Utilizing this type of integrated financial model provides several key advantages. It facilitates more accurate forecasting by linking financial projections directly to operational activities. This connection allows for scenario planning and sensitivity analysis, enabling businesses to assess the financial impact of various operational strategies and market conditions. Furthermore, it enhances communication and transparency by providing a clear and concise overview of the business’s financial and operational plans. This shared understanding can improve decision-making and alignment across different departments and stakeholders.

This article will delve deeper into the components and creation of such a model, exploring best practices for developing accurate assumptions, building flexible and dynamic models, and using the model for effective decision support. Topics covered will include revenue forecasting, cost modeling, key performance indicators, and scenario analysis techniques.

1. Forecasting Revenue

Accurate revenue forecasting is the cornerstone of a robust financial model. Within an integrated income statement and operating build template, revenue projections serve as the primary driver of projected profitability and inform critical operational decisions. A well-defined revenue forecast links operational assumptions to financial outcomes, enabling businesses to anticipate potential challenges and capitalize on opportunities.

- Sales Volume ProjectionsPredicting future sales volume is crucial for estimating revenue. This involves analyzing historical sales data, market trends, and competitive landscape. For example, a seasonal business might anticipate higher sales volumes during specific periods. In the context of the integrated model, sales volume projections directly inform revenue calculations, demonstrating the link between operational activities and financial outcomes.

- Pricing Strategies and AssumptionsPricing decisions significantly impact revenue generation. The chosen pricing strategy (e.g., premium pricing, competitive pricing) and assumptions about potential price changes must be clearly defined within the model. For instance, anticipated price increases due to rising input costs need to be factored into revenue projections. These pricing assumptions bridge the gap between operational strategy and financial performance within the model.

- Customer Segmentation and AnalysisUnderstanding customer behavior and segmentation allows for more granular revenue forecasting. Identifying different customer groups with varying purchasing patterns enables businesses to tailor sales strategies and predict revenue streams more accurately. This detailed customer analysis enhances the precision of revenue projections within the integrated model, providing a more nuanced view of future financial performance.

- Sales Conversion Rates and Pipeline ManagementTracking sales conversion rates and managing the sales pipeline provides valuable insights into potential revenue generation. Analyzing the effectiveness of sales efforts and estimating the likelihood of converting leads into paying customers allows for more realistic revenue forecasts. Integrating this operational data into the financial model strengthens the reliability of revenue projections and enhances the overall accuracy of the integrated planning process.

By incorporating these detailed facets of revenue forecasting into the integrated income statement and operating build template, businesses gain a comprehensive understanding of the factors influencing future financial performance. This interconnected approach enhances decision-making by providing a clear link between operational activities and financial outcomes, enabling more effective planning and resource allocation.

2. Modeling Costs

Accurate cost modeling is essential for a comprehensive income statement and operating build template. A detailed understanding of cost structures enables informed decision-making regarding pricing, resource allocation, and overall profitability. Effective cost modeling links operational activities to financial outcomes, providing a clear picture of how operational decisions impact the bottom line.

Cost modeling within this framework typically involves categorizing costs as either fixed or variable. Fixed costs, such as rent or salaries, remain constant regardless of production or sales volume. Variable costs, like raw materials or sales commissions, fluctuate directly with operational activity. Accurately classifying and projecting these costs is crucial for generating realistic income statement projections. For example, a manufacturing business must accurately model the variable costs associated with raw materials to understand how production increases impact overall profitability. Similarly, a software company needs to model the fixed costs of software development to determine the minimum sales volume required to cover these expenses.

Furthermore, cost modeling should incorporate detailed analysis of individual cost drivers. This includes understanding the factors influencing each cost category and how these factors might change over time. For instance, a transportation company must consider fuel prices, labor rates, and maintenance expenses when modeling their operating costs. Anticipating potential fluctuations in these cost drivers allows for more accurate forecasting and proactive adjustments to operational strategies. Failing to accurately model costs can lead to significant discrepancies between projected and actual financial performance, hindering effective decision-making and potentially impacting long-term financial health. Thorough cost modeling is therefore an integral component of a robust and reliable income statement and operating build template, providing the foundation for informed financial planning and operational management.

3. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) provide quantifiable measures of progress toward defined objectives within an income statement and operating build template. These metrics offer insights into the effectiveness of operational strategies and their impact on financial performance. Selecting and tracking relevant KPIs is crucial for informed decision-making, enabling proactive adjustments and course correction.

