Utilizing a structured format offers several advantages. It facilitates consistent reporting, simplifies analysis of financial trends, and aids in comparing performance across different periods or against industry benchmarks. This structured approach promotes transparency and allows for better financial planning and control.

This foundational understanding allows for deeper exploration of key components such as revenue streams, cost structures, and the factors influencing profitability. The following sections will delve into these aspects in detail.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of the income profit and loss statement. It represents the total income generated from the sale of goods or services before any deductions. Accurately recording and analyzing revenue is paramount for understanding financial performance and making informed business decisions. Revenue directly impacts profitability; higher revenue, assuming controlled costs, leads to greater profit. Conversely, declining revenue can signal market challenges or internal operational issues. For example, a software companys revenue might primarily come from subscription fees, while a retailers revenue stems from product sales. Understanding the sources and drivers of revenue is crucial for evaluating a company’s business model and growth potential.

The relationship between revenue and the income profit and loss statement is causal. Revenue figures initiate the cascade of calculations that determine gross profit, operating income, and ultimately, net income. Analyzing revenue trends over time provides insights into business growth, market share, and pricing strategies. For instance, consistently increasing revenue might indicate successful product launches or effective marketing campaigns. A decline in revenue could necessitate cost-cutting measures, pricing adjustments, or strategic pivots in the business model. Furthermore, comparing a company’s revenue growth to industry averages provides a benchmark for assessing competitive performance.

Analyzing revenue within the context of the income profit and loss statement offers crucial insights into a companys financial health and sustainability. Challenges in accurately recording revenue, such as complex revenue recognition rules or potential for fraud, can significantly impact the reliability of the entire statement. Therefore, robust internal controls and transparent accounting practices are essential. Understanding revenue streams and their influence on overall profitability enables stakeholders to assess investment opportunities, evaluate management effectiveness, and make strategic decisions for long-term success.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within the income profit and loss statement, COGS plays a crucial role in determining gross profit and ultimately, net income. Understanding COGS is essential for evaluating a company’s profitability and operational efficiency.

- Direct CostsCOGS encompasses direct costs, including raw materials, direct labor, and manufacturing overhead. For a furniture manufacturer, direct costs include wood, fabric, wages of production staff, and factory utilities. Excluding indirect costs like marketing or administrative expenses is crucial for accurate COGS calculation. Accurately allocating these costs directly impacts gross profit and subsequent profitability metrics.

- Inventory ValuationThe method used to value inventory (FIFO, LIFO, weighted average) directly affects COGS. During periods of inflation, FIFO (First-In, First-Out) generally results in a lower COGS and higher net income compared to LIFO (Last-In, First-Out). Choosing an appropriate inventory valuation method significantly impacts the income statement and requires careful consideration of its financial implications.

- Gross Profit CalculationCOGS is subtracted from revenue to arrive at gross profit. A higher COGS reduces gross profit, signaling potential issues with production costs, pricing strategies, or inventory management. For instance, a retailer experiencing rising COGS alongside stagnant revenue may need to re-evaluate supplier relationships or optimize inventory levels. Analyzing gross profit trends helps assess a company’s efficiency in managing production and sales.

- Impact on ProfitabilityCOGS directly impacts a company’s bottom line. Effectively managing COGS through efficient production processes, strategic sourcing, and optimized inventory control is essential for maximizing profitability. A company with strong revenue growth but poorly managed COGS might exhibit declining profitability, indicating operational inefficiencies. Therefore, analyzing COGS in relation to revenue and other expenses is vital for a comprehensive understanding of financial performance.

COGS provides crucial insights into a company’s operational efficiency and profitability. Analyzing COGS within the broader context of the income profit and loss statement allows stakeholders to assess the effectiveness of cost management strategies and make informed decisions regarding pricing, production, and inventory control. By understanding the relationship between COGS, revenue, and other expenses, investors and management can gain a comprehensive view of a company’s financial health and potential for future growth.

3. Gross Profit

Gross profit, a key metric within the income profit and loss statement, represents the profitability of a company’s core business operations after accounting for the direct costs of producing goods or services. It provides a crucial link between revenue and overall profitability, offering insights into a company’s pricing strategies, production efficiency, and cost management effectiveness. Understanding gross profit is essential for assessing a company’s financial health and its ability to generate profit from its primary business activities.

