Starting a new relationship with an investor client is more than just a handshake and a promise. It is the crucial first step in building a foundation of trust, understanding, and successful collaboration. Think of it as laying the groundwork for a skyscraper you both hope to build together, brick by brick, over many years. A well-designed intake process ensures you capture all the necessary information, align expectations, and set the stage for a productive partnership right from the beginning. It is about understanding their unique financial landscape, aspirations, and risk tolerance before any significant decisions are made.

This initial information gathering isn’t just a formality; it is a strategic necessity. It helps you tailor your services, identify potential red flags, and ensure regulatory compliance. For the client, it provides a sense of professionalism and thoroughness, reassuring them that they are in capable hands. Ultimately, a robust intake system streamlines your operations, saves time, and significantly reduces the potential for misunderstandings down the line, fostering a much healthier and more efficient client advisor relationship.

Why a Solid Investor Client Intake Form Template is Non-Negotiable

In the fast paced world of finance, efficiency and accuracy are paramount. An investor client intake form template isn’t just a document; it’s a vital tool that underpins the entire client onboarding process. It ensures consistency across all your new client interactions, no matter who on your team is handling the initial meeting. Imagine the chaos of trying to remember every detail discussed in a preliminary meeting without a structured way to record it. This template acts as your memory aid, your compliance checklist, and your strategic planning document all rolled into one. It empowers your team to gather all essential data systematically, reducing errors and ensuring nothing important slips through the cracks.

Beyond mere organization, a robust intake form elevates your professional image. When a prospective client sees that you have a structured and thorough process for understanding their needs, it instills confidence. It signals that you are meticulous, prepared, and genuinely invested in providing tailored solutions, not just generic advice. This early impression can be a significant differentiator in a competitive market, helping you convert prospects into long term, loyal clients. It shows that you value their time and their financial goals enough to invest in a detailed understanding from the outset.

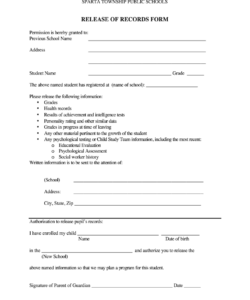

Furthermore, compliance is a non negotiable aspect of financial services. Regulations are constantly evolving, and the penalties for non compliance can be severe. An investor client intake form template helps you meet many of these regulatory requirements by systematically collecting information related to KYC Know Your Client, AML Anti Money Laundering, and suitability assessments. It provides an auditable trail of due diligence, demonstrating that you have taken reasonable steps to understand your client’s financial situation and objectives before recommending any products or services. This protective layer is invaluable for both your firm and your clients.

Establishing Client Suitability

One of the most critical functions of an intake form is to help you establish client suitability. You need to understand their financial objectives, risk tolerance, time horizon, and existing portfolio before you can recommend appropriate investments. This isn’t just about ticking boxes; it’s about genuinely understanding if their goals align with the investment strategies you offer. Are they looking for aggressive growth or stable income? Do they have a high tolerance for market fluctuations or prefer a more conservative approach? A well designed form guides these questions, ensuring you have a comprehensive picture before moving forward.

