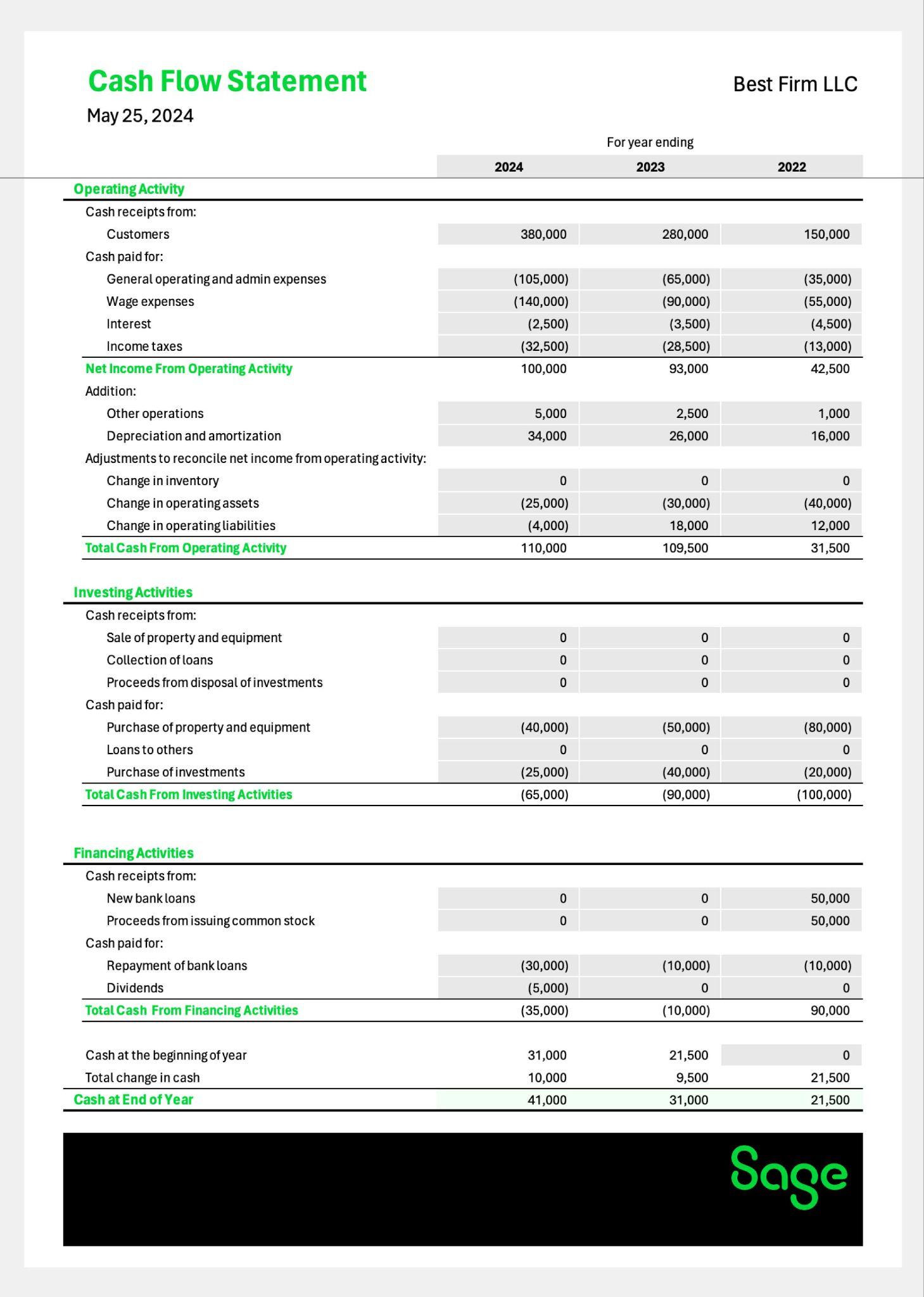

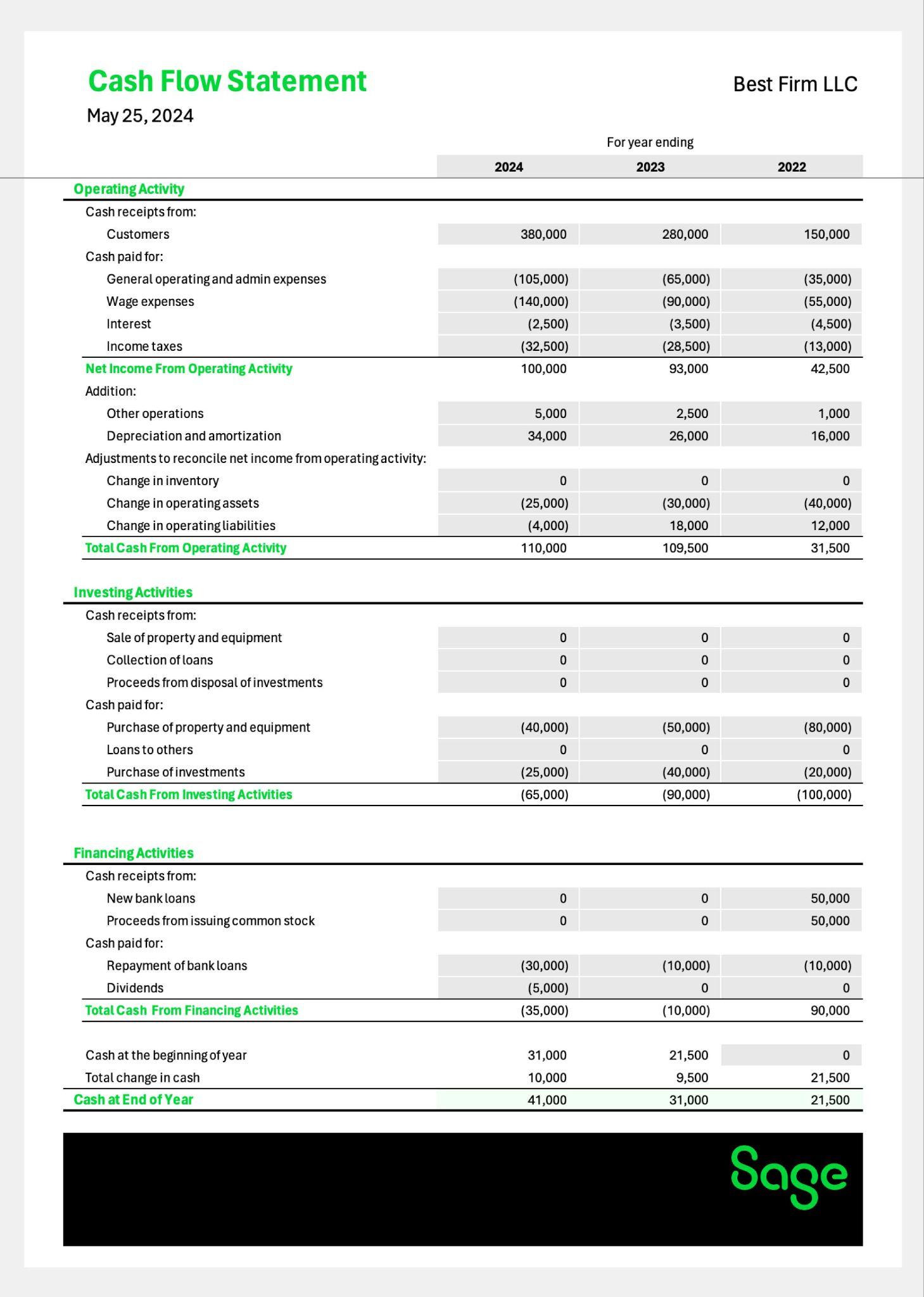

1. Operating Activities

Operating activities represent the principal revenue-producing activities of an entity and other activities that are not investing or financing activities. Proper presentation within the statement of cash flows, as required by IAS 7, is essential for understanding an entity’s core business performance and its ability to generate cash from those operations.

- Cash Receipts from CustomersThis represents the inflow of cash from the sale of goods or services. It’s a fundamental element in assessing the entity’s core revenue generation. IAS 7 mandates clear disclosure of these receipts, providing crucial insight into the entitys operating cycle and revenue recognition practices.