- Calculation and InterpretationGross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. A higher gross profit margin indicates a greater ability to generate profit from each dollar of sales. For example, a software company with high gross margins suggests lower relative production costs compared to a manufacturing company with typically lower margins. Analyzing gross profit trends over time provides insights into pricing power, cost control, and overall operational efficiency.

- Relationship with Revenue and COGSGross profit serves as a bridge between revenue and other profitability metrics. Changes in either revenue or COGS directly impact gross profit. For instance, if revenue remains constant but COGS increases, gross profit will decrease, signaling potential production inefficiencies or rising material costs. Therefore, monitoring the relationship between revenue, COGS, and gross profit is crucial for assessing the sustainability of a company’s profitability.

- Industry Benchmarks and ComparisonsComparing a company’s gross profit margin to industry averages provides valuable context for evaluating performance. Industries with high barriers to entry often exhibit higher gross margins compared to highly competitive industries. For example, pharmaceutical companies typically enjoy higher margins than retail companies due to patent protection and lower competition. Benchmarking against competitors highlights strengths and weaknesses in pricing strategies and cost management.

- Impact on Operating Income and Net IncomeGross profit forms the basis for calculating operating income and subsequently, net income. A healthy gross profit provides a cushion for absorbing operating expenses, contributing to higher operating and net income. Conversely, a declining gross profit margin can erode profitability, even if revenue remains stable. Understanding the flow of profitability from gross profit to net income is essential for assessing a company’s overall financial performance.

Analyzing gross profit within the context of the income profit and loss statement provides crucial insights into a company’s core business profitability and its ability to manage costs effectively. By examining gross profit trends, industry comparisons, and the relationship between revenue and COGS, stakeholders can gain a comprehensive understanding of a company’s financial health and potential for future growth. This analysis forms a foundation for informed decision-making regarding pricing strategies, cost optimization, and overall business strategy.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within the income profit and loss statement, operating expenses play a crucial role in determining a company’s operating income and ultimately, net income. Analyzing operating expenses provides essential insights into a company’s efficiency, cost structure, and overall profitability.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass costs related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, rent, office supplies, and legal fees. High SG&A expenses can impact profitability; therefore, monitoring and controlling these costs is crucial for maximizing operating income. For example, a rapidly growing company might experience increasing SG&A expenses as it expands its sales force and marketing efforts. Analyzing SG&A as a percentage of revenue helps assess the efficiency of these expenditures.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. These costs can be significant for technology or pharmaceutical companies, reflecting their commitment to innovation. While R&D expenses may not generate immediate revenue, they are crucial for long-term growth and competitiveness. For instance, a pharmaceutical company investing heavily in R&D might experience lower short-term profits but potentially higher profits in the future if new drugs are successfully developed and commercialized.

- Depreciation and AmortizationDepreciation and amortization represent the allocation of the cost of long-term assets over their useful lives. Depreciation applies to tangible assets like buildings and equipment, while amortization applies to intangible assets like patents and copyrights. These non-cash expenses reduce reported income but do not represent actual cash outflows. Understanding the impact of depreciation and amortization on profitability is crucial for assessing a company’s true cash flow generation.

- Impairment ChargesImpairment charges reflect a reduction in the value of an asset below its carrying amount on the balance sheet. This can occur due to various factors, such as technological obsolescence, changes in market conditions, or damage to the asset. Impairment charges are recognized as an expense on the income statement, reducing profitability in the period they occur. For example, a technology company might incur an impairment charge if its software becomes obsolete due to rapid technological advancements.

Analyzing operating expenses within the income profit and loss statement provides crucial insights into a company’s cost structure, operational efficiency, and overall profitability. Understanding the various categories of operating expenses, their drivers, and their impact on the bottom line allows stakeholders to assess a company’s ability to manage costs, generate sustainable profits, and invest in future growth. Comparing operating expenses to industry benchmarks and analyzing trends over time provides valuable context for evaluating a company’s financial performance and making informed investment decisions.

5. Operating Income

Operating income, a key performance indicator within the income profit and loss statement, reveals the profitability of a company’s core business operations after accounting for both the direct costs of goods sold (COGS) and operating expenses. It provides a crucial measure of a company’s operational efficiency and its ability to generate profit from its primary business activities, excluding any income or expenses unrelated to core operations. Understanding operating income is essential for assessing a company’s management effectiveness and its ability to generate sustainable profits.

