Creating a last will and testament might sound like a daunting task, something reserved for the very wealthy or those reaching their twilight years. However, nothing could be further from the truth. A will is a fundamental document for anyone who wants to ensure their wishes are honored and their loved ones are cared for, regardless of their current age or financial standing. It’s about securing peace of mind for yourself and clarity for your family during a difficult time.

Many people delay writing a will because they perceive it as complicated or expensive, involving lengthy consultations with lawyers. While professional legal advice is always valuable, the advent of the last will and testament form template has revolutionized how individuals can approach this essential task. These templates offer a straightforward and accessible pathway to drafting your own will, guiding you through the necessary steps and ensuring you cover all the crucial aspects without the initial hefty fees or confusing legal jargon.

Navigating the Importance of Your Last Will and Testament

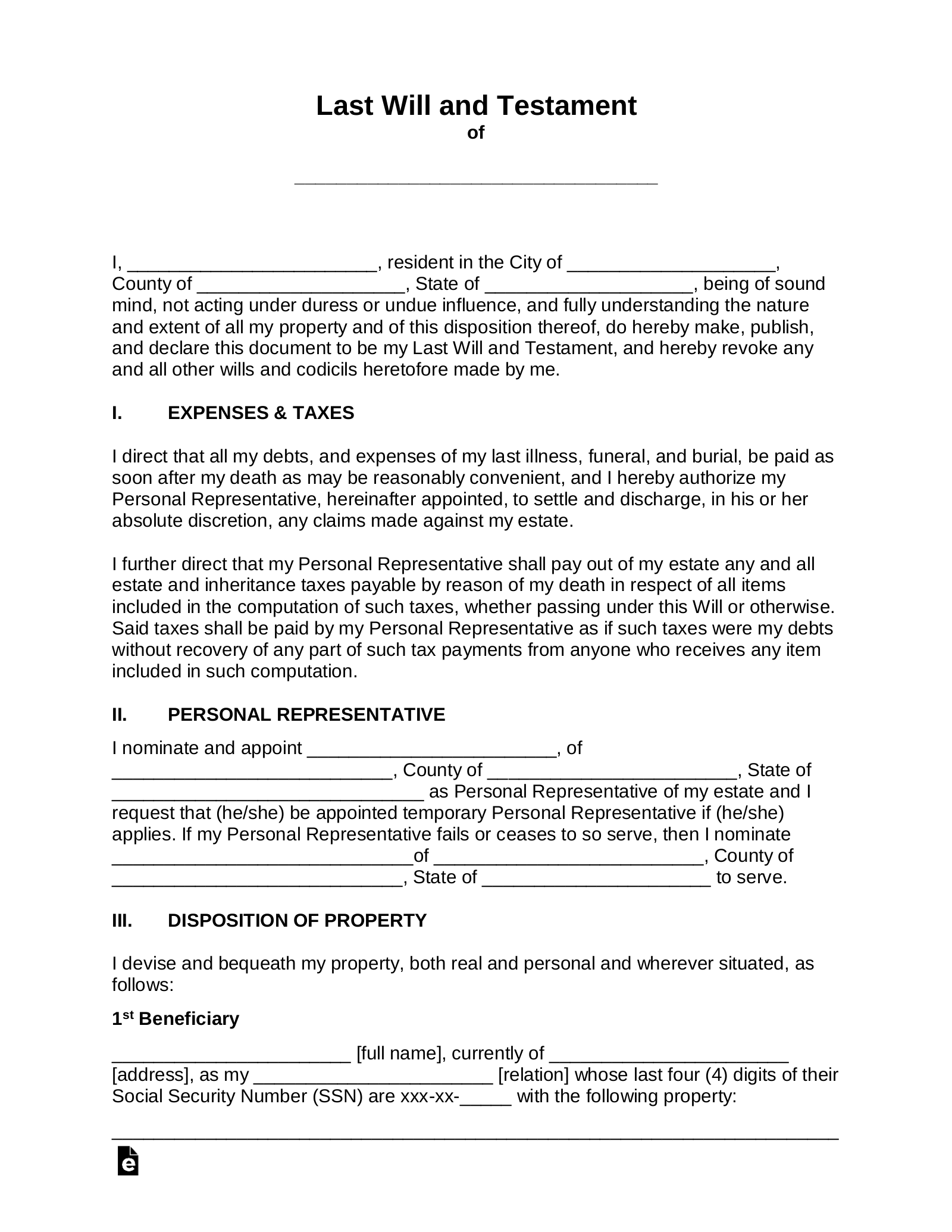

When we talk about a last will and testament, we’re essentially discussing a legal document that dictates how your assets will be distributed and how your minor children will be cared for after you pass away. Without a valid will, your estate could be subjected to probate court, and the distribution of your assets would follow state intestacy laws, which might not align with your true wishes. Imagine wanting your antique collection to go to your niece who shares your passion, only for it to be sold off because there’s no written instruction. This is precisely what a will prevents.

