Utilizing a predefined structure offers several advantages. It promotes consistency and comparability across reporting periods, facilitating trend analysis and performance evaluation. Furthermore, it streamlines the reporting process, reducing the risk of errors and omissions. This standardized approach also aids stakeholders, including investors and creditors, in readily understanding a company’s cash flow dynamics, enhancing transparency and informed decision-making.

This structured approach to cash flow reporting forms a cornerstone of financial statement analysis. Understanding its components and their interrelationships is essential for assessing a company’s financial health and predicting future performance. Subsequent sections will delve into specific elements of this structured report, providing practical examples and illustrating their significance in financial analysis.

1. Starts with net income.

The indirect method distinguishes itself from the direct method by its starting point: net income. This foundational difference shapes the structure and interpretation of the entire statement. Understanding the implications of beginning with net income is crucial for accurately analyzing cash flow dynamics.

- Accrual Accounting AdjustmentNet income, derived from accrual accounting, reflects revenues earned and expenses incurred, regardless of when cash changes hands. The indirect method adjusts for these non-cash items to arrive at operating cash flow. For example, depreciation expense reduces net income but doesn’t involve a cash outflow and is therefore added back. This adjustment provides a more accurate representation of actual cash generated from operations.

- Working Capital ChangesChanges in working capital accounts, such as increases in accounts receivable or decreases in inventory, further refine the cash flow picture. These changes impact cash flow even though they don’t directly affect net income. For instance, an increase in accounts receivable represents revenue recognized but cash not yet collected. The indirect method adjusts for these changes to arrive at a true reflection of operating cash flow.

- Reconciliation to Cash Flow from OperationsStarting with net income allows for a reconciliation between the accrual-based income statement and the cash-based statement of cash flows. This reconciliation enhances transparency and allows analysts to understand the relationship between reported profitability and actual cash generation. It bridges the gap between these two key financial statements.

- Focus on Operating ActivitiesBy beginning with net income, the indirect method emphasizes the cash flows generated from the core operating activities of a business. This focus provides insights into the sustainability and quality of earnings, which are critical factors for evaluating financial health and predicting future performance.

Starting with net income establishes the foundation for the indirect method’s analytical power. By systematically adjusting for non-cash items and changes in working capital, this method provides a comprehensive view of a company’s operating cash flows, enabling a more thorough assessment of financial performance and sustainability.

2. Adjusts for non-cash items.

A crucial characteristic of the indirect method within the structured format of the cash flow statement is its adjustment for non-cash items. These adjustments bridge the gap between accrual accounting, which recognizes revenues and expenses when earned or incurred, and cash accounting, which focuses solely on cash inflows and outflows. This reconciliation provides a clearer picture of a company’s operating cash flow by eliminating the impact of transactions that do not involve actual cash movement.

Several key non-cash items frequently require adjustment within this structured reporting format. Depreciation and amortization, representing the allocation of an asset’s cost over its useful life, are added back to net income since they reduce reported profit without impacting cash. Similarly, gains or losses on the sale of assets are adjusted. For example, a gain on the sale of equipment increases net income but only the cash proceeds from the sale represent the actual cash inflow from this transaction; the gain portion requires deduction. Changes in deferred taxes, reflecting the difference between tax expense reported and taxes actually paid, also require adjustments. Other non-cash adjustments include stock-based compensation, impairment charges, and bad debt expenses.

Consider a company reporting net income of $100,000 with $20,000 in depreciation expense. While net income suggests $100,000 in profitability, the $20,000 depreciation expense did not involve a cash outflow. The indirect method adds this non-cash expense back to net income, resulting in an operating cash flow of $120,000, a more accurate reflection of cash generated from operations. Understanding these adjustments is crucial for interpreting the statement effectively. Failure to account for these non-cash items can lead to misinterpretations of a company’s true cash generation capabilities and financial health. This process provides crucial insights for investment decisions, credit assessments, and overall financial analysis.

3. Reconciles to operating cash flow.

The indirect statement of cash flows template culminates in a reconciliation to operating cash flow. This reconciliation represents a critical element, connecting the accrual-based net income figure from the income statement to the cash-based perspective of operating activities. This process clarifies the relationship between profitability and actual cash generated from a company’s core business operations.

- Bridging Accrual and Cash AccountingThe reconciliation bridges the gap between accrual and cash accounting. Accrual accounting recognizes revenue when earned and expenses when incurred, regardless of cash timing. Conversely, the statement of cash flows focuses solely on cash inflows and outflows. The indirect method adjusts net income for non-cash items and working capital changes to arrive at operating cash flow, effectively translating accrual-based results into a cash-based perspective.

