Dealing with overdue invoices is one of those frustrating parts of running a business, isn’t it? You’ve provided a service or delivered a product, and now you’re stuck chasing payment. It’s not just about the money; it’s about the time and energy spent following up, which could be better invested elsewhere. This common challenge can disrupt your cash flow and even strain client relationships if not handled delicately.

Fortunately, there’s a straightforward solution that can help streamline this process and maintain professionalism: a well-crafted late payment request form template. Using a standardized form takes the guesswork out of what to say and ensures you’re consistent in your communication. It helps you present your request clearly, formally, and without unnecessary emotion, making the whole experience less stressful for both you and your client.

Why a Standardized Late Payment Request Form Template is Your Best Ally

When invoices go unpaid, it’s easy to feel a mix of frustration and awkwardness. Businesses, big and small, often struggle with the delicate balance of demanding payment while trying to preserve valuable client relationships. Without a clear process, each late payment becomes a unique, time-consuming problem, often leading to inconsistent communication and potential misunderstandings. This ad-hoc approach can seriously impact your cash flow and administrative efficiency.

This is where a dedicated late payment request form template becomes an indispensable tool. It provides a structured, professional framework for all your follow-ups, ensuring that every piece of crucial information is included. Consistency in your communication not only saves you time but also conveys a sense of professionalism and organization to your clients, subtly reinforcing your terms and expectations. It removes the emotional component from the interaction, allowing for a clear, business-oriented discussion.

Furthermore, using a template ensures that your requests are always documented properly. In the unfortunate event that a payment issue escalates, having a clear trail of professional, consistent communications is vital. This documentation serves as a record of your efforts to collect the debt, which can be invaluable if you ever need to involve a third party or pursue legal action. It protects your business by demonstrating a diligent and fair approach to managing overdue accounts.

A comprehensive late payment request form template also empowers you to be proactive rather than reactive. By having all the necessary information readily available and formatted professionally, you can send out reminders promptly, often preventing a payment from becoming significantly overdue. This proactive stance significantly improves your chances of timely collection and reduces the overall stress associated with managing accounts receivable.

