Life is a constant journey of change, and with these changes often comes the need to update crucial personal details with various service providers. When it comes to your insurance, keeping your information current is not just a suggestion; it is a necessity for ensuring your coverage remains valid and effective when you need it most. Whether you have moved to a new address, welcomed a new family member, purchased a new vehicle, or changed your name, your insurance provider needs to know.

Trying to remember every piece of information to convey, or which department to contact, can be a frustrating experience. This is where a well-designed insurance information update form template becomes an invaluable tool. It simplifies the process for you as the policyholder, ensuring you provide all necessary details in a clear, organized manner, and equally benefits your insurance company by streamlining their record-keeping.

The Crucial Role of an Effective Update Process

Maintaining accurate records is at the heart of any reliable insurance policy. Imagine you have moved homes, but your insurer still has your old address on file. If an incident occurs at your new location, or important policy documents are mailed out, you could face significant delays or even a denial of claims simply because your information was outdated. This scenario highlights why having a clear and accessible method for policyholders to update their details is not just convenient but essential for both parties.

From the policyholder’s perspective, life events happen rapidly. A marriage, a new baby, purchasing a new car, or even changing jobs might impact your insurance needs and premiums. Without a straightforward way to communicate these changes, you might find yourself underinsured, overpaying, or worse, having your policy invalidated. A standardized form removes the guesswork, guiding you through the exact information required to ensure your coverage aligns with your current circumstances.

For insurance companies, an efficient update process translates into better customer service and operational efficiency. When policyholders can easily submit their updates, it reduces the volume of phone calls and emails, freeing up customer service representatives to handle more complex inquiries. Furthermore, accurate data ensures that premium calculations are correct, claims are processed smoothly, and regulatory compliance is maintained. It helps prevent disputes and builds a stronger, more trusting relationship between the insurer and the insured.

Ultimately, the goal is to create a seamless experience where updating your insurance details is as simple as possible. This minimizes errors, maximizes coverage effectiveness, and provides peace of mind that your insurance protection is always up to date, safeguarding your financial future against life’s unpredictable moments.