- Gross Profit MarginGross profit margin, calculated as (Revenue – Cost of Goods Sold) / Revenue, reveals the profitability of core business operations after accounting for direct production costs. A declining gross profit margin might signal increasing production costs or pricing pressures, requiring operational adjustments. Within the integrated model, monitoring this KPI provides insights into the effectiveness of cost management strategies and pricing decisions.

- Operating Expense RatioThe operating expense ratio, calculated as Operating Expenses / Revenue, measures the efficiency of managing overhead and administrative costs. A rising operating expense ratio can indicate operational inefficiencies, prompting a review of spending patterns. Tracking this KPI within the model helps assess the impact of operational cost control measures on overall profitability.

- Customer Acquisition Cost (CAC)CAC represents the cost associated with acquiring a new customer. A high or increasing CAC can signify challenges in sales and marketing effectiveness, warranting further investigation. In the integrated model, monitoring CAC provides insights into the efficiency of customer acquisition strategies and their impact on profitability. For example, a rising CAC coupled with declining sales conversion rates might indicate a need to reassess marketing campaigns.

- Inventory Turnover RatioInventory turnover measures how efficiently a company manages its inventory. A low turnover ratio can indicate excess inventory or slow sales, potentially tying up capital and increasing storage costs. Tracking this KPI within the model helps optimize inventory management practices and minimize associated costs. For instance, a declining inventory turnover ratio alongside increasing storage costs might signal the need for improved inventory control measures.

These KPIs, derived from both the income statement and operating plan, provide valuable insights into business performance. Analyzing these metrics in conjunction with the underlying operational assumptions allows for a more comprehensive understanding of the interplay between operational activities and financial outcomes. By regularly monitoring and analyzing these KPIs within the integrated model, businesses can identify areas for improvement, optimize resource allocation, and enhance overall financial performance.

4. Scenario Planning

Scenario planning forms an integral part of a robust income statement and operating build template. It allows businesses to explore the potential impact of various external factors and internal decisions on projected financial performance. By considering a range of plausible future scenarios, organizations can proactively identify potential challenges and opportunities, develop contingency plans, and make more informed strategic decisions. This forward-looking approach enhances the practical utility of the financial model, transforming it from a static projection into a dynamic decision-making tool. For example, a company might model the impact of a potential economic downturn on sales volume and subsequently on profitability. This analysis can inform pricing strategies, cost-cutting measures, and other operational adjustments to mitigate the negative financial impact.

Constructing effective scenarios requires identifying key drivers of uncertainty and developing narratives around how these drivers might evolve. These drivers can include macroeconomic factors (e.g., interest rates, inflation), industry-specific trends (e.g., technological advancements, regulatory changes), and company-specific events (e.g., new product launches, competitor actions). Each scenario should outline a plausible future state, detailing the assumed values for key operational and financial variables. For instance, a “best-case” scenario might assume strong economic growth, increased market share, and successful product launches, while a “worst-case” scenario might incorporate an economic recession, increased competition, and product development delays. By modeling the financial impact of these different scenarios, businesses gain a more comprehensive understanding of potential risks and rewards, facilitating more informed strategic planning and resource allocation. A retail company, for instance, might use scenario planning to assess the impact of varying online sales adoption rates on its brick-and-mortar store footprint and overall profitability.

Integrating scenario planning within the financial model enhances its analytical power and practical value. It allows for sensitivity analysis, exploring how changes in key assumptions impact projected financial outcomes. This understanding enables businesses to identify critical vulnerabilities and develop contingency plans to mitigate potential downsides. Furthermore, scenario planning fosters a more proactive and strategic approach to financial management, empowering organizations to navigate uncertainty and optimize performance under various potential future conditions. The insights derived from scenario planning can inform strategic investments, operational adjustments, and risk management strategies, ultimately contributing to long-term financial sustainability and resilience. Neglecting to incorporate scenario planning within the financial model limits its ability to provide a comprehensive view of potential future outcomes, potentially hindering effective decision-making in the face of uncertainty.

5. Operational Drivers

Operational drivers are the fundamental factors influencing the financial performance of a business. Within an income statement and operating build template, these drivers serve as the key inputs shaping projected financial outcomes. A clear understanding of these drivers and their interrelationships is crucial for building a robust and insightful financial model. Accurately capturing these drivers allows for more realistic projections, facilitates effective scenario planning, and ultimately supports more informed decision-making.

