Navigating the world of investments can sometimes feel like a complex maze, especially when it comes to moving your hard-earned funds from one place to another. Whether you are rebalancing your portfolio, consolidating accounts, or simply changing custodians, the process of transferring investment funds needs to be handled with precision and care. It is a critical financial step that, if not managed correctly, can lead to unnecessary delays, errors, or even significant headaches.

That’s where a well-designed investment fund transfer form template comes into play. Think of it as your reliable roadmap, guiding you through each necessary field and ensuring all crucial information is captured accurately. Having a standardized form not only streamlines the entire process for you but also makes it much easier for the financial institutions involved to execute your request promptly and without hitches. It’s about making a potentially daunting task feel straightforward and secure.

Understanding the Importance of a Proper Fund Transfer Form

When you are dealing with significant financial assets, accuracy isn’t just a recommendation; it’s an absolute necessity. A properly structured fund transfer form is the bedrock of a smooth transaction. Without it, you are essentially leaving room for human error, misinterpretations, and potential compliance issues, which no one wants when money is involved. Imagine trying to transfer thousands, or even millions, without a clear, documented instruction set. It’s a recipe for confusion and potential financial missteps.

A standardized form reduces ambiguity significantly. It acts as a clear communication tool between you and your financial provider, ensuring that all parties are on the same page regarding the exact nature of the transfer. This precision minimizes the chances of funds being sent to the wrong account, incorrect amounts being processed, or unexpected delays arising due to missing information. It’s about building trust and ensuring the integrity of your financial movements.

Furthermore, these templates often incorporate necessary legal disclaimers and authorizations, protecting both you and the financial institutions involved. They ensure that all regulatory requirements are met, which is incredibly important in the highly regulated financial industry. By using a robust template, you are not just simplifying a task; you are also adhering to best practices that safeguard your financial interests. It’s a small effort that yields significant peace of mind.

Think about the time saved. Instead of multiple back-and-forth communications to gather all the required details, a comprehensive investment fund transfer form template provides a structured format that prompts you for every piece of essential information upfront. This proactive approach drastically cuts down on processing times and helps you get your funds where they need to be, faster.