Beyond just assets, a will is crucial for appointing guardians for any minor children you might have. This is perhaps one of the most compelling reasons for young parents to create a will. You get to choose who would raise your children if both parents were no longer able to, ensuring they are cared for by someone you trust implicitly, rather than leaving this incredibly important decision to a court that doesn’t know your family or your values. It provides a layer of protection and certainty for the most precious part of your life.

Some people mistakenly believe they don’t have enough assets to warrant a will, or that only the elderly need one. This is a common misconception. Even modest estates can benefit from a will, as it clarifies ownership and prevents potential disputes among family members. Furthermore, life can be unpredictable. Accidents can happen at any age, and having your affairs in order provides immense comfort to those you leave behind, alleviating stress during a period of grief.

Utilizing a last will and testament form template makes this process significantly less intimidating. These templates break down the complex legal requirements into manageable sections, allowing you to systematically fill in your information and make your decisions. They serve as a foundational guide, ensuring you don’t overlook critical elements that might otherwise be missed when attempting to draft a will from scratch. While templates are a great starting point, understanding what goes into one is key to their effective use.

Key Components to Include

When you’re filling out a last will and testament form template, you’ll encounter several important sections that need careful consideration. Each one plays a vital role in ensuring your will is comprehensive and legally sound:

- **Executor Designation:** This is the person or entity you name to manage your estate, pay your debts, and distribute your assets according to your wishes. Choose someone trustworthy, organized, and willing to take on this responsibility.

- **Beneficiary Designation:** Clearly name who will receive your specific assets (e.g., money, property, heirlooms). Be as specific as possible to avoid ambiguity.

- **Guardians for Minors:** If you have children under 18, this section is paramount. You specify who will become their legal guardian if you and the other parent are both unable to care for them.

- **Asset Distribution:** Outline how your property, finances, and other belongings should be divided among your beneficiaries. You can specify exact items or percentages.

- **Residuary Clause:** This crucial clause covers any assets not specifically mentioned in the will. It typically states who receives the remainder of your estate after all specific bequests and debts are handled.

- **Signature and Witness Requirements:** For a will to be legally valid, it must be signed by you (the testator) in the presence of a specified number of witnesses (typically two, depending on your jurisdiction), who must also sign the document. Witnesses usually cannot be beneficiaries in the will.

Practical Steps for Using a Last Will and Testament Form Template

Once you’ve decided to use a last will and testament form template, the next logical step is to understand the practical aspects of filling it out and what to do afterward. The availability of these templates online has made estate planning more accessible than ever before. Many reputable legal websites and service providers offer free or low-cost templates that are designed to be compliant with general legal principles, though always remember to check for state-specific requirements if possible.

Before you begin filling in the blanks, gather all necessary information. This includes a clear list of your assets (bank accounts, real estate, vehicles, investments, valuable possessions), debts, and the full legal names and addresses of all intended beneficiaries, guardians, and your chosen executor. Having this information readily available will streamline the process and reduce the likelihood of errors or omissions. Take your time with each section, reading the accompanying instructions carefully.

It’s crucial to be meticulous and precise when filling out the template. Avoid using vague language or abbreviations that could lead to confusion later on. For instance, instead of saying “my car to my son,” specify the make, model, and year of the vehicle, and your son’s full legal name. The more detailed and unambiguous your instructions are, the less room there is for misinterpretation or legal challenges down the line. Remember, this document is meant to speak for you when you cannot.

After you have completed drafting your will using the last will and testament form template, the process isn’t quite finished. For the document to be legally binding, it must be properly executed. This typically involves signing the will in the presence of the required number of witnesses, who must then also sign the document in your presence and in each other’s presence. Depending on your state, notarization might also be recommended or required. Once signed and witnessed, store your original will in a safe, accessible place where your executor can easily find it, such as a fireproof safe, a safe deposit box, or with your attorney. Inform your executor of its location.

Taking the initiative to prepare your last will and testament is a profound act of care for your loved ones. It eliminates guesswork and potential disputes, allowing your family to focus on grieving and healing rather than navigating complex legal processes. It ensures that your legacy is distributed precisely as you intend, reflecting your values and wishes.

Embracing the simplicity and convenience offered by modern resources means that securing your family’s future has never been more attainable. By taking this important step, you’re providing invaluable clarity and comfort, offering a final thoughtful gesture that will be deeply appreciated by those you cherish most.