- Sales VolumeSales volume, representing the number of units sold, directly impacts revenue and, consequently, profitability. Variations in sales volume, driven by factors such as market demand, seasonality, and competitive pressures, significantly influence the top line of the income statement. For a consumer goods company, accurately projecting holiday season sales volume is critical for forecasting revenue and managing inventory levels. Within the integrated model, sales volume acts as a primary driver, linking operational activities to financial outcomes.

- Production CapacityProduction capacity, the maximum output a business can achieve given its resources, constrains sales volume and influences costs. Limitations in production capacity can restrict growth and impact profitability. For a manufacturing firm, expanding production capacity might require significant capital investment, impacting the balance sheet and influencing future profitability projections within the integrated model.

- Pricing StrategyPricing decisions directly influence revenue generation and profitability. Factors such as competitive landscape, customer price sensitivity, and cost structure inform pricing strategies. A software-as-a-service company adopting a value-based pricing model must accurately assess the perceived value delivered to customers to optimize revenue generation. In the integrated model, pricing assumptions directly impact revenue projections and profitability margins.

- Customer Churn RateCustomer churn rate, the rate at which customers discontinue using a product or service, impacts recurring revenue streams and influences customer acquisition costs. A high churn rate necessitates increased marketing spend to maintain revenue levels. For a subscription-based business, understanding and managing churn rate is crucial for projecting future revenue and profitability. Within the integrated model, churn rate assumptions influence revenue projections and inform customer acquisition strategies.

These operational drivers, when integrated within an income statement and operating build template, create a dynamic and interconnected model. Changes in one driver can ripple through the model, impacting other drivers and ultimately influencing projected financial performance. This interconnectedness underscores the importance of carefully considering and accurately modeling these drivers to develop a realistic and insightful financial plan. Analyzing the interplay of these drivers provides a comprehensive understanding of the operational levers influencing financial outcomes, facilitating more informed strategic decision-making and enhancing overall business performance.

6. Dynamic Adjustments

Dynamic adjustments are crucial for maintaining the accuracy and relevance of an income statement and operating build template. The business environment is constantly evolving, influenced by factors such as shifting market conditions, fluctuating input costs, and evolving competitive landscapes. A static financial model quickly becomes outdated, failing to reflect the current realities of the business. Dynamic adjustments enable the model to adapt to these changes, ensuring that projections remain aligned with the current operating environment. This adaptability enhances the reliability of the model, supporting more informed decision-making and resource allocation. For example, if a company experiences an unexpected surge in raw material prices, dynamic adjustments allow for incorporating these changes into the cost model, providing a more accurate projection of future profitability. Without such adjustments, the model would overestimate profitability, potentially leading to misguided financial decisions.

Implementing dynamic adjustments requires building flexibility into the model. This can be achieved through the use of variables and formulas that automatically update calculations based on changing inputs. For instance, linking revenue projections to real-time sales data allows the model to automatically adjust revenue forecasts based on current sales performance. Similarly, incorporating macroeconomic indicators, such as inflation rates or interest rates, allows the model to adapt to broader economic changes. A retail business, for example, might link its sales projections to consumer confidence indices, enabling the model to automatically adjust revenue forecasts based on changes in consumer spending patterns. This dynamic approach enhances the model’s responsiveness to external factors, ensuring that projections remain aligned with the evolving business environment. Furthermore, incorporating sensitivity analysis within the model allows for assessing the impact of changes in key assumptions on projected financial outcomes. This understanding enables businesses to identify critical vulnerabilities and develop contingency plans to mitigate potential downsides.

The ability to make dynamic adjustments is essential for maximizing the value of an income statement and operating build template. It transforms the model from a static snapshot of the past into a dynamic tool for navigating the future. By incorporating flexibility and responsiveness to change, the model supports proactive decision-making, enhances resource allocation, and ultimately contributes to improved financial performance and long-term sustainability. Failing to incorporate dynamic adjustments limits the model’s practical utility, potentially leading to inaccurate projections and misguided decisions. Therefore, building a dynamic and adaptable model is crucial for effectively navigating the complexities of the modern business environment and achieving sustainable financial success.

Key Components of an Integrated Financial Model

Building a robust financial model requires a structured approach, integrating key components to provide a comprehensive view of projected financial performance and operational activities. The following elements are essential for developing an effective income statement and operating plan template.