- Highlighting Non-Cash ImpactsReconciling to operating cash flow highlights the impact of non-cash transactions on reported profitability. Items like depreciation and amortization reduce net income but don’t involve cash outflows. The reconciliation adds these back to net income, providing a more accurate representation of cash generated from operations. For example, a company reporting a net loss might still generate positive operating cash flow due to significant non-cash expenses.

- Evaluating Earnings QualityThis reconciliation provides valuable insights into the quality of a company’s earnings. A significant divergence between net income and operating cash flow can signal potential issues. For example, consistently high net income coupled with low operating cash flow might indicate aggressive revenue recognition practices or difficulties collecting receivables. Conversely, strong operating cash flow despite lower net income could suggest conservative accounting or investments in long-term assets.

- Informing Financial DecisionsThe reconciled operating cash flow figure is a crucial input for various financial decisions. Investors use it to assess a company’s ability to generate cash to fund operations, reinvest in growth, and distribute dividends. Creditors analyze operating cash flow to evaluate a company’s capacity to service debt obligations. Internal management uses this information for resource allocation, budgeting, and performance evaluation.

The reconciliation to operating cash flow within the indirect statement of cash flows template provides a crucial link between reported profitability and actual cash generation. By understanding this connection, stakeholders gain valuable insights into a company’s financial health, operational efficiency, and ability to generate sustainable cash flow, which are essential for informed decision-making.

4. Highlights working capital changes.

Analysis of working capital changes forms an integral part of the indirect statement of cash flows template. Working capital, representing the difference between current assets and current liabilities, provides insights into a company’s short-term liquidity and operational efficiency. The indirect method specifically focuses on changes in working capital accounts, as these fluctuations directly impact cash flow even if they don’t affect net income. Understanding these changes is crucial for accurately assessing a company’s operating performance.

- Accounts ReceivableIncreases in accounts receivable signify revenue recognized but cash not yet collected. Within the indirect method, increases in accounts receivable are deducted from net income because they represent a use of cash cash tied up in outstanding customer balances. Conversely, decreases in accounts receivable are added back, reflecting cash collections from customers. For example, if accounts receivable increase by $10,000, this indicates $10,000 less cash collected than revenue recognized, and therefore reduces operating cash flow.

- InventoryIncreases in inventory represent cash used to purchase goods, thus reducing operating cash flow within the indirect method framework. Decreases in inventory, on the other hand, indicate sales of goods, freeing up cash and therefore increasing operating cash flow. For instance, a $5,000 increase in inventory signifies a $5,000 cash outflow related to purchasing additional inventory, impacting operating cash flow negatively.

- Accounts PayableIncreases in accounts payable signify expenses incurred but not yet paid, effectively representing a source of cash. Therefore, increases in accounts payable are added to net income in the indirect method. Decreases in accounts payable represent cash outflows for settling outstanding supplier invoices and are deducted. An increase of $2,000 in accounts payable, for instance, signifies $2,000 of expenses incurred without a corresponding cash outflow, increasing operating cash flow.

- Prepaid ExpensesIncreases in prepaid expenses represent cash outflows for expenses paid in advance, reducing operating cash flow. Decreases indicate the consumption of prepaid expenses, having no impact on cash flow in the current period. For example, a $1,000 increase in prepaid insurance reflects a cash outflow for insurance coverage paid in advance, and thus decreases operating cash flow.

Analyzing changes in working capital accounts within the indirect statement of cash flows template provides crucial insights into a companys short-term financial management and operational efficiency. These adjustments refine the understanding of operating cash flow, offering a clearer picture of a company’s ability to generate cash from core business activities. By understanding these working capital fluctuations, stakeholders gain a more comprehensive view of a company’s financial position and can make more informed decisions.

5. Enhances financial transparency.

Financial transparency, a cornerstone of sound corporate governance and investor confidence, hinges on clear and comprehensive financial reporting. The indirect statement of cash flows template plays a vital role in promoting this transparency by providing stakeholders with a detailed understanding of how a company generates and uses cash. This structured approach offers insights beyond the accrual-based income statement, unveiling the underlying cash flow dynamics crucial for informed decision-making.

- Reconciling Profitability with Cash FlowThe template reconciles net income, an accrual-based measure of profitability, with operating cash flow, offering a clearer picture of a company’s true cash-generating capacity. This reconciliation clarifies the impact of non-cash items, such as depreciation and amortization, which affect profitability but not immediate cash flow. For example, a company reporting a net loss might still generate positive cash flow from operations, a critical insight revealed by the indirect method.