What to Include in Your Template

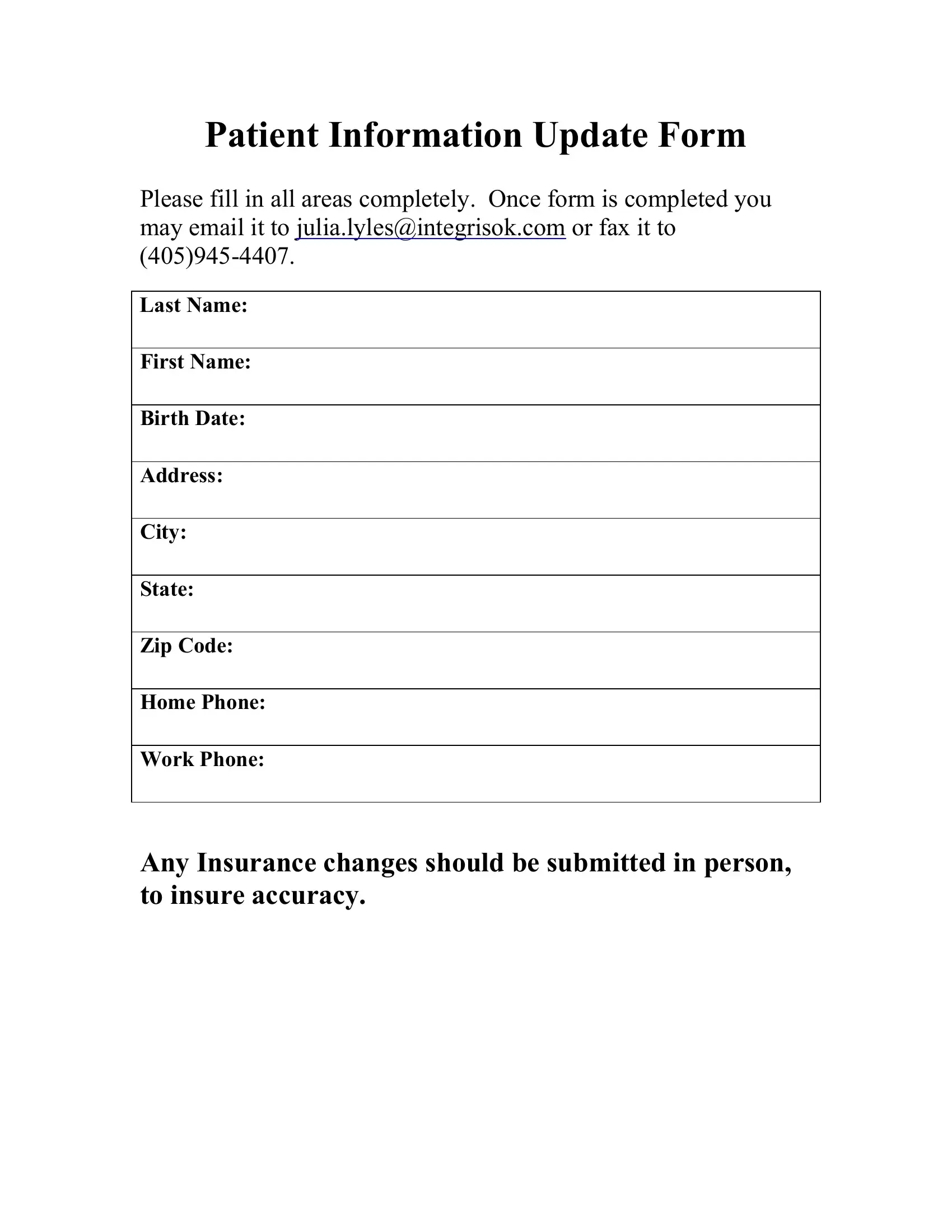

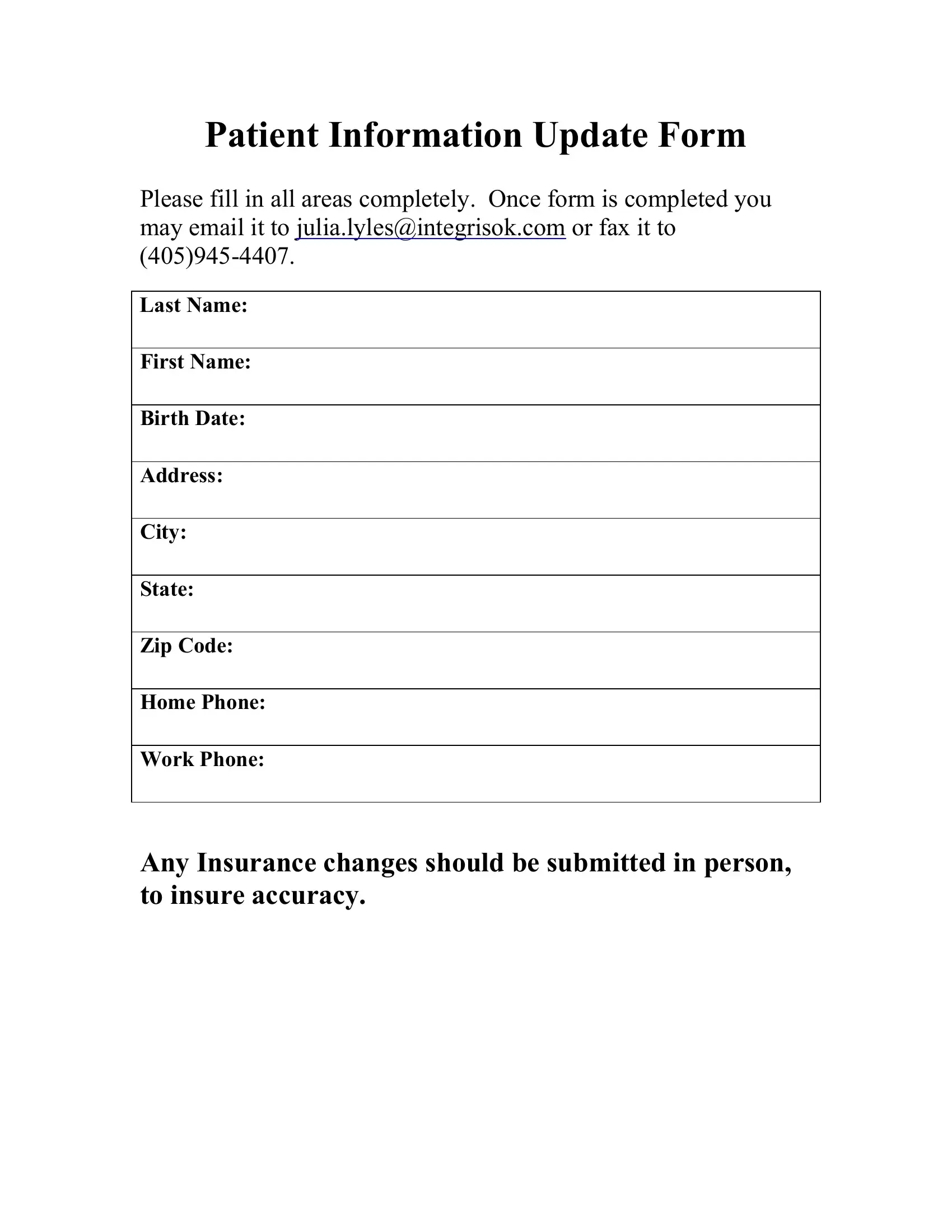

Creating a comprehensive yet user-friendly insurance information update form template requires careful consideration of all essential data points.

- Policyholder Identification: Clearly request the full name, policy number, and contact information (phone, email, current address) of the policyholder.

- Type of Update: Provide a section where the policyholder can specify what kind of change they are reporting (e.g., address change, name change, new vehicle, new dependent).

- Old vs. New Information: Create dedicated fields to differentiate between the information currently on file and the new, updated information. This helps in quick verification and data entry.

- Effective Date of Change: Ask for the date when the change became or will become effective, which is crucial for policy adjustments.

- Supporting Documentation: Include a note about any necessary supporting documents (e.g., marriage certificate for a name change, new vehicle registration for a car update) and how to submit them.

- Declaration and Signature: A section for the policyholder to declare the information is true and accurate, along with their signature and the date of submission.

Crafting a User-Friendly Update Form

Designing an effective insurance information update form template goes beyond just including the right fields; it involves creating a document that is intuitive and easy to navigate for anyone who needs to use it. The layout and language play a significant role in how quickly and accurately updates are submitted. A confusing form can lead to errors, frustration, and incomplete submissions, defeating the very purpose of having a template.

Consider the user experience from start to finish. Is the language clear and concise, avoiding jargon where possible? Are the fields logically grouped, perhaps by category like "Personal Details" or "Policy Information"? Using clear headings and ample white space can make the form less intimidating and more approachable. Think about the various methods a policyholder might use to fill out the form, whether digitally on a computer or by printing it out and filling it in by hand.