- Cash Payments to SuppliersThese outflows represent payments for goods and services necessary for ongoing operations. Analyzing these payments, as presented within the IAS 7 framework, offers insights into an entity’s cost management and working capital efficiency.

- Cash Payments to EmployeesSalaries, wages, and other benefits paid to employees are classified as operating activities. This component offers valuable insight into the entitys labor costs and their impact on overall profitability. Transparent reporting, in line with IAS 7, helps stakeholders understand the entitys human capital investment.

- Interest and Taxes PaidWhile interest and tax payments have elements related to financing and other activities, IAS 7 generally classifies them as operating activities. Including these cash flows within operating activities facilitates an assessment of the entity’s overall cash generation from its core business operations before considering the impact of financing decisions.

Accurate presentation of operating activities, as guided by IAS 7, provides stakeholders with a clear picture of an entity’s financial health. This understanding of core business performance is critical for investment decisions, credit assessments, and evaluating the long-term sustainability of the entitys operations.

2. Investing Activities

Investing activities within the context of IAS 7 encompass acquisitions and disposals of long-term assets and other investments not included in cash equivalents. These activities offer crucial insights into an entity’s strategic capital allocation decisions and their potential impact on future financial performance. The standard mandates specific disclosures, enabling stakeholders to assess management’s effectiveness in utilizing resources for long-term growth and value creation.

Acquisitions of property, plant, and equipment (PP&E) represent a significant category within investing activities. Cash outflows related to these purchases reflect investments in tangible assets essential for operations. Conversely, proceeds from the sale of PP&E represent cash inflows. Analyzing these flows helps stakeholders gauge the entity’s capital expenditure strategy, asset renewal cycle, and potential gains or losses on disposals. For example, a significant investment in new manufacturing facilities might signal expansion plans, while substantial disposals could indicate restructuring or divestment strategies.

Investments in other entities, including subsidiaries and joint ventures, also fall under investing activities. Cash outflows for acquisitions and inflows from divestments provide insights into the entity’s portfolio management strategy. These flows can signal diversification efforts, strategic alliances, or exits from underperforming investments. Furthermore, changes in long-term loan receivables and investments in securities are classified as investing activities, offering a comprehensive view of the entity’s investment portfolio and its potential impact on future cash flows. Understanding these activities through the framework provided by IAS 7 equips stakeholders with the necessary information to assess an entity’s long-term growth prospects and overall financial health.

3. Financing Activities

Financing activities, as defined within IAS 7, encompass transactions that alter the equity and borrowing structure of an entity. These activities provide crucial insights into how an entity obtains and manages its funding, offering stakeholders a clear picture of its capital structure and financial risk profile. The standard mandates specific disclosures, allowing for detailed analysis of an entity’s reliance on debt versus equity financing and its ability to meet long-term obligations.

Cash flows from equity financing include proceeds from issuing shares, repurchasing shares, and paying dividends. These transactions reflect the entity’s interactions with its shareholders. For instance, issuing new shares can indicate a need for capital to fund growth initiatives, while share repurchases might suggest management’s belief that the company’s stock is undervalued. Dividend payments, on the other hand, represent a return on investment for shareholders and can signal financial stability. Analyzing these flows within the framework of IAS 7 allows stakeholders to understand the entity’s equity funding strategy and its implications for shareholder value.

Debt financing activities include proceeds from borrowing and repayments of principal on loans. These flows reflect the entity’s reliance on debt capital. An increasing level of borrowing might indicate expansion plans or financial distress, while consistent principal repayments can signal financial discipline. IAS 7 requires clear disclosure of these cash flows, allowing stakeholders to assess the entity’s debt burden, its ability to service debt, and the associated financial risks. For example, a company consistently generating cash flow from operations and using it to reduce its debt load might be perceived as financially stronger than one relying heavily on new borrowing to meet its obligations.

Understanding financing activities within the context of IAS 7 allows for a comprehensive assessment of an entity’s financial stability and long-term viability. Analyzing these flows in conjunction with operating and investing activities provides a holistic view of the entity’s financial health, equipping stakeholders with the information necessary for informed decision-making. It enables them to evaluate the entity’s capital structure, its ability to generate cash flow to meet its financing obligations, and its overall financial risk profile.