1. Revenue Projections: Detailed revenue forecasts, incorporating assumptions about sales volume, pricing, and customer behavior, form the foundation of the income statement. Accuracy in revenue projections is crucial for determining overall profitability and informing operational decisions.

2. Cost Modeling: Comprehensive cost modeling, encompassing both fixed and variable costs, provides insights into the cost structure of the business. Understanding cost drivers and their potential fluctuations is essential for accurate profit projections.

3. Operating Plan: A detailed operating plan outlines the key activities and resources required to achieve projected financial outcomes. This plan should detail assumptions regarding production capacity, staffing levels, marketing spend, and other operational factors influencing financial performance.

4. Key Performance Indicators (KPIs): Selecting and tracking relevant KPIs provides quantifiable measures of progress toward defined objectives. KPIs offer insights into operational efficiency, profitability, and overall business performance.

5. Scenario Planning: Incorporating scenario planning allows for exploring the potential impact of various external and internal factors on projected financial performance. Developing and analyzing multiple scenarios enhances decision-making and risk management.

6. Dynamic Adjustments: Building in dynamic adjustments enables the model to adapt to changing business conditions and maintain accuracy. Flexibility and responsiveness to evolving circumstances are crucial for informed decision-making.

These interconnected components work together to provide a dynamic and comprehensive view of the business. Accurately capturing these elements allows for more realistic projections, facilitates effective scenario planning, and ultimately supports informed decision-making, resource allocation, and enhanced financial performance.

How to Create an Integrated Financial Model

Developing a robust integrated financial model, combining an income statement and operating plan, requires a structured approach. The following steps outline the process for creating such a model.

1. Define the Purpose and Scope: Clearly articulate the objective of the model. Is it for forecasting future performance, evaluating investment opportunities, or supporting strategic decision-making? Defining the scope helps determine the level of detail and complexity required.

2. Establish a Time Horizon: Determine the timeframe for the model. A long-term strategic plan might require a longer horizon than a short-term operational forecast. The time horizon influences the granularity of the data and the types of assumptions incorporated.

3. Gather Historical Data: Collect relevant historical financial and operational data. This data serves as the basis for developing assumptions and projections. Data sources may include financial statements, sales records, and operational reports.

4. Develop Key Assumptions: Formulate realistic assumptions about future performance. These assumptions should be based on historical trends, market research, and industry analysis. Key assumptions might include sales growth rates, cost inflation, and market share projections. Documenting these assumptions is crucial for transparency and model validation.