Accessibility is another key consideration. Ensure the font size is readable and that there is sufficient contrast between text and background. For digital forms, make sure it is compatible across different devices and browsers. Providing clear instructions at the beginning of the form can significantly reduce user error and the need for follow-up questions, making the entire update process smoother for everyone involved.

Ultimately, a well-crafted form respects the policyholder’s time and makes the often-daunting task of updating personal information feel manageable. It reinforces the idea that the insurance provider values accuracy and convenience, fostering a positive relationship built on efficiency and clarity.

- Keep it Concise: Avoid unnecessary fields or lengthy explanations. Only ask for information directly relevant to the update.

- Use Clear Headings and Labels: Every section and field should have a straightforward, understandable label.

- Provide Examples (If Needed): For complex fields, a small example of the required format can prevent common mistakes.

- Include a Confirmation or Next Steps Section: Let the policyholder know what to expect after submitting the form, such as a confirmation email or a timeframe for processing.

Having a robust system in place for updating policy details is more than just an administrative task; it is a foundational element of effective risk management and customer satisfaction. It ensures that your coverage remains perfectly aligned with your life’s evolving landscape, offering genuine protection when you need it most.

By proactively providing a simple, structured way for policyholders to communicate changes, insurance providers can significantly enhance their service quality and maintain highly accurate client records. This proactive approach benefits everyone involved, fostering a relationship built on clarity, efficiency, and a mutual understanding of current policy terms.