Venturing into the world of independent contracting offers incredible freedom and flexibility, allowing you to be your own boss and chart your own professional course. However, with that independence comes the responsibility of managing your own taxes. Unlike traditional employees who have taxes withheld from every paycheck, independent contractors are responsible for calculating and paying their own income and self-employment taxes, often in quarterly installments. It can feel like a complex maze, but understanding the essential forms and best practices can make the process much smoother.

Many new contractors find themselves overwhelmed by the array of IRS documents and the need to keep meticulous records. The good news is that with a bit of organization and a clear understanding of what’s expected, you can navigate your tax obligations with confidence. This guide will walk you through the key tax forms you’ll likely encounter as an independent contractor and offer practical tips for staying on top of your financial responsibilities, ensuring you’re prepared for tax season year-round.

Understanding Your Core Independent Contractor Tax Obligations

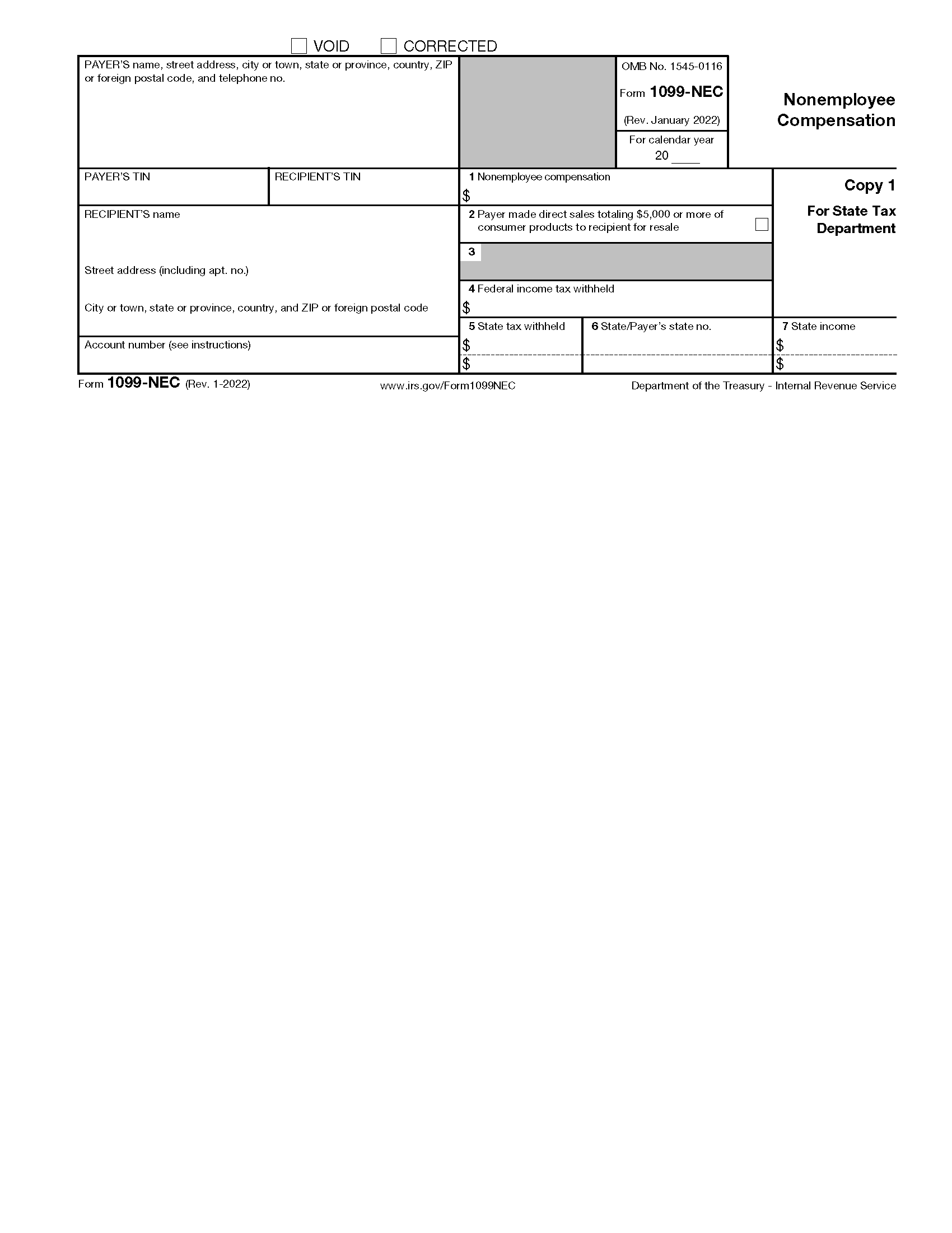

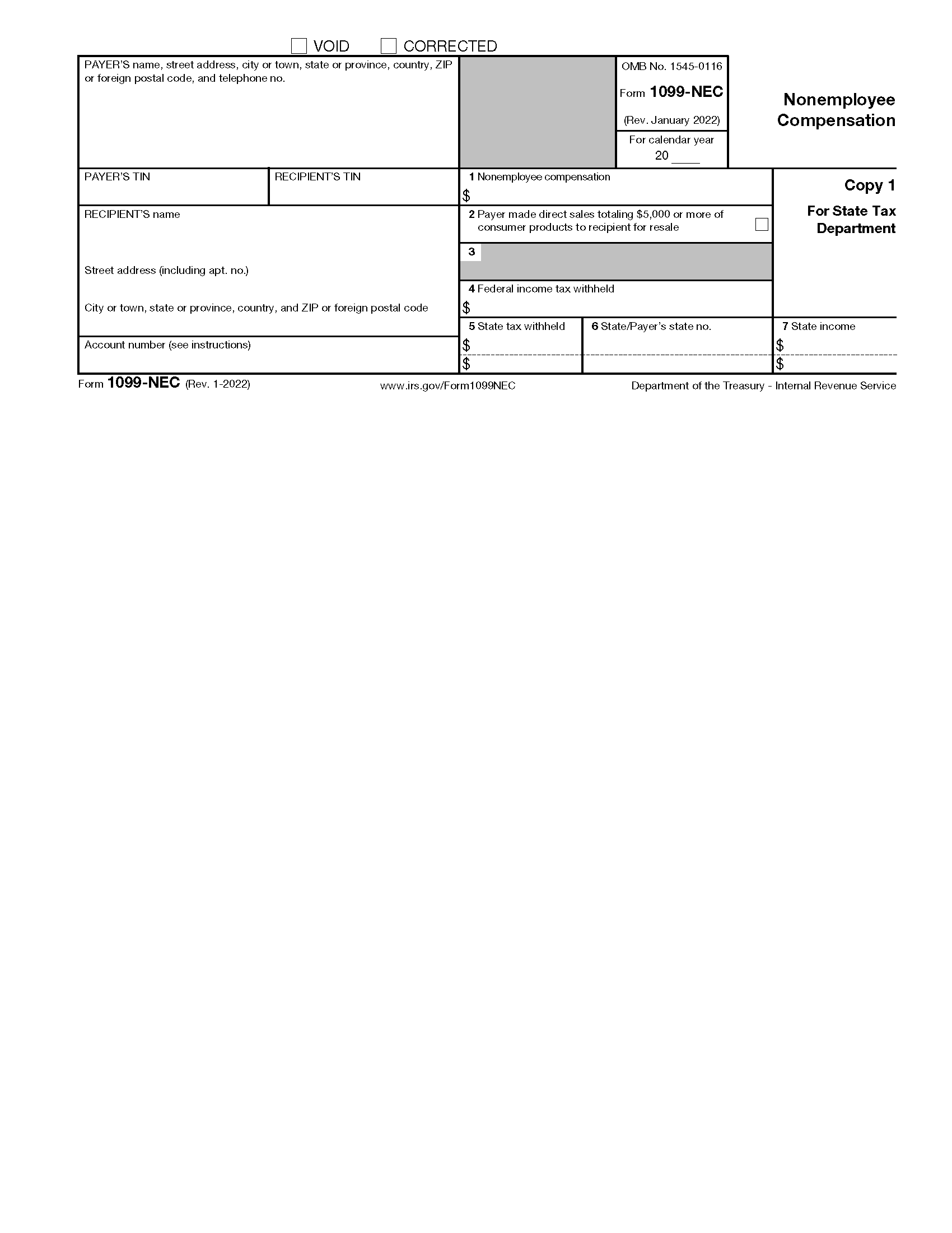

As an independent contractor, also often referred to as a freelancer or gig worker, the Internal Revenue Service views you as a self-employed individual. This distinction significantly changes how your income is taxed compared to an employee. Instead of receiving a W-2 form at year-end, you’ll primarily deal with Form 1099-NEC for nonemployee compensation. This form is typically issued by clients who have paid you $600 or more in a calendar year. Your total income reported on these forms will be subject to self-employment tax, which covers both your social security and Medicare contributions.

