When unexpected events cause damage to your property or assets, whether it is a natural disaster, an accident, or unforeseen circumstances, the initial shock can often be overwhelming. Beyond the immediate concern for safety and recovery, there is the crucial step of documenting the damage for insurance purposes. This process is not just about taking a few photos; it requires a systematic approach to ensure every detail is captured accurately and comprehensively. A well-prepared assessment lays the groundwork for a smooth and fair claims experience.

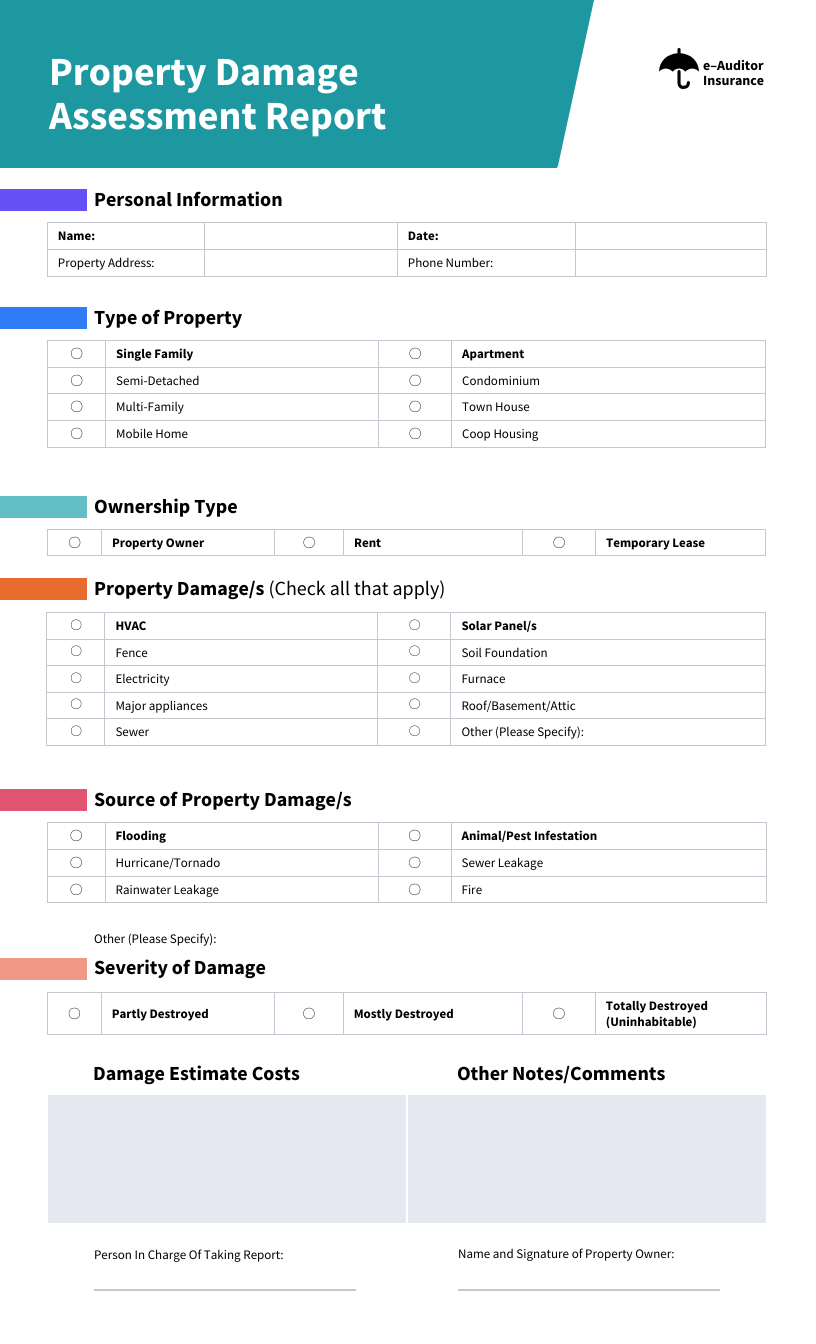

