Utilizing a pre-designed structure for these reports offers several advantages. It ensures consistency in reporting, simplifies financial analysis, and facilitates comparisons across different periods or against industry benchmarks. This structured approach enables businesses to readily identify areas for improvement, track key performance indicators, and make informed strategic decisions. Furthermore, a standardized format can streamline financial reporting processes, reducing the time and effort required for preparation.

This article will further explore the key components of such a report, including a detailed breakdown of cost categories and illustrative examples. It will also address best practices for implementation and utilization to maximize its value in driving informed decision-making within a manufacturing context.

1. Revenue

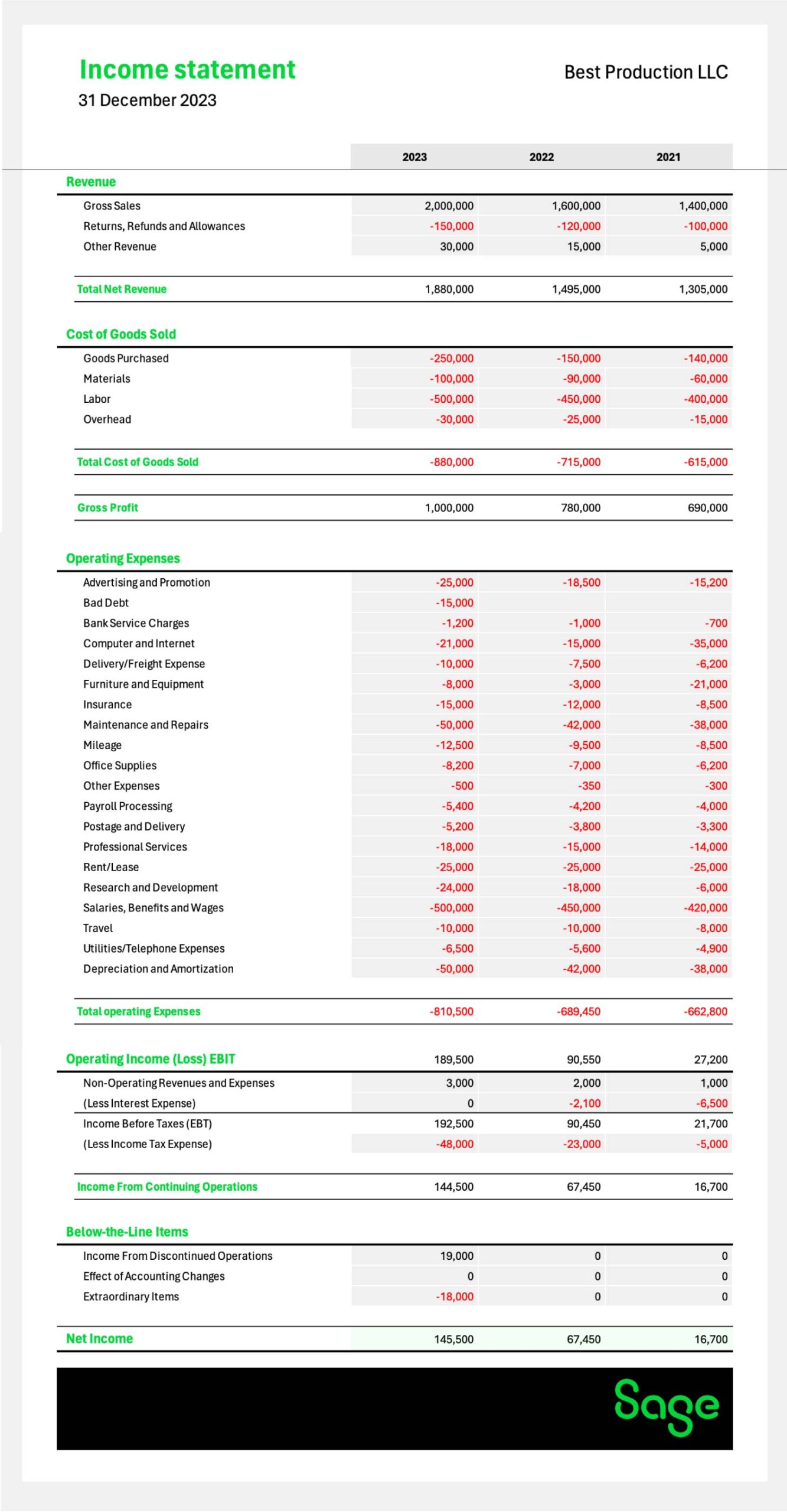

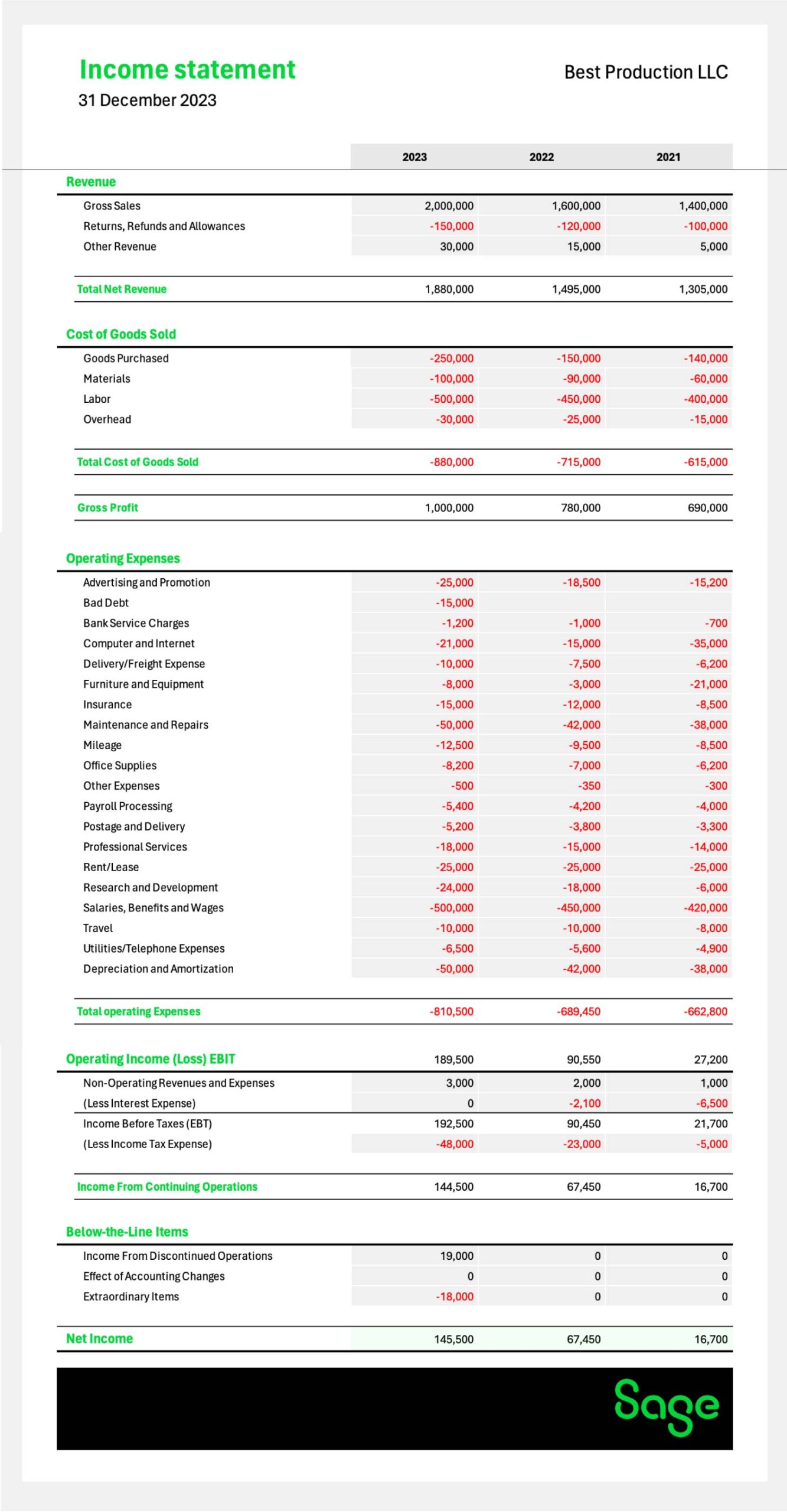

Revenue, the top line of a manufacturing company’s income statement, represents the total income generated from the sale of goods or services. Accurately representing revenue is foundational to a robust financial statement, as it serves as the starting point for calculating profitability. A deep understanding of its components is crucial for informed financial analysis and decision-making.

- Net Sales Revenue:This reflects the actual sales revenue after accounting for deductions like sales returns, allowances, and discounts. For example, if a manufacturer sells $1 million worth of goods but grants $50,000 in returns and discounts, the net sales revenue is $950,000. This accurate representation of income is critical for evaluating true sales performance and profitability. On a manufacturing income statement template, this figure provides a realistic assessment of earned income.