Key Elements to Look For

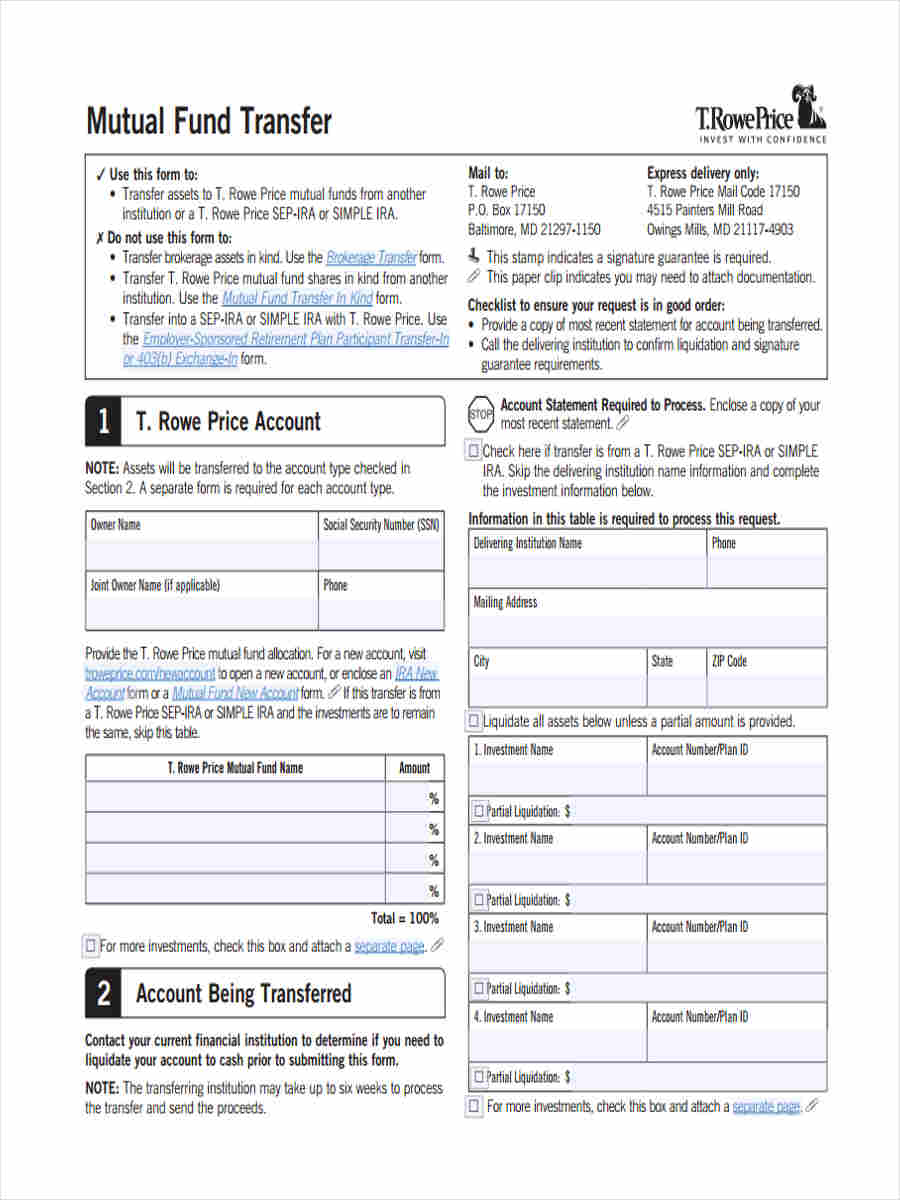

When you encounter an investment fund transfer form template, you’ll typically find several critical sections designed to capture specific details. Understanding these sections helps you prepare and fill out the form efficiently.

- Your current account details, including account number and institution name.

- The recipient account details: the exact account number and the name of the receiving institution.

- The specific amount or percentage of funds you wish to transfer.

- Clear instructions on the type of transfer, whether it’s a full transfer, partial, or an in-kind transfer of assets.

- Your clear authorization, often requiring a signature, to proceed with the transfer.

- Any necessary disclaimers or acknowledgments regarding processing times and potential fees.

Navigating the Transfer Process with Ease

Once you have the right investment fund transfer form template in hand, the actual process of moving your funds becomes far more manageable. Generally, the transfer process involves several steps: initiating the request, providing the necessary documentation, the financial institution processing the request, and finally, the funds settling in the new account. Each step, while seemingly simple, requires precise execution, and that’s where the template truly shines.

An investment fund transfer form template streamlines each of these stages by front-loading the information gathering. You’re not just filling out a piece of paper; you’re providing a comprehensive instruction set that your current and new financial institutions can easily interpret and act upon. This reduces the chances of miscommunication between the institutions, which is a common bottleneck in financial transfers. It’s like having a universal translator for your financial instructions.

Consider the compliance aspect. Financial institutions are under strict regulatory obligations to verify identities and ensure that fund transfers are legitimate and not involved in illicit activities. A well-designed form will typically ask for all the necessary identification and authorization details up front, allowing your institution to perform their due diligence efficiently. This adherence to compliance not only protects the institution but also adds a layer of security for your assets.

After you have completed the form, it’s always a good idea to make a copy for your personal records before submitting it. This ensures you have a clear paper trail, which can be invaluable if you ever need to follow up on the transfer status. Most institutions will then provide you with an estimated timeline for the transfer completion, keeping you informed every step of the way.

- Gather all necessary account information from both your current and destination institutions before you start filling out the form.

- Carefully review the terms and conditions associated with the transfer, paying attention to any fees or processing times.

- Double-check all numbers and names on the form for accuracy before submitting it. A single digit error can cause significant delays.

- Always keep a digital or physical copy of the completed and signed form for your records.

- Follow up with your financial advisor or institution if you don’t see the transfer reflected within the communicated timeframe.

Using a structured form for your investment transfers provides a sense of security and control over your financial journey. It minimizes potential pitfalls, ensuring that your valuable assets move smoothly and accurately from one investment vehicle to another. By leveraging such a tool, you are not just completing a transaction; you are proactively managing your financial future with precision and foresight.

Ultimately, whether you are an individual investor or a financial professional, having access to and understanding how to use an effective fund transfer template can save you time, reduce stress, and prevent costly errors. It empowers you to navigate the complexities of financial transfers with confidence, making sure your investment goals remain on track and your funds are precisely where they need to be.