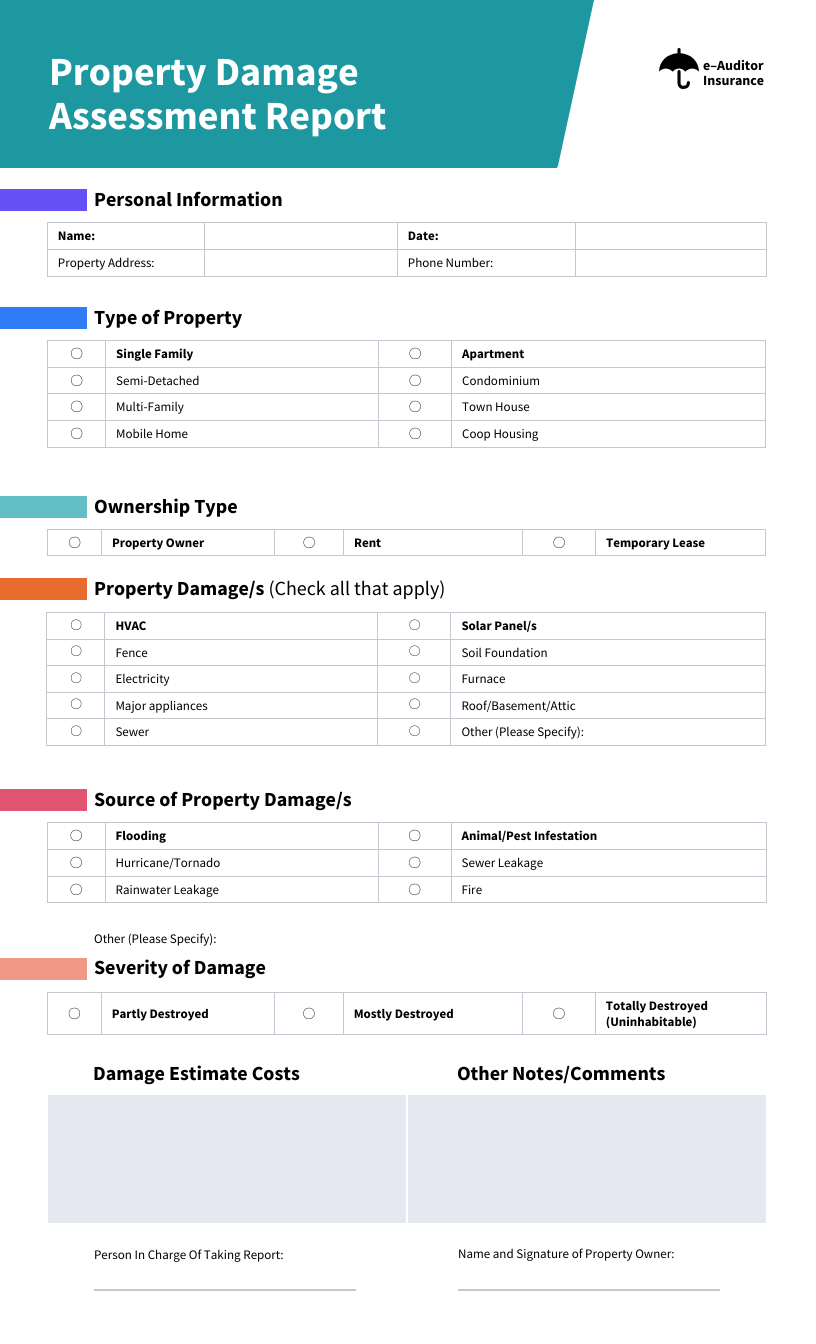

This is precisely where a dedicated insurance damage assessment form template becomes an invaluable tool. It acts as your structured guide through what can otherwise be a chaotic and confusing situation. By providing a clear framework, it helps you or an adjuster systematically record all the necessary information, from the nature of the damage to its estimated cost, ensuring nothing is overlooked. Utilizing a standardized template can significantly streamline the entire claims process, making it less stressful and more efficient for everyone involved.