4. Standard Format

The standard format mandated by IAS 7 for the cash flow statement ensures consistency and comparability in financial reporting. This standardized structure facilitates analysis across different entities and over time, enabling stakeholders to assess financial performance and make informed decisions based on a common framework. The format classifies cash flows into three principal activities: operating, investing, and financing, providing a clear picture of an entity’s cash generation and usage. Without a standard format, analyzing and comparing cash flow information across different companies would be significantly more challenging, potentially hindering investment decisions and market efficiency.

Consider two companies operating in the same industry: one presents cash flows using a customized format, while the other adheres to the IAS 7 standard. An investor attempting to compare their performance would face difficulties due to inconsistencies in classification and presentation. The standardized format eliminates this ambiguity. For example, the classification of interest paid as an operating activity under IAS 7 ensures consistent treatment across entities, unlike a scenario where one company might classify it as a financing activity, distorting comparisons. This standardization allows investors to focus on the underlying performance rather than deciphering different reporting methodologies. Furthermore, lenders can more effectively assess creditworthiness by comparing cash flow generation from core operations (operating activities) across potential borrowers.

Adherence to the standard format promotes transparency and accountability in financial reporting. This structured approach reduces the potential for manipulation or misrepresentation of cash flow information. By requiring consistent classification and presentation, IAS 7 enhances the reliability and credibility of financial statements, fostering trust among stakeholders. This standardization benefits the broader financial ecosystem by enabling efficient capital allocation and promoting market integrity. Challenges can arise in applying the standard format to complex transactions or specific industry practices. However, the overall benefits of comparability, transparency, and enhanced decision-making significantly outweigh these challenges, reinforcing the importance of the standard format as a cornerstone of robust financial reporting under IAS 7.

5. Cash Flow Classification

Cash flow classification is integral to the IAS 7 cash flow statement template. The standard mandates specific classifications for operating, investing, and financing activities, ensuring consistent and comparable reporting. This structured approach allows stakeholders to analyze an entity’s cash flows effectively, understand its core business performance, investment strategies, and financing methods. Without proper classification, the statement loses its analytical value, hindering informed decision-making. For example, misclassifying a loan repayment as an operating activity instead of a financing activity distorts the true picture of an entity’s operating cash flow and debt management practices.

IAS 7 provides detailed guidance on classifying specific cash flows. For instance, interest paid is generally classified as an operating activity, while interest received can be classified as operating, investing, or financing depending on the nature of the underlying transaction. Similarly, dividends paid are typically classified as financing activities, while dividends received can be classified as operating or investing. These classifications, while seemingly nuanced, significantly impact the interpretation of the statement. A company receiving substantial dividends from investments might appear to have strong operating cash flow if these dividends were misclassified as operating activities, obscuring the true source of cash generation.

Accurate cash flow classification ensures transparency and enhances the reliability of financial statements. It allows stakeholders to assess an entity’s liquidity, solvency, and financial flexibility. Challenges can arise when classifying complex transactions, requiring careful consideration of the underlying economic substance. However, adherence to the classification principles outlined in IAS 7 provides a robust framework for consistent and meaningful reporting. Understanding these classifications is crucial for anyone analyzing financial statements prepared under IAS 7, enabling informed assessments of an entity’s financial health and performance. This understanding empowers stakeholders to make sound investment decisions, assess creditworthiness, and evaluate the long-term sustainability of an entity’s operations.

Key Components of an IAS 7 Cash Flow Statement

An IAS 7 compliant cash flow statement comprises specific elements crucial for comprehensive financial reporting. These components provide a structured view of an entity’s cash flows, enabling stakeholders to assess its financial health and performance.

1. Operating Activities: These represent the principal revenue-producing activities and other activities not considered investing or financing. Examples include cash receipts from customers, payments to suppliers and employees, and interest and taxes paid. Accurate presentation of operating activities is essential for understanding an entity’s core business performance.

2. Investing Activities: These encompass acquisitions and disposals of long-term assets and other investments not included in cash equivalents. Key examples include purchases and sales of property, plant, and equipment (PP&E), investments in other entities, and changes in long-term loan receivables. Analyzing investing activities provides insights into an entity’s strategic capital allocation decisions.