- Illuminating Working Capital ManagementChanges in working capital accounts, such as accounts receivable, inventory, and accounts payable, significantly impact cash flow. The template explicitly details these changes, offering insights into a company’s operational efficiency and short-term liquidity management. For instance, a substantial increase in accounts receivable could signal potential difficulties in collecting payments from customers, a crucial detail not readily apparent from the income statement alone.

- Facilitating Comparative AnalysisThe standardized structure of the template facilitates comparisons of cash flow performance across different periods and against industry benchmarks. This comparability enables stakeholders to identify trends, assess performance improvements or deteriorations, and benchmark against competitors. Consistent reporting using the template enhances the ability to track performance over time and within the industry context.

- Supporting Informed Decision-MakingBy providing a comprehensive and transparent view of cash flow activities, the template supports more informed decision-making by investors, creditors, and other stakeholders. Investors can assess a company’s ability to generate cash for reinvestment, debt repayment, and dividend distributions. Creditors can evaluate a company’s capacity to service debt obligations. Internal management can utilize the information for resource allocation and performance evaluation.

The indirect statement of cash flows template, through its structured approach and detailed disclosures, significantly enhances financial transparency. This enhanced transparency fosters trust among stakeholders, facilitates informed decision-making, and contributes to a more robust and efficient capital market. By providing a clear understanding of a companys cash flows, the template strengthens the foundation for sound financial analysis and promotes better corporate governance.

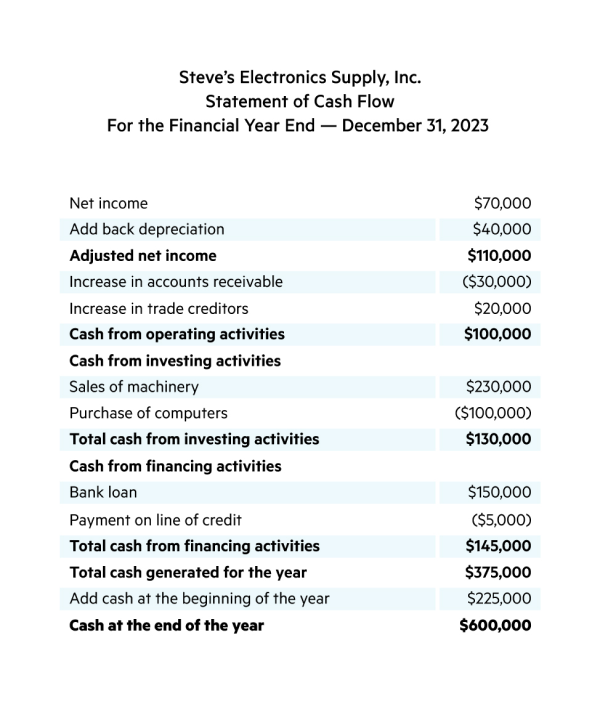

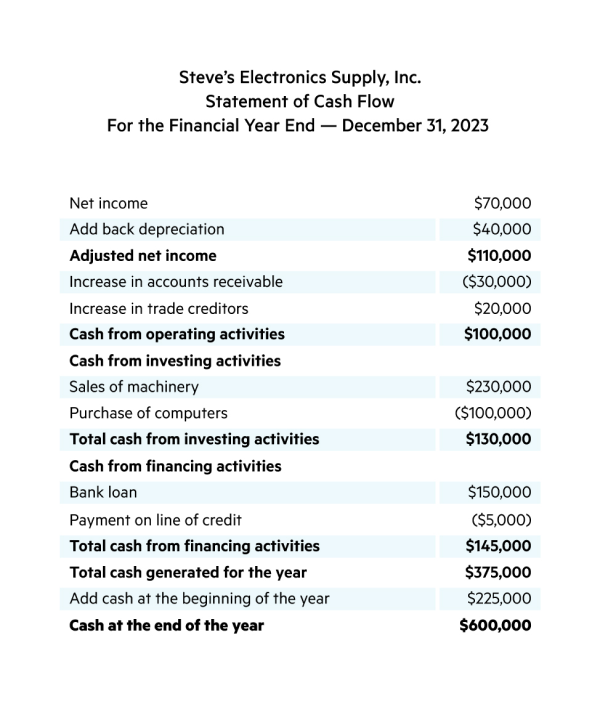

Key Components of the Indirect Cash Flow Statement

Effective analysis requires a thorough understanding of the key components comprising the indirect statement of cash flows. The following elements provide a foundational framework for interpreting this crucial financial statement.