Key Elements Your Template Must Include

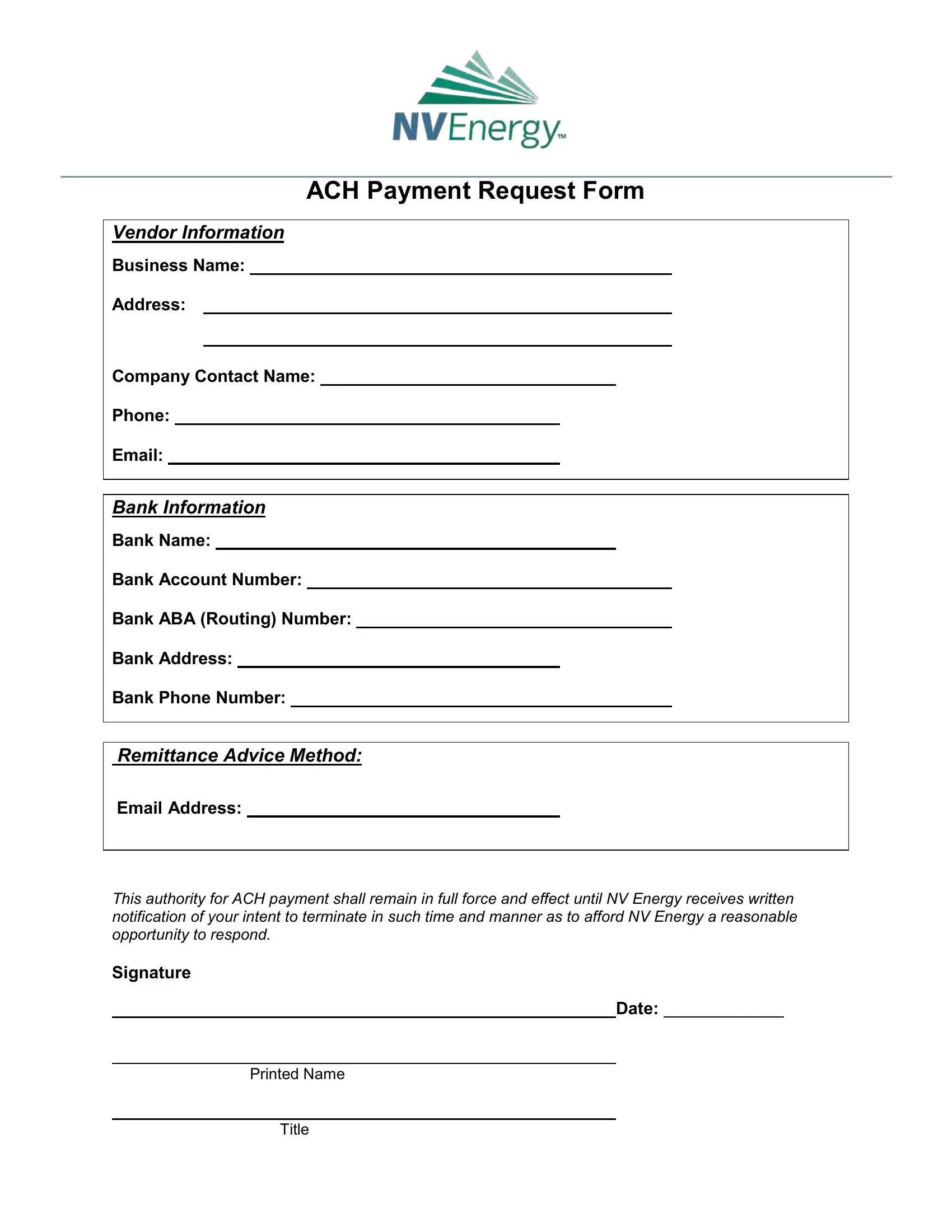

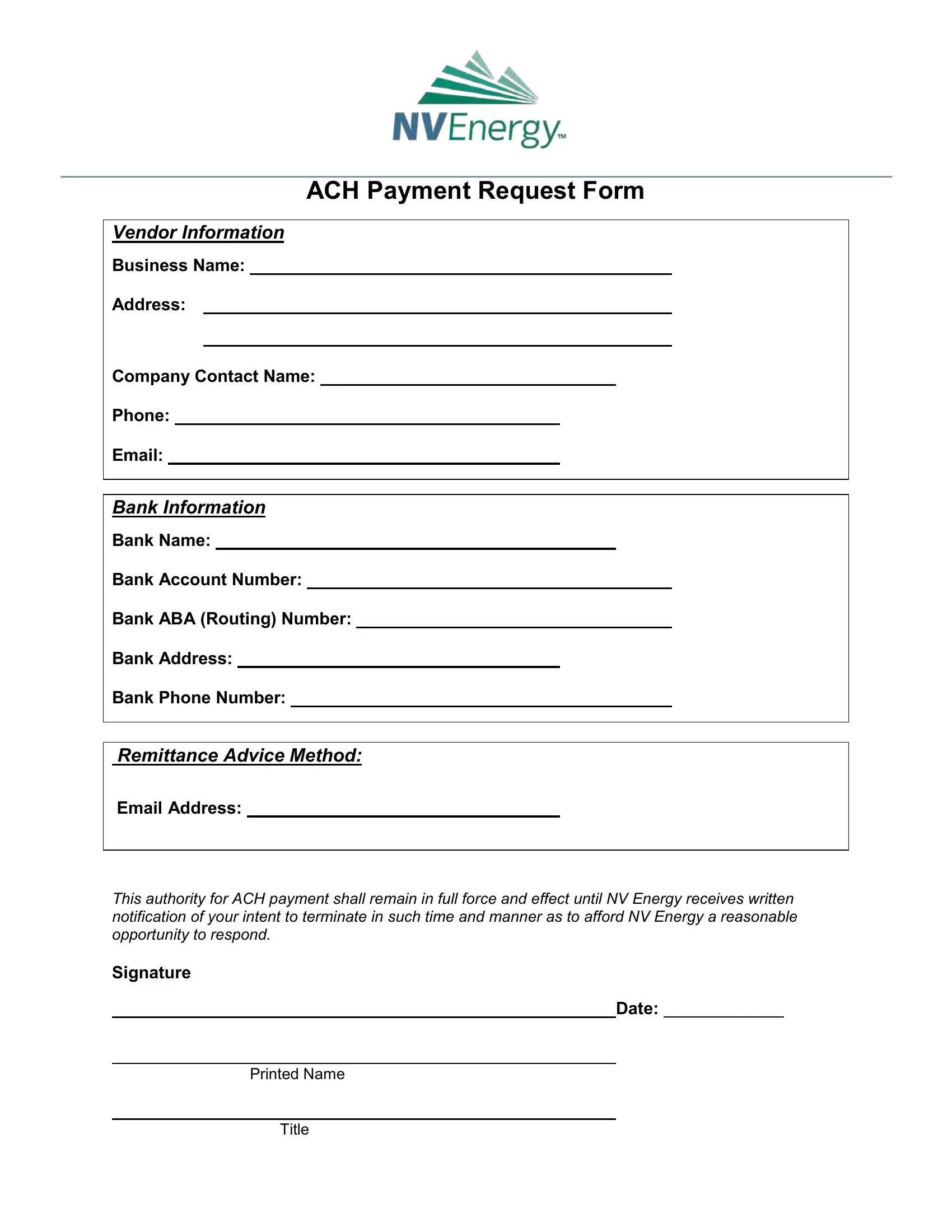

- Your Company’s Contact Information: Clearly state who the request is coming from.

- Client’s Details: Ensure accurate naming and contact information for the recipient.

- Invoice Number and Date: Specific identification of the overdue invoice.

- Original Due Date: Highlight when the payment was initially expected.

- Total Amount Due: State the exact outstanding balance.

- Late Fees (if applicable): Clearly itemize any penalties for overdue payment as per your terms.

- Payment Options: Provide various convenient methods for payment (bank transfer, online portal, etc.).

- A Clear Call to Action: Instruct the client on what steps they need to take.

- Polite but Firm Language: Maintain a professional and respectful tone throughout.

Beyond the Template: Best Practices for Handling Overdue Payments

While a robust late payment request form template is an excellent foundation, it’s just one part of a larger, effective strategy for managing accounts receivable. True success in reducing late payments comes from a combination of clear communication, proactive measures, and consistent follow-up, all wrapped in a professional approach. Think of the template as your primary tool, but recognize that a good carpenter also uses other instruments to complete the job.

One of the most crucial best practices is establishing crystal-clear payment terms from the very beginning. This means clearly outlining your payment expectations in your contracts, proposals, and on all invoices. Don’t assume your clients understand; explicitly state your payment due dates, any late fees that apply, and the methods of payment accepted. The fewer ambiguities there are upfront, the less likely you are to encounter issues down the line.