Why a Solid Damage Assessment Form is Your Best Friend

Navigating the aftermath of property damage can be a daunting task, especially when you are trying to piece together information for an insurance claim. Without a structured approach, it is easy to miss crucial details that could impact the outcome of your claim. A robust damage assessment form acts as a critical asset, ensuring that all necessary information is collected systematically and accurately. This level of detail provides a clear picture to your insurance provider, helping them understand the full scope of the loss.

Imagine the frustration of having your claim delayed or even denied simply because you overlooked a vital piece of evidence or failed to document a specific aspect of the damage. A comprehensive form helps prevent such oversights. It guides you or the assessor through each required field, making sure that every element of the damage, from its cause to its extent, is thoroughly documented. This meticulous approach significantly reduces the potential for disputes or misunderstandings later in the process.

For both policyholders and insurance adjusters, a well-designed template brings immense benefits. For the policyholder, it empowers them to present a strong and undeniable case for their claim, ensuring they receive the compensation they are entitled to. For adjusters, it provides a standardized format for data collection, speeding up their investigation and making their work more efficient. This mutual benefit ultimately leads to faster claim processing and a more satisfactory resolution for everyone.

Ultimately, using a reliable insurance damage assessment form template is about securing peace of mind. It transforms a potentially overwhelming situation into a manageable process, backed by solid documentation. It is not just a piece of paper; it is a vital component of a successful insurance claim strategy, ensuring that your interests are well protected and that you can move forward with repairs and recovery without unnecessary complications.

Key Elements to Include in Your Template

- Contact information for the policyholder and claimant

- Policy number and details of the insurance company

- Date and time of the incident

- Detailed description of the incident leading to the damage

- Location of the damaged property or asset

- Type of damage incurred, for example fire, water, impact

- Specific areas or items affected

- Photographic or video evidence references

- Initial assessment of the extent of the damage

- Estimated cost of repairs or replacement

- Notes from the assessor and any additional relevant observations

- Signatures of all involved parties and the date of assessment

Streamlining Your Claims Process with a Ready-Made Template

The efficiency of your insurance claim process heavily relies on the quality and organization of your initial damage assessment. Attempting to piece together information haphazardly after an incident can lead to delays, errors, and an overall frustrating experience. This is where a ready-made insurance damage assessment form template proves to be an indispensable tool, designed to streamline every step of documentation from the very beginning.

By adopting a standardized template, you eliminate the guesswork involved in what information is needed. The template provides a clear, consistent structure, ensuring that all vital details are captured accurately and completely. This consistency is crucial not only for the initial assessment but also for any subsequent review or audit by the insurance provider. It reduces the likelihood of omissions or misinterpretations that could otherwise complicate your claim.

Whether you are dealing with property damage from a storm, vehicle damage from a collision, or any other insured incident, a versatile template can be adapted to fit various scenarios. It helps to systematically document everything from the cause of the damage to its visual extent and estimated repair costs. Many templates also include sections for photographic evidence references, which are critical for substantiating claims and speeding up the approval process.

Furthermore, integrating a well-designed template into your claims protocol can significantly reduce the administrative burden. For businesses or individuals who frequently deal with potential claims, having a consistent system in place means less time spent on paperwork and more time on recovery and restoration. You can even explore digital versions of these templates, allowing for easier data entry, secure storage, and seamless sharing with all relevant parties, further enhancing efficiency and accessibility.

Having a robust and user-friendly system for documenting damage is not merely a formality; it is a strategic advantage. It empowers you to approach the claims process with confidence, equipped with a comprehensive record of the incident. This proactive stance ensures that you are prepared for every step, from initial submission to final resolution, ultimately leading to a more positive outcome for your insurance claim.

By diligently documenting all damage and losses, you are building a strong foundation for your claim. This thoroughness helps to paint a clear and undeniable picture for your insurer, facilitating a quicker and fairer assessment of your compensation. It is about taking control of the process and ensuring that your recovery is as smooth and efficient as possible.