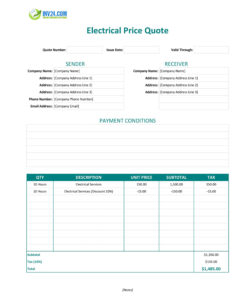

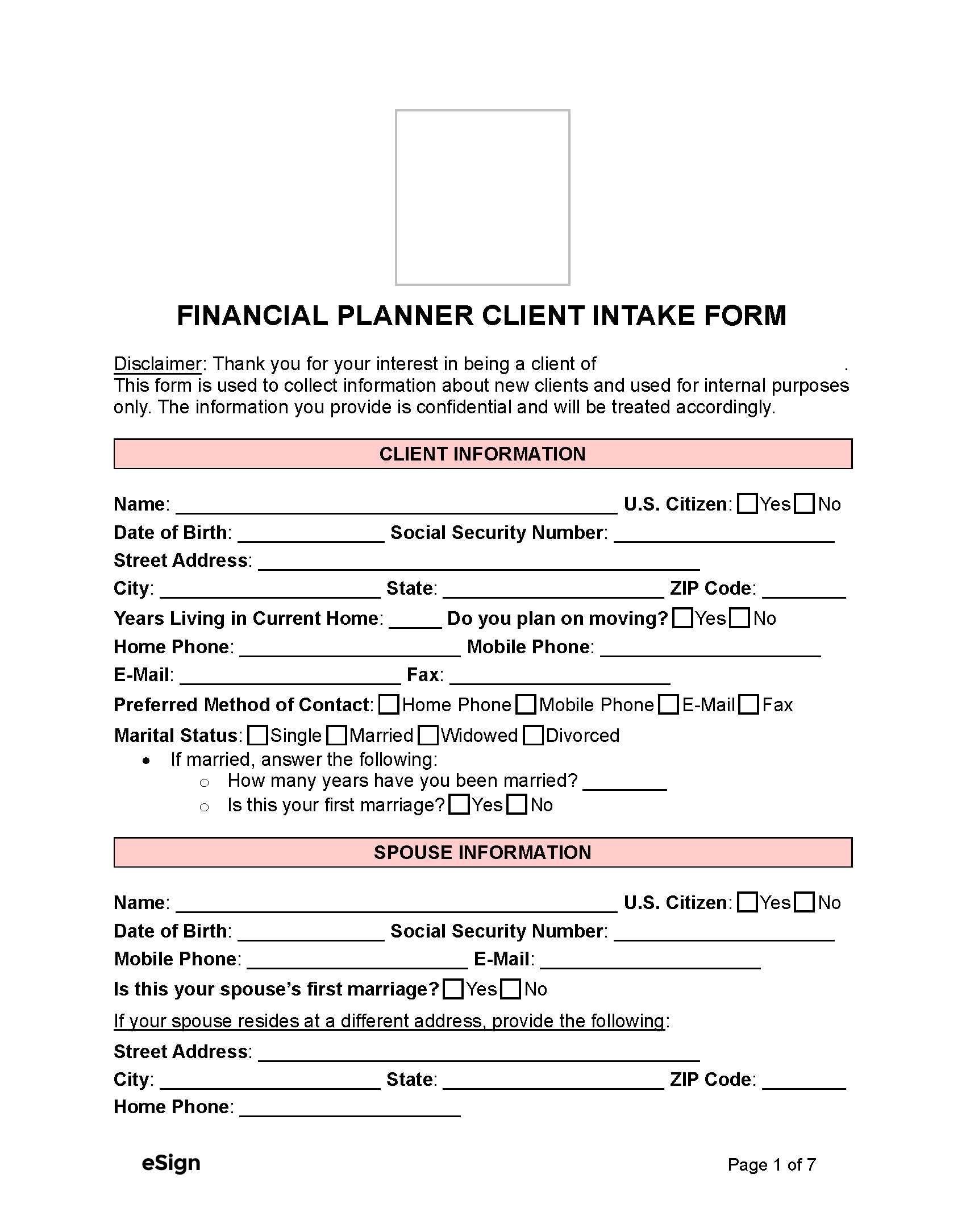

Key Elements to Include in Your Investor Client Intake Form Template

Crafting an effective investor client intake form template requires careful consideration of what information is truly essential. It is not just about collecting data, but collecting the right data that will inform your financial advice and service delivery. The form should be comprehensive enough to cover all necessary aspects of a client’s financial life, yet straightforward enough not to overwhelm them. Think about breaking it down into logical sections, guiding the client through their personal and financial landscape step by step. This thoughtful structure makes the process less daunting for the client and ensures you capture every vital piece of information.

