Navigating financial obligations, especially those involving support payments, can often feel like a complex journey. Whether you’re an employer needing to comply with a court order, or an individual responsible for child support or alimony, understanding the process of income withholding is crucial. It’s a system designed to ensure regular and consistent payments, offering stability to recipients and clarity to those making the payments. In Florida, like other states, there are specific legal requirements and procedures that must be followed to ensure compliance and avoid potential issues.

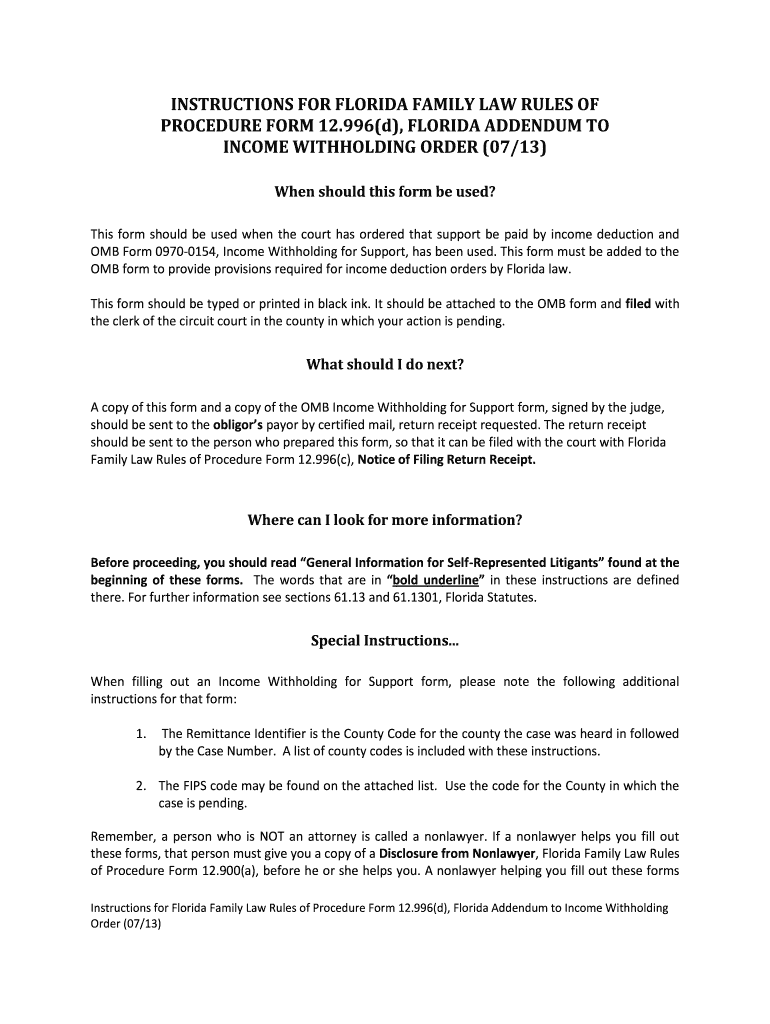

Having a reliable resource, such as an income withholding form template Florida residents can use, makes a significant difference. These templates streamline what could otherwise be a confusing and time-consuming task. They provide a structured framework that helps ensure all necessary information is included and presented in a legally acceptable format. This guide aims to demystify the process, offering insights into what income withholding entails and how to effectively utilize a template to meet your obligations.

Understanding Income Withholding in Florida

Income withholding, often referred to as a wage garnishment for support, is a legal mechanism where a portion of an individual’s earnings is directly deducted by their employer and sent to a recipient or a designated agency. This is typically done to fulfill court-ordered obligations such as child support, spousal support (alimony), or restitution. In Florida, these orders are issued by a court or administrative agency, and they legally bind the employer to deduct specific amounts from the employee’s paychecks and remit them as directed.

The primary purpose of income withholding is to ensure consistent and timely payments, reducing the burden on the recipient to chase payments and minimizing the potential for arrears. For employers, it’s a mandatory legal duty once they receive a valid income withholding order. Failure to comply can result in significant penalties, including fines and legal action, as employers essentially become agents of the court in facilitating these payments.