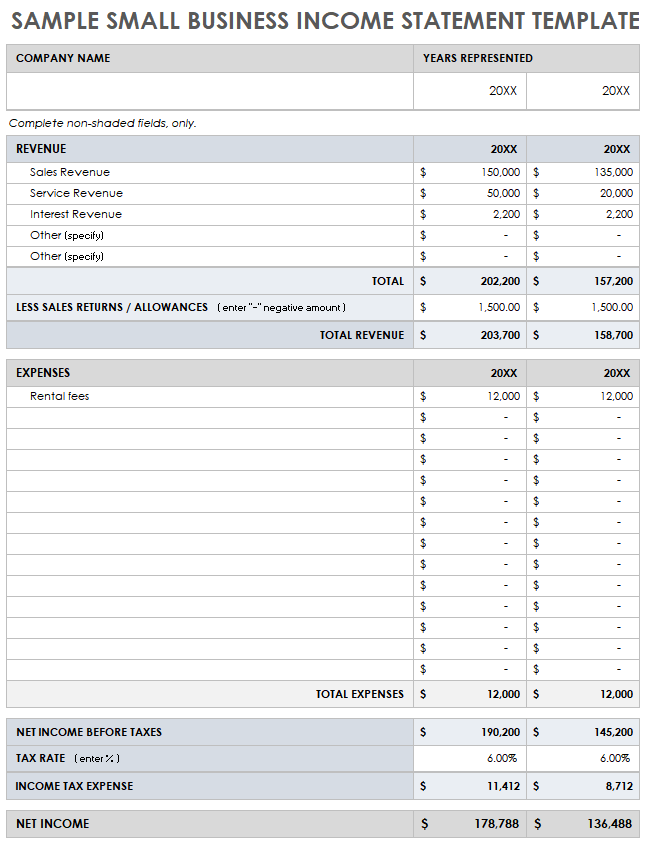

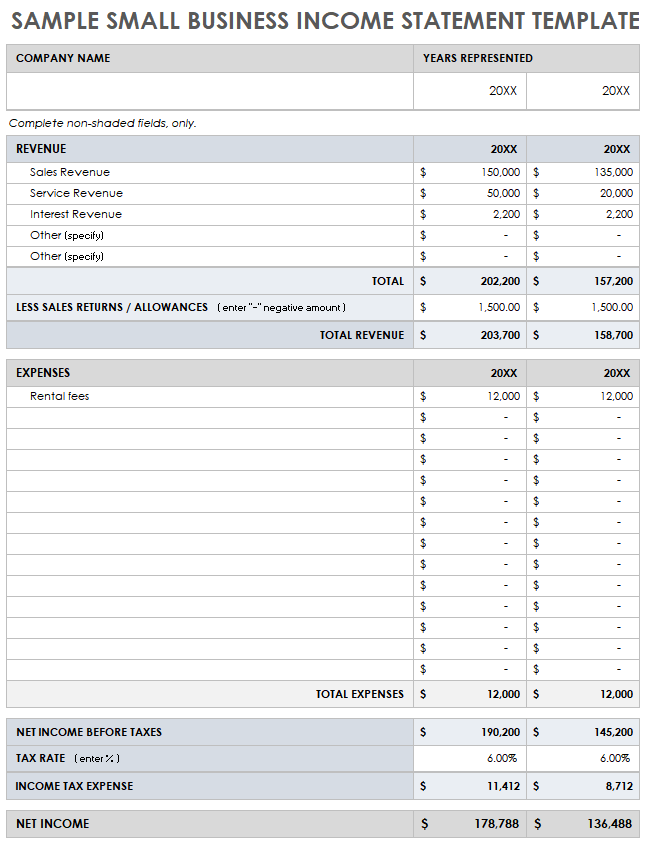

5. Build the Income Statement: Construct the projected income statement, starting with revenue projections and then incorporating cost forecasts. Calculate key profitability metrics, such as gross profit margin and operating income. Ensure formulas and calculations are accurate and transparent.

6. Develop the Operating Plan: Detail the operational activities required to achieve the projected financial outcomes. This plan should include assumptions about production capacity, staffing levels, marketing spend, and other operational drivers. The operating plan provides the context for the financial projections.

7. Integrate the Model: Link the income statement and operating plan. Ensure that operational assumptions directly inform the financial projections. This integration creates a dynamic model where changes in operational drivers automatically impact financial outcomes.

8. Conduct Sensitivity Analysis and Scenario Planning: Test the model’s robustness by conducting sensitivity analysis and scenario planning. Explore how changes in key assumptions impact projected financial performance. This analysis provides valuable insights into potential risks and opportunities.

A well-constructed integrated financial model provides a powerful tool for business planning, analysis, and decision-making. By incorporating these steps, organizations can develop a robust and insightful model that supports informed strategic choices and enhances financial performance.

An integrated financial model, combining a projected income statement and a detailed operating build template, provides a powerful framework for business planning and management. This approach facilitates a comprehensive understanding of the interplay between operational activities and financial outcomes. By linking revenue projections to underlying operational drivers, such as sales volume, pricing, and production capacity, the model enables more accurate forecasting and informed decision-making. Furthermore, incorporating scenario planning and sensitivity analysis allows businesses to assess the potential impact of various market conditions and operational strategies, enhancing risk management and strategic planning. Effective cost modeling, encompassing both fixed and variable costs, provides critical insights into the cost structure of the business and its impact on profitability. Regular monitoring of key performance indicators (KPIs) derived from both the income statement and operating plan allows for tracking progress, identifying areas for improvement, and optimizing resource allocation.

Effective utilization of an integrated financial model requires a structured approach, encompassing data gathering, assumption development, model building, and ongoing monitoring and refinement. The ability to make dynamic adjustments, adapting to changing business conditions, is crucial for maintaining the model’s accuracy and relevance. Organizations that embrace this integrated approach to financial planning and operational management gain a significant competitive advantage, enabling more informed decision-making, enhanced resource allocation, and improved financial performance in a dynamic and complex business environment. Building and maintaining such a model represents a significant investment, but the potential returns in terms of improved financial outcomes and enhanced strategic decision-making make it an invaluable tool for long-term success. The insights derived from a well-constructed model empower organizations to proactively navigate challenges, capitalize on opportunities, and achieve sustainable growth.