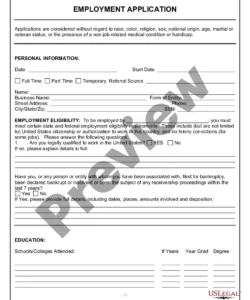

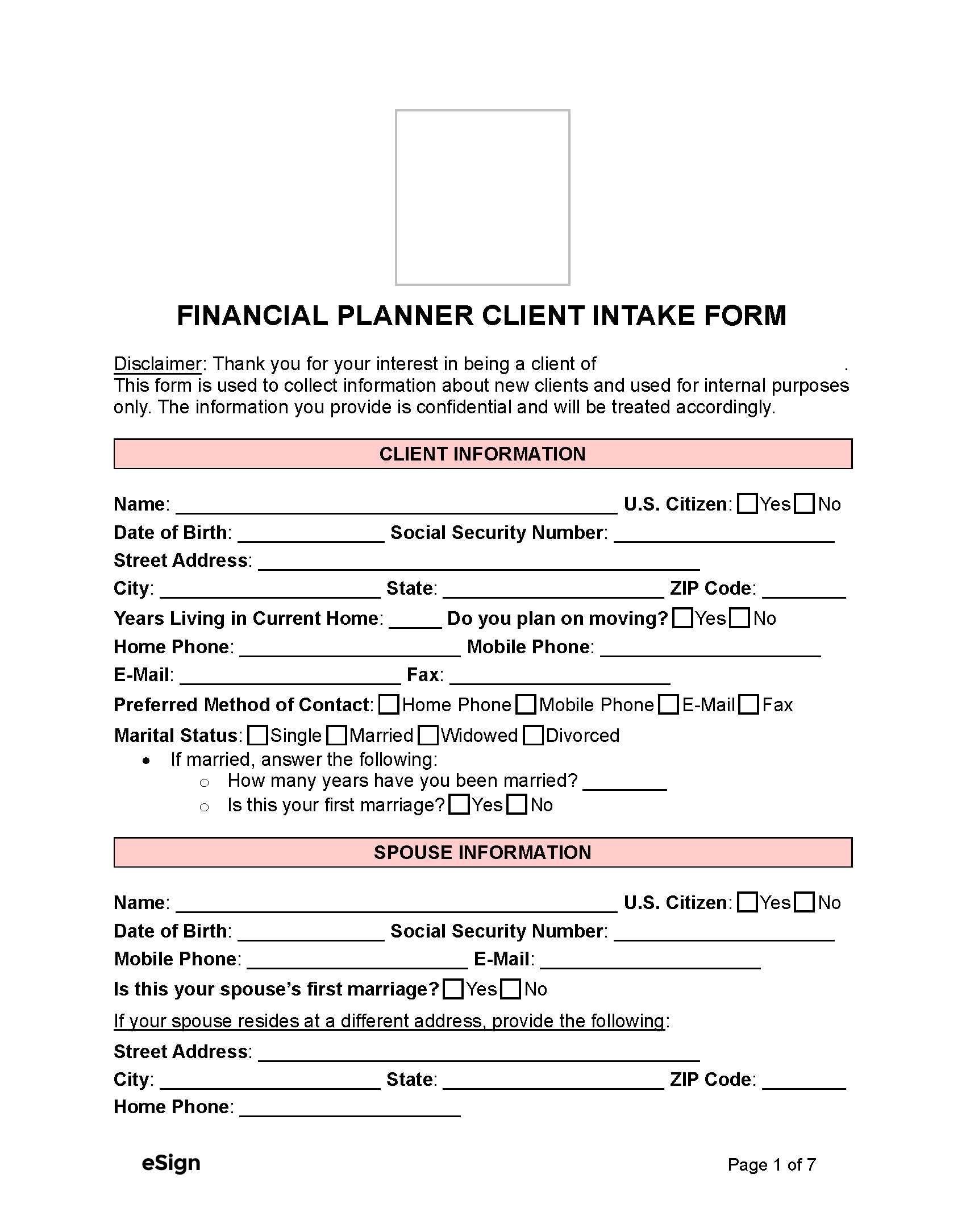

Firstly, you need to gather basic personal and contact information. This might seem obvious, but accurate names, addresses, phone numbers, and email addresses are fundamental for communication and record keeping. Beyond that, consider adding fields for their preferred method of contact and any specific times they might be available. This small detail can significantly improve the client experience. Also, think about collecting details on their occupation, employer, and approximate income; these factors can influence their financial capacity and investment choices.

Next, delve into their financial background and objectives. This is where you uncover their core needs and aspirations. It is crucial to understand not just what they want to achieve, but why. Are they saving for retirement, a child’s education, a down payment on a home, or perhaps building a legacy? Understanding their motivations helps you align your strategies with their deepest financial desires. This section should also cover their current assets and liabilities, providing a snapshot of their financial health.

Finally, and perhaps most importantly, assess their risk tolerance and investment experience. This is critical for portfolio construction. Do they have prior investment experience? How do they react to market volatility? What is their time horizon for investing? These questions help you gauge their comfort level with different investment vehicles and strategies. A well structured investor client intake form template will include a series of questions or even a simple questionnaire designed to objectively assess their risk profile, ensuring that any recommendations you make are suitable for their unique comfort level and financial situation.

- Personal and Contact Details Full name, address, phone, email, date of birth, social security number, marital status.

- Employment Information Occupation, employer, industry, annual income.

- Financial Situation Assets current accounts, savings, investments, real estate and Liabilities mortgages, loans, credit card debt.

- Investment Objectives Short term, medium term, and long term goals e.g., retirement, education, home purchase.

- Risk Tolerance Assessment Questions to gauge comfort with market fluctuations, potential losses, and different investment types.

- Investment Experience Previous investments, understanding of financial products, preferred level of involvement.

- Time Horizon How long they plan to invest for each objective.

- Source of Funds and Wealth Information for compliance purposes.

- Beneficiary Information For accounts and plans where applicable.

- Any Specific Needs or Preferences Environmental, Social, and Governance ESG preferences, ethical investing considerations.

Implementing a detailed yet user friendly intake process can significantly enhance your firm’s operational efficiency and client satisfaction. By gathering comprehensive information upfront, you establish a solid foundation for personalized financial advice and long term relationships. This proactive approach not only streamlines your work but also builds trust and demonstrates your commitment to understanding and meeting each client’s unique financial needs.

Ultimately, a well crafted intake system becomes an invaluable asset, ensuring that every new client relationship begins with clarity, compliance, and a clear path toward their financial aspirations. It sets the stage for mutual understanding and successful collaboration, paving the way for a prosperous future for both your clients and your firm.