Beyond simply receiving income forms, you’re also responsible for reporting all your business income and expenses. This is where meticulous record-keeping becomes incredibly important. You’ll use this information to calculate your net profit or loss, which then flows to your personal income tax return. Don’t forget that many common business expenses can be deducted, reducing your taxable income. Things like home office deductions, business-related travel, professional development, and even certain software subscriptions can often be written off.

Key Tax Forms You’ll Encounter as an Independent Contractor

Navigating the various IRS forms can seem daunting, but once you understand their purpose, it becomes much clearer. Here are the primary forms you’ll likely interact with:

- Form W-9, Request for Taxpayer Identification Number and Certification: This is a form you provide to your clients *before* they pay you. It gives them your Taxpayer Identification Number (usually your Social Security Number or Employer Identification Number) so they can properly report payments made to you to the IRS. Think of it as your client’s way of getting your information on file.

- Form 1099-NEC, Nonemployee Compensation: As mentioned, clients use this form to report payments they’ve made to you for services. You’ll receive a copy from each client who paid you $600 or more. This form is crucial for accurately reporting your gross income.

- Schedule C, Profit or Loss From Business (Sole Proprietorship): This is arguably the most important form for most independent contractors. You’ll use Schedule C to report your business income and expenses, ultimately determining your net profit or loss from your contracting work. This net figure then carries over to your personal Form 1040.

- Schedule SE, Self-Employment Tax: Since you’re paying both the employer and employee portions of Social Security and Medicare taxes, you’ll use Schedule SE to calculate your self-employment tax liability. This tax is typically around 15.3% on your net earnings from self-employment.

- Form 1040-ES, Estimated Tax for Individuals: If you expect to owe at least $1,000 in taxes for the year, the IRS generally requires you to pay estimated taxes quarterly. This form helps you calculate and pay those installments throughout the year, preventing a large tax bill and potential penalties at tax time.

Understanding these forms is the first step towards feeling confident about your tax responsibilities. Many independent contractor tax form template resources are available to help you organize the information needed for these forms.

Streamlining Your Tax Process and Staying Organized

Managing taxes as an independent contractor doesn’t have to be a last-minute scramble. By implementing a few smart strategies throughout the year, you can significantly reduce stress and ensure you’re always prepared. One of the most critical aspects is maintaining excellent records of all your income and expenses. This isn’t just about avoiding an audit; it’s about accurately determining your taxable income and identifying all eligible deductions to minimize your tax bill.

Consider setting up a dedicated bank account for your business income and expenses. This separation makes tracking much simpler than commingling personal and business funds. Utilize accounting software or even a simple spreadsheet to categorize every transaction. Regularly review these records, ideally monthly, to catch any discrepancies and ensure everything is properly classified. This proactive approach saves immense time and headaches when tax season rolls around.

Another crucial element is planning for your estimated tax payments. Since no one is withholding taxes from your paychecks, it’s your responsibility to set aside funds for your quarterly tax obligations. A common practice is to allocate a percentage of every payment you receive into a separate savings account specifically for taxes. The exact percentage will depend on your income level, deductions, and state tax laws, but often ranges from 25% to 35%. Missing these payments can result in penalties, so planning ahead is key.

Finally, consider utilizing an independent contractor tax form template or other tax planning tools. Many online resources and software programs are designed specifically for self-employed individuals, helping you track income, categorize expenses, and even calculate estimated taxes. These tools can automate much of the data organization, making the process less cumbersome. While templates can guide you, remember to consult with a tax professional, especially as your business grows or if your financial situation becomes more complex. Their expertise can ensure you’re taking advantage of all eligible deductions and remaining compliant with tax laws, ultimately saving you money and providing peace of mind.

Embracing your role as an independent contractor means taking full ownership of your business, and that includes your financial responsibilities. By staying organized, understanding the forms, and proactively managing your tax obligations, you’ll not only avoid last-minute stress but also build a solid foundation for your continued success. Remember, a well-managed tax strategy is a cornerstone of a thriving independent career.

With the right approach, navigating your taxes can become a routine part of your independent journey, freeing you up to focus on what you do best. Stay informed, keep good records, and don’t hesitate to seek professional advice when needed. You’ve got this.