Another powerful strategy involves proactive communication. Instead of waiting for an invoice to become overdue, consider sending friendly reminders a few days before the due date. A simple email or automated message can often prompt clients to make payment on time, preventing the need for a late payment request in the first place. This demonstrates good customer service while subtly encouraging promptness.

When an invoice does become overdue, maintaining a consistent follow-up schedule is key. Don’t just send one late payment request and hope for the best. Implement a series of escalating communications, starting with a polite reminder and progressing to firmer notices if payment isn’t received. Document every interaction, including dates, times, and the content of your messages. This meticulous record-keeping is invaluable for tracking progress and for any potential future action.

Finally, know when to escalate and consider professional help. While most late payments can be resolved through your internal processes and consistent use of your template, some might require further action. This could involve making a phone call, offering a payment plan, or, in persistent cases, engaging a collection agency. The goal is to resolve the issue as efficiently as possible, protecting your financial interests while preserving client relationships where feasible.

Adopting a structured approach to managing your accounts receivable, beginning with a well-designed late payment request form template, can dramatically transform your financial health. It empowers you to handle overdue invoices with confidence and professionalism, significantly reducing stress and reclaiming valuable time. By systematizing your follow-up process, you’re not just chasing money; you’re building a more resilient and efficient business operation.

Ultimately, clear communication and consistent processes around payments are foundational to maintaining healthy cash flow and fostering strong, respectful relationships with your clients. Implementing these practices means less time worrying about overdue payments and more time focusing on growth and what you do best.