1. Starting Point: Net Income

The indirect method begins with net income, a figure derived from the accrual-based income statement. This starting point sets the stage for subsequent adjustments that reconcile net income to operating cash flow.

2. Non-Cash Adjustments

Crucially, the indirect method adjusts for non-cash transactions impacting net income but not involving actual cash movement. Common examples include depreciation, amortization, stock-based compensation, and gains/losses on asset sales. These adjustments bridge the gap between accrual and cash accounting.

3. Changes in Working Capital

Fluctuations in working capital accountscurrent assets and liabilitiesdirectly influence cash flow. Increases in accounts receivable, for instance, represent revenue recognized but cash not yet collected. The indirect method meticulously accounts for these changes to derive a more accurate representation of operating cash flow.

4. Operating Activities Focus

The primary focus remains on cash flows generated from core operating activities. This emphasis provides insights into the sustainability and quality of earnings, key indicators of financial health and future performance potential.

5. Reconciliation to Operating Cash Flow

The ultimate goal is to reconcile net income to cash flow from operations. This reconciliation provides a crucial link between profitability and actual cash generated from the business’s core activities.

6. Investing Activities

While the primary focus lies on operating activities, the indirect method also considers cash flows related to investing activities, which typically involve the acquisition and disposal of long-term assets.

7. Financing Activities

Financing activities, encompassing transactions with creditors and owners (e.g., debt issuance, equity financing, dividend payments), are also incorporated to provide a complete picture of all cash inflows and outflows.

Through these components, the indirect statement of cash flows offers a comprehensive view of a companys cash generation and usage, providing critical insights for evaluating financial performance, liquidity, and long-term sustainability.

How to Create an Indirect Statement of Cash Flows

Constructing an indirect statement of cash flows requires a systematic approach, beginning with net income and adjusting for non-cash items and changes in working capital. The following steps outline the process.

1: Begin with Net Income: Obtain the net income figure from the company’s income statement for the reporting period. This serves as the starting point for the indirect method.

2: Adjust for Non-Cash Items: Add back non-cash expenses, such as depreciation and amortization, and subtract non-cash gains, such as gains on the sale of assets. These adjustments reflect the difference between accrual accounting and cash flow.

3: Analyze Changes in Working Capital: Evaluate changes in current assets and liabilities. Increases in current assets (except cash) are generally subtracted from net income, while decreases are added. Increases in current liabilities are generally added, while decreases are subtracted. This reflects the impact of working capital changes on cash flow.

4: Calculate Cash Flow from Operating Activities: The sum of net income, non-cash adjustments, and changes in working capital yields cash flow from operating activities. This represents the cash generated or used by the core business operations.

5: Incorporate Investing Activities: Account for cash flows related to investments in long-term assets, such as property, plant, and equipment (PP&E). Cash outflows for acquisitions are subtracted, while cash inflows from disposals are added.

6: Include Financing Activities: Document cash flows related to financing, such as debt issuance, equity financing, and dividend payments. Cash inflows from borrowing or issuing equity are added, while cash outflows for debt repayment or dividends are subtracted.

7: Calculate Net Change in Cash: Sum the cash flows from operating, investing, and financing activities to arrive at the net change in cash for the reporting period. This figure represents the overall increase or decrease in the company’s cash balance.

8: Reconcile Beginning and Ending Cash Balance: Finally, add the net change in cash to the beginning cash balance to arrive at the ending cash balance. This reconciliation ensures the accuracy of the statement and provides a clear picture of the company’s cash position.

By following these steps, a comprehensive and accurate indirect statement of cash flows can be constructed, offering valuable insights into a companys financial performance and cash management practices.

The structured approach offered by an indirect statement of cash flows template provides a crucial lens for understanding a company’s financial health. By starting with net income and systematically adjusting for non-cash items and changes in working capital, this method reveals the true cash generated from core operations. This detailed reconciliation between profitability and cash flow offers invaluable insights for stakeholders, enabling informed assessments of financial performance, liquidity, and long-term sustainability. Understanding the nuances of this structured format, including the impact of working capital fluctuations and the significance of non-cash adjustments, equips analysts with the tools necessary for a thorough and accurate interpretation of a company’s financial position.

Mastery of this analytical tool empowers stakeholders to make more informed decisions, fostering greater transparency and accountability in the financial landscape. Further exploration and application of these principles are essential for navigating the complexities of financial reporting and gaining a deeper understanding of a company’s true financial strength and potential. Continued analysis and scrutiny of cash flow data remain paramount for sound financial analysis and effective decision-making in the dynamic world of business.