- Relationship to Gross Profit and Operating ExpensesOperating income is derived by subtracting operating expenses from gross profit. This calculation highlights the impact of operating expenses on a company’s overall profitability. High operating expenses can significantly reduce operating income, even if gross profit is strong. For example, a retail company with efficient inventory management (leading to high gross profit) might still report low operating income due to high rent and marketing expenses. Analyzing the relationship between gross profit and operating expenses provides insights into a company’s cost structure and its ability to control operational costs.

- Indicator of Core Business PerformanceOperating income focuses solely on the profitability of a company’s core business operations. It excludes non-operating items such as interest income, investment gains, or restructuring charges, providing a clearer picture of the performance of the primary business. For example, a manufacturing company with substantial investment income might report high net income, but its operating income might be lower, revealing potential challenges within its core manufacturing operations. This distinction allows for a more focused analysis of a company’s operational strengths and weaknesses.

- Impact on Net IncomeOperating income forms a crucial link between a company’s core business operations and its overall profitability, as reflected in net income. While net income considers all revenues and expenses, operating income isolates the profitability derived from core operations. Analyzing operating income helps understand how effectively a company’s core business contributes to its bottom line. A consistently high operating income provides a strong foundation for achieving sustainable net income growth.

- Benchmarking and Trend AnalysisComparing a company’s operating income margin (operating income as a percentage of revenue) to industry averages and tracking its trend over time provides valuable insights into its performance and efficiency relative to competitors. A consistently improving operating margin suggests effective cost management and operational improvements. Conversely, a declining operating margin might signal operational inefficiencies or increasing competitive pressures. This analysis allows stakeholders to assess a company’s competitive position and identify areas for potential improvement.

Operating income, a cornerstone of the income profit and loss statement, provides a crucial lens for evaluating a company’s core business profitability and operational efficiency. Analyzing operating income in conjunction with other key metrics like gross profit, operating expenses, and net income provides a comprehensive understanding of a company’s financial health, its ability to generate sustainable profits, and its potential for future growth. This analysis is essential for informed decision-making by management, investors, and other stakeholders.

6. Net Income/Loss

Net income/loss, the ultimate bottom line of the income profit and loss statement, represents the total earnings or losses of a company after all revenues and expenses have been accounted for. It encapsulates the financial outcome of a company’s activities over a specific period. This figure is crucial for stakeholders as it provides a concise measure of a company’s profitability and overall financial performance. The income profit and loss statement serves as the structured framework for arriving at this critical metric, systematically detailing the various revenue and expense components that contribute to the final net income or loss figure.

Net income/loss is not merely a standalone number; it’s a culmination of all the elements within the income statement. Revenue generation, cost management, operational efficiency, and non-operating activities all converge to determine this final result. For instance, a retailer might experience strong sales revenue, but high operating expenses and interest payments could lead to a net loss. Conversely, a technology company with moderate revenue but tight cost control and successful investments might achieve a substantial net income. Understanding this cause-and-effect relationship between individual line items and the final net income/loss figure is crucial for comprehensive financial analysis. Analyzing trends in net income/loss over time offers valuable insights into a company’s financial health, its ability to generate sustainable profits, and its potential for future growth. Furthermore, comparing a company’s net income margin (net income as a percentage of revenue) to industry benchmarks provides valuable context for assessing its performance relative to competitors.

Accurate calculation and interpretation of net income/loss are critical for informed decision-making by various stakeholders. Investors rely on this figure to assess a company’s profitability and investment potential. Lenders use it to evaluate creditworthiness. Management uses it to track performance, identify areas for improvement, and make strategic decisions. Challenges in accurately determining net income/loss can arise from complex accounting rules, revenue recognition practices, or potential for financial manipulation. Therefore, maintaining transparent accounting practices and robust internal controls is crucial for ensuring the reliability of the income profit and loss statement and the resulting net income/loss figure. This foundational understanding of net income/loss and its derivation within the income profit and loss statement allows stakeholders to gain a comprehensive view of a company’s financial performance and make informed decisions regarding investment, lending, and business strategy.

Key Components of an Income Statement

A comprehensive understanding of the income statement requires a thorough analysis of its key components. These components provide a structured view of a company’s financial performance over a specific period.

1. Revenue: This represents the total income generated from a company’s primary business activities, typically from the sale of goods or services. Understanding revenue streams is fundamental to evaluating a company’s market position and growth potential.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold by a company. This includes raw materials, direct labor, and manufacturing overhead. Analyzing COGS helps assess production efficiency and pricing strategies.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit indicates the profitability of a company’s core business operations before considering operating expenses. It provides insights into pricing strategies and production efficiency.