- Sales Revenue Recognition:The timing of revenue recognition impacts the income statement. Revenue is typically recognized when the goods are shipped or services are rendered, not necessarily when cash is received. This accrual accounting principle ensures that revenue is matched with the corresponding expenses incurred during the production period, providing a clearer picture of profitability on the income statement.

- Product Line Breakdown:A detailed income statement might break down revenue by product line. This provides valuable insights into the performance of individual products and can inform strategic decisions regarding production, pricing, and marketing. For instance, a manufacturer might discover that one product line generates a significantly higher profit margin than others, suggesting opportunities for resource allocation.

- Impact of Revenue on Profitability:Revenue directly impacts profitability metrics like gross profit and net income. Higher revenue, assuming controlled costs, leads to increased profitability. Therefore, analyzing revenue trends is essential for evaluating business performance and making projections. Growth or decline in revenue signals areas requiring attention within the manufacturing operation.

A comprehensive understanding of revenue and its various facets is essential for interpreting the overall financial health of a manufacturing company. By analyzing revenue streams, recognition methods, and product line performance within the context of a structured income statement, businesses can gain actionable insights for strategic planning and informed decision-making. This analysis, enabled by a well-designed income statement template, helps optimize resource allocation and drive sustainable profitability.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a manufacturing company. Within a specialized income statement, COGS holds significant weight, directly impacting gross profit and ultimately, net income. Accurately calculating COGS is crucial for evaluating profitability and making informed business decisions. This involves meticulously tracking all direct costs attributable to the manufacturing process. A robust income statement template specifically designed for manufacturing facilitates this process by providing dedicated sections for each component of COGS, ensuring comprehensive cost capture.

Three primary components constitute COGS: direct materials, direct labor, and manufacturing overhead. Direct materials encompass raw materials and components directly used in production. Direct labor represents the wages and benefits paid to personnel directly involved in the manufacturing process. Manufacturing overhead includes all other costs associated with the production facility, such as rent, utilities, and depreciation of manufacturing equipment. For example, in automotive manufacturing, direct materials include steel and tires, direct labor comprises assembly line worker wages, and overhead covers factory utilities. Clearly delineating these costs within the income statement template allows for precise COGS calculation and subsequent profitability analysis. This clarity enables businesses to pinpoint inefficiencies and implement cost-saving measures, thereby enhancing profitability.

Understanding the relationship between COGS and the income statement is fundamental for effective financial management within manufacturing. A well-structured income statement template, customized for manufacturing operations, provides a framework for accurate COGS calculation and insightful analysis. By carefully tracking and analyzing each component of COGS, businesses can gain a granular understanding of their production costs, identify areas for improvement, and optimize pricing strategies. This meticulous cost analysis ultimately contributes to informed decision-making, improved profitability, and enhanced financial performance within the competitive manufacturing landscape.

