In today’s dynamic world, organizations and individuals often contribute more than just money. They offer their valuable time, skills, and resources, known as in-kind services. These non-cash donations, whether it’s pro-bono legal work, skilled volunteer hours, or donated professional advice, are incredibly beneficial and form a crucial part of many operations, especially for non-profits, startups, and community groups. However, effectively tracking and valuing these contributions is paramount for transparency, accountability, and even for tax purposes. Without proper documentation, the true impact and value of these generous gestures can easily be overlooked or mismanaged, leading to potential compliance issues or missed opportunities for recognition.

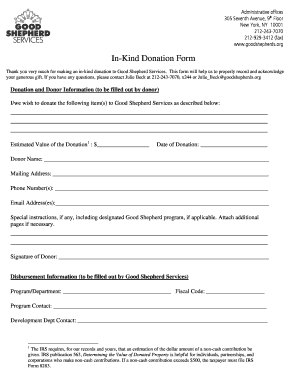

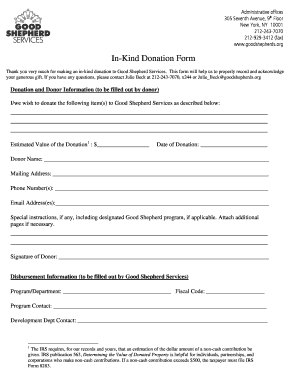

This is where a robust and reliable in kind services form template comes into play. Imagine having a straightforward, standardized way to record every hour of volunteer time, every expert consultation, or every piece of equipment lent. Such a template simplifies the entire process, ensuring that every detail is captured accurately and consistently. It moves you away from scattered notes and informal agreements to a professional, auditable record, making it easier to report on impact, apply for grants, or even claim tax deductions. Having a dedicated form not only streamlines administrative tasks but also reinforces the value of the contributions, demonstrating respect and appreciation for those who offer their services.

Why an In Kind Services Form Template is a Game-Changer

The importance of meticulously documenting every form of contribution cannot be overstated, especially when it comes to non-cash donations like in-kind services. For many organizations, particularly non-profits relying heavily on community support, these services represent a significant portion of their operational budget and capacity. Proper documentation ensures clarity for all parties involved, providing a clear record of what was contributed, by whom, and for what purpose. This level of transparency builds trust with donors, stakeholders, and regulatory bodies, showcasing responsible stewardship of resources, whether monetary or service-based.

Beyond mere transparency, there are tangible legal and financial benefits associated with well-documented in-kind contributions. For eligible organizations, these services can sometimes be assigned a fair market value, which can then be reported as income or support. This is crucial for grant reporting, demonstrating organizational capacity, and in some cases, for supporting tax deductions for the donor. An auditable trail, facilitated by a comprehensive in kind services form template, becomes invaluable during financial reviews or audits, proving the legitimacy and valuation of these non-monetary assets. Without it, valuing and acknowledging these contributions becomes arbitrary and prone to dispute.

Key Elements of an Effective In Kind Services Form Template

- **Contributor Information:** Full name, contact details, organization (if applicable).

- **Service Description:** A detailed explanation of the service provided, including specific tasks performed.

- **Date and Duration:** The dates the service was rendered and the total hours or period involved.

- **Valuation Method and Amount:** How the service was valued (e.g., professional hourly rate, market rate) and the total estimated fair market value.

- **Recipient/Project:** The specific program, project, or department that benefited from the service.

- **Authorization Signatures:** Signatures from both the contributor and an authorized representative of the receiving organization.

- **Terms and Conditions:** Any specific agreements or understandings related to the service.

Ultimately, a standardized template significantly simplifies what could otherwise be a cumbersome administrative process. It reduces the likelihood of errors, ensures that all necessary information is captured consistently, and minimizes the time spent on manual data entry or follow-up questions. By providing a clear framework, it empowers both the service provider and the recipient to accurately record and acknowledge the value of the contribution, moving beyond informal handshake agreements to professional, auditable documentation. This streamlined approach frees up valuable time and resources, allowing organizations to focus more on their core mission rather than getting bogged down in administrative complexities.

How to Customize and Use Your In Kind Services Form Template Effectively

While a generic in kind services form template provides a solid foundation, its true power lies in its ability to be customized to fit the unique needs and operational specifics of your organization. Every entity, whether a small local charity or a large international NGO, will have slightly different requirements for tracking, valuation, and reporting in-kind contributions. Taking the time to tailor the template by adding fields relevant to your projects, incorporating your organization’s branding, or adjusting the valuation methodology to align with your internal policies ensures that the form is not just a document but a truly integrated part of your administrative workflow. This personalization makes the form more user-friendly for both your team and your generous contributors, fostering greater accuracy and compliance.

Once customized, effectively using the template involves a few key steps. First, ensure that all parties involved understand the purpose of the form and how to complete it accurately. Provide clear instructions for contributors on how to describe their services and, if applicable, how to assist in valuing their contribution. For your internal team, establish a clear process for reviewing submissions, assigning fair market values where needed, and obtaining the necessary signatures. Consistency in data entry is vital, as this forms the basis for all future reports and audits. It’s also beneficial to have a designated person or team responsible for managing these forms to ensure continuity and accuracy.

Valuing in-kind services can sometimes be the trickiest part, but it’s crucial for accurate financial reporting. The general principle is to assign a fair market value for the service provided. This might involve researching professional rates for similar services in your area, using established hourly rates for certain professions, or referring to recognized valuation guides. For instance, if a lawyer provides pro-bono legal counsel, their standard hourly rate could be used as the basis for valuation. Transparency in how values are determined should be maintained, and it’s often wise to have a clear policy on valuation methods that is consistently applied. This minimizes discrepancies and supports the integrity of your financial records.

Finally, effective management extends to the storage and maintenance of these valuable records. Completed in-kind services forms should be stored securely, whether in a digital database or a physical filing system, ensuring they are easily retrievable for reporting, auditing, or donor recognition purposes. Consider implementing a systematic approach to archiving, perhaps categorizing forms by project, date, or donor. Regularly review your stored forms to ensure data integrity and to identify any trends in contributions that could inform future fundraising or resource allocation strategies. Proper record-keeping not only ensures compliance but also provides valuable insights into the non-monetary support your organization receives, highlighting the collective effort that drives its success.

Harnessing the power of a well-designed and consistently used in-kind services form can significantly elevate an organization’s ability to track, value, and acknowledge the crucial non-monetary contributions it receives. By bringing structure and professionalism to the documentation of these valuable services, you not only ensure compliance and transparency but also gain a clearer picture of the full spectrum of support that fuels your mission. This foundational tool allows you to confidently report on the true scope of your resources, showcasing the generous spirit of your community and its profound impact.

Ultimately, embracing a standardized approach to tracking in-kind services empowers organizations to operate with greater efficiency and accountability. It transforms what could be an administrative challenge into a streamlined process, enabling you to better recognize your supporters and leverage every contribution, big or small. This dedication to detailed record-keeping fortifies your operational integrity and lays a solid groundwork for continued growth and success in achieving your objectives.