Florida statutes, particularly those related to family law and child support enforcement, govern the specifics of income withholding. These laws outline who can issue an order, the maximum amount that can be withheld, and the procedures for serving the order on an employer. It’s not just about deducting money; it’s about following a precise legal protocol to ensure fairness and compliance for all parties involved.

Key Elements of an Income Withholding Order

An income withholding order is a detailed document that specifies exactly what needs to be withheld and how. When working with an income withholding form template Florida, it’s essential to understand the various sections and what information they require. This ensures that the completed form is legally sound and actionable.

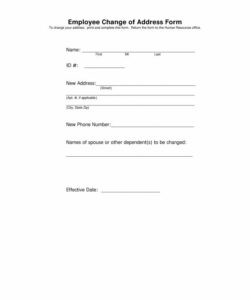

- Employer Information: This includes the employer’s name, address, and any relevant identification numbers.

- Employee/Obligor Information: Details about the person whose income is being withheld, such as their name, address, and social security number.

- Recipient Information: Who the payments are for, including their name, address, and payment forwarding details.

- Type of Obligation: Clearly states if the withholding is for child support, alimony, medical support, or a combination.

- Withholding Amount: The specific dollar amount to be deducted per pay period, distinguishing between current support and arrears, if applicable.

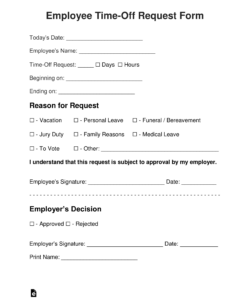

- Payment Frequency: How often the deductions should occur (e.g., weekly, bi-weekly, monthly) to align with the employee’s pay schedule.

- Instructions for Employer: Specific guidance on how to remit payments, including where to send them and any processing fees they might deduct.

- Effective Date: When the withholding is supposed to begin.

Accuracy in filling out each of these sections is paramount. Any discrepancies could lead to delays, incorrect payments, or even legal challenges. This is where a well-designed template proves invaluable, guiding users through each required field.

Utilizing an Income Withholding Form Template for Florida

Using an income withholding form template Florida can significantly simplify the process for individuals, legal professionals, and employers alike. These templates are designed to incorporate the specific legal requirements of Florida, ensuring that all necessary information is collected and presented in a format that courts and employers can easily understand and act upon. They reduce the likelihood of errors and omissions that could delay the enforcement of support orders.

The main benefit of a template is standardization. It provides a consistent framework, ensuring that all critical data points are addressed. Instead of drafting a document from scratch, which might overlook specific legal nuances, a template guides you through the process, prompting you for all the necessary details. This not only saves time but also provides peace of mind that the document is legally compliant and comprehensive.

When you obtain an income withholding form template specific to Florida, the first step is to ensure it is the most current version. Laws can change, so using an outdated form could lead to issues. Once you have the correct template, gather all the relevant information for the obligor (the person paying), the obligee (the person receiving), and the employer. This includes personal identification details, the court case number, the support order details, and the precise amounts to be withheld.

Carefully fill in each field on the template. Pay close attention to dates, addresses, and especially the monetary amounts. Double-check all numbers and ensure that the calculations for current support and any arrearages are correct. If there are multiple children or different types of support (e.g., child support and health insurance), make sure each component is clearly itemized as required by the template. Once completed, review the entire document for accuracy, spelling, and grammar. A neat and error-free form reflects professionalism and facilitates smoother processing.

Finally, once the income withholding form template is accurately filled out, it must be properly served to the employer. Florida law specifies how these documents should be served, often requiring certified mail or personal service to ensure the employer receives official notification. Retain copies for your records and be prepared to answer any questions the employer or the support enforcement agency might have regarding the order. Following these steps helps ensure that the income withholding process proceeds smoothly and effectively, fulfilling its purpose of ensuring consistent support payments.

Understanding and correctly implementing income withholding orders are vital components of ensuring financial stability for many families in Florida. Whether you are obligated to make payments or are responsible for processing them as an employer, having a clear grasp of the procedures involved is essential. The right tools and knowledge can simplify what might initially seem like a daunting task.

By utilizing precise forms and following established guidelines, all parties can contribute to a system that functions efficiently and fairly. This proactive approach helps in meeting legal responsibilities while also providing consistent support, fostering greater financial predictability and security for those who rely on these regular payments.