3. Gross Profit

Gross profit, a key performance indicator on a manufacturing company’s income statement, represents the profitability of core production activities. Calculated as revenue minus the cost of goods sold (COGS), it reflects the financial gain derived directly from manufacturing processes before accounting for operating expenses. A specialized income statement template designed for manufacturing operations highlights gross profit, providing a clear view of production efficiency and pricing effectiveness. This focus on gross profit allows businesses to assess the profitability of their core manufacturing operations, independent of other business functions. For example, if a clothing manufacturer sells goods for $500,000 and incurs COGS of $300,000, the gross profit is $200,000. This figure signals the financial health of the production process itself.

Analyzing gross profit within the context of a manufacturing income statement provides valuable insights into several key areas. A healthy gross profit margin indicates effective cost management and optimal pricing strategies. Conversely, a declining gross profit margin may signal rising production costs, increased competition requiring price reductions, or inefficiencies within the manufacturing process. Tracking gross profit over time reveals trends crucial for informed decision-making. For instance, consistent increases in raw material costs, reflected in a shrinking gross profit margin, may necessitate adjustments in pricing or sourcing strategies. This data-driven analysis, facilitated by a detailed income statement template, empowers businesses to proactively address challenges and maintain profitability.

Understanding the connection between gross profit and a manufacturing income statement is essential for evaluating financial performance and guiding strategic decisions. A dedicated income statement template, specifically structured for manufacturing companies, allows for precise calculation and prominent display of gross profit, enabling insightful analysis. By monitoring gross profit trends and understanding their underlying causes, businesses can optimize production processes, refine pricing strategies, and ultimately enhance profitability. This focused approach to financial analysis empowers manufacturing companies to navigate the complexities of their industry and achieve sustained financial success.

4. Operating Expenses

Operating expenses represent the costs incurred in running a manufacturing business outside of the direct production costs. Within a specialized income statement template for manufacturing, these expenses are categorized separately from the cost of goods sold (COGS), providing a clearer picture of overall profitability and efficiency. Analyzing operating expenses is crucial for understanding a company’s cost structure, identifying areas for potential savings, and making informed decisions about resource allocation.

- Selling ExpensesThese costs are associated with marketing and selling the manufactured goods. Examples include advertising campaigns, sales commissions, and salaries of the sales team. On the income statement, these expenses demonstrate the investment required to generate revenue. High selling expenses relative to revenue may signal inefficiencies in sales and marketing strategies.

- Administrative ExpensesAdministrative expenses encompass the costs of general business management not directly tied to production or sales. These include salaries of administrative staff, office rent, utilities, and legal expenses. Within the income statement template, administrative expenses offer insights into the overhead cost structure. Monitoring these expenses is critical for maintaining operational efficiency.

- Research and Development (R&D) ExpensesR&D costs represent investments in developing new products or improving existing ones. These expenses, although not directly related to current production, are essential for future growth and competitiveness. Within the income statement, R&D spending reflects a company’s commitment to innovation and long-term sustainability.

- Depreciation and AmortizationThese non-cash expenses reflect the gradual reduction in value of long-term assets, such as machinery and software. Depreciation applies to tangible assets, while amortization applies to intangible assets. While not representing a direct cash outflow, these expenses are crucial for accurately reflecting the cost of using these assets over time on the income statement.

By carefully analyzing operating expenses within a structured income statement for a manufacturing company, businesses gain a granular understanding of their cost structure beyond direct production costs. This detailed analysis facilitates better cost management, informed resource allocation, and ultimately, improved profitability. Comparing operating expenses to revenue and industry benchmarks can reveal opportunities for optimization and enhance overall financial performance.

5. Operating Income

Operating income, a crucial line item on a manufacturing company’s income statement, reveals the profitability of core business operations, excluding non-operating income and expenses. Calculated as gross profit minus operating expenses, this figure provides a clear view of a company’s ability to generate profit from its primary manufacturing and sales activities. A specialized income statement template designed for manufacturing businesses prominently features operating income, facilitating direct analysis of operational efficiency and profitability. This focus allows businesses to isolate the financial performance of their core operations, independent of external factors like investments or interest expenses. For example, if a manufacturer reports a gross profit of $300,000 and operating expenses of $150,000, operating income stands at $150,000. This figure directly reflects the profitability derived from manufacturing and selling goods, excluding extraneous financial activities.