4. Operating Expenses: These are the expenses incurred in running a company’s day-to-day operations, encompassing selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization. Analyzing operating expenses provides insight into cost management and operational efficiency.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of a company’s core business operations. This metric isolates the earnings generated from a company’s primary activities, excluding non-operating income and expenses.

6. Other Income/Expenses: This category includes income and expenses not directly related to a company’s core operations, such as interest income, investment gains/losses, and gains/losses from the sale of assets. These items provide a broader perspective on a company’s overall financial activities.

7. Income Tax Expense: Represents the expense associated with income taxes owed by the company. This is calculated based on applicable tax laws and regulations and impacts the final net income.

8. Net Income/Loss: This bottom-line figure represents the total earnings or losses of a company after all revenues and expenses have been considered. It serves as a critical measure of a company’s overall profitability and financial performance.

These interconnected components provide a comprehensive view of a company’s financial performance, enabling stakeholders to assess profitability, operational efficiency, and overall financial health. Analyzing these elements in conjunction with industry benchmarks and historical trends allows for informed decision-making and strategic planning.

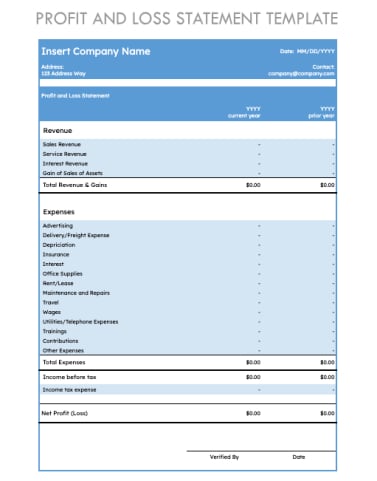

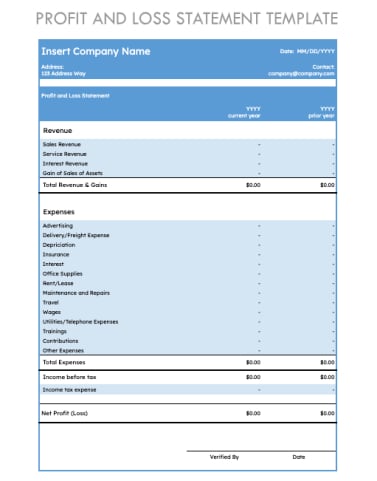

How to Create an Income Statement

Creating a clear and accurate income statement is crucial for understanding financial performance. The following steps outline the process of developing this essential financial document.

1. Choose a Reporting Period: Specify the timeframe for the income statement (e.g., month, quarter, year). A consistent reporting period allows for meaningful comparisons and trend analysis.

2. Record Revenue: Document all revenue generated from sales of goods or services during the chosen period. Ensure accuracy and completeness in revenue recognition.

3. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing the goods sold, including raw materials, direct labor, and manufacturing overhead.

4. Determine Gross Profit: Subtract COGS from Revenue to arrive at Gross Profit. This metric reflects the profitability of core business operations before accounting for operating expenses.

5. Itemize Operating Expenses: List all operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization. Categorize expenses for clarity and analysis.

6. Calculate Operating Income: Subtract Operating Expenses from Gross Profit to determine Operating Income. This metric reflects the profitability of core business operations.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income, investment gains/losses, and gains/losses from asset sales.

8. Determine Income Tax Expense: Calculate the income tax expense based on applicable tax laws and the company’s pre-tax income.

9. Calculate Net Income/Loss: Subtract Income Tax Expense (and other non-operating expenses) from Operating Income (plus other income) to arrive at Net Income or Loss. This is the final bottom-line figure reflecting overall profitability.

Accurate and consistent application of these steps ensures a reliable income statement, providing a clear picture of financial performance and enabling informed decision-making.

Careful analysis of a standardized financial statement offers crucial insights into an organization’s financial health, operational efficiency, and overall profitability. Understanding the interconnectedness of revenue, cost of goods sold, operating expenses, and other key components allows for informed decision-making regarding pricing strategies, cost management, and investment allocation. Leveraging this structured approach to financial reporting enables stakeholders to assess past performance, identify trends, and project future outcomes with greater accuracy.

Mastery of this reporting structure empowers stakeholders to navigate the complexities of financial analysis, driving strategic decisions that contribute to long-term success and sustainable growth. Consistent application and thorough analysis of this reporting tool provides a foundation for sound financial management and informed strategic planning.