3. Financing Activities: These activities involve transactions that alter the equity and borrowing structure of an entity. Examples include proceeds from issuing shares, share repurchases, dividend payments, proceeds from borrowing, and repayments of principal on loans. Understanding financing activities reveals how an entity obtains and manages its funding.

4. Standard Format: IAS 7 mandates a specific format for presenting cash flows, ensuring consistency and comparability across different entities and reporting periods. This standardized structure classifies cash flows into the three core activities mentioned above, facilitating effective analysis and informed decision-making.

5. Cash Flow Classification: Proper classification of cash flows into operating, investing, or financing activities is critical for accurate reporting. IAS 7 provides detailed guidance on classifying specific cash flows, ensuring consistent treatment and enhancing the reliability of financial statements. This standardized classification is essential for meaningful analysis and interpretation of the statement.

These components, when presented accurately and in accordance with IAS 7, provide a transparent and comprehensive overview of an entity’s cash flows. This detailed insight enables stakeholders to assess its liquidity, solvency, financial flexibility, and overall financial health, facilitating informed assessments and sound decision-making.

How to Create an IAS 7 Cash Flow Statement

Creating a compliant IAS 7 cash flow statement requires a systematic approach, incorporating key data from financial records and adhering to specific classifications. The following steps outline the process:

1: Determine the Reporting Period: Specify the start and end dates for the reporting period, ensuring consistency with other financial statements.

2: Identify Cash Flows from Operating Activities: Begin with net profit/loss and adjust for non-cash items like depreciation and amortization. Include changes in working capital, such as accounts receivable, accounts payable, and inventory. Classify interest paid and income taxes paid within operating activities.

3: Identify Cash Flows from Investing Activities: Analyze changes in long-term assets. Include cash flows from acquiring or disposing of property, plant, and equipment (PP&E), investments in other entities, and changes in long-term loan receivables.

4: Identify Cash Flows from Financing Activities: Analyze changes in equity and debt. Include proceeds from issuing or repurchasing shares, dividend payments, proceeds from borrowing, and repayments of principal on loans.

5: Calculate Net Increase/Decrease in Cash and Cash Equivalents: Sum the net cash flows from operating, investing, and financing activities.

6: Reconcile Beginning and Ending Cash Balances: Confirm the calculated net increase/decrease in cash aligns with the difference between the beginning and ending cash and cash equivalents balances.

7: Disclose Non-Cash Investing and Financing Activities: Report significant non-cash transactions, such as acquiring assets through debt assumption or issuing shares for assets, in a separate note or supplementary schedule.

8: Review and Verify: Thoroughly review the completed statement for accuracy and completeness, ensuring compliance with all IAS 7 requirements.

A meticulously prepared statement provides a clear and comprehensive overview of an entity’s cash flows, enabling informed assessments of its financial performance, liquidity, and solvency. This structured approach facilitates comparability across different entities and reporting periods, enhancing transparency and promoting sound financial analysis.

Adherence to the International Accounting Standard 7 (IAS 7) framework provides a structured approach to cash flow reporting, enabling stakeholders to gain valuable insights into an entity’s financial health. The standard’s emphasis on classifying cash flows into operating, investing, and financing activities offers a transparent view of cash generation and usage. This structured presentation facilitates informed decision-making by investors, creditors, and other stakeholders. Furthermore, the consistent format promotes comparability across different entities and reporting periods, enhancing market efficiency and fostering trust in financial reporting. Through accurate classification and presentation, a clear picture emerges of an entity’s ability to generate cash from core operations, its strategic investment decisions, and its financing strategies.

Understanding and applying the principles of IAS 7 is crucial for anyone involved in preparing, analyzing, or interpreting financial statements. As financial markets continue to evolve, the importance of transparent and standardized cash flow reporting remains paramount. This rigorous approach to financial reporting strengthens the overall financial ecosystem by enabling informed resource allocation and promoting sustainable economic growth. Consistent application of IAS 7 contributes to greater financial transparency, ultimately fostering stability and confidence within the global financial landscape.