Understanding the relationship between operating income and a manufacturing-specific income statement template is crucial for insightful financial analysis. Changes in operating income reflect the impact of decisions related to production efficiency, pricing strategies, and cost control measures. Analyzing trends in operating income over time provides valuable data for strategic planning and performance evaluation. For instance, declining operating income, even with steady revenue, might indicate rising operating expenses or shrinking margins, warranting further investigation. This focused analysis, facilitated by a detailed income statement template, allows businesses to identify operational strengths and weaknesses, guiding corrective actions and improvements. Furthermore, comparing operating income to industry benchmarks provides external context for evaluating performance and identifying areas for competitive advantage.

In summary, operating income serves as a critical indicator of operational efficiency and profitability within a manufacturing context. A well-designed income statement template specifically for manufacturing operations highlights this key figure, enabling focused analysis and informed decision-making. By tracking operating income, analyzing its components, and understanding its implications, manufacturing businesses gain valuable insights into their core operations, enabling data-driven strategies for sustained growth and profitability.

6. Net Income

Net income, often referred to as the “bottom line,” represents the ultimate measure of profitability for a manufacturing company. Located at the bottom of the income statement, it reflects the residual earnings after all revenues and expenses have been accounted for. Within the context of an income statement template specifically designed for manufacturing businesses, net income provides a comprehensive view of financial performance, encapsulating the results of core operations, non-operating activities, and tax obligations. This figure is essential for assessing the overall financial health and sustainability of a manufacturing enterprise. Understanding the derivation of net income within this structured template allows for in-depth analysis of profitability drivers and informs strategic financial decision-making.

Calculating net income involves a series of deductions from revenue. Starting with revenue, the cost of goods sold (COGS) is subtracted to arrive at gross profit. Operating expenses, including selling, general, and administrative expenses, are then deducted from gross profit to determine operating income. Non-operating income and expenses, such as interest income or expense and gains or losses from investments, are then considered. Finally, income tax expense is subtracted to arrive at net income. For example, if a manufacturer has an operating income of $200,000, a non-operating loss of $10,000, and an income tax expense of $40,000, the net income would be $150,000. This final figure, prominently displayed within the income statement template, reflects the overall profit available to shareholders after all expenses and obligations have been met. This structured presentation enables straightforward analysis and comparison of net income performance across different periods.

Analyzing net income trends within the framework of a manufacturing income statement template provides critical insights into the company’s financial health and long-term sustainability. Consistent growth in net income demonstrates effective management of costs, pricing, and operational efficiency. Conversely, declining net income may signal challenges within the manufacturing process, pricing pressures, or rising operating costs. Furthermore, comparing net income to industry benchmarks offers a valuable external perspective on performance, identifying potential areas for improvement or competitive advantages. Understanding the components contributing to net income empowers data-driven decision-making, enabling adjustments to operational strategies, pricing models, and cost control measures to enhance profitability and ensure long-term financial success within the manufacturing sector.

Key Components of a Manufacturing Income Statement Template

A robust income statement template tailored for manufacturing operations provides a structured framework for analyzing financial performance. Understanding its key components is essential for extracting meaningful insights and making informed business decisions. The following elements comprise a comprehensive manufacturing income statement template.

1. Revenue: This represents the total income generated from sales of manufactured goods. Net sales, after accounting for returns and discounts, form the basis for calculating profitability. Breaking down revenue by product line offers granular insights into performance. Accurately capturing revenue is fundamental for evaluating financial health.

2. Cost of Goods Sold (COGS): COGS encompasses all direct costs associated with producing goods sold. This includes direct materials, direct labor, and manufacturing overhead. Precise COGS calculation is critical for determining gross profit and net income. A detailed breakdown of COGS components facilitates cost control and efficiency analysis.

3. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of core production activities. Analyzing gross profit margins helps assess pricing strategies and production efficiency. Monitoring gross profit trends reveals potential challenges and opportunities.

4. Operating Expenses: These expenses encompass costs incurred outside of direct production, including selling, general, and administrative expenses. Categorizing and analyzing these expenses provides insights into overhead costs and operational efficiency. Controlling operating expenses is crucial for maximizing profitability.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income represents the profitability of core business operations. This key figure allows businesses to assess the effectiveness of their manufacturing and sales activities independent of non-operating factors.

6. Non-Operating Income and Expenses: This category includes income and expenses unrelated to core business operations, such as interest income or expense, and gains or losses from investments. These items provide a comprehensive view of a companys overall financial activities.

7. Income Tax Expense: This represents the expense associated with income taxes. Accurate calculation of income tax expense is essential for determining net income and complying with tax regulations.

8. Net Income: This “bottom line” figure represents the ultimate measure of profitability after all revenues and expenses have been considered. Net income reflects the earnings available to shareholders and provides a comprehensive assessment of financial performance.

Careful analysis of these interconnected components within a structured template yields a comprehensive understanding of financial performance, informing strategic decision-making and driving sustainable growth within the manufacturing industry. Regularly reviewing and interpreting these figures is essential for effective financial management and long-term success.

How to Create an Income Statement for a Manufacturing Company

Creating a precise income statement is crucial for understanding the financial performance of a manufacturing company. The following steps outline the process of developing a structured and informative income statement template.

1. Choose a Reporting Period: Define the specific time frame for the income statement, such as a month, quarter, or year. Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Calculate Revenue: Determine the total revenue generated from sales of manufactured goods during the reporting period. Deduct any sales returns, allowances, and discounts to arrive at net sales revenue. Consider presenting revenue by product line for detailed analysis.

3. Determine Cost of Goods Sold (COGS): Calculate all direct costs associated with producing the goods sold. This includes direct materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from revenue to arrive at gross profit. This figure represents the profitability of core production activities. Analyzing gross profit margins helps assess pricing strategies and production efficiency.

5. Itemize Operating Expenses: List all operating expenses incurred during the reporting period. These include selling, general, and administrative expenses, such as salaries, rent, marketing costs, and depreciation. Categorizing expenses facilitates detailed analysis and cost control.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This figure reflects the profitability of the company’s core business operations, excluding non-operating income and expenses.

7. Account for Non-Operating Income and Expenses: Include any non-operating income and expenses, such as interest income or expense and gains or losses from investments. This provides a comprehensive view of the company’s overall financial activities.

8. Calculate Income Tax Expense: Determine the income tax expense for the reporting period based on applicable tax regulations. This expense is crucial for arriving at net income.

9. Calculate Net Income: Subtract income tax expense from the result of step 7 (operating income +/- non-operating income/expenses) to determine net income. This “bottom line” figure represents the overall profitability after all revenues and expenses have been considered.

10. Present the Information Clearly: Organize the calculated figures within a clear and structured template. Use headings and subheadings to delineate each section, ensuring readability and facilitating analysis. Consider using a spreadsheet program to create a reusable template.

A well-structured income statement provides a comprehensive overview of financial performance, enabling informed decision-making. Regularly generating and analyzing this statement is crucial for monitoring profitability, identifying trends, and implementing effective financial strategies.

A standardized financial statement designed specifically for manufacturing businesses provides essential insights into profitability by detailing revenue streams, production costs, operational expenses, and resulting net income. Understanding the structure and components of this specialized report, including cost of goods sold, gross profit, and operating income, is crucial for effective financial management. Utilizing a template ensures consistency, simplifies analysis, and facilitates comparisons, enabling informed decision-making regarding pricing strategies, cost control, and resource allocation.

Effective utilization of a manufacturing-specific income statement empowers businesses to identify areas for improvement, optimize operational efficiency, and enhance profitability. Regularly generating and analyzing this report, coupled with comparisons against industry benchmarks, provides a data-driven foundation for strategic planning and long-term financial success within the competitive manufacturing landscape. This meticulous financial analysis is not merely a reporting exercise but a critical tool for navigating complexities and driving sustainable growth.